Summary:

- Renewable energy arms of major utility sector stocks, including NextEra Energy, have faced uncertainty due to rising interest rates.

- NextEra Energy consists of Florida regulated utilities and NextEra Energy Resources, which generates wind, natural gas, nuclear, and solar-powered assets.

- Despite a recent drop in stock price, NEE remains undervalued and has strong long-term growth potential and a rising dividend.

- I highlight key price levels to monitor ahead of earnings next month.

shulz

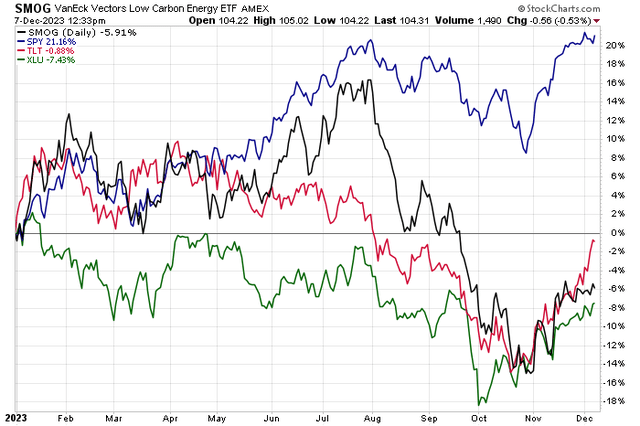

Everything seems to be a play on rates these days. That might be the investment theme of 2023. Quickly rising yields caused volatility and falling stock prices among indebted firms and those with earnings not until years away. What also felt the brunt of the bears was an area dependent on financing for its continued rapid growth. Renewable energy arms of major Utility sector stocks had their futures called into question in recent months. No name is more prominent in the space than NextEra Energy (NYSE:NEE).

I was bullish on the stock earlier this year, and I reiterate my positive outlook following a massive drop and quick pop over the last few months.

Clean Energy Stocks (SMOG), Utilities Stocks (XLU) Correlated With Bonds (TLT) in 2023

According to Bank of America Global Research, NEE consists of two core business operating segments: the Florida regulated utilities (primarily Florida Power & Light) and NextEra Energy Resources, a deregulated generator of predominantly wind, natural gas, nuclear, and solar-powered assets in North America. It also holds an ownership position in the YieldCo NextEra Energy Partners (NEP). Other businesses include gas pipelines, electric transmission, and other energy businesses.

The Florida-based $124 billion market cap Electric Utilities industry company within the Utilities sector trades at a near-market 19.3 forward-12-month non-GAAP price-to-earnings ratio and pays an above-market 3.1% dividend yield. Ahead of earnings next month, shares feature a moderate 25% implied volatility percentage while NEE’s short interest is low at just 1.1%.

Back in October, NextEra reported a solid quarter, and shares responded accordingly. Q3 non-GAAP EPS of $0.94 topped the Wall Street consensus estimate of $0.88 while revenue of $7.2 billion, up 7% from year-ago levels, was about in line with expectations. The company reaffirmed its long-term outlook – for 2023 and 2024, adjusted EPS is forecast at $2.98 to $3.13 and $3.23 to $3.43, respectively. A dividend growth target was set at 10% through next year.

The management team addressed concerns about its funding plans, and the plan is to primarily use debt for Energy Resources, NextEra’s subsidiary. $3 billion of asset sales is also in the cards through 2026, though concerns are front and center regarding how higher interest rates today could impact the company. Of course, since the Q3 report, yields across the belly and long end of the Treasury curve have retreated, helping the Utilities sector and firms with significant renewable energy assets.

Elsewhere, NEE has a growing backlog, now 21 GW, up 3.2 GW from the previous look. Also, CEO John Ketchum sees advantages in establishing financing sources given the firm’s size and ability to scale, according to a fireside chat with BofA last month. Be on the lookout for a possible investor day in late February or early March that could shed further light on future projects. On a positive note for shareholders, analysts at Wells Fargo were favorable on NEE, among other sector companies, in a note two weeks ago.

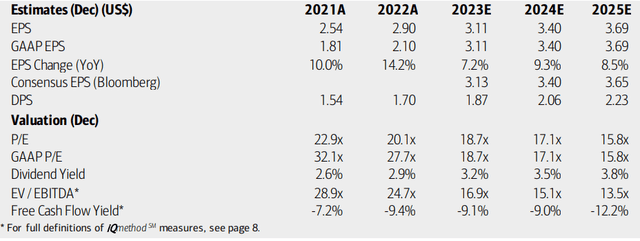

On valuation, analysts at BofA see earnings coming in just above $3 for this year while per-share profits are expected to rise by more than 9% to $3.40 in the out year, on par with the current consensus outlook per Seeking Alpha. EPS in 2025 should approach $3.70 as the dividend grows over the coming quarters. Free cash flow is sharply negative, but that is common for Utilities, and the valuation reset was perhaps a needed catalyst to attract value investors.

NextEra: Earnings, Valuation, Dividend Yield Forecasts

If we assume a 19x earnings multiple, below NEE’s 5-year average, and apply normalized operating EPS of $3.50, then shares should be near $66.50, making the stock undervalued today. While not a screaming buy, the dividend growth and its industry-leading position are positive factors.

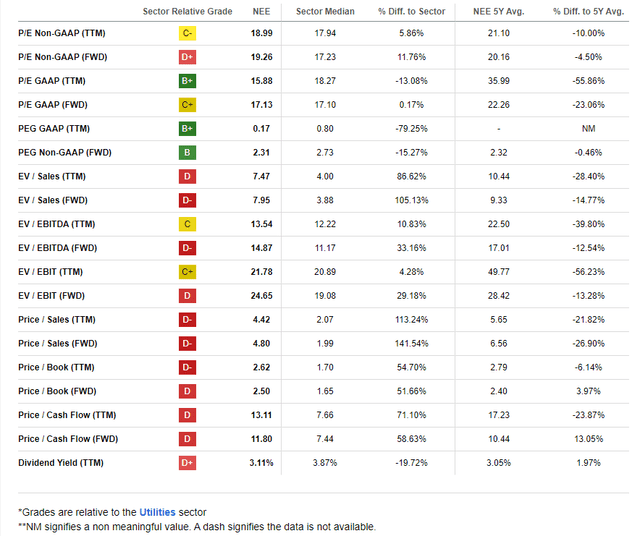

NEE: Remains A Premium-Valuation Sector Leader

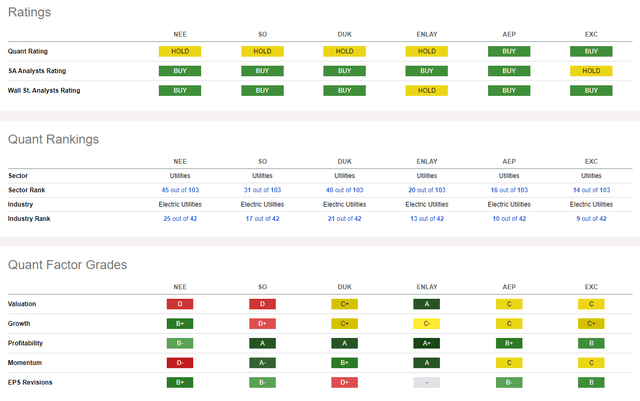

Compared to its peers, NEE features a premium valuation, but I again assert that it is deserved even with this year’s unfavorable turn in market interest rates. Long-term growth trends remain quite strong for NextEra versus its competitors while profitability metrics are still robust. Of course, share-price momentum took a serious blow in September and October, but I will spot key prices that are in play over the coming months that suggest a low is in place. Finally, EPS revisions have been surprisingly strong as analysts defend shares following the recent major plunge.

Competitor Analysis

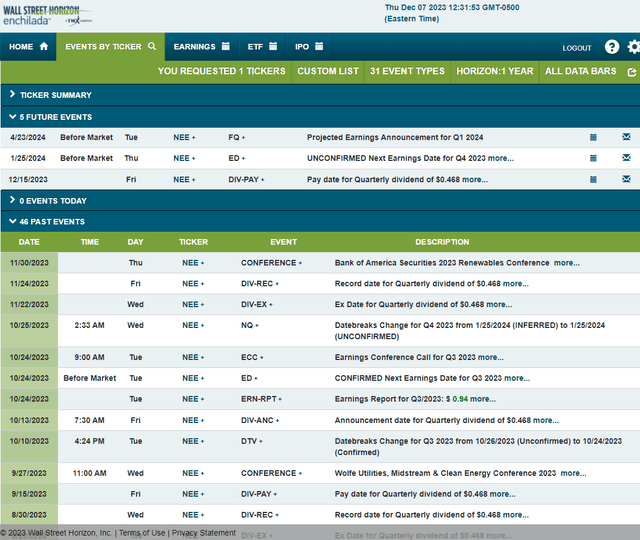

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2023 earnings date of Thursday, January 25 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

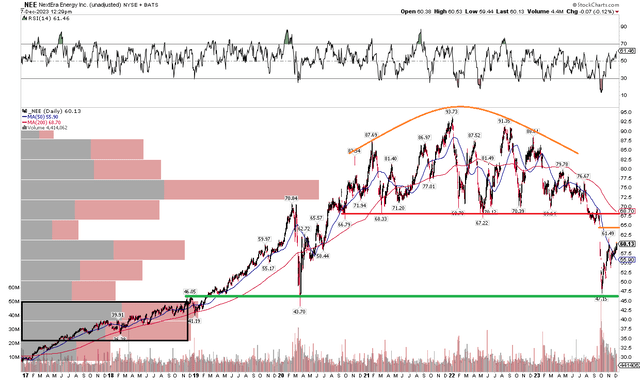

The Technical Take

Back in Q3, I urged caution on the chart. It was a situation in which I was bullish on the fundamentals and valuation, the momentum was clearly favoring the bears. Indeed, I should have leaned with the “CMT” side, and been more cautious on NEE. Notice in the chart below that a bearish rounded top pattern played out almost to perfection. In September, I noted that the mid-$40s would likely be supported on a break of the key $67 to $68 area. That break came, and it came with intensity. Shares fell to the March 2020 low and the peak from late 2019 – that’s where major volume came into the stock, and where an apparent bottom is today.

Going forward, we have to presume that what was old support will become new resistance. So, I see upside to the stock to the tune of about 10% more, given that shares are near $60 today. Also, take a look at the gap I noted in orange in the graph – that is near $65. The long-term 200-day moving average is negatively sloped, however, so the broader trend favors the bears. What’s more, the RSI momentum oscillator at the top of the chart remains in the bearish 20 to 60 zone, so we’ve yet to see a solid breakout on that front, in my view.

Overall, I think the stock can rally a bit more, but a significant overhead supply means that strong rallies may be met with selling pressure. Long-term support is apparent in the mid-$40s, though.

NEE: Bearish Rounded Top Pattern Completes, Resistance Near $67-$68

The Bottom Line

I reiterate my buy rating on NextEra. Shares appear attractive on valuation, and the recent fall in interest rates has been a boon for the yield-sensitive company. The technicals, meanwhile, completed a bearish pattern while a bearish overhead supply is seen on the chart.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.