Summary:

- Nike’s consensus estimates for fiscal Q2 ’24 are currently $0.84 in EPS on $13.4 billion in revenue.

- The Company is thought to be fully valued to overvalued.

- The EPS and revenue revisions indicate more of a slow recovery for NKE.

Joe Raedle

Nike (NYSE:NKE) reports their fiscal Q2 ’24 quarter Thursday night, December 21, ’23 after the closing bell.

The stock peaked at $179 and changed in mid-November ’21, so Nike is still down 28% or 14.66% (annualized) since that date, even though – like so many laggards – it’s trying to work higher into the end of 2023. Looking at the 3-year annual return, Nike is down -3.1% over that 36-month time period. (Return data courtesy of YCharts and Morningstar.)

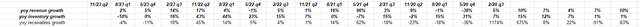

Not to bury the lede, but if you ask me Nike’s story is a lot like so many companies who outsourced the supply chain to China and then watched that supply chain bite them in the backside, as evidenced by this “sales to inventory growth” comparison, going back to 2020:

Prior to August-November ’21, Nike saw healthy sales growth relative to inventory growth which is necessary for a retailer, since it ensures healthy cash flow, but starting in late ’21 (calendar ’21) corporate constipation started, and inventory swelled relative to sales for 7 of the last 9 quarters. Only in the last two quarters did inventory at Nike start to right itself, relative to sales.

This same “affliction” was common in Walmart (WMT) and many other retailers over the identical time period.

Nike is now exiting this period and hopefully the footwear and athletic giant can print the third straight quarter of higher revenue vs. inventory growth.

EPS and revenue revisions:

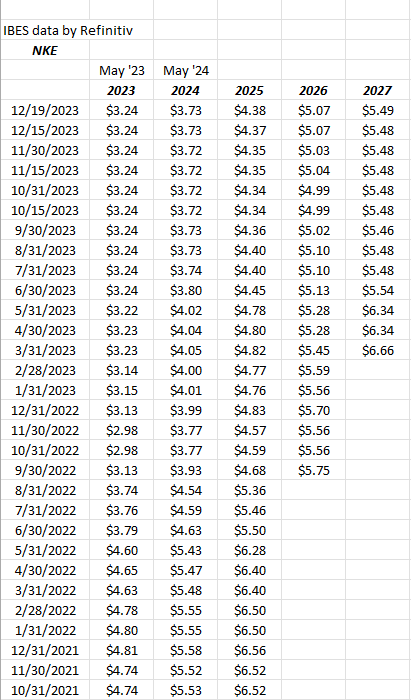

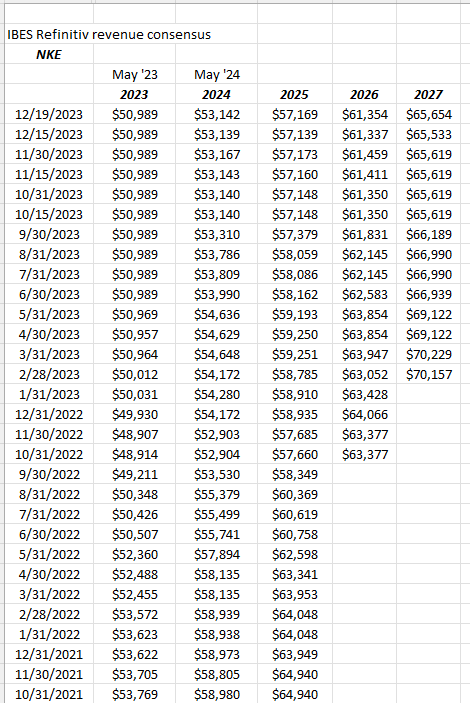

Looking backward to the point where the stock price peaked, 2024 and 2025 “expected” EPS is still lower than the peak EPS between $5.50 and $6.00 per share, while revenue estimates have flattened for fiscal 2024 and ’25 in the last 6 months.

Foot Locker’s (FL) earnings report from late November ’23 was better than expected and notes said that the footwear outlet was getting “vendor support” around inventory, which is another indication that inventory in the channel may be getting cleaned up. (This blog has never owned or followed FL, so further conclusions wouldn’t necessarily be of use to readers.)

Nike’s consensus estimates for fiscal Q2 ’24 are currently $0.84 in EPS on $13.4 billion in revenue, for “expected” year-over-year (yoy) growth of -11% and +4% respectively, which is against a relatively easy compare from November ’22.

Full-year fiscal ’24 (ends May ’24) is expecting $3.73 on $52.3 billion in revenue for expected year-over-year (yoy) growth of 15% and 4% respectively. For the next three fiscal years – 2024 to 2026 – consensus estimates expect 15-17% EPS growth, which is still better than the S&P 500’s expected growth.

Valuation

Trading still with a low 30x P/E versus the expectation of 15-17% earnings growth over the next 3 years, Nike is still thought to be fully valued to overvalued, and it doesn’t look any better when the cash flow valuation is 24x and free cash flow valuation is 29x (and that’s ex-cash).

Price-to-sales is still over 2x as well.

That being said, Nike is still a world-class brand, comparable in consumers’ eyes to Apple (AAPL) and Coca-Cola (KO).

Chart-watching:

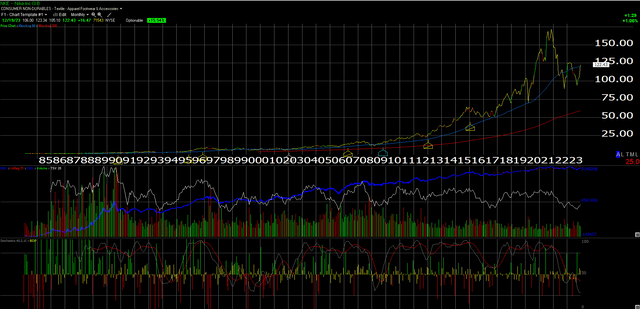

This monthly chart of Nike shows an “oversold” stock for the footwear giant, which hasn’t happened since 2008 and 2009, and today’s chart is even more oversold than back in the depths of the financial crisis.

What to worry about: the biggest issue around Nike is the question of whether the brand is eroding or losing some of its luster so to speak. I believe it was Morningstar who noted in one of their write-ups on the stock that China has become Nike’s most profitable geography. Some might consider that not a small issue, given the government control that China exercises over its populace.

Mark Parker, the former CEO, was a so-called natural-born killer as Nike’s CEO. John Donahoe, the current CEO, seems to be more low-key, and with Phil Knight still a presence, maybe that’s what’s needed, but the point is brands do change over time, and can grow stale.

Summary/conclusion

The one positive aspect to Nike’s expected Thursday night, December 21st earnings release is that the stock hasn’t been upgraded coming into the earnings release and hasn’t seen the investor exuberance of trying to catch a laggard before it takes off into the year-end 2023 rally.

That being said, the EPS and revenue revisions linked above, indicate more of a slow recovery to Nike than anything else.

Clients own a 1.5% position in the stock, which is the biggest position for Nike in the last 10 years, simply given it’s the first time the stock has seen such a sharp correction. It’s been rare the stock has been down like this, i.e. a -3.10%, 3-year annualized return as the above chart indicates.

The first technical test would be for the stock to take out the early Feb ’23 high of $131 and change, which was the stock’s highest print off its late 2022 lows near $90 per share.

It may take a while for the stock to return to the old 2021 high of $179 and change, but that’s not a bad thing.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.