Summary:

- Nike faces challenges with slow innovation, rising competition, slower consumer demand, and sales in China.

- Financially, revenue growth is stagnant, with focus on direct-to-consumer business and improving margins.

- Despite challenges, I expect Nike to grow revenue above industry rates and improve margins, with a recommended buy rating.

Thank you for your assistant

Overview

Nike faces important challenges, such as a slow innovation cycle, rising competition, slower consumer demand, and slower sales in China.

Figure 1: Seeking Alpha

Some consumers perceive a decline in Nike’s innovation and excitement factor, leading to less hype around some of its recent product releases, especially in the markets farther away from its home market: Asia, especially in China and Europe. The structural problem is its innovation capacity, which has lost its efficacy. At the same time, as the company tries to modernize, it wants to push its digital channels, but it has done so with massive damage to its all-time partners: sports apparel retailers. During the pandemic, Nike was too aggressive in fostering its digital channel and tried to be a digital company, not considering the reality: an important part of its business model is the trusting relationship with its retailers.

I argue that those problems are solvable, and Nike will again be the industry leader. The downside is that it will need time to turn around, but in the end, I recommend buying Nike at this price point.

Financial Performance

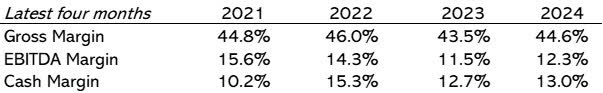

Revenue was $12.6 billion in Q4 2024, down 2% from last year’s period and $250 million below expectations. Fiscal 2024 revenue was $51.2 billion, practically the same as last year. This poor growth is due to lower shipments to wholesale to clear excess inventory and focus on direct-to-consumer (DTC) business.

North America and APLA (Asia Pacific and Latin America) were the fastest-growing geographies, at 5% and 4%, respectively. North America grew for Jordan brand and women’s apparel. Digital sales push APLA. EMEA (Europe, Middle East, and Africa) declined revenue to 3% due to geopolitical tensions and macroeconomic issues.

Direct-to-consumer (DTC) business revenue was $5.1 billion, 8% lower than a year ago. Wholesale revenue was $7.1 billion, up 5%. This reflects the company’s focus on fixing its retail problem rather than growth.

Consequently, gross margins improved by 110 basis points compared to last year. One reason for this increase is strategic pricing actions, where the company raised prices where materials prices raised, optimized promotions, and made geographic pricing adjustments. On the offsetting side, digital channel margins lowered due to more promotional activity, and I estimate that the company is getting rid of inventory through this channel.

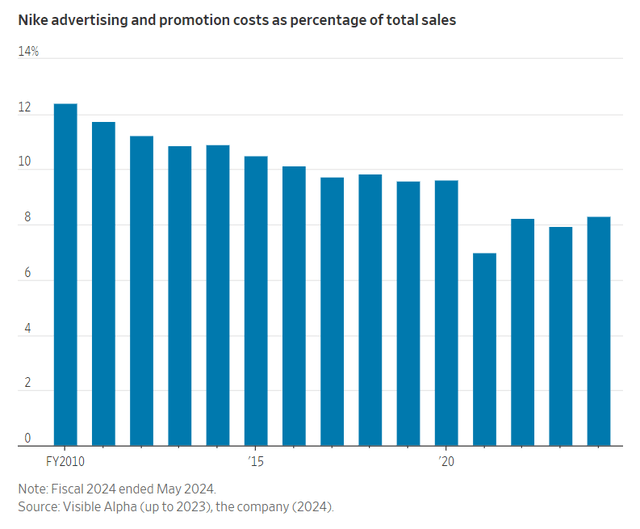

Sales and administrative expenses decreased 7% to $4.1 billion. Advertising expenses were replaced with sports marketing expenses, indicating they were trying to control demand generation and connect with potential clients.

The picture showing those results is ambiguous: it doesn’t show a clear direction. Revenue doesn’t get traction, and margin improvement is a good sign but not sustainable by itself. I think the company must invest to get out of this situation. Nike is not a clear leader in the industry nowadays. These short-term results are not sufficient to guide the decision.

Valuation

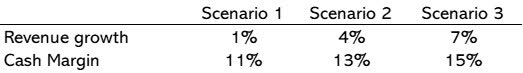

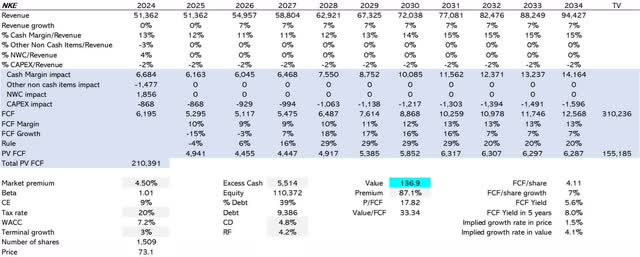

In this article, I will change my methodology, adding a twist. I will set up several scenarios and estimate the company’s value. Later, I will prove or reject the hypothesis I used in each scenario. The variables I will change in the different scenarios are revenue growth and cash margin.

I consider three possibilities in the revenue growth variable. The first is a growth rate below industry growth, the second is in line with the industry’s growth, and the third is above this reference growth rate. Firstly, I will calculate the industry growth rate. The global sports apparel market is $200 billion and is expected to grow between 2024 and 2030 at a rate of 4.38% and 6.72%. I hope to be closest to the 4.38% number because the macro growth rates expected by the IMF are 3.0% for 2024 and 2.9% for 2025, lower than the historical 3.5% world growth rate from 1961 to 2022.

So, I set scenarios with a growth rate of 1%, another of 4%, the industry growth rate, and the last scenario at 7%, assuming Nike grows faster than the industry because I presume it will regain its leadership.

Cash margins are more stable, and their variation is not too significant. I consider 2 percent points below the current 13% cash margins or 2 percent points above this level. So, in the first scenario, I will assume the company faces margin constraints and lowers its current 13% to 11%. The second scenario maintains the current margin. And the last one assumes the company will improve its margins to get a 15% cash margin. In Figure 2, you can see the scenarios I am going to analyze.

Figure 2: Author

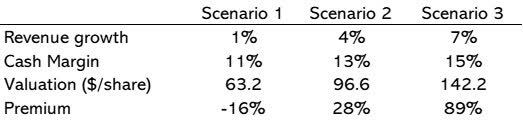

Cash flows will be discounted at a 7.2% WACC because the beta is 1.01 and risk-free at 4.2%. Given the company’s low leverage, the cost of debt is 4.8%, with 39% debt over capital. The terminal growth rate is set at 3%.

The results of each scenario are based on Figure 3.

Figure 3: Author

Let’s see which scenario I consider more likely.

Can Nike grow revenue higher than the market?

Innovation has hit Nike hard. It has experienced a slowdown in launching new products, from 12 months before the pandemic to 18 months recently. For example, launching the next innovation on Vaporfly has made Adidas launch a competing version sooner. The Latest Nike launches, like Forward, haven’t gotten the attention that previous ones like Flyknit or Foamposite have. Nike has lost the market in running shoes in favor of new brands like HOKA and ON.

With these negative points, I think Nike can turn around its innovation leadership. I estimate Nike spends about $1-1.5 billion in research and development, a quantity similar to Adidas’s but far greater than that of smaller competitors. Nike has an innovation DNA and a deep culture ingrained in its employees. I trust Management will foster this nontangible asset. Nike has always worked with strategic partners (Universities, startups, material science companies…) that help Nike push new technologies. Nike’s digital ecosystem is also a platform for leveraging analytics and AI to create and monetize new services.

Besides, they have launched important and breakthrough innovations. Air Zoom Alphafly is a high-performance running shoe credited with breaking the world record for a marathon in Chicago. I notice that they haven’t been consistent in their innovation efforts. Management is committed to a multi-year cycle of innovation that fits in this need for consistency.

Another point of concern about revenue growth is consumer behavior disconnection. Nike has focused on sports performance when designing its products, but people have turned to athleisure and casual wear. Nike hasn’t reacted fast enough to this trend and lost market share (Figure 4). Besides, Nike took aggressive steps to reduce the importance of wholesale, but this point of contact with the client is critical to grasping the customer who likes to see and touch the product, an important part of the selling process. To catch up on this issue, you need a management team that fosters this sensitivity in the company. I am not sure the current manager or CEO can push the company in that direction, but it is fixable.

Figure 4: The Wall Street Journal

The Chinese market presents an opportunity for Nike. Nike reported a 6% increase in revenue from this market, which, as a constant currency, is about 8%. Revenue in China is $2.03 billion. Digital revenue increased by double-digit growth, and inventory decreased by 26%. Even though local brands intensified with companies such as Anta and Li-Ning, its Consumer Direct Acceleration program focuses its organizational structure on a more regional focus with greater autonomy in the local decisions. Appoint experienced leaders in the regional manager role. In this line, Nike is trying to sponsor local athletes like basketball players like Zhou Qi and Yi Jianlian, tennis star Zheng Qinwen or football player Wang Shuang.

So, in general, I think Nike will turn around this situation and grow revenue above the industry.

Can Nike increase its margins?

In Figure 5, you can observe that the gross margin rate has been stable with ups and downs in freight costs, better or worst product mix, and inflationary disruptions. I don’t expect much gain or deterioration in this margin.

Figure 5: Author

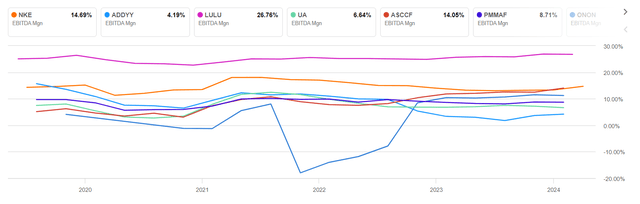

The significant impact has been the declining EBITDA margin. Cash margins have evolved erratically due to non-cash items like amortization or deferred income taxes. The critical margin, though, is EBITDA.

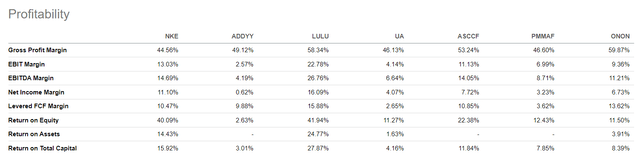

Figure 6: Seeking Alpha

The central pressure for margin preservation is competition. Nike had the most extensive global athletic footwear market share, at 38.2% in 2023. However, its market share has been on the decline in recent years. The reasons are that consumer preferences are changing towards athleisure and lifestyle. New brands have emerged, like HOKA ONE and On Running.

As I have said, Nike’s EBITDA margin is among the highest, and its evolution is declining. But if you compare it with other competitors, mainly Adidas, the situation is not that bad.

Figure 7: Seeking Alpha

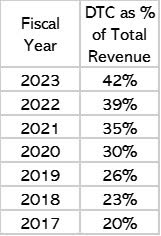

Nike has been expanding the Direct-To-Consumer (DTC) channel. Even though the company doesn’t report margins for the channel, Management has stated that it has higher margins than the wholesale channel. As shown in Figure 8, I estimate this tendency will continue over time and will be a tailwind for the margins.

Figure 8: Author

Management is committed to reducing costs. In Q4 2024, $284 million was incurred in employee and contract termination charges. Inventory levels decreased by 14% compared to the latest year. As I have said before, selling and general expenditures decreased by 6.5% compared to last year’s quarter to $4.1 billion.

In the short term, I expect general costs to increase relative to revenue to encourage innovation and to decline as a percentage of revenue in the long term.

Conclusion

Based on my analysis, I believe that Nike will be outpacing the market in revenue growth, but its margins will deteriorate. Until reaching a Cash Margin of 11%, but later on, it will rise to 15%

Figure 9: Author

My estimation of value is $137 per share, an 87% premium over its current price, and I recommend buying.

fig

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NKE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.