Summary:

- Nike’s stock has recently underperformed the index.

- Economic downturns, supply chain disruptions, and rising input costs are squeezing profit margins and slowing revenue growth.

- NKE’s direct-to-consumer push, geographic expansion, and focus on key growth categories offer possibilities for future revenue growth and profitability.

- While the Company’s brand strength and long-term strategies are promising, the current economic climate and execution risks warrant a wait-and-see approach for investors.

Pablo Cuadra/Getty Images Entertainment

Nike’s stock (NYSE:NKE) has taken a beating lately. After years of unstoppable growth, Mr. Market seems to have had a change of heart. But could this pullback create a rare buying opportunity in a legendary company?

Let’s break down the numbers to see if Nike is a bargain in disguise. Maybe it’s time to lace up and add this stock to your portfolio, or are there better plays in the athletic apparel sector? Let me know your thoughts in the comments: Do you see Nike as a fading star or a buying opportunity in the making?

Real Challenges

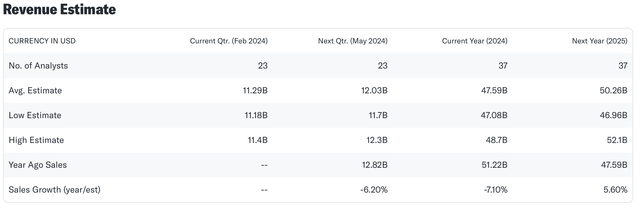

Nike isn’t immune to the macroeconomic headwinds facing many companies. Rising input costs, stemming from high inflation in recent years and lingering supply chain disruptions, have squeezed profit margins in recent years:

The above graphs show that the 3 percent decline in Nike’s bottom-line profit margin is mostly explained by the declining gross profit margin due to rising input prices and lingering supply chain issues, but readers should note that there also appears to be some deterioration in the operating efficiency of the company as evidenced by an even greater decline of 4 percent in the company’s trailing-twelve-month operating margin since 2021.

Global supply chain woes remain a significant challenge for Nike. While the worst disruptions of the pandemic may have eased, geopolitical tensions and unpredictable shipping costs continue to create uncertainty. These factors make it more expensive for Nike to produce its footwear and apparel, ultimately forcing the company to either absorb those costs or risk alienating consumers with higher prices, which has played into the next section.

Low Revenue Growth

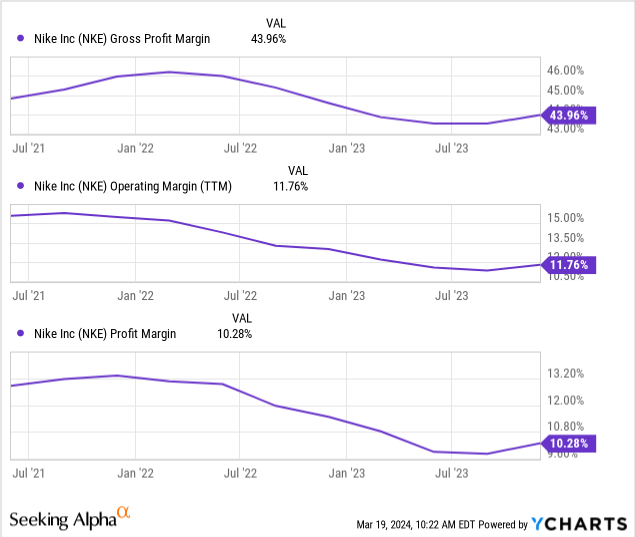

The company experienced significant revenue growth in the early part of the pandemic, fueled by demand for athleisure and workout-from-home apparel; however, recent years have brought economic uncertainty, supply chain disruptions, and inflationary pressures that have pressured growth:

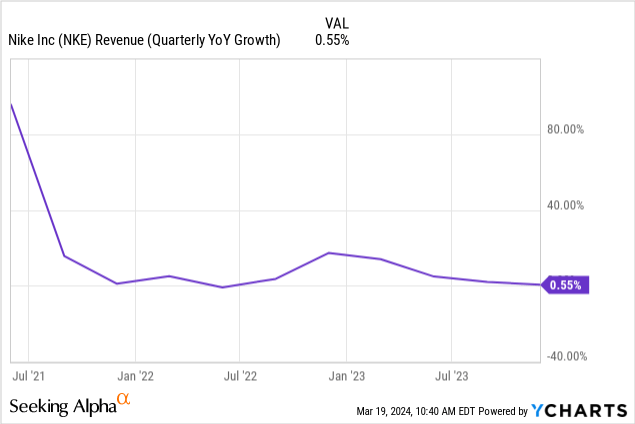

Nike faces continued headwinds in 2024 due to lingering supply chain issues and a slowdown in consumer spending, but analysts forecast a better 2025, as the following table shows, driven by the reopening of China, Nike’s direct-to-consumer push, and a potential easing of inflationary pressures.

While Nike’s full-year guidance has been revised downward, there’s still a possibility for growth in specific regions and sales channels in 2025, as the company management discussed in detail during the last earnings call.

Management Action

To drive revenue growth, Nike is heavily emphasizing direct-to-consumer sales channels, allowing them to capture a greater portion of the profits, and recent results have been promising: NIKE Direct revenues were $5.7 billion, up 6 percent on a reported basis and up 4 percent on a currency-neutral basis.

Nike’s push into direct-to-consumer sales has been largely successful, as NIKE Direct sales have grown at a faster pace than overall revenue growth, indicating this shift is paying off. The company continues to invest in building a digital and physical shopping experience for consumers within this model.

Further, the company is focusing resources on key growth categories like women’s sportswear, the Jordan Brand, and fashion-forward athletic wear, as management discussed during its most recent earnings call:

First, let’s discuss Women’s, which is already a roughly $9 billion business, and that’s just a NIKE brand, excluding Jordan and Converse. Our Women’s business has grown high single digits on average over the past 3 years. And while we’re encouraged by this progress, we now have line of sight into what we believe is the best plan we’ve ever had to accelerate growth in Women’s. Our plan makes us even more confident in serving her through sport and style. Today, about 40% of our members are women consumers. They make up a bigger proportion of new members, and their demand per member is growing faster.

On the cost front, management aims to deliver up to $2 billion in cumulative cost savings over the next three years and listed the following target areas: simplifying product assortment, improving supply chain efficiency, leveraging scale to lower the marginal cost of operations, increasing automation and speed from data and technology, streamlining organizational structure, reducing management layers, and enhancing procurement capabilities.

While I acknowledge the potential benefits of Nike’s direct-to-consumer strategy and cost optimization initiatives, I maintain a cautious outlook on their near-term impact on revenue growth. It remains to be seen whether the gains from direct sales can fully offset potential losses in the wholesale market.

Additionally, I’m interested in observing the long-term implications of cost-cutting measures. I want to ensure these efforts contribute to sustainable profitability and don’t compromise workforce stability or product quality.

For now, I suggest adopting a wait-and-see approach, reassessing Nike’s performance over the next few quarters to gain a clearer picture of the success of these strategies.

Dividend Yield And Safety

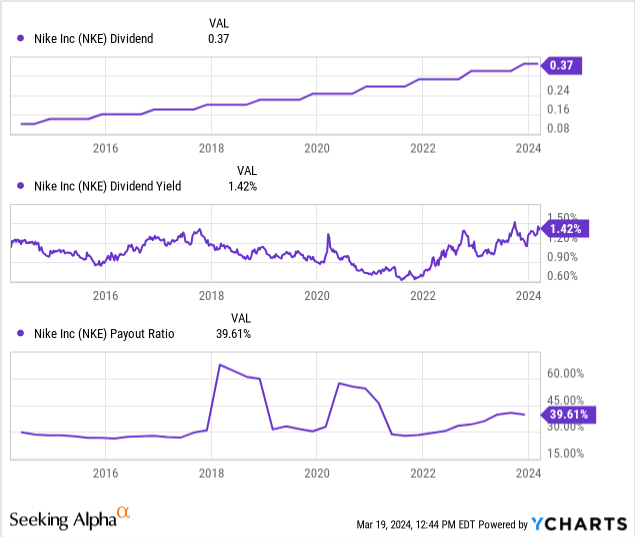

Nike has steadily grown its quarterly dividend throughout the last decade:

Despite Seeking Alpha Quant’s unfavorable “D” rating on Nike’s dividend safety, I deem the dividend is currently secure. While it’s true that payout ratios have fluctuated and Nike’s yield is lower than others in the consumer discretionary sector, there are several reasons for cautious optimism.

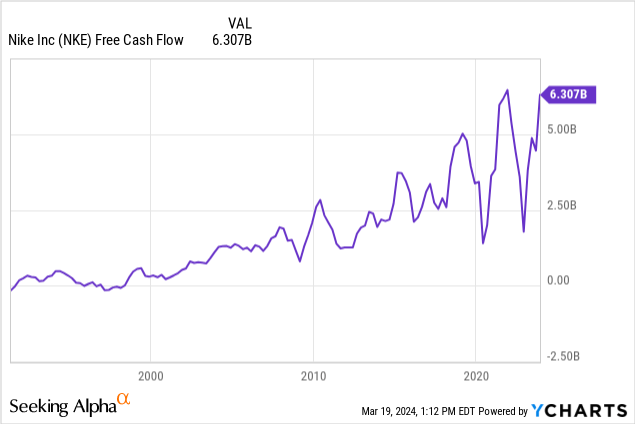

Nike has a long history of consistently increasing its dividend, demonstrating a commitment to returning value to shareholders. Additionally, Nike maintains a healthy balance sheet and generates positive cash flow, providing financial flexibility.

Nike’s current dividend appears safe for the foreseeable future, but economic headwinds that I discussed in my recent article, Employment Market Is Weakening, could affect the company’s dividend growth trajectory.

Valuation

Nike’s valuation presents a complex picture. The stock currently trades at a P/E ratio of around 29, which is somewhat below its historical average. This could indicate an opportunity if future earnings growth rebounds; however, ongoing economic uncertainties and rising input costs cloud the outlook.

Considering these factors alongside Nike’s strong brand, growth potential in emerging markets, and focus on direct-to-consumer sales, I believe a reasonable price target in the near term to be within the range of $70 to $80, reflecting a more reasonable 20x earnings multiple given the significant execution risk and macroeconomic headwinds that the company faces.

Conclusion

Nike is no doubt an iconic company with enduring brand power. However, the economic headwinds and lingering supply chain issues pose real challenges to its current growth trajectory. While the direct-to-consumer push and expansion into promising markets offer potential, the success of these strategies might take time to fully materialize. Additionally, the execution of the cost-saving initiatives will require careful navigation to avoid negative impacts on product quality or the workforce.

Investors must weigh the company’s potential with the risks involved. At its current valuation, Nike is not a screaming bargain; however, if the company successfully navigates the turbulent economic climate and demonstrates renewed earnings growth, a price target within the $70 to $80 range could offer an attractive entry point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.