Summary:

- Nike stock is rated “Sell” due to poor FY24 results, negative FY25 revenue guidance, and a long-term outlook of low growth and declining market share.

- Despite a 27% price drop YTD, Nike remains fairly priced, reflecting its mature phase rather than a growth company.

- Nike’s profitability is strong, but its market share has eroded over the past decade due to rising competition and changing industry trends.

code6d

Executive Summary

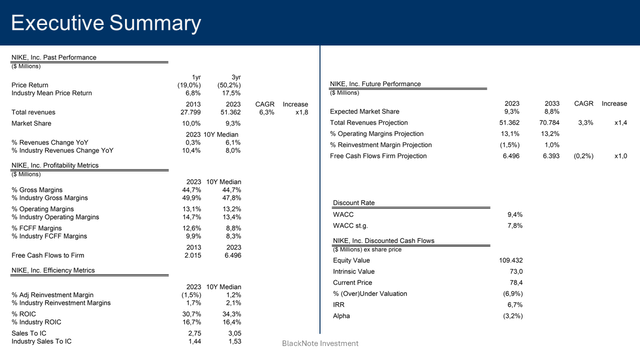

Nike (NYSE:NKE) stocks are currently trading around their fair market price, but the long-term outlook is negative, suggesting low growth and declining market shares.

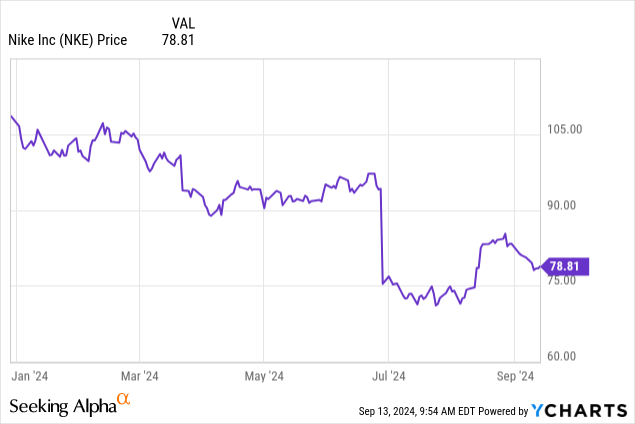

After poor results in fiscal year 2024 and a disappointing fiscal 2025 revenue guidance – which expects revenue growth rates to be negative – Nike stock prices have collapsed, registering a minus (27%) year to date.

However, despite the significant price correction, which might mislead investors into thinking that Nike can represent an interesting long-term opportunity, based on our assumption, even after the recent price downfall, Nike is still barely fairly priced, let alone undervalued.

Rather than considering the past drops in prices as an opportunity to buy the firm, they should be better seen as the market finally recognizing Nike for the company it truly is, that is, a mature company likely to enter a declining phase, instead of pricing the firm as it still was a growth company.

For the reasons discussed from now on, we decided to assign Nike a “Sell” rating, however, before deep diving into the valuation, it’s worth mentioning that the Sell rating we express is not, and never will be, an invitation to short-sell companies.

Rather, if you are not yet invested, it would be a suggestion to not buy the company at the current prices, or, if you are already invested, an invitation to re-evaluate your position in the company to check whether or not might it be worth it to cash in the profits and look for better investment opportunities.

Source – Analyst’s compilation

Operation Overview

In the most recent fiscal year, Nike’s growth stumbled, with total revenues barely growing 0.3% YoY. North America which accounts for 43% of total revenue saw a negative growth rate of (1%), while the EMEA area – representing 28% – grew 1% in FY24.

Only China – 15% of total revenues – helped tip the scale upward, registering a 4% growth rate YoY, showing recovery signs from the past two years which saw the Chinese market registering negative growth rates, but still underperforming pre-pandemic levels as it used to growth at double-digit rates.

The growth decline affected both the footwear and apparel segments, with the latter sitting at a negative (0.5%) while the footwear segment registered a timid 0.9% increase in FY24.

FY2024 results are certainly alarming, however, when considering the firm’s performances compared to the overall industry, Nike has been delivering underwhelming results for over a decade.

With a median revenue growth rate of 6.1% over the past decade, Nike has underperformed the luxury and apparel industry, which registered a 10-year median revenue growth rate of 8%, suggesting that Nike’s high growth phase has long faded away, contrary to what Wall Street expects from the firm.

Rather than punishing Nike for its disappointing FY24 results and FY25 guidance, the market should have better priced Nike for what it was, a company well into its mature phase, and possibly approaching a decline phase as competition keeps rising.

Profitability, on the other hand, remains strong and in line with industry levels.

The gross margin floats around 45%, perfectly in line with the industry’s median levels. Both the FY24 and the 10-year median operating margins sit at 13% – again in line with industry levels. As regards free cash flows to the firm (FCFF), in 2024 the FCFF margin was 12.6%, improving from Nike’s 10-year median value of 8.8% and higher than the industry median value of 9.9% registered in 2023 – 10-year industry median value is equal to 8.3%.

Improvements in free cash flow generation are strongly correlated to reduced reinvestment needs as the firm approaches the last stages of its mature phase, diminishing capital investments and ultimately shrinking its operations, the latter symptom, however, has yet to be seen in Nike.

Over the past decade, Nike’s median reinvestment margin – which indicates the percentage of revenues reinvested into capital expenditure, acquisitions, intangible assets, and working capital net of depreciation and amortization – was 1.2%, lower than the industry 10-year median reinvestment margin of 2.1%. An indicative sign of a mature company rather than a growth-oriented one.

Industry Overview

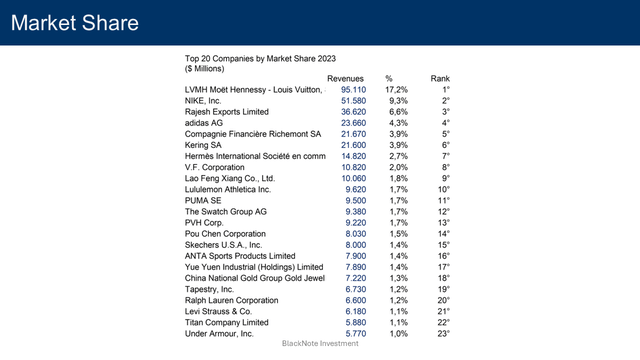

Nike, with its $51.4 billion in revenues in FY 2024, has established a dominant presence in the luxury and apparel industry, representing 9.3% of the industry’s total revenues of $553.4 billion.

Source – Analyst’s compilation

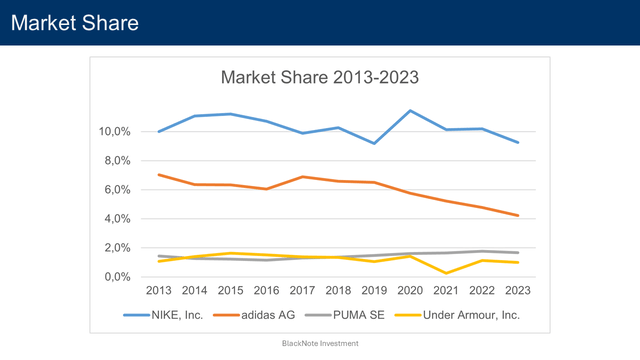

However, despite the overwhelming presence in the market, it is worth mentioning that in the last 10 years, Nike’s market share has been eroded by competitors, as it was 11.1% in 2014.

Currently, in the overall industry, Nike is second only to the juggernaut group of luxury fashion LVHM Moet Hennessy (OTCPK:LVMHF), which has a market share of 17.2% but targets a completely different audience.

Among Nike’s major historical competitors are Adidas (OTCQX:ADDYY), with a market share of 4.3%, Puma (OTCPK:PMMAF) sitting at 1.7%, and Under Armour (UAA) with a more modest 1% market share. With the sole exception of Puma, which managed to slightly improve its market share, all of these well-known athleisure brands have seen their market share decline in the last decade as new competitors emerged.

Source – Analyst’s compilation

In the footwear segment, established companies like Deckers Outdoor (DECK), which managed to revitalise its running brand HOKA, and new entrants like On Holding (ONON), which introduced innovative technologies like the CloudTec cushioning system, have rapidly conquered market shares at the expense of old players like Nike.

It is also true, however, that the overall industry has notably expanded in the last decade, and the booming popularity of athleisure – referred to the style of wearing athletic clothing as everyday wear and not only for sports activities – strongly contributed to enlarging the market pie allowing the entrance of new players.

Although the old guards like Adidas, or the privately owned New Balance, have lost market share over the years, in 2024 they still managed to be featured as the most popular sneakers by many fashion and sports magazines like GQ, FLEXDOG, RunRepeat, and GLAMOUR, contrary to Nike that doesn’t seem to be as popular as it used to be.

In the magazines cited above, the most recurrent brands of sneakers, by far, were Adidas, thanks to the huge popularity of the Samba model, and New Balance. Following them were Nike, Asics, and the uprising ON and Hoka.

As regards sports clothing instead, the athleisure industry has seen the rise of Lululemon Athletica (LULU), primarily targeting the women’s segment, which grew its market share from 0.7% in 2014 to 1.7% by 2023, and the privately owned British start-up Gymshark, founded in 2012, which registered revenues for $709 million in 2023

Younger players like Lululemon, Gymshark, and ON have also shown a different marketing approach to increase brand awareness, preferring to focus on local community influencers, aiming at a closer relationship with customers, rather than looking for expensive partnerships with celebrity athletes.

All things considered, the sudden decay of Nike’s growth – in light of its already fading momentum – might suggest that the firm is struggling to keep up with new competitors and the emerging trends that give a nod to comfort and sustainability rather than pure fashion, inevitably driving Nike towards a declining phase.

Industry Growth Forecasts

As said previously, from 2013 to 2023, the luxury and apparel industry’s revenues grew at a modest rate, with a CAGR of 7.2%, increasing 2 times from $276.8 billion to $553.4 billion.

Luxury and Apparel Industry Past Revenues (in $millions)

|

Overall, the apparel industry is a mature market, and when considering the collective investments made by luxury and apparel companies through the years, to support future growth, the 2024 expected growth rate for the industry is 3.96%, which is in line with the expected economic growth rate in perpetuity.

We projected the industry’s expected revenues 10 years from now, applying the expected growth rate of 3.96% and allowing it to slowly decline as the industry approaches the economy’s perpetual growth rate, represented in this case by the USD risk-free rate.

Hence. by 2033, the luxury and apparel industry revenues are expected to reach $804.4 billion, increasing 1.5 times from the $553.4 billion registered in 2023 at a CAGR of 3.8%.

Luxury and Apparel Industry Future Revenues (in $millions)

|

Company Growth Forecasts

Over the period 2013-2023, Nike’s revenues grew at a CAGR of 6.3% increasing 1.8 times from $27.8 billion to $51.4 billion.

Nike Past Revenues and Market Share (in $millions)

|

In the latest earnings call, the management expressed their worries about the 2025 fiscal year outlook, expecting 1Q25 revenues to be down in the high single-digit range, and for the all-year to be down in the mid-single-digit range.

However, Nike is not the only company facing a gloomy 2024/25. Many other apparel firms, which were used to reporting healthy revenue growth rates, like Lululemon, expressed their worries about weaker demand and the worsening of macroeconomic conditions which will inevitably impact a cyclical industry like the luxury and apparel one.

Combining macroeconomic headwinds, with Nike’s issues to keeping up with the competition, the outcome is likely to be lower growth and declining market share.

Analysts expect a negative revenue growth rate of (4.7%) in fiscal 2025, which implies that Nike’s FY25 market share would decline to 8.5%.

In the following years, considering the cyclicality of the apparel industry, we reasonably expect Nike’s market share to timidly rebound, however, as competition rises, we expect it to continue down the declining trend from its historical levels, with a market share sitting around 8.8% by 2033.

With these assumptions, Nike’s revenues are projected to reach $70.8 billion by 2033, representing an increase of 1.4 times from the 2023 revenues of $51.4 billion at a CAGR of 3.3%.

Nike Future Revenues and Market Share (in $millions)

|

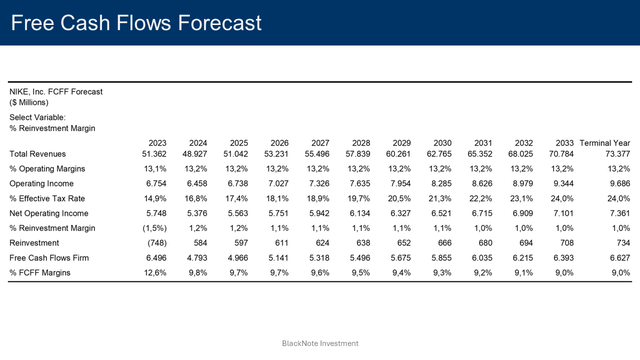

Free Cash Flows Forecasts

As Nike pivots towards the last stages of its mature phase, we expect it to maintain operating margins in line with historical values, around 13%.

As regards the reinvestment margin instead, we expect it to further decline from 1.2% to 1% by 2033, as Nike gradually reduces capital investments in light of declining growth and market share, as it has done in the past.

Due to the reduced reinvestment needs, we can expect Nike’s FCFF margins to keep improving from the historical average, sitting around 9% by 2033. The positive effect of reduced capital investments is partially offset by lower growth and higher tax rates as the company enters its steady state.

With these assumptions, Nike’s FCFFs are projected to be around $6.4 billion by 2033.

Source – Analyst’s compilation

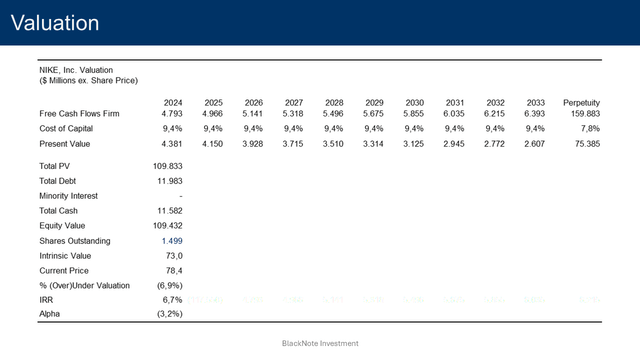

Valuation

Applying a discount rate of 9.4% for the next 10 years, and a discount rate of 7.8% in perpetuity, we obtain that the present value of these cash flows – after adjusting for debt and cash on hand – is equal to $109.4 billion or $73 per share.

Compared to the current prices, Nike stocks are fairly valued.

Source – Analyst’s compilation

The street target for Nike – based on 34 different analyst expectations – is sitting at $91.8 per share, as of the 11th of September 2024, with 17 street recommendations expressing the rating “Hold” and the remaining 17 expressing the rating “Buy”.

Discount Rate

To determine the appropriate discount rate, we employ the WACC method, which considers both the cost of equity and the cost of debt.

The cost of equity – 9.9% – is derived using the USA equity risk premium of 4.6% – as of September 2024 – the current USD risk-free rate of 6.7%, and the company’s beta of 1.36. The company’s beta is based on the luxury and apparel industry’s unlevered beta of 0.8.

The cost of debt – 4.4% – represents the expected return demanded by debt holders and is influenced by the company’s specific risk profile and the broader market conditions. It is computed considering the current USD risk-free rate of 3.7%, the company’s default spread of 0.69%, and the USA default spread of 0%.

With a current Equity to EV of 92.3% and a Debt to EV of 7.7%, the discount rate for the next 10 years is 9.4%. In perpetuity, the discount rate adjusts to 7.8% to reflect more stable cash flows and lower risk.

Conclusion & Counter Thesis

In conclusion, despite our assumptions suggesting that, at current prices, Nike is trading around its intrinsic value, the poor 2025 outlook and the deteriorating long-term expectations regarding Nike’s operations, brought us to express a “Sell” rating.

So far, Nike has been able to whittle away the damage inflicted by new and more innovative players thanks to its renowned brand, which to this day is still one of the most powerful and well-known brands in the world. However, as witnessed in the past decade, the Nike brand has not been enough to guarantee continued over-performance.

The sudden collapse of growth in FY24 and the poor guidance for FY25, made stock prices collapse more than (27%) since the beginning of the year, and due to a combination of macroeconomic headwinds and lack of competitiveness from Nike, further price corrections might be expected in the foreseeable future, as Wall Street analysts price Nike for the mature/declining company that it is rather than the growth company they expect it to be.

For such reasons, Nike does not represent a good investment opportunity.

A counter thesis to our “Sell” rating, which would see an upgrade to “Hold”, is primarily represented by the possibility that Nike can rediscover growth momentum in 2025 and introduce new products able to repristinate the brand’s popularity among customers.

Another major catalyst that would upgrade Nike’s rating to Hold is the acquisition of 3 million shares by the notable activist investor Bill Ackman – dated 14th of August 2024 – which made stock prices rebound before the end of August. However, the current stake owned by Bill Ackman is still too small to indicate an active role of the investor in turning around the company, as it only represents 0.25% of Nike, and few judgments about the company’s future can be made due to the lack of information behind their new acquisition.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.