Summary:

- Nike, Inc. delivered an excellent third quarter earnings report that easily outperformed both my own and analyst estimates.

- Nike looks like it has its inventory better under control with a sequential decline.

- Strong growth across all regions looks very promising, but with more challenging comparable quarters incoming, growth rates will likely drop.

- Nike direct revenues grew at a strong pace once more during the latest quarter, primarily driven by digital sales growth.

- The outlook for Nike looks strong, but the current valuation leaves investors with very little upside from current price levels around $124.

Robert Way

Introduction

Nike, Inc. (NYSE:NKE) might be one of the most recognizable brands in the world through its famous “swoosh” logo. The American multinational designs, manufactures, and sells mostly footwear and apparel, and I am yet to meet anyone unfamiliar with the Nike logo. Through this excellent branding power, the company has been able to show impressive growth over the last decade, and decent resiliency during the more difficult economic times like we are experiencing today. This consistency enabled it to double its revenue numbers over the last 10 years, while also lowering its store count to increase margins. The shift towards digital has been working out for Nike, as it is still seen as one of the primary growth drivers today.

Therefore, my outlook for the company is strong, and I believe that Nike is very well able to keep growing revenues and EPS over the next decade, although not as fast as we have gotten used to. Yet, despite my strong confidence in the long-term outlook, the valuation was simply too rich for me with the shares valued at a P/E of close to 40x when I covered Nike back in December. Back then, I wrote the following:

Despite the impressive quarterly results and strong growth drivers, I rate Nike a hold due to the increase in share price following its 2Q23 results. The stock does not offer a lot of upside potential at prices around $117 per share and a price target of $120.

Yesterday, March 21, Nike reported its 3Q23 results and managed to beat both top and bottom-line estimates. Revenue outperformed by $910 million, and EPS came in $0.25 above the consensus estimates, an approximate 30% beat. On top of this, the company also managed to beat my own estimates which I laid out in my previous article. I expected Nike to report revenue of $12 billion and EPS of $0.77, and while EPS was roughly in line with my estimates as it only beat by $0.02, revenue was still $390 million above my already high estimate. Therefore, I was quite impressed by the headline line numbers reported by Nike.

Following these results, I will revisit my rating and financial projections on the company by diving deeper into the company’s quarterly results, financials, and developments.

Let’s dive in!

Quarterly Review – Another impressive quarter

Nike already showed very impressive results when it reported its second quarter results back in December, as it managed to blow away the consensus and showed little weakness despite very high inflation and lower consumer spending, illustrating the incredible brand strength. 3Q23 was no different, with Nike again blowing away estimates and reporting very solid growth of 14% YoY to $12.4 billion. With Nike deriving a lot of revenue from outside the U.S., this meant that the revenue number was impacted by FX headwinds. Taking away these headwinds and Nike would have reported revenue growth of 19%, which is quite impressive. Yes, it was a slowdown from the 17% and 27% it reported last quarter, but it is nothing to complain about at all.

And Nike is not just growing its revenues at a rapid pace by passing on the increased production prices to its customers, but it actually seeing growth in volumes. This is what was said about this during the earnings call:

Consumer demand for our portfolio of brands remains uniquely strong, fueling unit growth of approximately 10% despite increased macro uncertainty.

Also, growth was strong across all geographies, with all except for China reporting double-digit growth on a currency-neutral basis. Europe witnessed the strongest growth with 25%, followed closely by North America and Asia Pacific & Latin America with 23% and 22% revenue growth YoY, respectively. China was still falling behind on these growth numbers with the region only growing revenue by 1% YoY due to the shift in covid measures in the country and the extremely high number of covid cases during the December quarter. With covid cases dropping and lockdowns all gone, growth in China should rebound during the current quarter and the rest of the year, boosting sales numbers. Nike already reported that it saw strong traffic increases in its physical stores in China during January which continued into February as well. Nike continues to invest heavily in China to extend its lead as the number one brand in the country, and management remains confident about the long-term growth fundamentals in China.

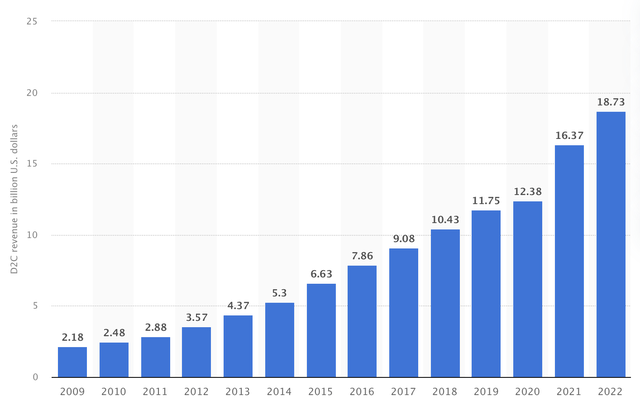

Incredibly important for Nike is its Nike Direct segment. Nike has been shifting from a wholesale business model to selling its products directly through its own stores and websites. By doing this, the company has been able to increase margins and have better control over pricing. I discussed this extensively in my previous article and concluded the following:

Nike is shifting to a Direct-to-consumer model which should drive margins as it controls the price of its product and takes the full profit for itself. I expect Nike to continue working on this strategic shift and believe it will be able to increase its margins as a result. In turn, this will drive EPS higher as well.

The graph below shows just how fast Nike has been able to increase its Nike Direct revenue, which was in large part boosted by the online sales during the covid-19 induced lockdowns.

Nike Direct Revenue (Statista)

And Nike managed to grow its Nike direct revenues at a strong pace once more during the latest quarter. This segment recorded revenue of $5.3 billion, up 17% YoY on a reported basis. This was primarily driven by digital sales growth of 20%, which was fueled by double-digit increases in traffic across its mobile apps. At the same time, the wholesale part of the business also showed strong growth as it recovered from the pain it still experienced from the Omicron variant one year ago. Wholesale grew by 12%.

Important to highlight as well are the inventory numbers for Nike, as this caused the share price to fall by over 10% after Nike reported its 1Q23 result 6 months ago, following increased inventory levels as a result of a significant slowdown in consumer spending. This was not something to worry about for this quarter, though, as Nike saw its inventory drop sequentially and only grow 16% YoY, showing that Nike has its supply chain now better under control and is able to sell down its inventory without high markdowns. Contributing to this strong improvement in inventory was also the fact that demand for Nike products was still higher than anticipated by management.

Still, despite the increased inventory numbers, the gross margins were impacted by some markdowns, combined with increased product input costs and elevated freight and logistics expenses. This resulted in a 330 basis points decline in gross margins, resulting in a gross margin of 43.3%. As a result, Nike reported a net income of $1.2 billion which, despite the strong increase in revenues, was down by 11% YoY, showing that Nike is still struggling with the continued high inflation. This also resulted in a 9% decline in EPS YoY to $0.79. This means that Nike reported a net income margin of slightly above 10%, which was at the low end of my expected 10-11% net income margin.

Overall, Nike delivered a very strong quarter once more as it showed that its brand is still unchallenged across all regions. Yet, while the inventory levels are starting to look better, Nike is still struggling with high inflation numbers which result in a negative impact on its margins and bottom line. I do expect this to improve over the next couple of months as inflation eases, resulting in lower input costs and freight expenses.

Balance Sheet & Dividend

Due to Nike struggling with high inflation over the last 12 months, resulting in a decreased bottom line result, its balance sheet also deteriorated quite a bit. Its total cash position decreased by 20% over this period and now stands at $10.8 billion. At the same time, its debt position increased by 8%, resulting in a long-term debt pile of $9.5 billion. This should not come as a surprise, but it is not what you like to see. Still, the cash position of Nike is sufficient and, with the expectation of improved profitability over the next couple of quarters, I don’t think this trend should worry investors.

And despite the pressure on profitability, Nike remains focused on returning cash to shareholders through share repurchases and dividends. Last quarter, Nike returned $528 million through dividends, up 9% YoY, while share repurchases totaled $1.5 billion.

Nike currently yields 1.08% based on an annual payout of $1.36. And while the yield is not overly attractive, the company has a strong history of dividend growth, and I see no reason why we should not expect the same going forward. Nike has been increasing its dividend at a 5-year growth rate of 11% and has been increasing for 11 straight years. In addition to this, the current payout ratio is only 34%, leaving plenty of upside for further increases even if the company struggles to grow over the next couple of years, which is also highly unlikely. Therefore, I believe we can expect Nike to keep growing its dividend at around 8-10% per year, making the company attractive to dividend growth investors.

Outlook & Valuation

Moving on to the outlook given off by management, they are quite confident about their performance. Nike continues to see strong demand and new product releases should boost consumer interest in the company. At the same time, the current macro environment remains challenging and uncertain, which results in Nike taking a somewhat conservative stance when it comes to its operations.

Following these excellent 3Q23 results, Nike now expects to report FY23 revenue to grow by high single digits, compared to a previous expectation of mid-single-digit growth. This includes approximately 600 basis points headwinds from foreign exchange rate headwinds. This means that Nike expects barely any growth for the fourth quarter which seems to be quite conservative indeed, but this is in part due to a moderation in wholesale growth due to a tougher comparable quarter.

Nike expects FY23 margins to decline by 250 basis points as a result of further inventory markdowns, high freight costs, and higher input costs. And while Nike is not giving any outlook for its fiscal FY24 yet, I expect this to show a similar performance as is expected for the next quarter. This means slight margin improvement sequentially as cost pressures start getting less, while revenue growth rates will start to come down due to tougher comparable quarters and continued macroeconomic headwinds.

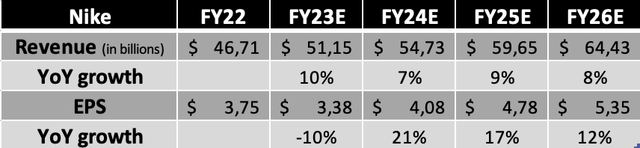

Now, following my deep dive into the company and all the aspects laid out above, I arrive at the following financial expectations for the years until FY26.

(4Q23 projection: Revenue of $12.67 billion and EPS of $0.81.)

Shortly explaining these estimates, I expect Nike to report 4% growth for the next quarter, slightly above management expectations, and the net income margin to remain relatively flat sequentially. I expect Nike to struggle in FY24 as macroeconomic worries and lower consumer spending will impact financial results, but with inflation coming down and Nike having its inventory better under control, I do believe there is room for significant margin improvements, driving EPS higher. In the years after, I continue to project revenue growth of high-single digits, while margin improvement through Nike direct and cost savings will boost EPS.

So, how does this compare to the Wall Street analyst consensus? According to data derived by Seeking Alpha, analysts expect Nike to report EPS of $0.70 for next quarter, combined with revenue of $12.61 billion, both slightly lower compared to my expectations. For the years up until FY26, the analyst consensus is roughly in line with my own, although my EPS estimate for FY24 is slightly higher. Also, my expectations by FY26 are slightly higher for both EPS and revenue, although not far from each other.

Now, as for the valuation, I concluded the following when I covered Nike after its 2Q23 results back in December:

I believe the company deserves a high valuation thanks to its resiliency and incredible brand strength which gives it a significant competitive advantage. Based on a 32x P/E ratio, which I believe is fair for Nike, I calculate a price target of $120 per share.

Since then, the share price has increased by 7% at the time of writing, with the current share price of $124. Yet, with analysts upwards revising their revenue and EPS projections, Nike is now valued at a forward P/E of 33x based on the current EPS consensus for FY24. I still believe that a quality compounder such as Nike deserves a higher valuation, but the stock is looking quite overvalued for some time now.

Based on a forward P/E ratio of 31x, which I believe is fair for Nike, and my FY24 EPS projection, I calculate a target price of $126 per share, leaving investors with pretty much no upside potential. As for comparison, 39 Wall Street analysts currently maintain an average price target of $133 per share or an 8% upside.

Conclusion

Nike, Inc. blew away all estimates once more with its third quarter results. This quarter showed once again just how strong the Nike brand is. And whereas competitors such as Adidas (OTCQX:ADDYY) are struggling to keep reporting solid financial numbers as a result of high inflation and lower consumer spending, Nike was once again able to grow revenues by solid double digits and destroy the consensus estimates. Nike acted accordingly once it noticed the changing market environment about 6 months ago and this is shown in the excellent results as well. This is what management said about this:

NIKE is more agile, responsive and resilient than before the pandemic with operational capabilities and an experienced team that enable us to create competitive separation. While we may continue to face heightened volatility, we are confident in our ability to drive sustainable and more profitable growth.

Nike looks well set for a strong performance over the next couple of years and this makes this quality compounder very attractive to investors. Yet even Nike is not worth any price, and with the shares currently valued at a forward P/E (FY24 EPS) of 33x, it is quite expensive.

Based on my own EPS projections for FY24, I do upgrade my Nike, Inc. price target from $120 to $126 but keep my hold rating unchanged, as upside potential from current price levels of around $124 simply does not leave enough upside potential to recommend buying this amazing apparel giant. Therefore, I feel no need to change what I said three months ago:

I do remain of the opinion that the company is a strong long-term investment and will start buying if the stock gets close or below $110 again.

I remain very enthusiastic about Nike, but simply not at this price. Therefore, I rate Nike, Inc. stock a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.