Summary:

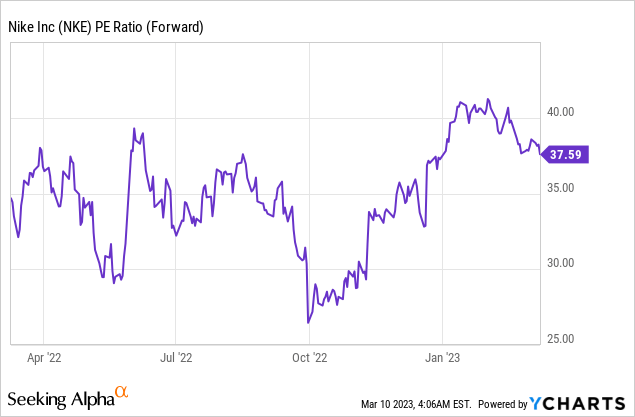

- Shares of Nike are trading for almost 40 times forward earnings.

- Nike is still the leading sports brand in the world.

- Investors should follow Nike and wait for a better buying opportunity.

Joe Raedle

Introduction

As an investor focused on dividend growth, I constantly seek new investment opportunities in income-generating assets. Whenever I encounter attractively valued assets I already hold, I consider adding to my existing positions. Furthermore, during market volatility, I take advantage of the situation by initiating new positions in different assets to expand my holdings and boost my dividend income while investing less capital.

Investors may find the consumer discretionary sector attractive due to the concerns around lower consumer spending. While some companies in this sector may be depressed, it’s worth noting that others, like Nike (NYSE:NKE), have a long track record of execution and may be better equipped to weather the storm as a leading athletic footwear and apparel brand. While risks may be associated with investing in the consumer discretionary sector, Nike may be an attractive investment opportunity for those willing to weather short-term fluctuations.

I will analyze Nike using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

NIKE designs, develops, markets, and sells men’s, women’s, and kids’ athletic footwear, apparel, equipment, and accessories worldwide. In addition, it sells a line of performance equipment and accessories comprising bags, socks, sports balls, eyewear, timepieces, digital devices, bats, gloves, protective equipment, and other equipment for sports activities under the NIKE brand and various plastic products to other manufacturers. The company markets apparel with licensed college and professional teams, league logos, and sports apparel.

Fundamentals

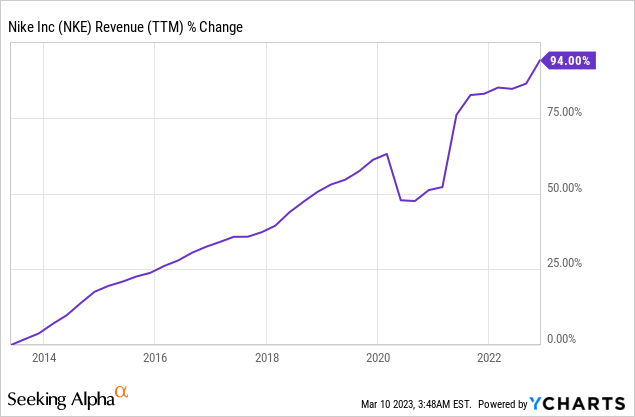

Over the past decade, Nike has experienced significant revenue growth, an increase of 94%. This growth was primarily driven by organic expansion into new markets, the launch of new products, and increased prices. Nike has consistently worked towards expanding its global footprint, establishing a strong presence in key markets like China and Europe. The company has also been innovative in its product offerings, introducing new lines such as Nike Flyknit and Nike React, which customers have received well.

Additionally, Nike’s focus on premium pricing has increased revenues as customers continue to place a high value on the brand and its products. In the future, as seen on Seeking Alpha, the analyst consensus expects Nike to keep growing sales at an annual rate of ~8% in the medium term.

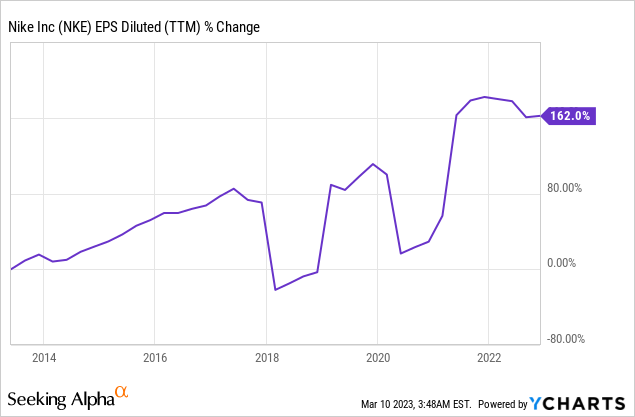

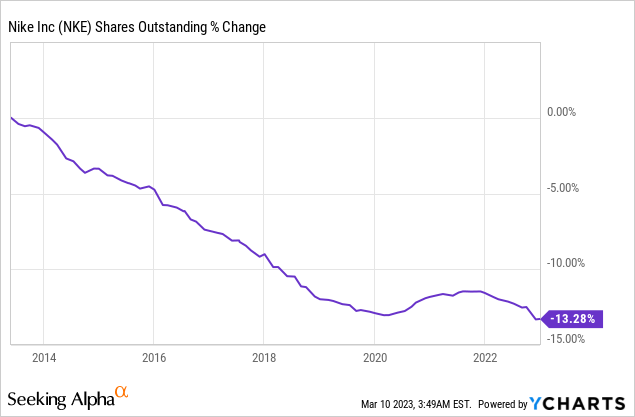

In addition to the significant revenue growth over the past decade, Nike’s EPS (earnings per share) has grown even faster, exceeding 160%. The faster growth in EPS can be attributed to a lower number of outstanding shares and improved margins. Nike has been committed to reducing its share count through share buybacks, resulting in fewer shares available in the market. Nike has also focused on increasing its margins by optimizing its supply chain, improving manufacturing processes, and reducing costs. In the future, as seen on Seeking Alpha, the analyst consensus expects Nike to keep growing EPS at an annual rate of ~6% in the medium term.

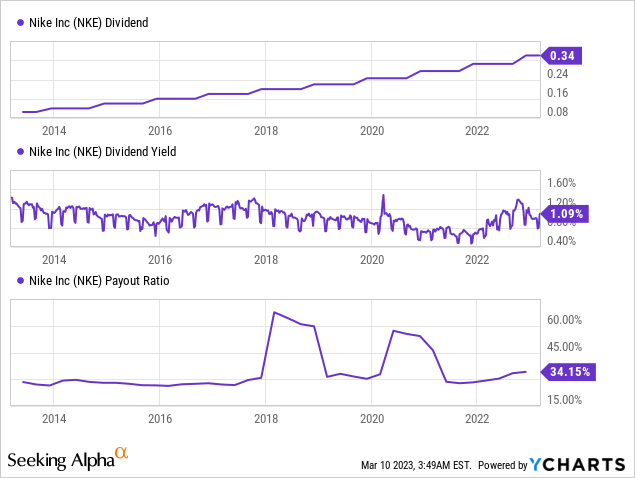

Nike has a strong reputation regarding dividend growth, having increased its dividend for 20 consecutive years and not having lowered it for nearly four decades. The company has been growing its dividend at a double-digit pace, reflecting its commitment to returning value to shareholders. While the current yield of 1.1% may seem low, it is worth noting that the payout ratio is only 34%, indicating that the dividend is sustainable and leaves room for further growth. Given the company’s strong financial position and consistent earnings growth, investors can reasonably expect high-single-digit dividend increases in the foreseeable future.

In addition to dividends, companies often return capital to shareholders through share buybacks. With a payout ratio of only 34%, Nike has room for buybacks, which can efficiently return value to shareholders when the share price is attractive. However, aggressive buybacks may not make sense as the current share price of Nike is high. Nonetheless, Nike has been consistently buying back its shares over the past few years, resulting in a reduction of outstanding shares by 13%. This approach has benefited shareholders as it increases the ownership stake in the company while boosting earnings per share.

Valuation

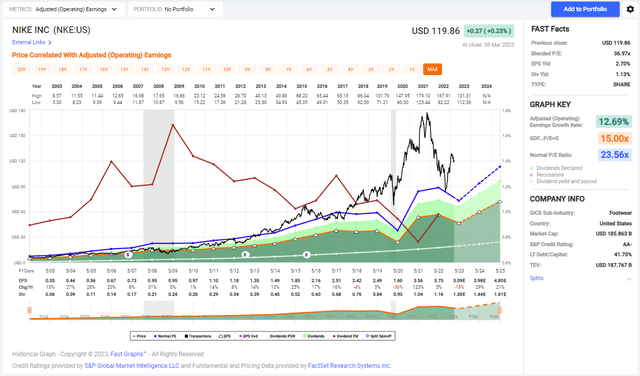

Nike’s P/E (price to earnings) ratio is not particularly attractive, standing at roughly 37 when using the 2023 earnings estimates. However, it seems investors believe in Nike’s management and ability to adapt to challenges. Despite the potential for weaker results in 2023, investors continue to give Nike a significant premium based on its strong track record, brand recognition, and ability to innovate.

Looking at the graph below from Fastgraphs.com, the shares of Nike seem expensive. Despite decreased EPS, the current share price is still elevated. Therefore, while the average P/E ratio of the company stands at 23.5, the current P/E ratio is closer to 40. The company has been growing historically at a double-digit rate, and analysts expect it to keep growing fast following the current year. However, it is still hard to justify the current premium with the level of uncertainty we see in the markets.

Nike demonstrated impressive revenue and earnings per share growth over the past decade, thanks to its focus on expanding into new markets, launching new products, reducing share count, and improving margins. The company has a reputation for consistent and substantial dividend growth, with a sustainable payout ratio leaving room for further increases. Share buybacks have also been a consistent means of returning capital to shareholders. While the current P/E ratio may not be attractive, investors appear to believe in Nike’s management and strategic initiatives in my view.

Opportunities

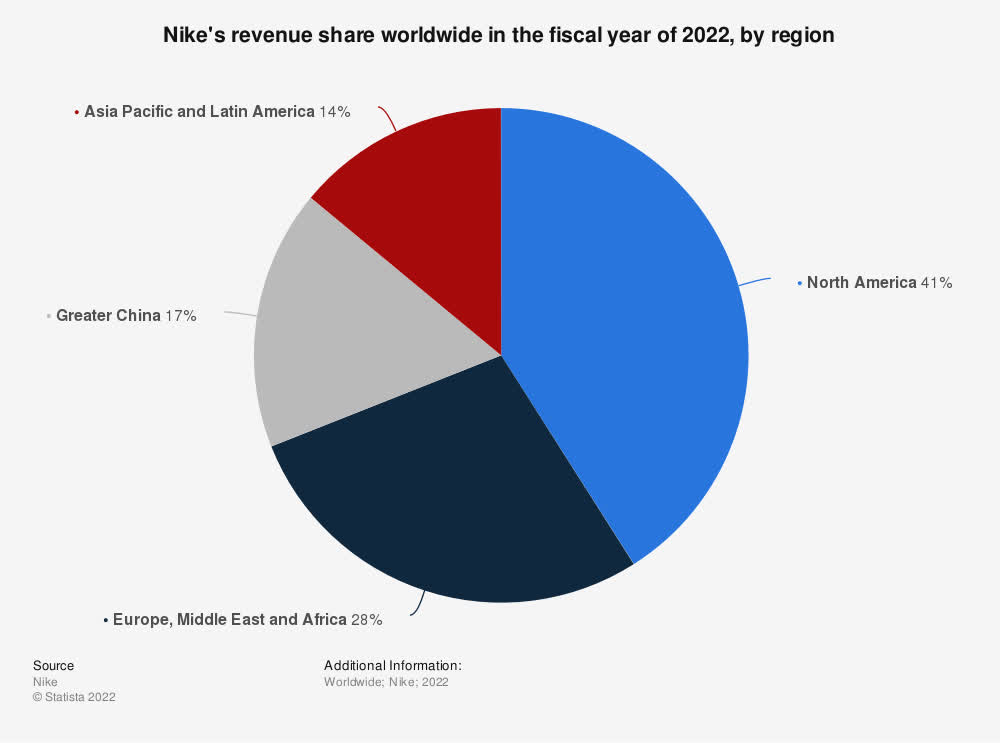

Nike is one of the world’s largest and most popular athletic footwear and apparel brands. Its success can be attributed to its diversification in sports and global reach. Nike is in various sports, such as basketball, soccer, running, and tennis. This diversification helps the company to reduce its risk exposure to a particular sport or market. Nike has a global reach and presence in over 190 countries, making it a truly global brand.

Nike’s diversification in sports and global reach also help increase its customer base, ultimately leading to higher sales and profits. This strategy has been highly beneficial to the company as expanding on both axes- global markets and different sports, allowed it to increase its footwear market share significantly from 17% in 2011 to 30% in 2021. Market share gives Nike better brand recognition and pricing power.

Statista

Another reason to invest in Nike is its leading contracts with top athletes. Nike has a long-standing tradition of partnering with top athletes across different sports. For example, the company has endorsement deals with some of the most famous athletes in the world, including Michael Jordan, LeBron James, Cristiano Ronaldo, and Serena Williams, to name a few. These athletes promote Nike’s products and help create a strong brand image.

Nike’s partnership with top athletes also helps to attract more customers who aspire to be like their favorite athletes. This ultimately leads to higher sales and profits for the company. The most crucial sponsorship deal Nike has is with Michael Jordan. Sales of the Jordan brand totaled $5.1B in 2022, up 6% compared to 2021 and 42% higher than in 2020. The sale of the Jordan brand alone is more than 10% of the total sales to show its importance.

Coming soon, we’ve got some exciting signature debuts in NIKE Basketball and Jordan brand that we can’t wait for consumers to see. With our strong product portfolio and unparalleled roster of athletes that we have today, we couldn’t be more excited about the future of our basketball business.

(John Donahoe, President and CEO, December 2022)

Finally, Nike’s solid digital and e-commerce presence and its Nike membership program make it an attractive investment opportunity. The company has invested heavily in digital and e-commerce platforms to improve the customer experience and increase sales. Nike’s digital platforms include its website, mobile app, and social media channels, which help to promote its products and engage with customers.

Nike’s membership program also provides customers with exclusive offers, free shipping, and personalized experiences. This program helps to increase customer loyalty and encourages repeat purchases, ultimately leading to higher sales and profits for the company. Focusing on direct digital sales allows the company to control the value chain better and not rely on large wholesalers. It will eventually improve margins as there are fewer middlemen. In 2016 roughly 25% of the sales were direct, and the rest were through wholesalers. In 2022, this figure increased to 40%.

In North America, Nike Digital sales grew 31% year over year. That fueled 23% direct-to-consumer sales growth in the region

(Matthew Friend, CFO of Nike, November 2022)

Risks

While Nike is a highly successful company with promising prospects, several risks are associated with investing in the company. One of the primary risks is intense competition from other athletic footwear and apparel brands. Nike faces competition from established brands like Adidas (OTCQX:ADDYY) and Under Armour (UAA) and newer entrants into the market. Competition can result in price pressures and reduced profit margins, negatively impacting Nike’s financial performance.

Another significant risk associated with investing in Nike is the potential impact of a recession. During a recession, consumer discretionary spending tends to decrease, which could lead to lower sales of Nike’s products. As a result, Nike’s revenue and profits could decline, putting pressure on the company’s stock price. Furthermore, during an economic downturn, consumers may opt for lower-priced products, which could negatively impact Nike’s premium pricing strategy.

Finally, Nike’s high inventory levels could pose a risk to investors. Excessive inventory levels can result in increased costs and pressure on margins. At the moment, Nike’s inventory is worth almost $10B. The last quarter was the first decline in inventory since the pandemic. Still, the inventory is very high, and if the demand for Nike’s products does not meet expectations, the company will be forced to discount prices to move inventory, which could impact profit margins. Currently, Nike copes with the high inventory level thanks to high demand from wholesalers, yet weaker demand may force discounts.

Nasdaq.com

Conclusions

All in all, Nike has shown decent fundamentals and has maintained its leading position in the sportswear market. However, the current valuation is very high. While the company has grown rapidly over the past decade, investors should be cautious about the high P/E ratio. Despite the high valuation, Nike still has decent growth opportunities, primarily focusing on digital and e-commerce capabilities. There are also limited long-term risks for the company, as it has a strong reputation for innovation and consistently adapting to changes in the market. While there are potential risks, such as competition and the potential for decreased consumer spending during a recession, Nike has demonstrated resilience in the past and has a solid foundation to weather any future challenges.

Despite the potential for long-term success, the high valuation of Nike stock at the moment makes it a HOLD for investors. While the company has solid fundamentals and growth opportunities, the current P/E ratio is relatively high, which may limit potential returns in the short term. Investors may want to wait for a better chance to invest in Nike, such as when trading within its historical valuation. A share price of $90-$100 would make Nike more attractive, even if not cheap. It would imply a P/E ratio in the low 20s when looking at the estimates for 2024.

Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.