Summary:

- Nike’s opportunities in emerging markets should enable high levels of growth as more regions enter the middle class.

- Nike’s competitive advantage, based on its brand and cost advantages, has proven to be secure despite significant competition.

- Nike’s direct-to-consumer model has diminished wholesale redundancies and image diminishment and brings the Nike brand closer to the customer.

- Supply chain/inventory-based headwinds should peter out as COVID protocols loosen.

Robert Way

Investment Thesis:

NIKE (NYSE:NKE) has been the leader in the athletic apparel market for years, and it is my belief that Nike’s moat, consumer plan, and potential in developing markets justify a BUY in NKE.

Moat

Nike’s moat has a few aspects. Nike’s brand recognition is second to none, as shown through its leading market position in both North America and China, as well as promising growth in emerging markets and dominance of certain sports, such as basketball.

In addition, Nike’s cost advantages are significant — their annual revenue of $49 billion dwarfs adidas’ (OTCQX:ADDYY) $22 billion and Under Armour’s (UA) $5.7 billion, which enables them to come to more favorable terms with retailers, vendors, and suppliers, which gives it an advantage in economies of scale in its industry.

In the same vein, Nike is able to spend more on marketing, R&D, and other miscellaneous expenses than its competition despite similar revenue distribution per expense (e.g. if Nike spent $4.9 billion on these expenses, it would be equivalent to $2.4 billion for Adidas, or $570 million for Under Armour — all 10% of revenue). This enables Nike to maintain its competitive advantage by ensuring that they are consistently top of the industry in advertising and innovation.

Valuation

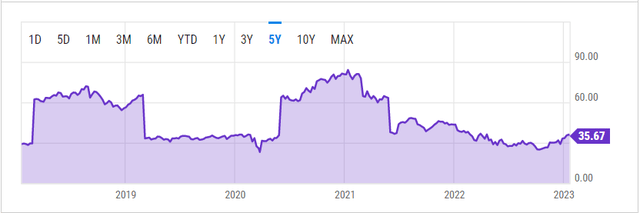

Nike’s valuation is, admittedly, somewhat high. Its current P/E ratio hovers around 35, which is well above the industry average. However, I believe that now is a good time to buy for a few reasons. For one, Nike has had a historically high P/E, as seen below.

I find that Nike’s current P/E is contextualized by its historic values, and it helps to justify investing in Nike at its current price. Furthermore, FactSet analyst composites put a fair price for Nike at about $130 per share, which is promising for its current value. I also find Nike’s growth potential, discussed below, to help explain its somewhat high valuation.

Current Issues

Nike has recently struggled with supply chain and inventory, in large part due to the effects of the COVID-19 pandemic on production and shipping, specifically in Asian markets. This has led Nike to apply generous markdowns on their excess product, which has eaten into margins. However, I believe that these problems are mostly in the past. Nike themselves declared last month that they believe the worst of the issues are behind us, and with COVID regulations loosening, as well as the abnormal nature of the pandemic, I do not anticipate a resurgence in these problems.

Nike’s inventory has begun decreasing (down 1% in late 2022), which is promising for future margins as markdowns become less common. Nike forecasts a healthier inventory position by the end of FY 2023, and it is my belief that the company will see margin growth as a result.

Emerging Markets

Nike’s footing in China, greater Asia, Africa, and Latin America suggests healthy room for growth in developing markets. Only 40% of Nike’s revenue comes from North America, with another 16% coming from China and 13% coming from Latin America and the remainder being made up of EMEA. As more underdeveloped regions continue to modernize and advance towards the middle class, as is projected, Nike stands to increase its customer base. Because of this, I find it highly likely that Nike’s sales will grow at an enticing rate. Morningstar projects that more than 70% of Nike’s growth over the next five years may come from outside North America — and this growth is more sustainable than simply further saturating developed markets.

Consumer Plan

Nike’s “Triple Double” plan has already begun paying dividends. Nike Direct sales already make up more than 1/3rd of Nike brand revenues and improved 32% from 2020 to 2021 as well as 14% from 2021 to 2022. This will allow Nike to edit out many of their distribution partners to focus on a superior customer experience and brand management.

The Nike App has accumulated hundreds of millions of users. It enhances the shopping experience by granting access to the Nike+ rewards program and more personalization, with the added benefit of Nike being able to analyze customer data to effectively view shopping habits and product preferences.

I find this streamlined approach likely to improve margins and perhaps market share. Membership in its digital channels has grown at speeds that have exceeded expectations, which bodes well for future growth.

Financials & Comps Analysis

A chart comparing Nike’s financials to its competitors is shown below.

| Total Revenue TTM | Price/Earnings | EBITDA TTM | Debt/Assets TTM | Operating Margin TTM | Return on Equity TTM | ||

| NIKE (NKE) | $49,107,000 | 35.77 | $7,602,000 | .32 | 12.99% | 37.01% | |

| Under Armor (UA) | $5,753,092 | 38.90 | $334,306 | .32 | 4.60% | 8.16% | |

| adidas (OTCQX:ADDYY) | $24,283,210 | 33.09 | $3,074,892 | .27 | 6.51% | 12.51% | |

| Skechers U.S.A. (SKX) | $7,195,992 | 10.45 | $654,193 | .24 | 7.69% | 23.23% | |

| ASICS (OTCPK:ASCCF) | $3,576,783 | 37.90 | N/A | .27 | 4.99% | 8.10% |

All data sourced from Morningstar, Inc.

Financially, Nike stands above its competitors.

First, Nike has the advantage of size. As stated before, the economies of scale afforded to Nike because of its large revenue base and impressive global reach help it reach more favorable terms with suppliers and distributors, as well as spend more on operating expenses.

Second, Nike clearly has the best profitability. Their operating margin and ROE are significantly better than all relevant competitors, and I suspect that these margins will be augmented by Nike’s direct-to-consumer plan and continued brand advantage.

Third, Nike’s P/E ratio doesn’t seem so outrageous when compared to its direct competitors. It is difficult to say Nike is overvalued when given the alternatives in the industry.

Looking at growth, Nike’s revenue has been growing at a consistent, though modest, pace over the last several years. More promising, however, has been Nike’s net margin growth — returning from pandemic lows of 6.79% to a record 12.94% in FY 2022. Due to their presence in developing markets, I find this growth to be sustainable.

Nike’s dividend yield, while moderate, should not be discounted. $1.26 per share makes a dividend yield of nearly 1%, which supplements Nike’s future growth prospects.

I do not find Nike to be the most rapid growth stock out there — rather, I find their modest growth to be sustainable and anticipate that their consumer plan and presence in diverse markets will help them at the least keep pace with the broader index. Therefore, I find Nike to be an excellent exposure to its industry, with by far the most promising growth in the sector.

Risks and Other Considerations

As with all stocks, Nike is not without risks.

First, Nike’s inventory problems are somewhat indicative of poor management. While the excess inventory is slowly dwindling, Nike has proven that supply chain disruptions can and will disturb their margins & inventory management.

Second, Nike’s position in the Chinese market is somewhat vulnerable to China’s nationalist sentiment and strict government regulations (see the recent COVID situation). Should Nike lose a significant share in this market, I am much less confident in its future.

Third, competition. Brands like Under Armour, while not yet very significant when compared to Nike, have been growing at a commensurate rate to Nike, and it is possible that Nike may lose share should market opinion shift away from them due to some unforeseen factor.

Fourth, as a global brand, Nike is exposed to global risks. Rapid currency exchange rate changes, shipping delays, and international conflicts are all potential factors that could negatively impact Nike’s global business (which, I remind you, is a major portion of its revenue).

The Bottom Line

Overall, I find Nike to be in a very good position. As global markets mature, Nike stands poised to take the lion’s share. Further, their streamlined consumer plan has shown promising results. Finally, their moat affords Nike a sustainable competitive advantage, and Nike’s valuation is considered at least near fair by most metrics. Throw in a decent dividend & stable revenue base, and I find Nike to be a buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NKE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.