Summary:

- Income-based investors frequently like to purchase dividend-growth stocks that have a solid record of growing their dividends over the long run.

- Nike is a stock that seems to meet this criterion.

- With a recession looming and current price levels, now is likely not the best time to purchase shares.

stockelements/iStock Editorial via Getty Images

Many American investors are focused on the income their holdings might provide. Some want current income; others want future income. The former tend to focus on purchasing shares in companies or funds with higher yields. What constitutes a high yield can depend on the investor. Some look at 4% as a relatively high yield. Others try to lock in yields of 8%, 10% or higher.

There are other investors who focus on dividend growth. Most of the time, dividend growth stocks have lower yields with a dividend that grows over time. Frequently, lower yielding stocks can afford to grow their dividends at a rate that exceeds 10% annually. One such company that I own is Lowe’s (LOW). This stock yields around 2%, but over the past several years, the dividend payment has doubled roughly every four years, give or take.

Another company that fits into the latter group would be Nike (NYSE:NKE). This company has a long track record, and it’s grown its dividend quickly in recent years. I can remember my grandparents buying me a pair of Nikes before Air Jordans were popular. Once Michael Jordan signed on, Nike became an iconic brand. The “swoosh” logo is known throughout the globe, and the company sells shoes, athletic apparel, and equipment to brand-conscious consumers. In addition to selling the Nike brand, the even more traditional basketball brand Converse (think Larry Bird and Magic Johnson) is owned by NKE.

The company’s stock also has a strong track record. Investors in Nike have done well over the long run, and the company is not likely to go away anytime soon. However, just because a company has had a strong track record, it does not necessarily make sense for an investor who is focused on income to purchase its stock.

Nike’s Dividend Growth

The dividend growth record of Nike is strong. The company has grown its dividend every year since 2004. While this is not a strong as some other companies like Johnson & Johnson (JNJ) or McDonald’s (MCD) that have a dividend growth record of 50 years or more, it’s still continued through a couple of major recessions and a global pandemic.

Not only has the dividend grown, it’s grown quite rapidly. Over the past five years, NKE has grown its dividend 11.14% per year. This rate would lead to the doubling of the dividend in a little more than six years.

It is likely that NKE can continue raising its dividend at a healthy rate in the near future. The payout ratio for most of the past decade has been around a third of earnings. There were a couple of outliers, but these years only had a payout ratio in the 60% range. A lower payout ratio generally corresponds with a safe dividend that allows for future raises, and Nike fits the bill.

The yield, even with this strong record of growth, is quite low, however. The current yield is only 1.07%, which is well below the yield offered by the S&P 500 as a whole. Those looking for current income along with strong dividend growth can find other options that would likely work better.

Financial Overview

Over the past ten years, Nike has nearly doubled its revenue, going from $25.3 billion to $46.7 over that period of time. The most recent quarterly report showed a 17% increase in revenue on a year-over-year basis. However, the company noted that its gross margin decreased because of higher markdowns intended to liquidate inventory. Current inventories were actually up 43% over the prior years as supply chains improved as pandemic restrictions eased. This inventory will need to be sold, but with the recent increase in sales, it remains to be seen how quickly Nike can turn it around.

Net income has more than doubled over the past decade, as have earnings per share, from $2.472 billion to $6.046 billion and $1.34 (diluted) to $3.75, respectively. The company paid down a little bit of its debt over the past annual report, as well, improving its financial position. As of the May 2022 annual report, the company owed $12.722 billion. Based upon recent sales numbers, this should not be an overly concerning level of debt.

One factor that could bode well for NKE shareholder returns is a new share repurchase program. The company approved an $18 billion buyback. The company has cut its share count by about 1/9 over the past ten years, and this latest buyback program could cut slightly more than 9% from the current number of shares outstanding, based upon the company’s current market cap.

Assessment

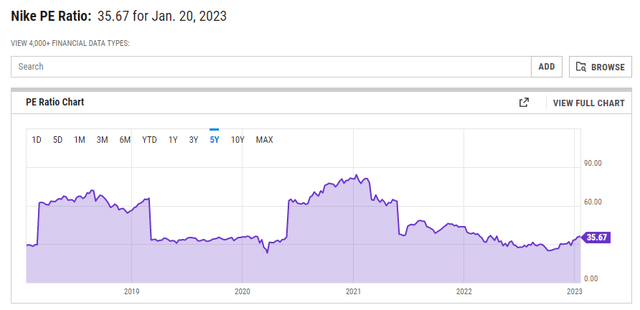

While the dividend yield is low, Nike is still a great company with solid financials and a growing dividend. It’s worth holding in a portfolio. However, I am not ready to start a position at current levels. The current price of $126.62 (as of January 21, 2023) corresponds to a PE ratio of nearly 36. While this is fairly normal when looking at the last five years, there have been a few opportunities to purchase shares at a lower price.

Most recently, shares fell as low as $83 a share at the end of September 2022. This would have been a prime buying opportunity. The price has increased by about 50% in less than four months. Such rapid growth is not really sustainable for the long term.

Additionally, if the concern over a recession becomes a reality, consumer discretionary stocks like Nike could get hit as people stop spending as much as they might otherwise spend. This could provide a better entry price and dividend yield, even if the PE ratio is higher. If the economy recovers relatively quickly, those who hold off on purchasing until the price drops could benefit quite a bit. At this price and this yield, I’m not likely to be a buyer, but if I held the stock, I’d continue to do so.

Disclosure: I/we have a beneficial long position in the shares of LOW, JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment professional. The preceding is intended for informational and educational purposes. Please make sure to perform due diligence before investing in equities, as losses up to all capital invested can occur.