Summary:

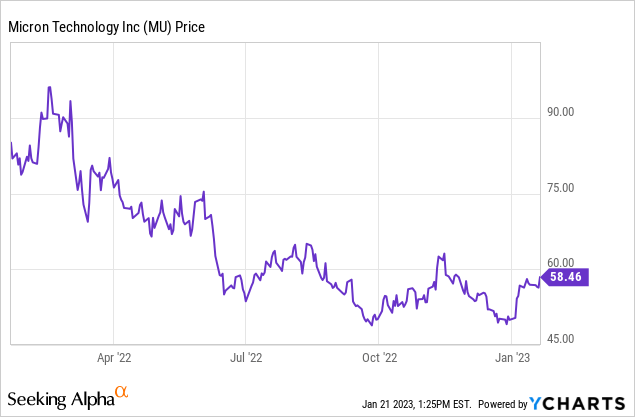

- Shares of Micron are down 31% over the past year and the chipmaker’s first-quarter fiscal 2023 figures signal that things will continue to deteriorate.

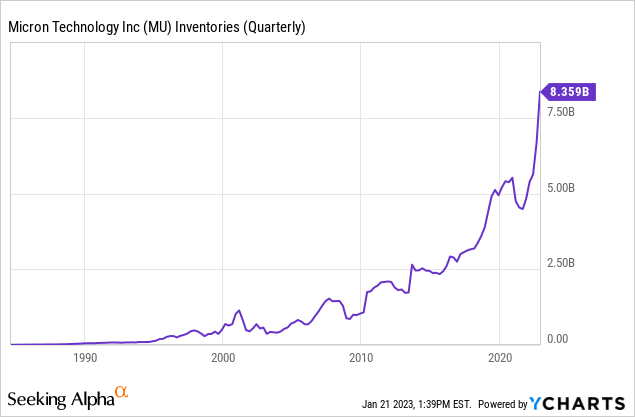

- The amount of surplus inventory that the company possesses will be one factor that makes this slump significantly worse than other downturns.

- Profitability may continue to be difficult through 2023, but investors should anticipate stronger margins as memory chip demand picks up.

- Micron probably won’t find its pace again until 2024.

- The company has a solid balance sheet and moat that will shield it from serious harm, but I still think it’s a HOLD, at least until it starts making money again.

vzphotos

Investment Thesis

Shares of Micron (NASDAQ:MU) Technology are down 31% over the past year and the chipmaker’s first-quarter fiscal 2023 figures signal that things will continue to deteriorate.

The company’s most recent quarter showed a dramatic fall in revenue, and the company went from making a profit to losing money. The forecast for the current quarter indicates that difficult times will persist for some time.

However, Micron has capitalized on the expansion of the memory chip market over the past many years. The corporation has accumulated a substantial amount of cash on its balance sheet as a result of record profits and cash flow in the previous years, which will be useful now that demand and prices for memory chips are plummeting. Moreover, analysts believe that the computer memory business will continue to see rising demand in the future, and this, combined with Micron trading at low multiples, causes investors to wonder if the company represents an opportunity.

The Inventory Level Is Concerning

The amount of surplus inventory that the company possesses will be one factor that makes this slump significantly worse than other downturns. Before memory chip prices may stabilize, a number of events must take place, and it will take some time for them to unfold. Analysts predict that the company’s unprofitability will remain through 2023, though they do anticipate some progress the following year. This year, the demand for PCs suddenly fell, and Micron anticipates weaker demand from cloud computing customers as well as sluggish demand for smartphones.

The company’s own inventory issue is really bad. According to the most recent report, Micron has $8.359 billion in inventory, an increase from $6.663 billion three months earlier and $4.827 billion one year ago. Moreover, the number of bits in inventory is probably increasing far more swiftly than the value of that inventory, as per-bit prices are falling so quickly as a result of the decreased demand. This quickly depleting inventory may also indicate that the company’s sales were lower than the management anticipated, leaving a large amount of stock on hand. The inventory position at Micron indicates that this slump will be more severe and prolonged than any previous downturn.

How The Future Looks Like

Revenue for Micron’s fiscal first quarter decreased dramatically from the same period last year to $4.1 billion as a result of both lower memory shipments and a steep drop in prices. This also caused the margin to drop significantly. The gross margin for the company dropped to less than 22% from 46% in the same period last year.

As expected, Micron reported an adjusted loss of $0.04 per share versus a profit of $2.16 at the same time last year, and according to the company’s predictions, things are about to get worse. This quarter, the management projects an adjusted gross margin of just 8.5%, a decrease of almost 40% from the same period last year. In contrast to the prior-year period’s profit of $2.14 per share, analysts have projected an adjusted loss of $0.62 per share.

In contrast to last fiscal year’s earnings of $5.56 per share, analysts do not expect a rebound in the full fiscal year, projecting a 46% decline in revenue to $16.65 billion and an adjusted loss of $1.91 per share.

This is not unexpected given the weakening demand for memory chips following a decline in sales of personal computers (PCs) and smartphones.

Additionally, there has been a decline in the market for memory chips used in servers and graphics cards. As a result, it is anticipated that the cost of dynamic random access memory (DRAM) chips will decrease by 13%–18% this quarter.

As a result, profitability may continue to be difficult through 2023, but investors should anticipate stronger margins as memory chip demand picks up as businesses in this sector cut spending and scale down production in response to the bad market.

Moreover, at a compound annual growth rate (CAGR) of 7.7%, analysts forecast that the size of the worldwide memory chip market would increase from $83.81 billion in 2022 to $90.24 billion in 2023. As a result, Micron’s luck may begin to improve as demand for memory chips increases, but it might take some time before prices begin to rise.

Micron probably won’t find its pace again until 2024. Smartphone sales are anticipated to pick up steam beginning in the second half of 2023, while PC sales are anticipated to rebound in 2024. The memory market is now experiencing rapid price drops, but these should lessen when demand starts to increase and supply starts to become constrained.

Micron is anticipated to deliver significantly higher performance in fiscal 2024 as a result. In fiscal 2024, analysts predict a 44% rise in revenue and a return to profitability, followed by another strong year in fiscal 2025.

Conclusion

In conclusion, it is challenging to predict whether and when Micron’s stock will hit the record highs attained in late 2021 and early 2022. The sector appears to be quickly returning, though. After all, there will always be a need for semiconductors, and in 2023, demand for memory is anticipated to exceed supply. Sales and profitability for Micron will soar after the remaining stock is depleted.

Currently, it’s difficult to predict exactly when that will happen, but I wouldn’t anticipate that run to start until the end of 2023. Micron’s shareholders might continue to take advantage of the dividend and stock repurchase programs in the meantime.

Personally, I think Micron will continue to be a major participant in the semiconductor industry. However, the company’s near-term prospects don’t seem all that bright, so I wouldn’t start a position right now. Having said that, I might reconsider whether to include Micron in my portfolio once the company gets back on track and demand for its goods recovers to its prior levels. The company has a solid balance sheet and moat that will shield it from serious harm, but I still think it’s a HOLD, at least until it starts making money again.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.