Summary:

- NIO reported mixed Q4 results and submitted light outlook for Q1’24 deliveries.

- The EV maker reported better-than-expected Q4 revenues, but EV demand is slowing which may, together with concerns over near-term profitability, weigh on the company’s valuation factor.

- NIO’s vehicle margins are improving, however, which was a major takeaway for investors. Stronger margin growth could accelerate the firm’s profitability timeline.

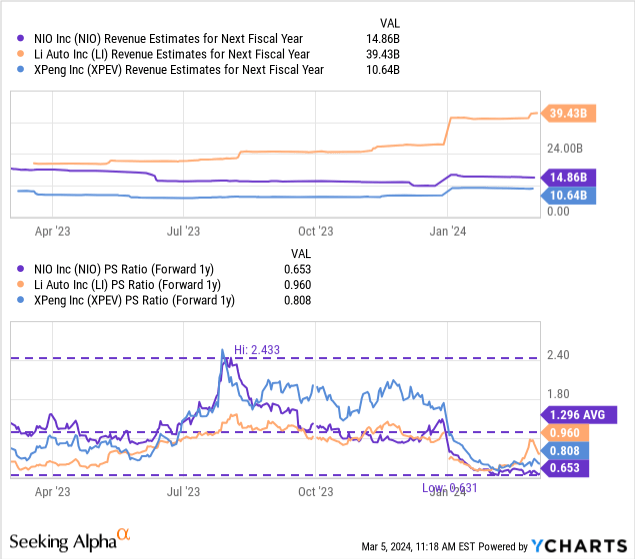

- Shares trade at half NIO’s 1-year average P/S ratio, implying that investors are overly bearish.

MediaProduction/iStock via Getty Images

NIO (NYSE:NIO) reported mixed results for the fourth quarter that saw 7 cent EPS miss, but a $70M revenue beat (Source). The electric vehicle maker reported single-digit top-line growth for the fourth-quarter and widening losses Q/Q… which were expected. The outlook for Q1’24 was also light and missed consensus expectations. However, the company is making crucial progress when it comes to its vehicle margin trend, which I believe will be the defining theme in FY 2024. With NIO growing into a larger production footprint, vehicle margin expansion could accelerate NIO’s profitability timeline. While there is a risk that shares drop into the penny stock zone (a price below $5), shares of NIO are cheap based off of revenues and have revaluation potential in the longer term!

Previous rating

I rated NIO a strong buy due to the company’s extended liquidity run-way following its last convertible senior debt offering as well as solid delivery momentum in the second half of FY 2023: Why 2024 Could Be The Year Of NIO. I also see continual margin expansion potential for NIO after the EV marker reported its third consecutive quarter of margin growth in Q4’23. Li Auto (LI) also reported a sequential improvement in its margin profile in the fourth-quarter. With both margins and deliveries pointing upwards, I believe it will only be a question of time until NIO’s share price follows.

NIO delivers a decent earnings report for Q4’23

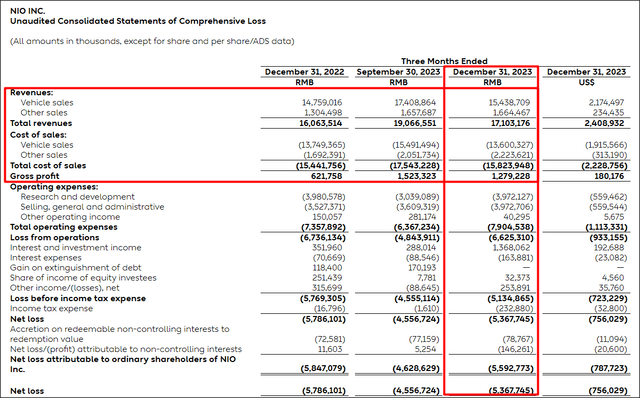

NIO reported mixed results for its fourth fiscal quarter which included total revenues of $2.41B compared against the consensus prediction of $2.34B. NIO missed on adjusted earnings, with this figure coming in at $(0.39) which was 7 cents worse than the EPS expectation.

NIO generated revenues of 17.1B Chinese Yuan ($2.4B) in the fourth-quarter, showing only 7% Y/Y growth as the EV market experiences headwinds in terms of demand and more EV makers are competing for customers in the segment. For those reasons, NIO also saw a dip in delivery volumes in the fourth-quarter during which the EV company delivered 50,045 electric vehicles to its customers, a decline of 5,387 units Q/Q.

Since NIO is still ramping up its production of SUV and sedan models, and because delivery volumes dropped Q/Q, NIO also reported expanding losses on an operating and net loss basis. In Chinese currency terms, NIO’s operating loss widened to 6.6B Chinese Yuan (+37% Q/Q) while its net loss increased to 5.4B Chinese Yuan (+18% Q/Q).

While the lack of profitability is something that has been weighing on NIO’s valuation, the EV maker’s margin profile continued to improve in Q4’23.

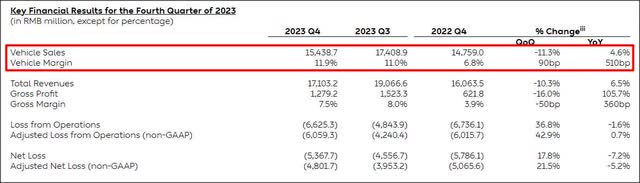

3rd consecutive quarter of vehicle margin improvement

NIO’s vehicle margins expanded for the third consecutive quarter in Q4’23 and now stand at 11.9%, showing an increase of 0.9 PP Q/Q. Li Auto’s vehicle margins are more than twice as high as NIO’s: they reached 22.7% in Q4’23 which is see Li Auto as the most promising stock in the Chinese electric vehicle start-up market.

The vehicle margin trend is obviously a positive as is a potential lever for NIO to reduce its losses going forward and accelerate its profitability timeline. NIO is currently expected to be profitable by FY 2024. This year, NIO is going to release 2024 models of its current SUV and sedan line-up with updated hardware configurations and the company has said that it will launch a new model, the ET9 sedan, in Q1’25.

The ET9 sedan marks NIO’s entry into the luxury sedan EV segment: the EV maker has been chiefly focused on an SUV-centric line-up in its early history, but is making increasingly aggressive moves in the sedan space to appeal to a different customer group. The ET5 and ET7 were both entry models in the sedan space and their deliveries have ramped up nicely in 2023.

NIO’s updated 2024 EV line-up, according to a regulatory finding (Source), will also include shorter range vehicle options for consumers. Therefore, I expect NIO to become a lot more active on the expense side of the business this year, work out production improvements and lower operating expenditures in a bid to control cash burn.

NIO’s projection range for Q1’24 deliveries

NIO projects to deliver between 31,000 and 33,000 electric vehicles in the first-quarter of FY 2024, implying only 6.3% year-over-year growth, in the best case. Revenues are projected to come in between 10.5-11.1B Chinese Yuan ($1.5-1.6B), potentially showing growth of up to 3.8%. The outlook is light and came in below the Q1’24 consensus delivery expectation of 44,000 units.

NIO’s licensing agreement with Forseven

In February, NIO announced that it entered into a technology license agreement with Forseven Limited. Forseven is a subsidiary of CYVN Holdings, an investment firm majority-owned by the Abu Dhabi government, which last year invested $738.5M into NIO. I called the deal at the time a game-changer for NIO last year because it shored up the company’s balance sheet, improved its liquidity profile and showed confidence in NIO’s growth strategy.

Forseven is a British start-up that will build luxury EVs and is also financed by CYVN Holdings. The technological license agreement — which calls for the use of NIO’s EV software for R&D and production of Forseven’s electric vehicles — is valuable because it recognizes NIO’s driving technology as state-of-the-art EV tech. It also highlights the increased collaboration potential that exists for electric vehicle companies in terms of sharing software and driving technology.

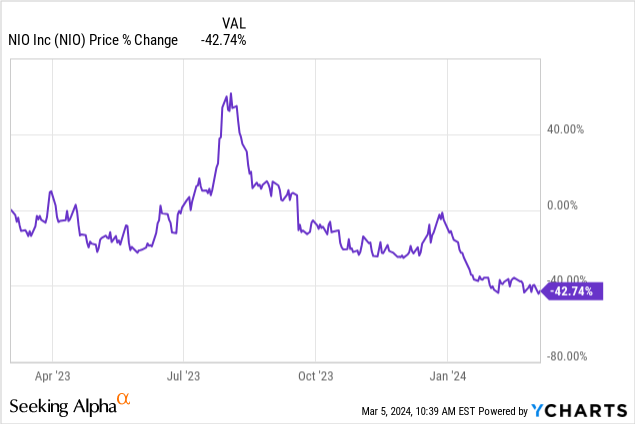

NIO’s valuation is still the biggest reason to invest

While NIO needs to get a grip on its profitability situation, I believe the margin trend was a positive take-away from the earnings report. Additionally, NIO is most attractive as an investment, in my opinion, in terms of its valuation: the EV maker’s shares are trading at its lowest P/S ratio recorded in the most recent past: 0.65X.

The 1-year average P/S ratio, which I am using since NIO is not yet profitable, is 1.30X so if NIO could only revalue to its 1-year average sales multiplier then NIO could double its valuation to about $10.80. In the longer term, I see a fair value of $11 for NIO, as I explained in my last work on the EV maker. This fair value has not changed since my last coverage, but it may change going forward depending on the company’s progress in terms of delivering growth and narrowing operating losses. I would also be willing to adjust my fair value estimate downward in case NIO’s vehicle margins were to drop back to the mid-single digit territory seen at the beginning of FY 2023 which is when margins bottomed out at 5.1%. Since the margin trend is favorable and NIO’s production footprint is growing, I don’t see this as a likely outcome in the short term, however.

Penny stock risks with NIO

The biggest risk for NIO, as I see it, is a potential reversal in the margin trend if EV companies continue to compete chiefly on price. Tesla (TSLA) has been responsible, mainly, for growing margin pressure for Chinese EV companies as the U.S. company announced aggressive price cuts for its most EV popular models last year. Secondly, in the near term, NIO has a risk of sliding into penny stock territory ($5 or less) which could weigh on investor confidence and may at some point even force the company to do a reverse stock split.

Thirdly, a weak (reservation) start for the ET9, falling sedan production shares and slowing top-line growth would all be reasons why an investment in NIO would not meet my expectations. An invasion of Taiwan may also be included as a macro-specific risk that could further dent the reputation/investability of Chinese EV companies.

Final thoughts

NIO delivered an overall decent earnings sheet for the fourth-quarter that showed expanding operating/net losses (which was expected), but also a somewhat disappointing near term outlook for first-quarter deliveries. However, on the positive side, NIO was able to expand its vehicle margins to 11.9% in Q4’23, representing a 0.9 PP change Q/Q and it marked the third consecutive quarter of positive margin growth… which is the reason, together with the valuation, why I maintain my strong buy rating. Shares of NIO are a bargain based off of revenues, which likely reflects overly bearish investor sentiment with regard to the company’s profit situation!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NIO, LI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.