Summary:

- Wall Street analysts rate NIO stock as a strong buy with an average rating of 3.89.

- I disagree with this bullish sentiment.

- I have been concerned about NIO’s profitability, and my concern is exacerbated by China’s ongoing EV overcapacity and intensifying competition.

BobHemphill

Wall Street rates NIO stock as a BUY

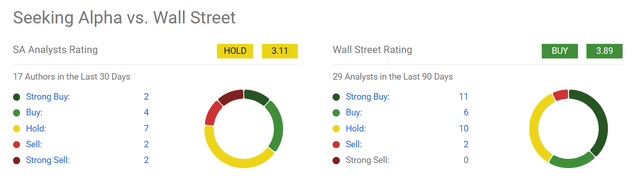

Wall Street analysts have a pretty strong Buy rating on NIO Inc. (NYSE:NIO) stock. As seen in the chart below, they give it an average rating of 3.89. This is based on ratings from 29 analysts in the last 90 days. And 11 of them rated the stock as Strong Buy and six as buy. There’s a good reason behind such bullish sentiment as NIO is a textbook growth stock in a new market.

Seeking Alpha

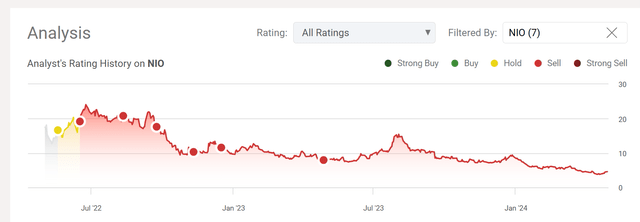

I have been in disagreement with such bullish sentiment for a while. As you can see from the chart below, I have been rating the stock as a SELL since mid-2022 when the stock was trading around $20 per share. My bearish view was largely due to the following considerations, as detailed in my earlier articles:

- Its rapid growth in revenues and deliveries has not translated into healthy profits.

- Besides chronic profitability concerns, competition intensification and price wars also add to my list of concerns.

- I consider NIO at a disadvantage in a price war on almost every front compared with more established EV makers such as BYD or Tesla: Brand image, margins, and scale.

Today, I think these considerations are still valid. Moreover, there’s also a concern of EV overcapacity among China’s EV makers as to be detailed in the next section. Given these risks, this article reiterates my SELL rating on the stock.

Seeking Alpha

NIO stock’s profit outlook

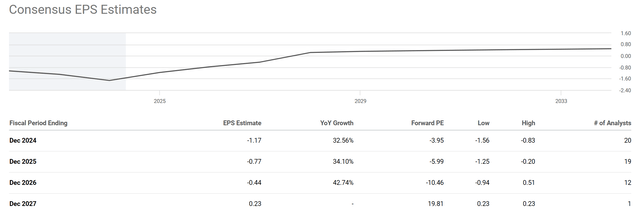

As aforementioned, profitability is still a concern and breaking even is at best years out. The chart below describes consensus EPS estimates for NIO stock in the next few years. Based on the chart, analysts expect NIO to become profitable – with a small EPS of $0.23 per share – by the end of fiscal year 2027. Before that, the consensus EPS estimates point to sizable loss in 2024, 2025, and also 2026.

Seeking Alpha

First, I’m pessimistic about the above projection. I think there’s a good chance that NIO won’t be able to turn a profit even by 2027 (more on this in the next section). But even if it does break even by then, I’m still not optimistic about the shareholder returns in this period.

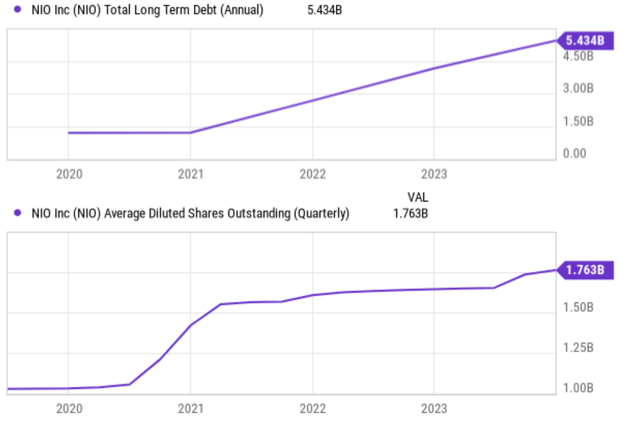

Without a profit, NIO has been relying on debt financing and stock issuance. The chart below shows NIO’s debt levels (top panel) and its number of shares outstanding (bottom panel) in recent years. As seen, NIO’s total long-term debt has been increasing significantly. NIO’s total long-term debt has increased from less than $1.5B in 2020 to the current level of $5.43 billion. The chart also shows NIO’s average diluted shares outstanding has been increasing rapidly over this time. Its average diluted shares outstanding has increased from about 1 billion shares in 2020 to the current 1.763 billion shares. Issuing more shares outstanding, especially at its currently low share prices, can dilute the ownership stake of existing shareholders and be highly destructive to shareholder returns.

Seeking Alpha

NIO stock and EV overcapacity

A key reason I’m pessimistic about NIO’s profit outlook is China’s EV overcapacity issue. As pointed out by a recent Nikkei Asia report,

Electric vehicle production capacity in China continues to expand at breakneck speed despite being vastly larger than domestic demand, fanning fears that manufacturers will export vehicles abroad at cut-throat discounts. The breakeven point for factory utilization in the automotive industry is usually around 80%, but the level for new energy vehicles, which includes EVs, is only around 50% in China. Several emerging EV makers have already gone bankrupt due to overcapacity in the industry.

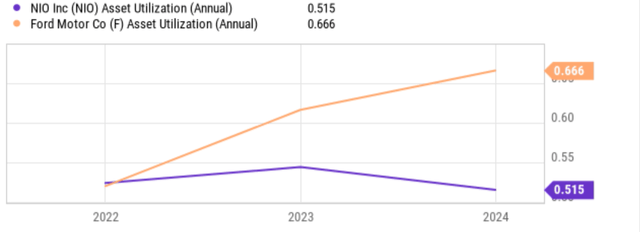

And I can see NIO is not immune here, judging by its asset turnover rate. The chart below displays NIO’s current asset utilization rate (blue line) in comparison to its historical record and also to that of Ford Motors (orange line). As seen, NIO currently has an asset utilization rate of 0.515, which is its lowest level in the past three years and also far below F’s current asset utilization rate of 0.666.

Seeking Alpha

Other risks and final thoughts

Other downside risks include those risks common to other Chinese EV stocks, such as the overall economic slowdown in the country, government policy, etc.

Among the risks that are more particular to NIO, brand recognition is at the top of my list. Compared to some of its peers, NIO is a relatively young brand with lower brand recognition. This could make it more difficult to compete for market share. However, maybe quite counterintuitively, NIO’s sales depend significantly on the high-end market. NIO is currently focused on the premium segment of the EV market, which is a smaller and more volatile market compared to the mass market segment. The combination of low brand recognition and reliance on high-end market makes NIO more susceptible to economic downturns and less likely to break even, in my view.

Of course, as aforementioned, Wall Street likes the stock for a number of good reasons too. Besides its growth potential, NIO’s cars could attract a specific customer base. It targets young and affluent professionals seeking luxury EVs with advanced features. The company’s business also goes selling cars. Notably, NIO offers a unique battery-swapping technology alongside traditional charging. This allows for quick battery swaps in minutes, addressing range anxiety, a major concern for EV adopters. NIO is also building a lifestyle brand with its NIO Life ecosystem. This includes NIO Spaces (which are upscale showrooms that double as community centers for members) and NIO Services (which are subscription-based services offering charging infrastructure access, roadside assistance, and other benefits). These help diversify its income streams and also make them more recurring at the same time.

All told, I see far more downside potential in the next few years than upside potential. As a result, I keep disagreeing with Wall Street and rating the stock as a Sell under current conditions. My key concerns persist regarding NIO’s profitability, with a projected breakeven point not until 2027. I think even this projection is already on the optimistic side given China’s ongoing EV overcapacity concern. Even if it does break even by them, I’m still pessimistic about shareholder return potential with the debt burden and the detrimental share dilution.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.