Summary:

- While NCLH has returned to its pre-pandemic occupancy and revenue levels, it has yet to return to profitability due to the added interest expenses.

- I believe NCLH will return to profitability in Q2 2023 and will beat the EPS estimates of $0.26.

- NCLH still has a massive $14 billion debt that is weighing on its balance sheet.

Buzun Maksimilian/iStock via Getty Images

Thesis

Like other cruise line companies, Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) has accumulated huge debt throughout the pandemic to stay afloat. The debt is weighing on the company’s balance sheet, and its interest expenses present another hurdle in its path to profitability. That said, I expect NCLH to return to profitability in Q2 2023 and beat its EPS estimates. Furthermore, NCLH has worked on refinancing its near-term debt that will give it room to breathe, which is why I believe NCLH is a buy ahead of its Q2 earnings on August 1st.

Q1 2023

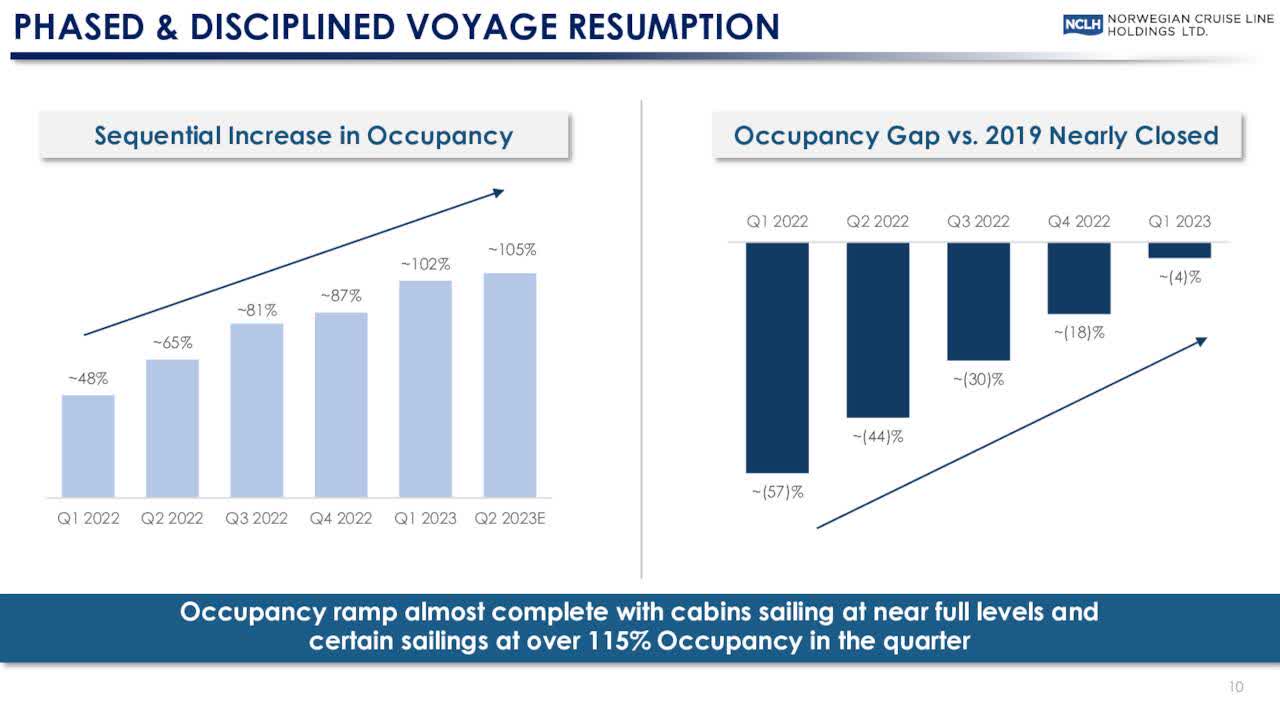

In Q1 2023 NCLH saw itself back to pre-pandemic levels in revenue and occupancy levels, with only a 4% gap in occupancy compared to 2019.

NCLH Q1 2023 Presentation

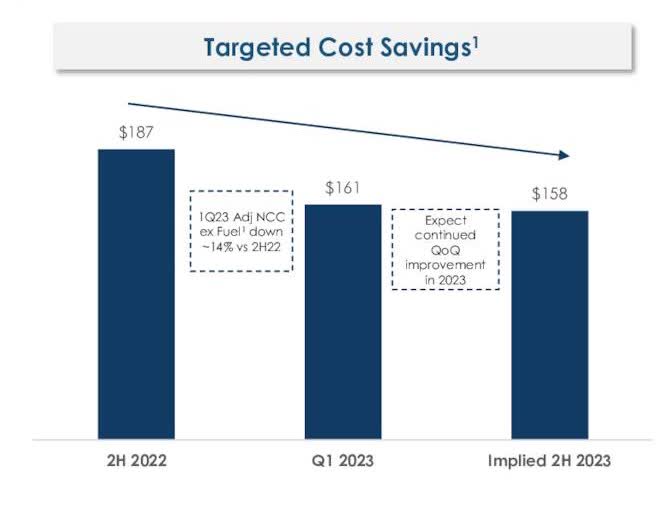

Also, according to management in Q1 2023 earnings call, NCLH doubled its pre-sold revenue on a per-passenger day basis compared to that of 2019. NCLH has seen better-than-expected net cruise expenses as well excluding fuel and expects further improvements in Q2 2023.

NCLH Q1 2023 Presentation

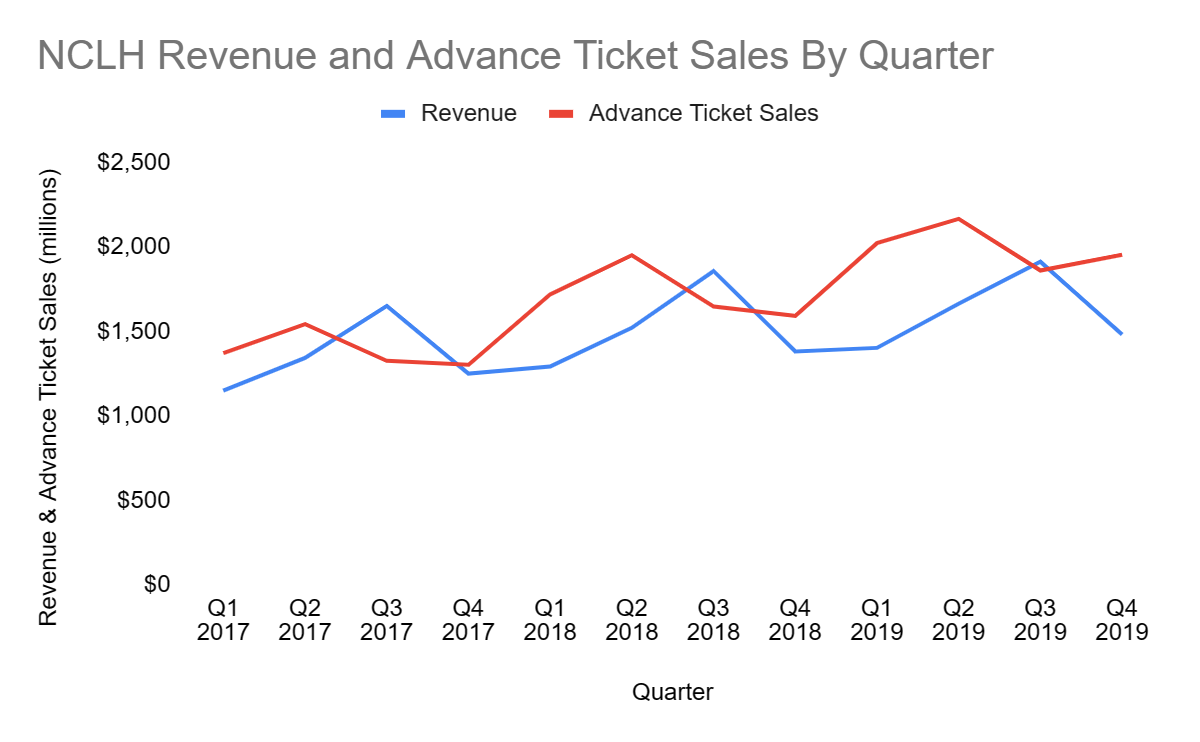

Furthermore, NCLH has seen record advance ticket sales, which is going to reflect on its Q2 2023 revenues.

Despite the impressive numbers, NCLH didn’t achieve profitability in Q1 due to the added interest expense and general and administrative expenses compared to 2019. The debt NCLH accumulated during the pandemic drove Q1 interest expense to $171 million.

Q2 2023 Forecast

The current EPS analyst estimates for NCLH is around $0.25, however, I believe NCLH is going to beat that estimate.

NCLH had $3.177 billion in advance ticket sales in Q1, which is unearned revenue by the company. Taking into account the average revenue to advanced ticket sales ratio in the five quarters prior to the pandemic and Q1 2023, NCLH would have revenue to advanced ticket sales ratio of 0.82 in Q2 2023. This means that, on average, 82% of advanced ticket sales are reported as revenue in the next quarter. In this way, I’m projecting that NCLH will report a record quarterly revenue of $2.618 billion.

|

Quarter |

Revenue |

Advance Ticket Sales |

(Revenue/Advance Ticket Sales) % |

|

Q4 2018 |

$1,382 |

$1,593 |

83.86% |

|

Q1 2019 |

$1,403 |

$2,023 |

88.07% |

|

Q2 2019 |

$1,664 |

$2,167 |

82.25% |

|

Q3 2019 |

$1,913 |

$1,861 |

88.28% |

|

Q4 2019 |

$1,482 |

$1,954 |

79.63% |

|

Q1 2023 |

$1,822 |

$3,177 |

72.42% |

|

Q2 2023 |

*$2,618 |

*82.42% |

Furthermore, NCLH had a gross margin of around 30% in Q1 2023. Adjusting this to the lower fuel expenses, NCLH expects in Q2 it should see a better gross margin of around 34%.

|

Q1 2023 |

Q2 2023 |

|

|

Fuel Consumption (metric tons) |

255,000 |

235,000 |

|

Fuel Price Per metric ton |

$755 |

$740 |

|

Fuel Expenses |

$192,525,000 |

$173,900,000 |

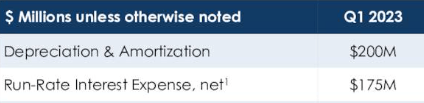

Based on my projections, NCLH’s gross profit would be around $885 million. Adding the average marketing, general and administrative expenses of around $355 million and the $200 million management expects in depreciation and amortization, NCLH would realize $330 million in operating income.

NCLH Q1 2023 Presentation

That, coupled with the $175 million in interest expenses that I’m projecting, would see NCLH achieve $155 million in net income and an EPS of $0.37, which beats the estimated $0.25 by $0.12.

|

(All in millions, except EPS) |

|

|

Revenue |

$2,618 |

|

Cost of Revenue |

$1,734 |

|

Gross Profit |

$885 |

|

Operating Expenses |

555 |

|

Interest Expenses |

175 |

|

Net Income |

$155 |

|

Shares Outstanding |

424 |

|

EPS |

$0.37 |

Q2 2023 may also see NCLH achieving record advance ticket sales since historically Q3 is NCLH’s best quarter revenue-wise and Q2 is its best quarter advance ticket sales-wise. Since advance ticket sales grew 11% on average in the pre-pandemic years of 2017, 2018, and 2019, I expect NCLH to report around $3.538 billion in advance ticket sales in Q2 2023.

|

Quarter |

Advance Ticket Sales Growth |

|

Q2 2017 |

12.46% |

|

Q2 2018 |

13.43% |

|

Q2 2019 |

7.12% |

|

Average |

11.37% |

NCLH Quarterly Filings

Risks

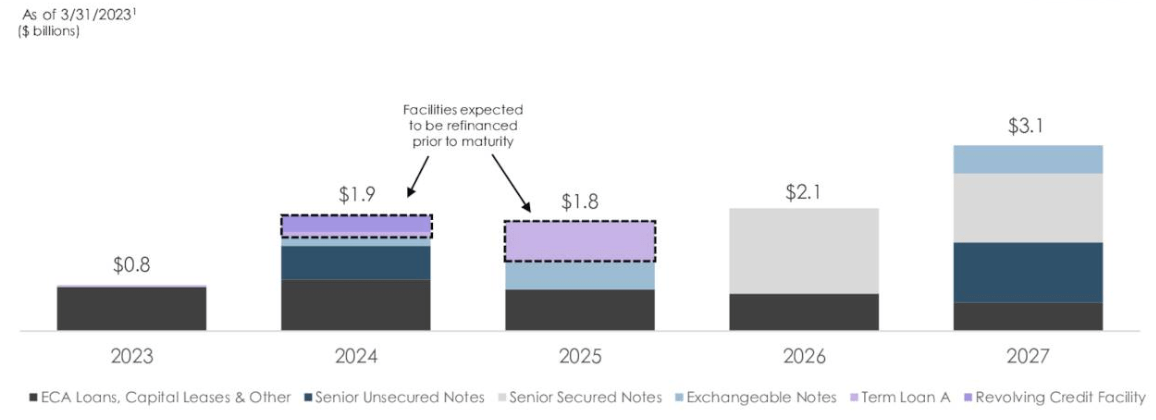

The massive debt NCLH is holding is a major risk for its future. The cruise line currently has $1.95 billion in liquidity and will be seeing $300 million from a new backstop commitment by next October that provides backstop committed financing to refinance up to $300 million of amounts outstanding under the Operating Credit Facility, which would see its liquidity at around $2.25 billion. In my opinion, NCLH pursued this financing to boost its liquidity in order to navigate the 2023 maturities of $800 million. However, these funds would not be enough to pay off the 2024 maturities.

NCLH Q1 2023 Presentation

However, I believe NCLH would be able to refinance its upcoming debt easily since I’m projecting it to return to profitability, which would be a positive sign for its debtors.

|

Year |

Debt Maturities As of Q3 2022 |

Debt Maturities As of Q1 2023 |

|

2023 |

$1,000 |

$770 |

|

2024 |

$3,763 |

$1,943 |

|

2025 |

$1,148 |

$1,846 |

|

2026 |

$2,050 |

$2,053 |

|

2027 |

$3,101 |

$3,106 |

While the 2024 maturities can be paid in case NCLH refinanced the term loans and the revolving credit facility debts, the years after would be hard to tackle without the company generating cash, which is why its return to profitability is pivotal for its future.

Conclusion

While the massive debt is still a risk that investors need to factor in when investing in NCLH, the cruise line operator is projected to have a great second quarter this year after the great Q1 it had. According to my projections, the company has a chance to beat its EPS estimates and achieve record revenues in Q2 that could be followed by yet another record quarterly revenue in Q3 since it is historically its strongest quarter revenue-wise. Furthermore, in case NCLH can reach and maintain profitability, it could have a chance to tackle the upcoming debt maturities since it has done a great job refinancing its debt. All of that makes NCLH a buy for me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.