Summary:

- Bitfarms is a Canadian Bitcoin miner with a market value of around $760M.

- The company has experienced growth and raised over $300M in capital in 2021 to expand its operations.

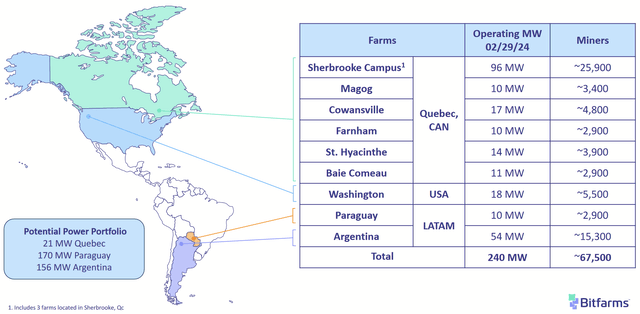

- BITF operates mining farms in Quebec, Washington, Paraguay, and Argentina, focusing on low operating costs and hydroelectric energy.

- Upcoming halving may lead to M&A opportunities down the road, while the Milei government should make expansion in Argentina more favorable.

- Yet, the main hurdle is the transition to positive free cash flow.

South_agency

Bitfarms (NASDAQ:BITF) is a well-known, Canadian miner of Bitcoin (BTC-USD). I’ve been looking at companies in the BTC universe, which brought Bitfarms to my attention. The stock price has also had some interesting action lately.

BITF Price Last 6m (Seeking Alpha)

From pessimism in the fall to wavering optimism in the winter, the market has recently decided that the company is worth about $760M. Since other BTC miners exist, it’s worth looking at Bitfarms to see what kind of opportunity they present to the long-term investor.

Financial History

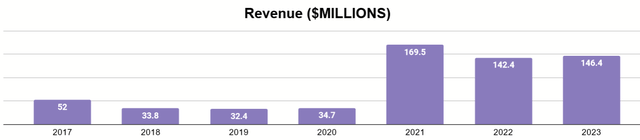

The company was founded in 2017 as a private company. It went public in Canada in 2019 and entered the NASDAQ 2021. The NASDAQ listing allowed it to raise over $300M in capital, allowing for significant growth in the business.

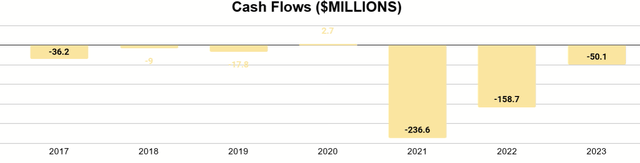

These funds were used to acquire and develop sites in North and South America and increase production. What was the impact to cash flows?

Free cash flow increased in negativity as the scale increased, but the trend has been one of decline since that initial spike in 2021. This has partly been due to declines in both capex and operating expenses.

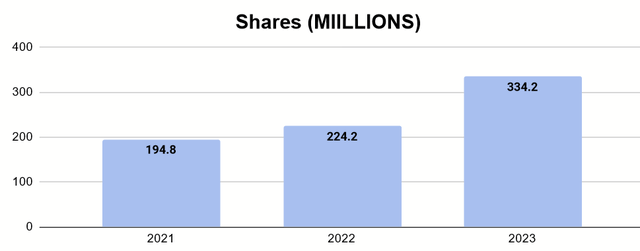

Total shares outstanding have also grow substantially since the NASDAQ listing. This is due to issuance of new shares and stock-based compensation that have occurred each year.

Business Model

As a BTC miner, Bitfarms operates sites that run “miners,” computers designed specifically to solve blocks and earn points to create BTC. This process requires solving hashes and thus increasing the company’s hash rate to produce BTC competitively against other miners. If, by doing this, they can produce BTC for less than it costs to sell it on the market, it has a profitable operation.

February 2024 Company Presentation

Most their operations are in Quebec, with others in Washington, Paraguay, and Argentina. The company generally seeks out places that it can establish mining farms with low operating costs, of which electricity is a key component.

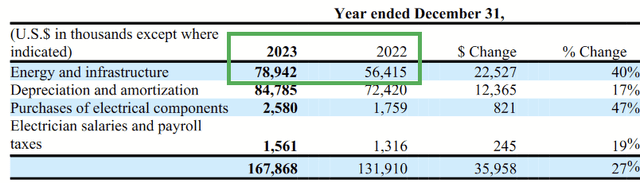

Cost of revenues is their biggest expense. Seen above, most of that cost comes from electricity, so keeping that cost low is of key importance.

Q4 2023 Company Presentation

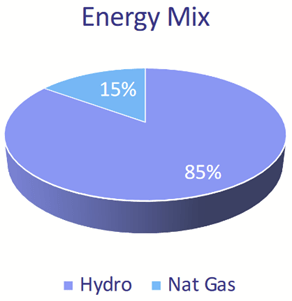

To this end, the vast majority of its energy is hydroelectric. Volta, a wholly owned subsidiary, provides electrician services to their Canadian farms, as well to third-party customers.

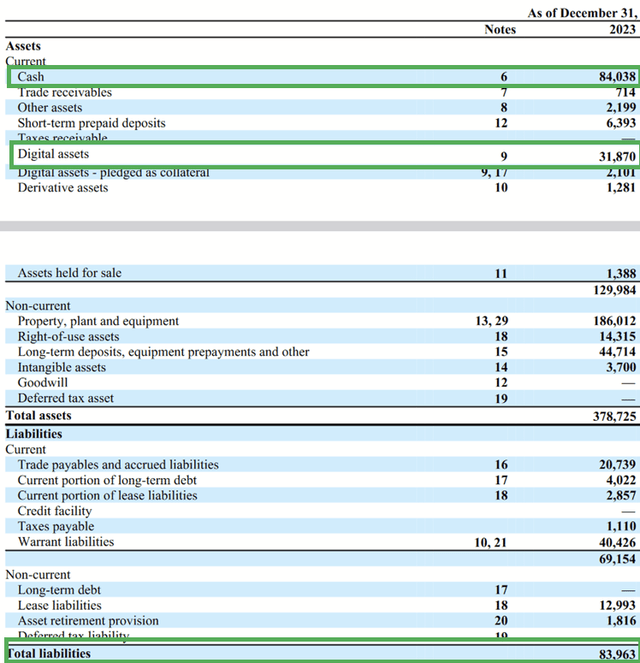

The balance sheet is healthy, with no long-term debt as of February, $84M in cash, and $31.8M in BTC, giving it sufficient liquidity in the near term.

A Look to the Future

We discussed before that free cash flow is negative. Operating cash flows for this company have been positive, a good step, so the reason FCF is negative is because capex is usually greater than OCF. What are things that will help or hurt this situation going forward?

Halving

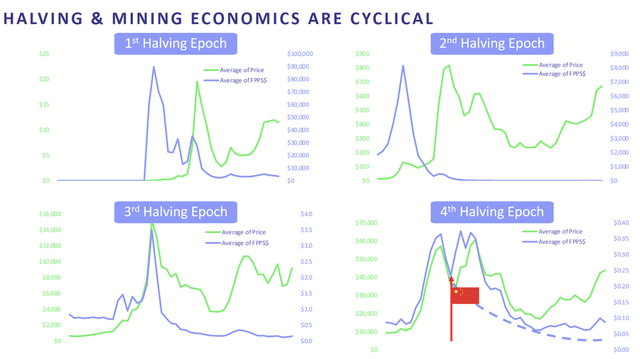

There is both the upcoming halving and future events to consider with this company. In its recent Q4 2023 earnings call, CEO Geoff Morphy explained how strong BTC prices ahead of halving have changed expectations on M&A:

Originally with the halving coming up, we thought probably 20, 25, maybe even 30% of the network hash rate would come off from the less efficient miners. That’s what’s happened in the past. But this time with the ETFs, the demand, the price going up to an all-time high, effectively like five weeks ahead of the halving, these are different market conditions that are prevailing right now. This — we are in a transitionary market, a paradigm shift, as I said in my script.

This is was said in response to a question that M&A and room for consolidation as less-efficient miners fall off. While they affirmed their long-term view that acquisitive opportunities will come, the recent rise in the price of BTC will delay that.

Thinking more long-term since halving will, as implied, cut BTC production in half, the company’s revenues will be impacted each time this occurs, especially if there is not a price increase to make up for the loss of production. While it seems intuitive for prices to rise accordingly, I don’t think anything obligates the market to do that.

The company believes cyclical forces will determine the path of BTC going forward, but I believe older patterns may be less indicative of the future considering the much smaller market cap of BTC during previous halvings and how BTC doesn’t have the same nature as cycles in the real world, like with grain and metals. These things are physically used and need to be extracted and shipped. Human inability to do that smoothy leads to these lumps called “cycles.”

Even if we forget about all that for a second, the price still needs to increase enough to make up for the effects of capex, which I will address next.

Capex

Most of the company’s capex comes from the purchase of new miners and the development of new mining farms. These investments are made because, as demand for BTC grows, more mining occurs in network, which increases the difficulty of solving a block and requires a higher hash rate. This creates an arms race among all the different participants, which includes Bitfarms, requiring more miners to increase a participant’s computing power.

Halving necessarily reduces the long-term output of these miners, while hash rates create a need to acquire more. Overtime, Bitfarms will need to consolidate effectively and continue to manage its electrical costs so that significant cast outflow on capex isn’t needed. Many other miners struggle with this problem, and there is no clear sign that Bitfarms will do it either, except for one…

Personally, I founded a immersion technology company back in 2018 where I was doing immersion with 3M, an US manufacturing for Bitcoin mining purposes. Realistically, when we look at immersion versus air-cooled, sure there are some benefits from using immersion from efficiency perspective, but the capital expense required to set up that infrastructure versus the air-cooled infrastructure, really we just feel is unjustified.

In Q4 earnings, Chief Mining Officer Ben Gagnon explained above their flexibility in how they develop their farms. They differ from other players, like Riot (RIOT), in that they aren’t committed to immersion-cooling due to its high capital costs. This could be one thing that gives Bitfarms better long-term ability to lower capex in a way that is more challenging for competition.

Argentine Tailwinds

One thing that will likely bode well for Bitfarms is the recent election of Javier Milei in Argentina as President. Morphy explained in the same earnings call:

They have all this shut in natural gas and to be able to monetize it, because it’s not really able to push it into a pipeline and send it to other countries. They don’t have an LNG port, so it’s there. And we’ve now got a government there, the Milei government, that is pro-business, that wants to reduce government bureaucracy and really transform the country. And it’s exactly what is really, frankly, needed there.

With the opportunity for low energy costs, this could be a prime time for Bitfarms to expand its footprint in Argentina with a president who is supportive of BTC. I believe this could create newer growth opportunities that were not present under the old government.

Declining Share Dilution

The company just paid off the last of its long-term debt in February and is happy to keep it that way. Yet, with only about $120M in liquidity between its cash and BTC positions, the company may need to raise more capital to fund these growth opportunities in coming years.

Morphy mentioned in the earnings call that the company can currently generate about $7 billion in cash per month. That suggests OCF of about $84M is possible, and that may be sufficient to cover necessary capex. If not, then the liquid position isn’t high enough historically to maintain growth, and more shares would need to be issued to fund it, diluting current shareholders. Either way, I believe the rate of dilution, with the improvement of the business in recent years, will be less than we have seen in the past, which bodes well for current holders.

Conclusion

Bitfarms is working hard to ensure that people’s dream of a decentralized, digital currency can exist, and it shows potential to be one of the few to do so in a way that makes money for investors. While operating cash flows are positive, the overall record is still negative.

With no debt and a decent cash balance, this isn’t a company that is about to get wiped out, but I also want to see the transition to positive FCF so that I can have some gauge to do a valuation, which I have not done here. Until then, I am going to wait and let the situation develop before I consider this a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.