Summary:

- Abercrombie & Fitch has significantly underperformed the broader market year-to-date, but we believe that there is further downside.

- Declining sales, elevated freight and raw material costs, increasing inventory, declining demand for the Hollister brand and capital allocation decisions are all raising concerns.

- We are currently rating ANF as “sell”.

tupungato/iStock Editorial via Getty Images

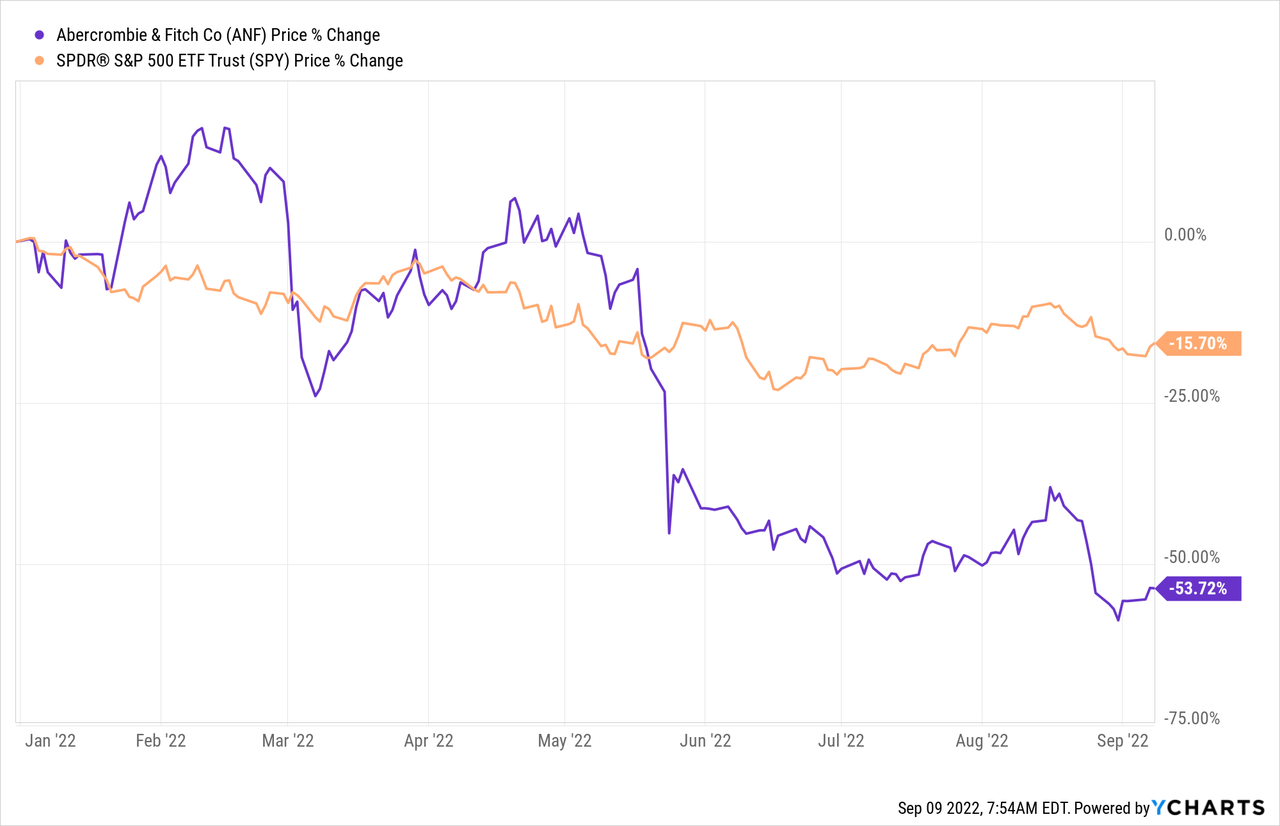

This year, Abercrombie & Fitch’s (NYSE:ANF) stock has been performing poorly, declining as much as 54% year-to-date, substantially underperforming the broader market.

In our opinion, the current macroeconomic environment generates a number of headwinds for ANF’s business and we expect that the firm will keep underperforming in the near future.

In this article, we will highlight the key points that we believe make ANF unattractive at the current times. We will touch upon indicators like consumer sentiment, and take a look at the firm’s latest quarterly results.

1.) Consumer sentiment

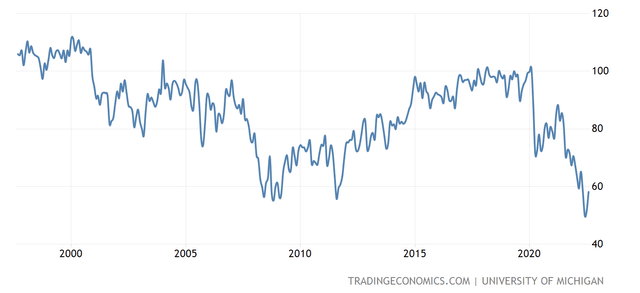

Consumer confidence – a leading economic indicator – is often used to estimate potential changes in the spending behaviour of the consumer in the near future.

Since the beginning of 2020, consumer confidence in the United States has been on a steep decline, despite the short uptick in the second half of 2020.

U.S. Consumer confidence (Tradingeconomics.com)

In 2022, confidence has even fallen below the levels observed during the 2008-2009 financial crisis.

Confidence can be driven by a wide range of parameters, including inflation, energy prices, job security and it gives a measure of how optimistic or pessimistic people are about their financial outlook. Low consumer confidence implies that people are pessimistic about their financial expectations and therefore are likely to save more. Such trends can lead to reduced demand for durable, discretionary, non-essential items, resulting in a negative impact on the financial performance of the firm’s manufacturing and selling such goods.

Companies, which are categorised into the consumer discretionary sector are likely to be directly hurt by pessimistic consumer sentiment. As ANF is also categorised into this sector, we believe that ANF is likely to keep underperforming as long as the sentiment does not improve.

Let us now take a look at how ANF’s stock has performed in the last 20 years, during times of low consumer confidence.

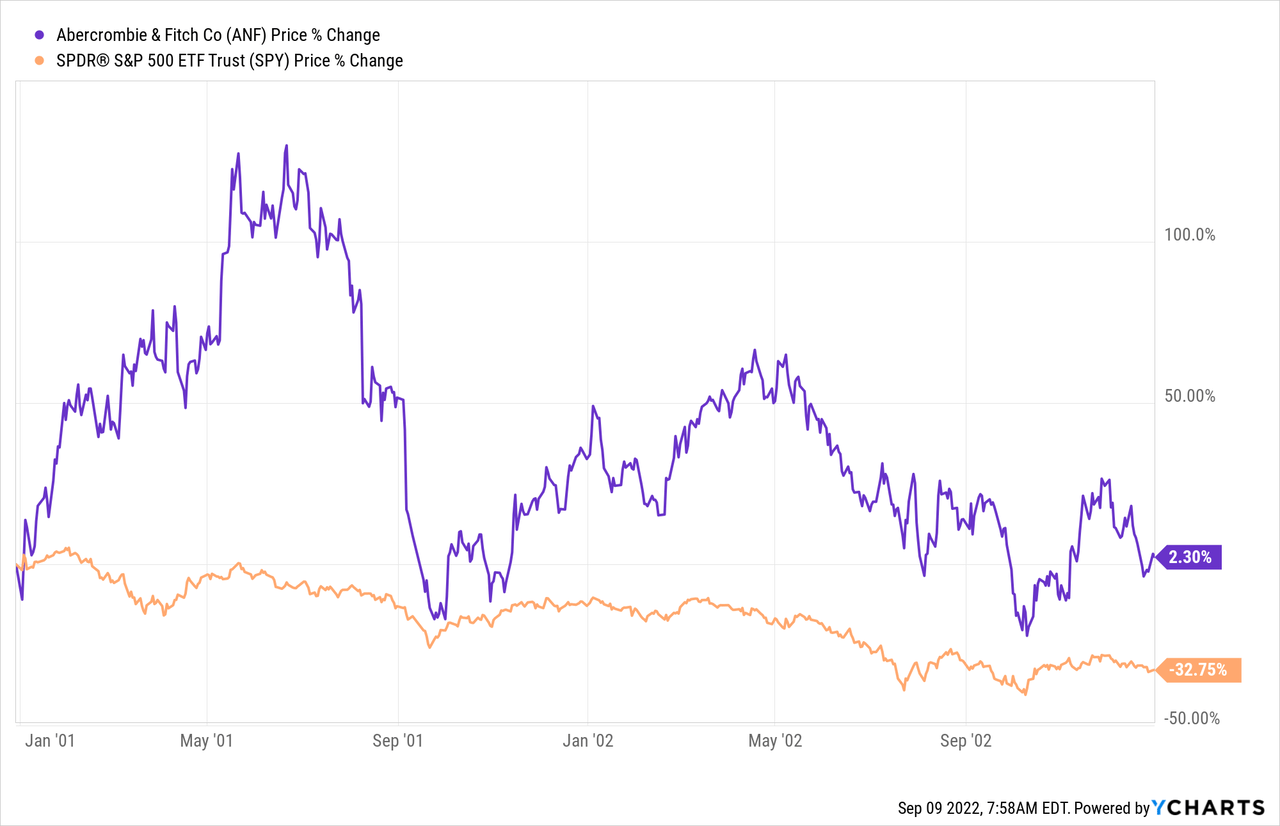

2001-2003

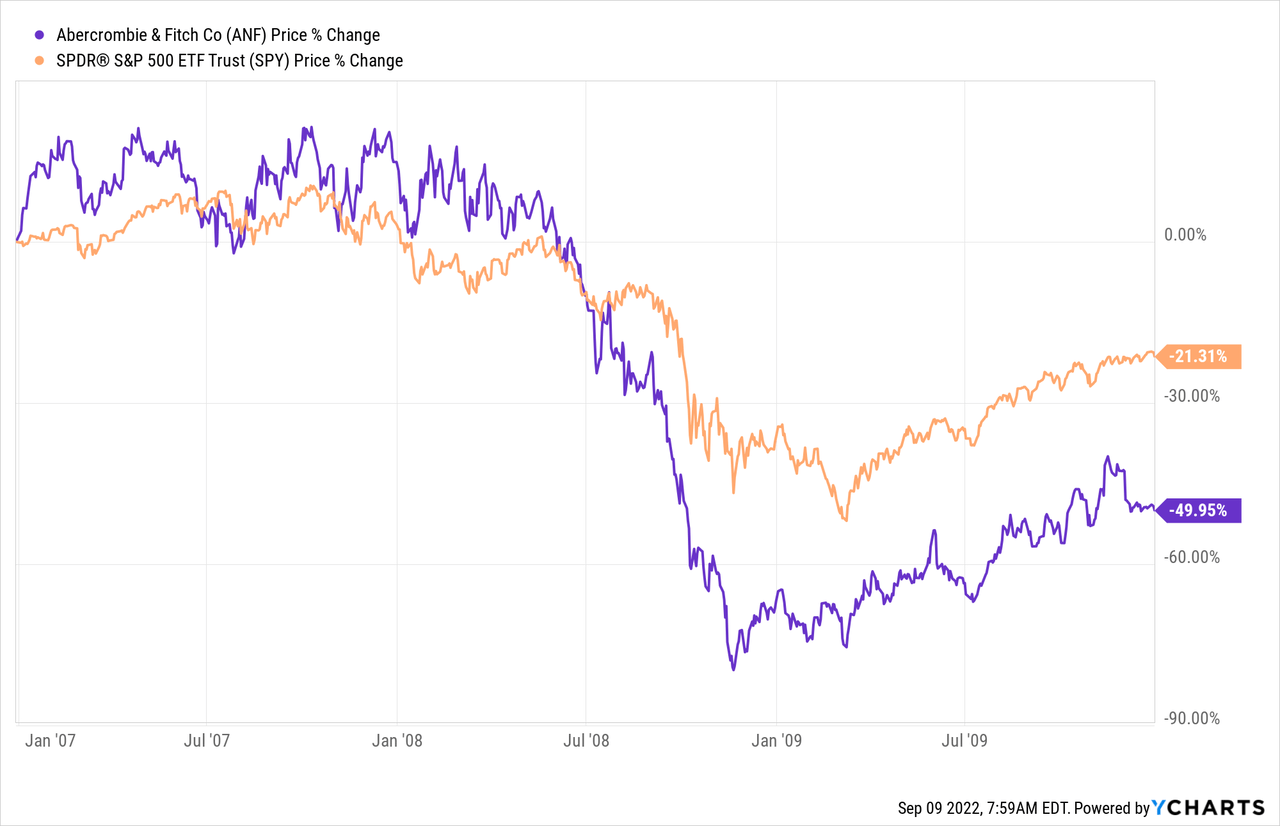

2007-2010

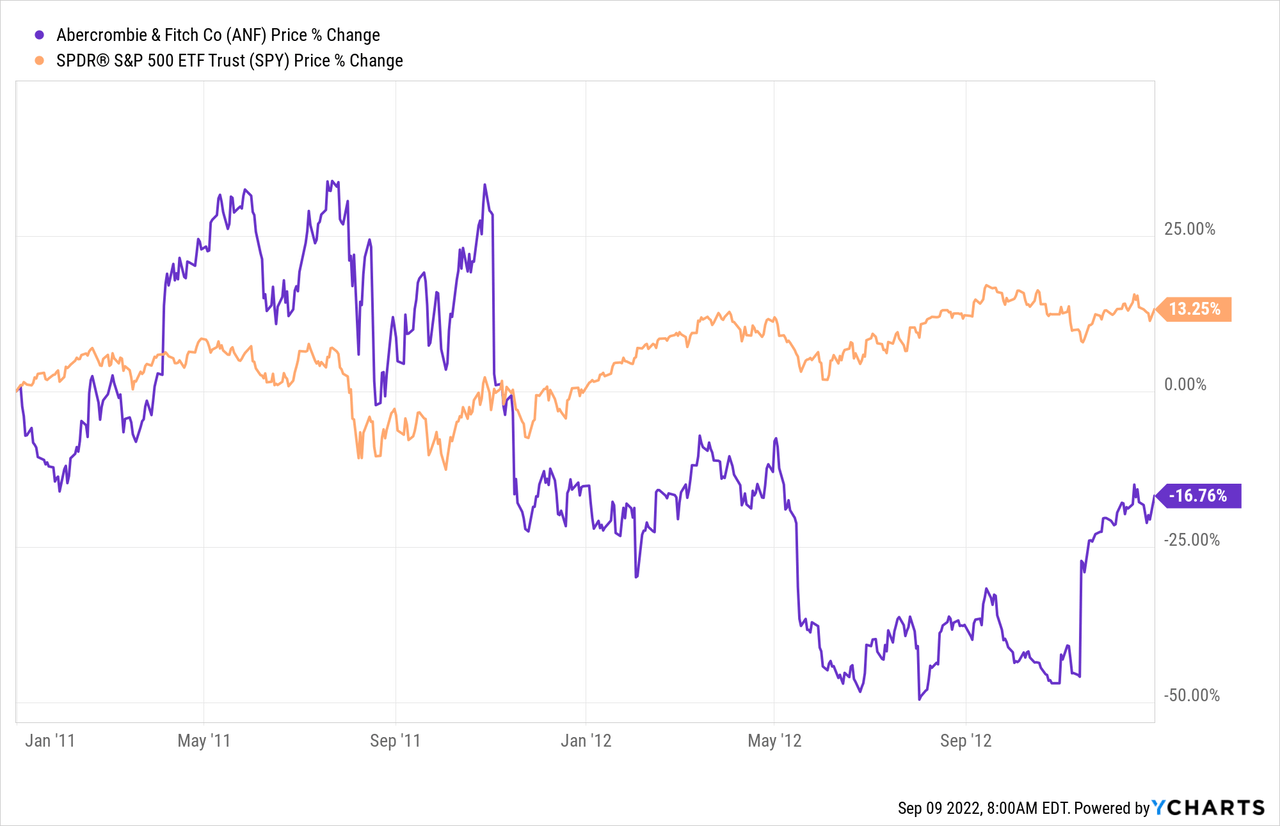

2011-2013

Two out of three times ANF has substantially underperformed the broader market.

Although between 2001-2003 ANF has outperformed the SPY, its stock price has been highly volatile in the period. During the financial crisis in 2008, at one point the stock was down by almost 90%. From 2011 to 2013 the stock lost as much as 17%, while the broader market was up by more than 13%.

All in all, we believe that in the current market environment, despite the sharp sell-off, there is further downside for ANF’s stock. For these reasons, we believe it is not a good time to be a shareholder of ANF.

2.) Quarterly financial performance

ANF has recently published their Q2 earnings presentation, summarising their financial performance. We will highlight a few items from this presentation that raise concerns for us.

Decreasing sales

Net sales decreased 7%, or $60M, as compared to last year.

Gross margin rate declined 730 basis points as compared to last year to 57.9%, driven by higher product costs and commodity inflation partially offset by higher average unit retail at Abercrombie.

Digital fulfillment expense increased $17M, reflecting an increase in digital shipping and handling and digital direct expense.

Asset impairment charges of $2M for this year versus $1M last year.

ANF also points out that the main driver for declining sales was low demand for the Hollister products. Although the firm aims to focus more on brands that have performed well during the first half of the year to boost their sales, they underline that the macro headwinds are likely to persist for the rest of 2022.

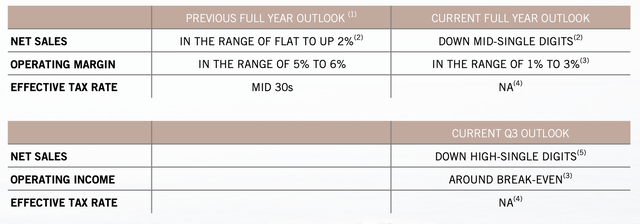

The firm has updated their most recent outlook accordingly.

Inventory management

We have seen earlier this year that many firms have been struggling with inventory management and had to use significant discounting in order to reduce inventory.

ANF’s inventory has increased by as much as 70% compared to Q2 2021. The main drivers of this increase are supply chain disruptions in Vietnam, leading to goods stuck in transit, and the higher freight and raw material costs. The unit-on-hand inventory levels in 2021 were also the lowest since the mid 2000’s, making the 70% increase slightly exaggerated.

ANF believes that inventory growth has peaked in Q2:

Looking ahead, we will continue to monitor sales volumes and react with agility to ensure inventory turns appropriately, and we expect year-over-year inventory growth to have peaked in Q2 and to moderate significantly in the back half as we lap late receipts from last year.

We remain cautious however, because it is not yet clear whether part of the inventory may already turn out to be obsolete, or to what extent discounting needs to be used to get rid of the excess items.

Capital allocation

The company repurchased approximately 4.3 million shares and has returned $118 million to shareholders during the year-to-date period ended July 30, 2022

While in general we favour share repurchases as a way to return value to shareholders in ANF’s case there may be better uses of capital. A share buyback is beneficial for a company if it has no reason to fund expansions or other projects or wants to influence its share price in the market.

In our opinion, the firm should focus more on potential expansions and other projects that could lead to improved sales figures, growing market share or improved efficiency.

Key takeaways

Abercrombie & Fitch’s stock has substantially underperformed the broader market year-to-date and we expect the underperformance to last for the rest of the year due to the macroeconomic headwinds, including rising inflation, supply chain disruptions, low consumer confidence and elevated freight and raw material costs.

Declining sales, increasing inventory and capital allocation decisions also appear concerning.

For these reasons, we rate ANF as “sell.”

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in ANF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.