Arrival: An EV Company That Might Never Depart

Summary:

- Arrival strives to be the inventor of a radical new method in producing electric vehicles using its microfactories.

- The initial prospectus was very promising as it looked to disrupt the traditional production line and bring in high margins.

- Delays and unfulfilled promises have caused the share price to go into free fall, and it might never recover.

Editor’s note: Seeking Alpha is proud to welcome John Choong as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

onurdongel

Just as many SPAC mergers have failed to live up to the expectations initially set out, Arrival (NASDAQ:ARVL) has been no exception. Investors like myself have caught a falling knife as its stock continues to plummet to all-time lows, caused by constant delays and empty promises. Therefore, investors are only going to continue getting burned until it starts delivering on its promises.

Climate Change

Climate change continues to accelerate the use of EVs as governments push for bigger consumer adoption through grants and legislation. Climate pledges such as the ones made at COP26 and the Paris Climate Accords serve as a catalyst for the industry. As such, the EV market is certainly a lucrative one to get into as demand for low-emission vehicles continues to head upward.

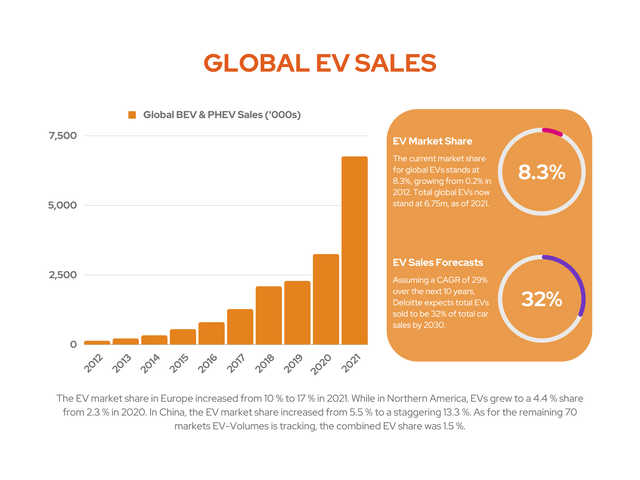

Global EV Sales (EV-Volumes and Deloitte Insights)

Global EV sales are expected to grow at a steady and healthy rate of over 20% per year through to 2030, as forecast by Deloitte. Hence, electric vehicle (EV) companies are trying to capitalize on this tailwind.

In an increasingly saturated market, new EV companies pop up every so often, with each one of them trying to outdo the competition with its unique selling point. Here’s where I think Arrival could be a game changer.

The Arrival of a Disruptor

Arrival is an EV manufacturer that focuses primarily on lightweight commercial vehicles. The company’s goal is to be able to produce vehicles with a low amount of capital expenditure (capex) through its extremely efficient manufacturing process and ditching the traditional assembly line pioneered by Henry Ford.

The British-based firm is ditching the conveyor belt for interchangeable cells with its microfactories. This allows for the production of up to 10,000 vans a year, per factory, allowing the company to achieve breakeven on its operating margins within a year – or at least in theory.

| Metrics per Microfactory | Value |

|---|---|

| Production Capacity | 10,000 Vans |

| Capex Required |

$50m |

| Gross Margin per Year | $100m |

Arrival claims that this low-cost model can work due to three factors:

- Electric vehicle platform: The platform can be scaled to make many variants in multiple vehicle categories such as buses, vans, and cars. This allows its microfactories to produce different vehicles simultaneously.

- Cheap and durable materials: With thousands of patents, Arrival produces its own unique composites and materials, stripping out unnecessary costs such as paint jobs.

- Small space requirements: With only 200,000 square feet of space required for a microfactory, Arrival can set up a factory in areas of demand using existing commercial spaces or warehouses. Microfactories can be operational within six months from a site’s readiness.

This production strategy has stimulated the firm to secure key partnerships with the likes of Microsoft (MSFT), Hyundai (OTCPK:HYMTF), and Uber (UBER) to help meet a rapidly growing demand for eco-friendly commercial vehicles. Most importantly, the unicorn plans to price its electric vehicles at a similar price point to its petrol and diesel equivalents, thus making them competitively priced as compared to other EVs.

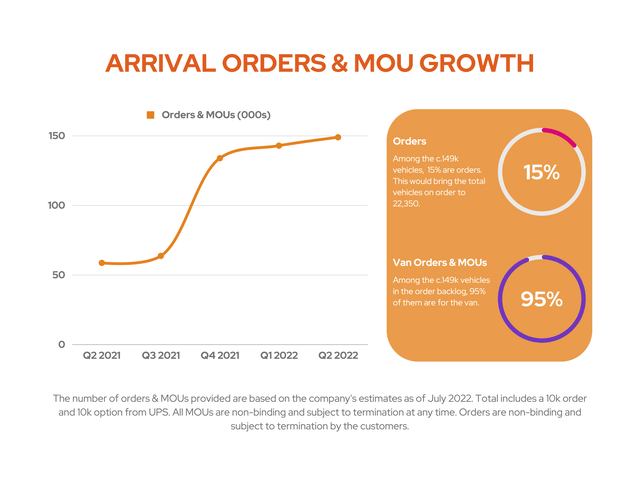

This pricing model has led to a huge order backlog of about 149k orders, letters of intent, and MOUs. Out of this number, there is an order for 10,000 vans from UPS (UPS) with the option for an additional 10,000. There’s also orders for 3,000 vans from LeasePlan, 193 buses from FirstGroup (OTCPK:FGROF), and five buses from Anaheim Public Transit Operator.

Delayed Departure

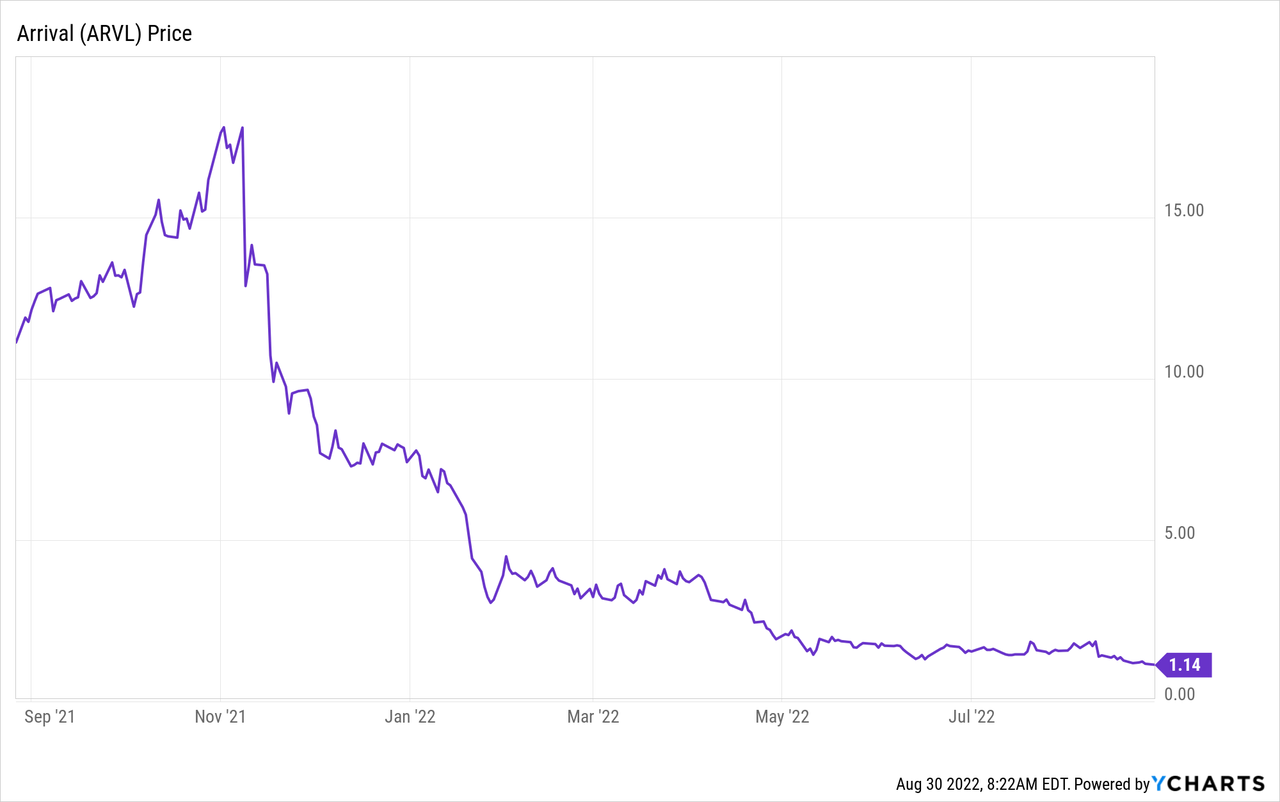

When the EV manufacturer debuted on the stock market last year, the sky was the limit. Initial company projections forecast about $5.1bn in revenue by 2023 and $14.1bn by 2024. These projections were so high that it almost seemed too good to be true – and, unfortunately, it was.

Prior to the SPAC merger, the Arrival share price rose to as high as $31.54 on the back of these estimates. But after numerous delays, broken promises, and capital funding via share dilution, the stock has been in free fall ever since. It now sits just above the $1 mark.

Aside from the delays of road trials and achieving certification, the board has pushed back its start of production three times. And investors who were hopeful that management would keep to its revised guidance of producing 400 to 600 vans by the end of the year were greatly disappointed when the company released its latest Q2 results.

Unfortunately, the setbacks continue as Arrival now only expects to produce 20 vehicles by the end of the year, with no revenue expected. In addition, management has decided to put a pause on its bus and car projects until further capital can be sourced. Consequently, start of production (SOP) at its Charlotte plant has also been pushed back to next year. This is all a result of the company’s effort to control its capital by cutting 30% of its costs, and it might dismiss roughly the same portion of its 2,600 employees.

Lagging Behind

Taking all that into consideration, the rate of growth in orders and MOUs have also seen a decline over the last couple of quarters, as Arrival’s reliability of producing vehicles continues to dwindle. Orders and MOUs only grew by a mere 6k in Q2. This decline comes after 9k in Q1 and 70k in Q4 of last year. Ultimately, there’s no point having an extensive backlog when vehicles aren’t being produced.

Arrival Orders & MOU Growth (Arrival Investor Relations)

Nonetheless, President Avinash Rugoobur mentioned that the slowdown in orders and MOUs is due to the company attempting to convert MOUs into orders. Even so, Arrival is yet to announce an order since its deal with Leaseplan over a year ago.

While Arrival still has the biggest backlog for electric vans among its peers, it’s significantly lagging behind its competitors in terms of production. This is a cause for concern as it’s important for Arrival try to snatch up as much market share as possible before the rest of the competition takes it away. This is already starting to take effect as Ford (F) claimed that the most recent deliveries of its E-transit product means that it now constitutes 95% of the U.S. electric van market.

Low on Fuel

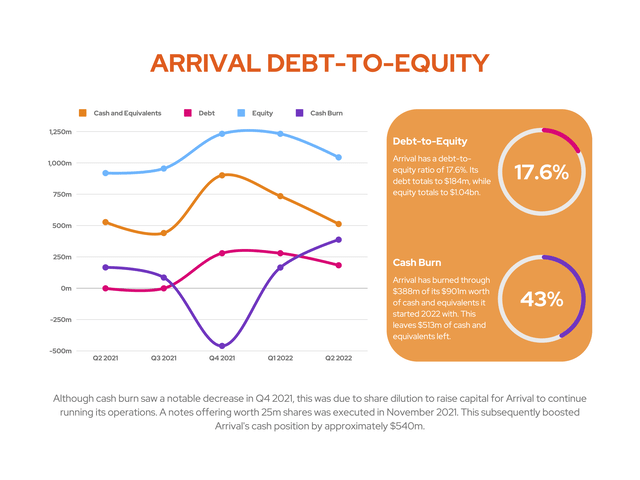

Having started with approximately $600m worth of cash when it debuted on the Nasdaq, the manufacturer has burned through all of its cash. As a result, the board opted to raise capital via a notes offering in November 2021, and is expected to do dilute shareholders again via a new $300m at the market (ATM) offering. CFO John Wozniak said that the ATM is expected to raise $90m in 2022 and another $210m in 2023.

These actions are increasingly frustrating given the poor allocation and judgement of capital required, which has resulted in an extreme deterioration of shareholder value. On that account, I was left very surprised when Founder and CEO Denis Sverdlov mentioned on the latest earnings call that Arrival has been “extremely efficient with cash spent.” So, even though Arrival’s balance sheet isn’t in tatters, it’s worth noting that its cash burn has seen worrying increases with little to nothing to show for it.

Its total assets are worth $1.50bn, which can comfortably cover its total liabilities worth $459m, but it’s worth noting that the company only has $656m of current assets. Considering the rate at which it’s burning cash, this could put Arrival in a tricky position when it has to repay its debt worth $184m, especially if it continues delaying production.

Arrival Debt-to-Equity (Arrival Investor Relations)

Nevertheless, Wozniak expects Arrival to finish the year in line with its initial guidance of $150m to $250m of cash and equivalents. He also expects the company to have approximately $300m to $350m of cash by the end of 2023. According to the CFO, this is possible from its new cost-savings strategy and ATM offering.

Management also assured investors that Arrival plans to hit its margin target by 2024. Despite that, I’m anything but optimistic about such statements given the team’s track record of overpromising and underdelivering.

Producing Worries

Arrival has at least stuck to its word of initiating SOP in Q3 for now, albeit with only 20 vehicles. Having said that, I’m still rather wary of the statements made by Sverdlov claiming that the microfactory is operational and a success.

Investors got a taste of robots assembling parts of the van during the Q4 2021 earnings call. Still, management is yet to show a van being built from scratch to finish in an interchangeable cell, and that worries me. Although this may come off as a paranoid concern, one only needs to take a look at Nikola (NKLA). The EV peer infamously pushed its truck down a hill to prove a working prototype, only to get caught redhanded with an unfinished product.

As only 20 vans are expected by the end of the year, I can’t help but wonder whether these will all be built manually. Moreover, having a microfactory fully up and running and producing 10,000 vans by 2024 is ambitious. I only need to refer to the likes of Rivian (RIVN) and Lucid (LCID), both of which had to cut production targets due to a slower-than-expected ramp-up in production.

Foggy Route Ahead

Arrival has no revenue, zero earnings, and negative free cash flow. The lack of guidance regarding production figures going into 2023 and 2024 doesn’t help either, as any predictions would be like driving in thick fog. For that reason, it makes forecasting its fair value and forward price-to-earnings ratio extremely difficult.

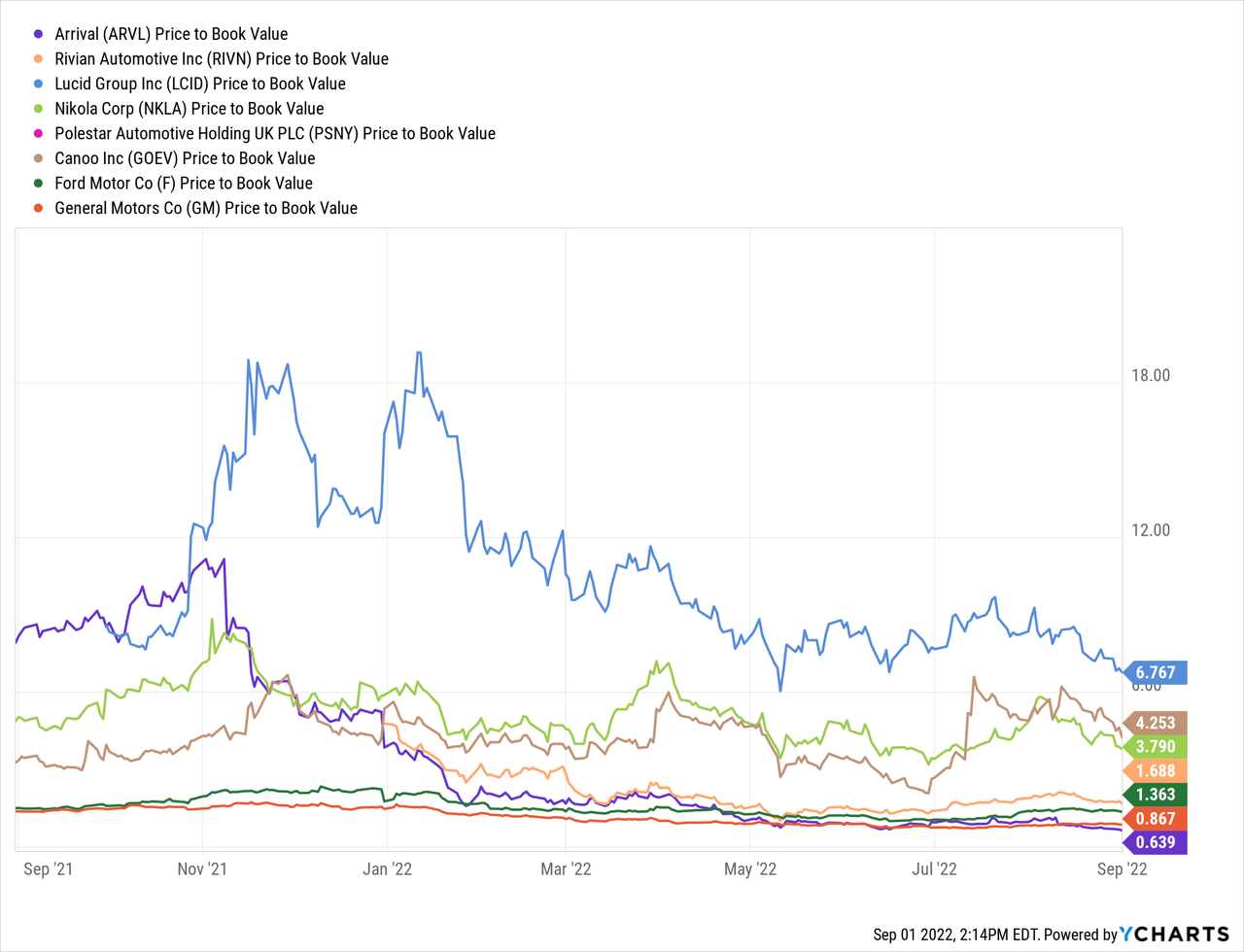

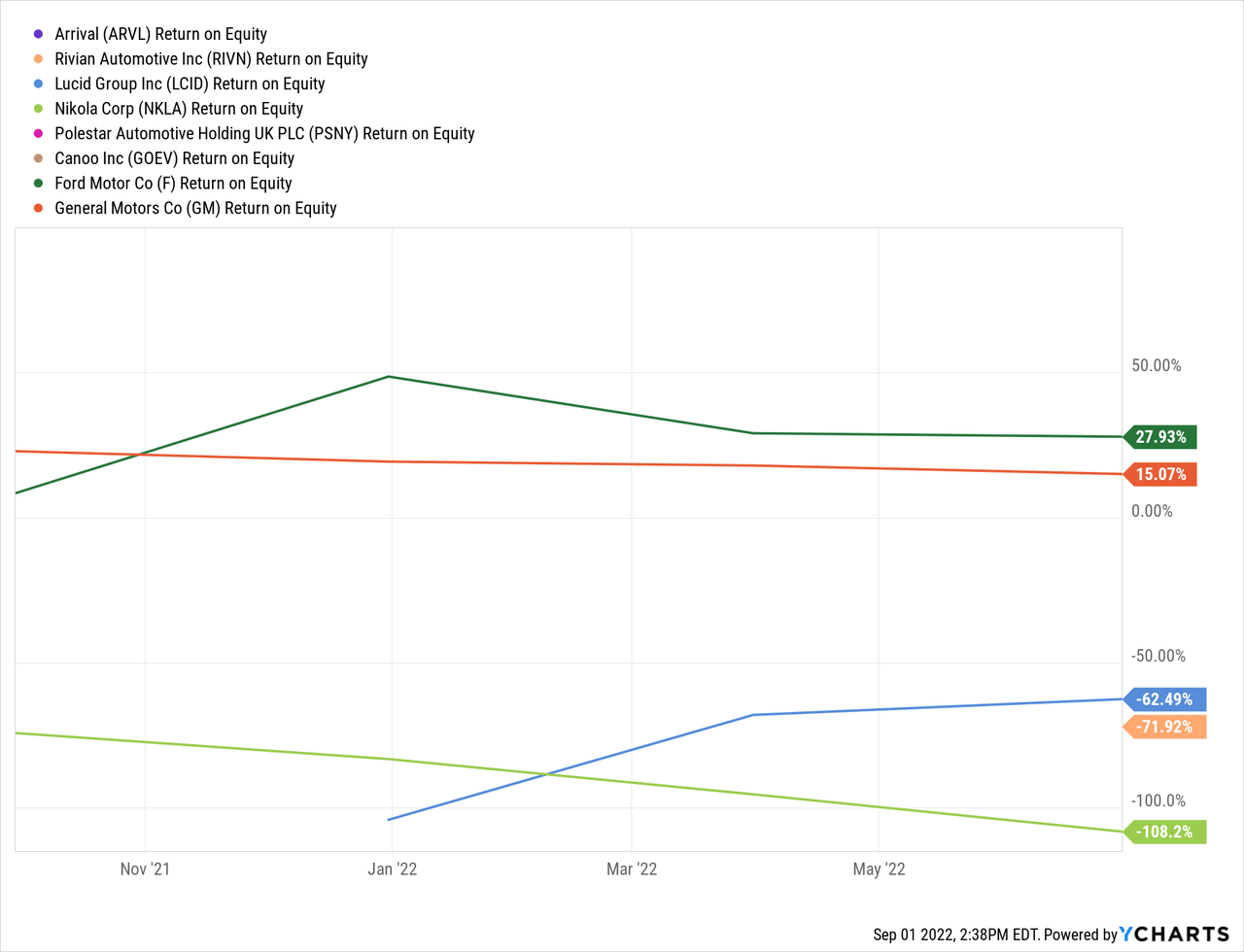

With that in mind, I’m opting to use the price-to-book (P/B) ratio to determine how Arrival fairs vs. its EV peers and the rest of the automotive industry.

Taken on face value, Arrival shares are decently priced in relation to their book value, as it’s below one. For context, the industry average sits at 2.6. This indicates that the share price might be undervalued in relation to the company’s book value. Be that as it may, P/B ratios have to be analyzed in relation to the company’s return on equity (ROE). Since Arrival has no revenue, it’s performing tremendously lower than that of its peers. In fact, large discrepancies between P/B ratio and ROE might be a red flag, as is the case with Arrival.

Get On Track

Arrival initially came to market with a tremendous amount of promise, and it’s certainly admirable to see a startup attempt to revolutionize a production method that’s been working so effectively for over a century. If Arrival can pull it off, the upside potential to this stock could be massive. After all, it currently has an average price target of $3.46, which would present a potential upside of over 300%.

That said, it has been its own worst enemy by overpromising, underdelivering, and miscalculating the capital required to put this radical new idea into practice. Countless pushbacks and undelivered targets have only soured investor confidence and sentiment further, which is why its stock has gotten demolished, dropping a staggering 95% from its all-time high.

Will Arrival be able to pull it off, or will the company die a slow and painful death? With my stake in Arrival down 85%, I can only hope that it’s the former. It’s been too much talk and not enough doing. Production needs to depart soon, or it’ll risk never arriving.

Disclosure: I/we have a beneficial long position in the shares of ARVL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.