Ambarella: An Earnings Beat Likely, But Shares Stuck In A Range

Summary:

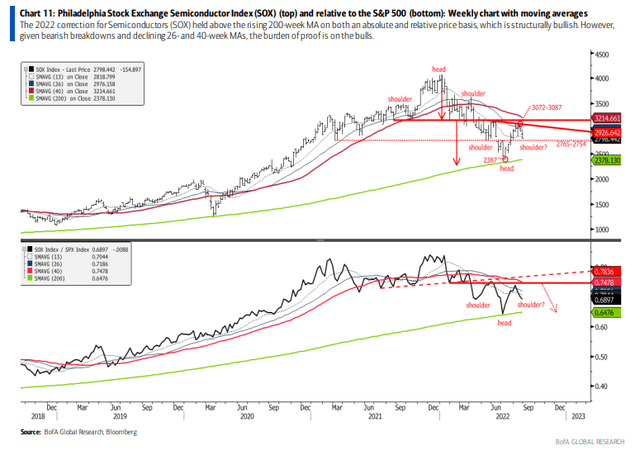

- The cyclical semiconductor index has turned negative on a relative basis to the S&P 500.

- Firms with high valuations now must prove their muster.

- One small-cap semi stock has earnings after the bell Tuesday, and options traders expect a big move.

sankai

Semiconductor stocks had a summer rebound on an absolute and relative basis, but Stephen Suttmeier at Bank of America notes that the cyclical industry important to the health of the S&P 500 may have room to the downside. He notes that the burden of proof is indeed on the bulls.

I would pay attention to the bottom portion of this BofA chart – after years of leading the market higher, it appears semi stocks are now a laggard. That makes it hard for high-valuation firms to continue to command optimism from Wall Street. One small-cap semiconductor firm has earnings after the bell Tuesday – its long-standing EPS beat rate history will be put to the test.

Semis’ Story: Once a Leader, Now Turning Laggard?

BofA Global Research

According to Bank of America Global Research, Ambarella (NASDAQ:AMBA) is a fabless developer of low-power, high definition (HD) and Ultra HD video compression, image processing, and computer vision chips. Ambarella combines its processor design with expertise in video/image processing, computer vision algorithms, and software to provide a platform that is scalable across a multitude of applications such as: security, sports, wearable, drone, and automotive video cameras. The company was founded in 2004 and went public in 2012.

The California-based $3.2 billion market cap Semiconductors & Semiconductor Equipment industry company within the Information Technology sector has negative trailing 12-month earnings and does not pay a dividend, according to The Wall Street Journal. Importantly ahead of earnings, 4.3% of the float is short.

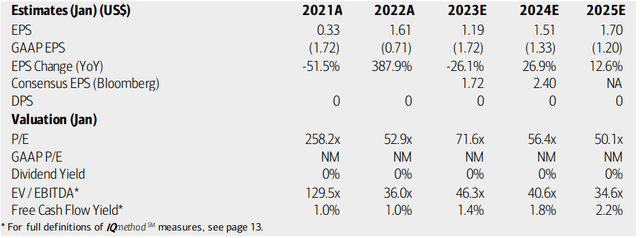

On valuation, analysts at BofA are less optimistic than the Bloomberg consensus EPS forecast. Earnings are seen as dipping in FY 2023 (which is currently ongoing) but then accelerating next year before stabilizing in FY 2025. The stock will then have an elevated price-to-earnings multiple and currently has a very high EV/EBITDA ratio. AMBA also has soft free cash flow. So while there are strong opportunities with its computer vision technology and robotics business, a lofty valuation means the company has a lot to live up to.

AMBA: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

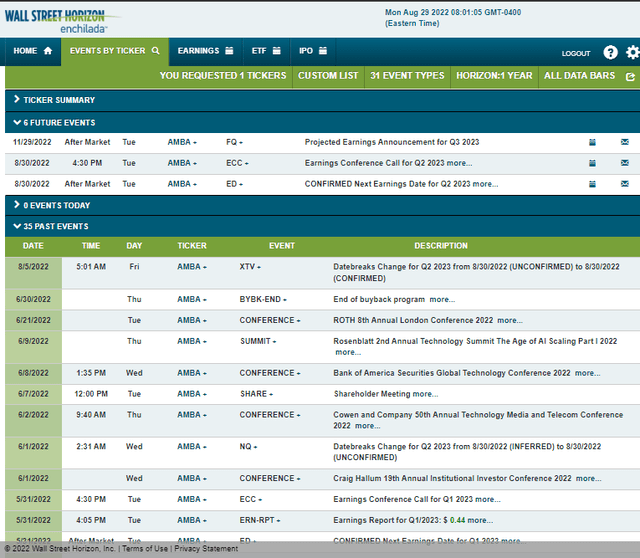

Wall Street Horizon’s data show a confirmed Q2 2023 earnings date for Tuesday, Aug. 30, AMC with an earnings conference call to follow. You can listen live here. Its Q3 reporting date is projected for Tuesday, Nov. 29 AMC.

Ambarella Corporate Event Calendar

Wall Street Horizon

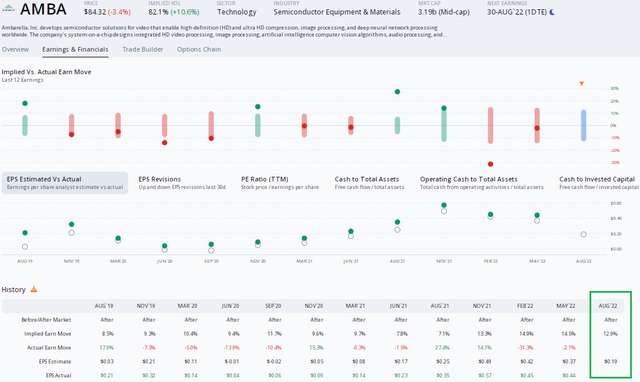

Digging into earnings Tuesday night, AMBA has a remarkable beat-rate history. The company has topped analysts’ expectations in each quarter dating back to August 2019, according to data from Options Research & Technology Services (ORATS). For its Q2 report Tuesday, the consensus EPS estimate is $0.19, per ORATS, and the options market implies a 12.9% stock price move post-earnings using the nearest-expiring at-the-money straddle. Three of the past four earnings reactions have been at least +/- 14%.

Options Angle: Traders See A 13% Post-Earnings Swing

ORATS

The Technical Take

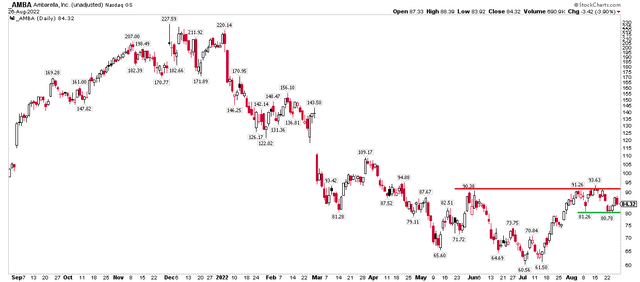

AMBA fell big off its high last December. After a whopping 73% drawdown, the stock stabilized in the low $60s in a bullish basing pattern from May through July. AMBA then climbed above $81 – a key spot – before pausing at $93. If shares can climb above the August peak, then a rally toward the March high of $109 could be in play. On the downside, a breakdown below $80 could lead to a quick move into the low $70s.

Overall, AMBA’s rate of trend has broken to the bullish side. I think there are positive reversal signs here ahead of earnings.

AMBA Bearish Trend Reverses, Consolidating Into Earnings

Stockcharts.com

The Bottom Line

If history is a guide, expect an EPS beat, but the stock price reaction could be a different story. Fundamentals and valuation suggest some downside risk, but the technical situation has improved. Overall, it’s a mixed picture considering some bearish trends in the Semiconductor index. Wait for a breakout above $94 or a breakdown below $80.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.