Exela Technologies: No Way Out. Likely Going Bankrupt

Summary:

- Exela Technologies is mostly a low-margined, labor-intensive, highly-leveraged business outsourcing company.

- It needs to quadruple its share count to meet its short-term obligations, not to mention a $1 billion long-term debt maturing the next few years.

- Management is exaggerating the company’s position in the Business Process Automation market.

NiseriN

Investment Thesis

Exela (NASDAQ:XELA) shares dropped 98% since my last article, warning meme traders that the company will knock down their positions through new equity offerings with magnitude multiple times their meme bonanza. Despite its enormous drop in the past few quarters, the ticker’s prospects of a rebound are anchored by a heavy debt load, gradually pushing XELA into bankruptcy as it continues burning cash it acquired from retail investors.

Meme traders are unlikely to return after last year’s burn. A meme trade requires a certain level of camaraderie, trust that the herd will stand by their positions in the face of volatility, Wall Street skeptic research notes, and hedge funds’ short positions, long enough for meaningful volumes to profit from the higher price and formation of a new technical resistance line serving as a psychological assurance for late traders.

Last year, meme traders tried lifting the company’s shares twice. Still, they failed, lowering morale and weakening one of the corners of a meme trade: trust that a fellow trader will buy the shares for a higher price than you paid instead of trade pioneers buying and exiting first.

During the Q2 earnings call, management stated that it would continue relying on equity to pay down debt, verifying our hypothesis that even if a meme trade emerges, it will be short-lived, similar to previous ones.

Balance Sheet

XELA was born in the offices of leverage buyout firms slicing and dicing businesses to make a quick profit. The company is the aggregation of five businesses, which, from my understanding, haven’t been profitable since 2014, at least when combined together under the XELA brand. Still, private equity firms HandsOn Global Management and Apollo Global Management leveraged the business with nearly $2 billion in debt before dumbing it to the public market late in 2017, where its shares declined from $600 to $1 at the time of this writing.

The company doesn’t have a chance of survival without lowering its debt as it faces serious liquidity issues. In the next ten months, it needs to come up with $530 million to cover short-term obligations, from supplier bills to the current portion of long-term debt. Currently, the company only has $240 million in assets liquid enough to be used to repay the debt, including receivables and other current assets.

The company can’t lean on its operating income to help pay the short-term debt. Gross margin stood at $50 million last quarter. However, most of that goes to repay interest on its long-term debt, the additional $1 billion 10% long-term debt. In Q2, the company paid $42 million in interest, representing 84% of gross margin, leaving little for the company to pay for electricity, rent, and other administrative expenses such as accounting and legal costs, let alone accommodating its current liabilities.

Thus, roughly the company will need to fund about $290 million ($530 million current debt – $240 million current assets) through new equity offerings in the next ten months, translating to 250 million new shares based on the current price of $1.15 more than quadrupling its share count, currently standing at 65 million shares.

The equity offering will likely put pressure on the share price. We had seen these dynamics in Q2, when the company issued approximately 40 million new shares between May and August, using the proceeds to pay some of its debt but contributing to the ticker’s 70% decline. This is why we started the article discussing meme trades. Practically, it is the only way the company could be saved especially given that the current share price is trading near the NASDAQ listing requirements of $1 per share and dim revenue growth prospects, as discussed in the next section.

If the company repaid its short-term debt by a miracle, it would still need to find another way to repay its $1 billion long-term debt. The company will likely face higher refinancing fees, given the deteriorating revenue and profitability and tightening monetary policy.

Revenue Trends

Beyond buzzwords bombarded on retail investors, XELA is essentially a cash-strapped, highly leveraged call center. Its ventures into Business Process Automation “BPA,” a term used to describe software developers writing programs that automate back-office processes, are too small.

For now, the majority of the company’s revenue comes from low-margined, labor-intensive outsourcing tasks provided by its call centers in India and the US, the latter mainly covering banking customers with regulatory mandates prohibiting the transfer of data outside the US.

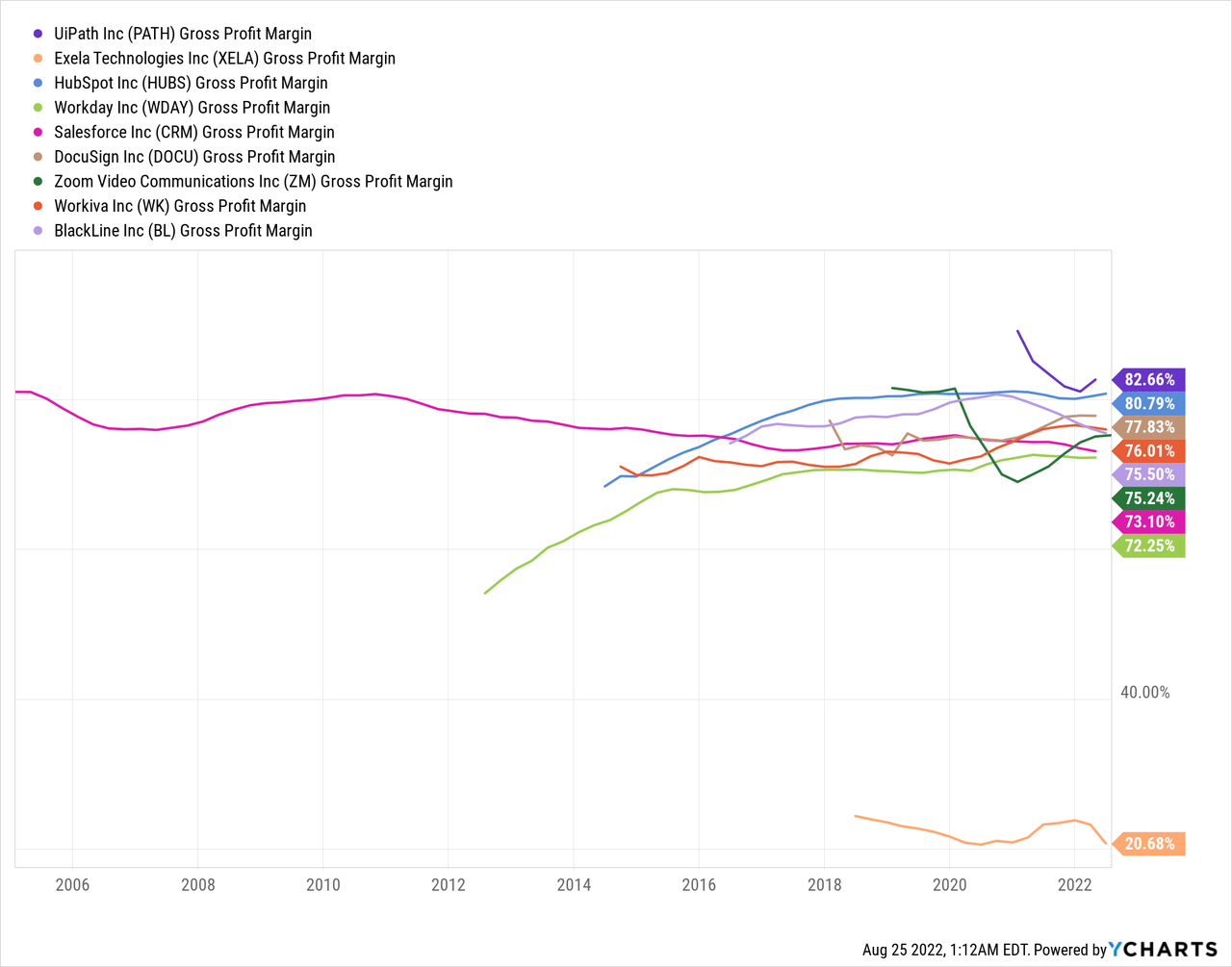

Thus, while XELA’s BPA business occupies the majority of its investors’ presentations and pitch, it is, in fact, a tiny part of its business, as mirrored in the gross margin comparison of XELA and pure BPA businesses, such as UiPath (PATH), Workday (WDAY), DocuSign (DOCU) and BlackLine (BL), showing XELA margin at the bottom of the chart.

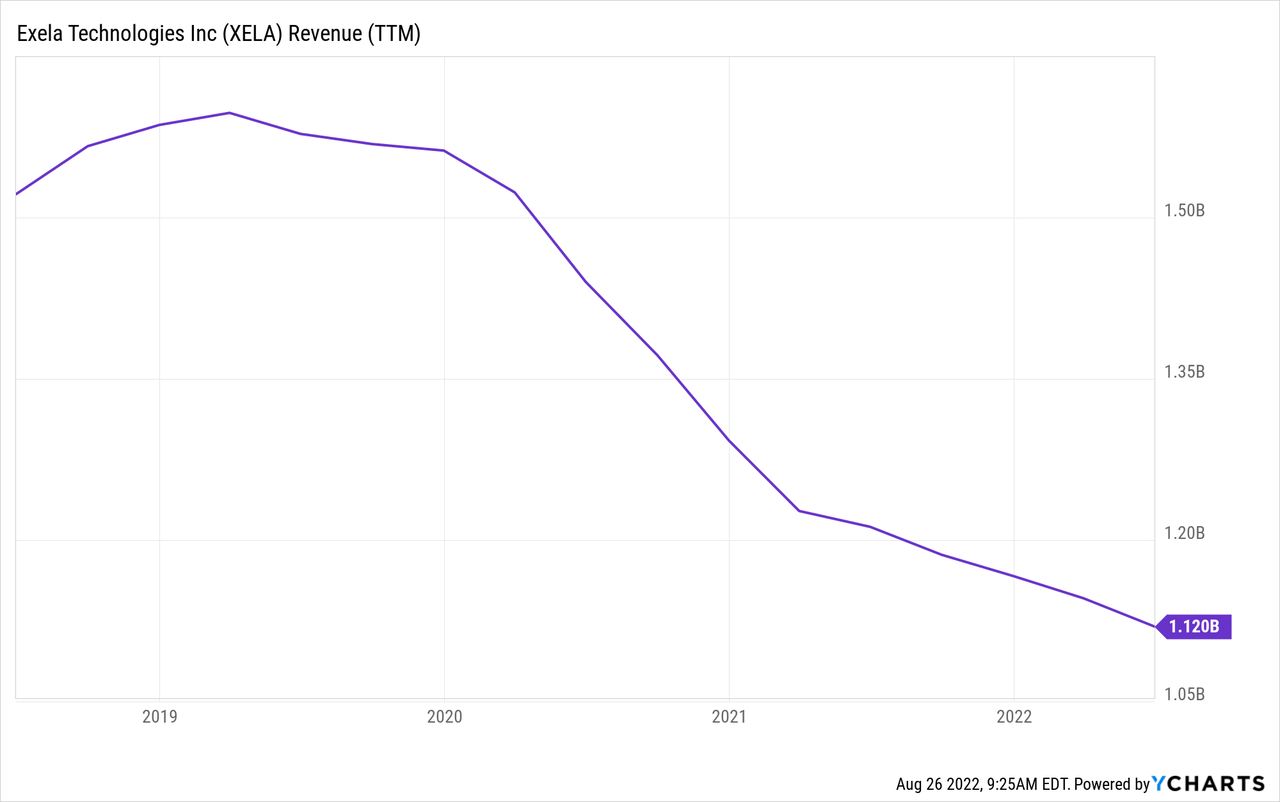

A common procurement standard by large corporations is that no single contract represents more than 10% of the supplier’s revenue. This requirement guided XELA’s management and probably its private equity sponsor’s decisions to prioritize volume over profit, growing revenue so that it could bid for bigger contracts. This hasn’t materialized, and the company has been reversing this trend, dropping its less profitable contracts, underpinning its revenue decline shown in the graph below.

Beyond strategy backpaddling, XELA faces challenges from current macroeconomic conditions, namely inflation, tight labor market, and rising interest rates. For example, the tight labor market caused staffing shortages during Q2, costing XELA nearly $5 million in lost revenue. Rising interest rates and higher cost of living impacted loan application volumes, which could push banks to renegotiate their contracts for lower Full-Time-Equivalent employees at XELA’s call centers.

Summary

XELA is a low-margined, highly leveraged, labor-intensive business outsourcing business slowly heading towards bankruptcy unless meme trades sacrifice their monies (for a third time) to bail out institutional lenders. Even if, by some miracle, the company managed to raise $290 million to repay short-term obligations, it will need to find a solution for its long-term debt, standing at about $1 billion with 10% interest, weighing heavily on profitability.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.