Summary:

- Novavax has seen a surge in stock price due to recent COVID-19 and bird flu vaccine developments, reaching over $27 per share.

- The company is making headlines with updates on their COVID-19 vaccine, bird flu vaccine, and potential FDA approval, with upcoming catalysts expected.

- Investors need to consider competition risks, but potential for Novavax to generate revenue and validate their vaccine technology with upcoming clinical trials.

JUN LI

It has been just over a month since my last Novavax (NASDAQ:NVAX) article, where I highlighted the company’s recent partnership deal with Sanofi (SNY) and updated my NVAX strategy. At that time, the company had mentioned that they were moving forward with their COVID-19 vaccine programs, as well as doing some pre-clinical work for a H5N1 bird flu vaccine. However, I underappreciated the timeliness of those updates because it was only days later that the FDA announced their suggested strain for the fall COVID-19 vaccine season. In addition, we have seen an increase in the number of reports from healthcare organizations about a potential public health crisis as humans are starting to be infected with the bird flu. As a result, the ticker went from roughly $8.60 per share to over $27 per share. Since then, NVAX has receded to around $14 per share, but it still has plenty of bullish signals and seasonality to potentially support a sustained rally. The ticker may be in reversal mode, forcing me to rework my NVAX strategy to adjust for multiple potential upcoming catalysts.

I intend to review some of the recent vaccine headlines and provide some background on Novavax’s efforts. In addition, I will highlight some of the downside risks that investors need to consider when managing their NVAX position around these headlines. Finally, I share how I plan to adjust my NVAX strategy if these recent headlines turn into a string of catalysts.

Recent COVID Headlines

Novavax has gained recognition as an innovative vaccine company during the COVID-19 pandemic as it battled other vaccine developers to get their unique vaccine through healthcare organizations to be available to the public. Although Novavax did not receive preferential treatment during COVID, the company was able to benefit from their efforts and became a household name. The ticker benefitted from the onslaught of COVID-related headlines, going from roughly $4 per share to $300 per share in just over a year’s time. Following the pandemic, I expected Novavax to retain some name recognition as they attempted to get their COVID-19 vaccine fully approved and work on their other vaccine programs through the FDA. At the same time, I anticipated the share price to weaken as the COVID-related headlines lost their punch.

Now, Novavax is back making headlines regarding their COVID-19 vaccine and labor in developing a bird flu vaccine. Back in May, the FDA revised their EUA for Novavax’s COVID-19 vaccine to have this season’s formula. In addition, the company’s vaccine has been given the green light for people 12 years old and older for both the vaccinated and those who have not been vaccinated against COVID-19. I must also point out that Novavax’s vaccine can now be administered to people who have already been vaccinated with an mRNA vaccine. This was a notable update because it unlocks the broader population who have been regulated into sticking with the mRNA vaccines.

Luckily, Novavax has been preemptive in updating its COVID-19 vaccine to be prepared for the latest variants and posted encouraging results from its XBB.1.5 Omicron subvariant, which is expected to be operative against the JN.1 Omicron subvariant. Today, Novavax has the regulatory authorization to vaccinate or boost a large millions of Americans as we head into the vaccination season. Luckily, Novavax has worked with the Serum Institute of India to prepare vaccines in prefilled syringes that will be set for distribution by mid-July.

Into the bargain, the FDA informed Novavax that they have reviewed their BLA and set the vaccine’s PDUFA date for next April. If approved, the company would have a fully-approved commercial product, and won’t have to keep reapplying for EUAs for their next COVID vaccine formulations.

Looking ahead, Novavax is looking to launch a Phase III trial for its COVID-Influenza Combination (CIC) vaccine and stand-alone influenza vaccine programs. The company believes they are on track to submit an IND for this pivotal trial in 2H of this year, which could allow for a potential product launch at some point in 2026. This is an important program to keep an eye on because the CIC vaccine is probably the ideal formulation, as it would allow an individual to get one shot to prepare for the COVID-Flu season rather than getting two separate shots.

So, despite the pandemic coming to an end, the company’s COVID-related headlines are still plentiful. Although these headlines might not produce a parabolic move in the share price as they did during the pandemic, these advancements are meaningful to the company’s long-term outlook and could lead to durable moves in the share price.

Bird Flu Headlines

The Avian/Bird Flu headlines might seem like another potential epidemic or even a pandemic. However, the world has had to deal with bird flu scares a few times over the past 20 years, and Novavax has attempted to produce a viable candidate for those circumstances. In 2007, Novavax reported that its H9N2 bird flu vaccine triggered a strong immune response in animal models. The study was published in the online journal Vaccine. In 2008, Novavax reported that its H5N1 bird flu vaccine generated produced a robust immune response in animal models. In mice, the vaccine protected them from death. In ferrets, the vaccine protected them from live H5N1 bird flu viruses.

This time, Novavax is utilizing their platform technology utilizing mucosal vaccination routes and employing their high-density nanoparticles. Unlike most contemporary vaccines that are administered via injection, Novavax is looking to administer the bird flu vaccine via mucosal surfaces, such as the nasal or oral routes. This type of vaccine can offer a number of edges over the competition, including ease of administration, the prospective for a mass immunization campaign, as well as both systemic and local immunity at the point of infection/entry. In addition, the company would still be using their high-density nanoparticle technology to help boost the vaccine’s efficacy by producing a stronger and more durable immune response.

At the moment, it looks as if the U.S. government is partially ready if the bird flu becomes a legitimate epidemic. BARDA has “hundreds of thousands of doses” of H5N1-strain vaccines stockpiled, which appears to be operative against this strain. In addition, manufacturers could yield millions more within weeks and “up to 100 million doses in five months.” However, the concern is that the approved bird flu vaccines are grown in chicken eggs, and the virus is later killed and bottled into a vaccine. Although this method works, you are relying on chicken eggs to produce the vaccine to a virus that kills chickens… so, chicken eggs could become a scarce commodity if the virus starts to spread like wildfire amongst livestock.

Novavax does not have to worry about chicken eggs because their particles are produced in more stable insect-cell cultures, and yields are seven to 10x higher than egg-based manufacturing. In addition, Novavax vaccines can also be created within 10 to 12 weeks of identifying a pandemic strain, which is half the time it takes to make egg-based vaccines.

Looking ahead, Novavax is preparing to start clinical trials for their bird flu vaccine. If approved, Novavax’s vaccine would the company have the prospects to generate some revenue and would validate their ability to quickly develop an operative vaccine for a growing public health concern. The bird flu headlines and the vaccine’s regulatory journey could deliver numerous catalysts that should have a positive impact on NVAX’s performance.

Accepting The Risks

Although these recent headlines and developments could benefit Novavax, investors need to concede that the company has several hurdles to overcome if they want their efforts to translate to revenue. Unfortunately, the biggest concern is competition for both COVID and bird flu. Moderna and Pfizer were able to exploit their connections in the government and health agencies to get the red-carpet treatment. Novavax will have to continue to compete with both of those companies for COVID. However, it looks as if Moderna (MRNA) and Pfizer (PFE) are also working on their bird flu vaccine candidates. So, we could see another replay of COVID where Novavax can produce a viable vaccine candidate in a similar time frame as Moderna and Pfizer but is not given the same support despite being an alternative vaccine technology. Furthermore, Novavax will have to face competition from existing bird flu vaccines from GlaxoSmithKline (GSK), Sanofi, and Novartis (NVS). These vaccines are already stockpiled, and government agencies could request them to restart production to ensure they have enough to cover an initial vaccination campaign and could be perceived as the best option moving forward considering the reliability of those vaccines. So, not only does Novavax have competition from the mRNA vaccines in the clinic, but they will have to prove they are a better option than the reigning bird flu vaccines from Big Pharma.

Novavax may get their full approval for their COVID-19 vaccine and produce a bird flu vaccine candidate, only to have the government and distributors choose the competition as their preferred brand. I wish this weren’t a possible scenario, but the company’s history for both COVID and bird flu suggests this is a strong probability… at no perceivable fault of the company.

Luckily, it would appear there is some public apprehension about using mRNA tech for vaccines and the older egg-based vaccine technology might raise concerns, forcing authorities to consider Novavax as one of the favored brands moving forward. Still, NVAX investors need to accept the company could generate impressive clinical data with a legitimate commercial structure for their own vaccines, and the agencies shrug at Novavax.

My Plan

Although I am willing to trade around these potential COVID and bird flu catalysts, I must have some parameters to follow to ensure my transactions coincide with my long-term plan NVAX strategy. In my previous article, I disclosed that I had to adjust my trading levels for the company’s deal with Sanofi, which could provide Novavax with billions in revenue in the upcoming years. As a result, I upgraded my Buy Threshold to $25 per share, which will be the limit I am willing to buy NVAX. Considering the ticker is trading below this level, I am still looking to add to my position.

Now that the recent headlines have provided some additional bullish momentum, I am going to have to be ready to work my Buy and Sell Targets to take advantage of the elevated volatility. Typically, I tend to rely on executing these trades manually, but NVAX’s volatile movements tend to offer brief opportunities to manage your position. Therefore, I am going to set both buy and sell orders to prevent missing out on an opportunity to get a discount or sell at a premium. Indeed, this strategy does carry the risk of missing out on a big move higher or buying during an intense sell-off. However, it is a risk I am willing to take, considering the Sanofi partnership and the ticker’s history.

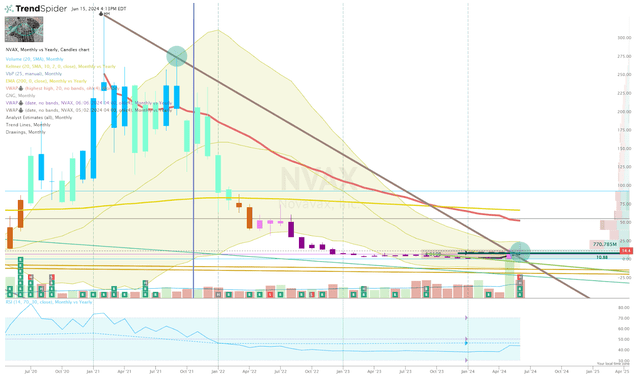

Looking at the monthly chart, we can see that NVAX finally broke the downtrend ray from the 2021 high, but looks to be forming an inverted hammer on the June monthly candle.

NVAX Monthly Chart (TrendSpider)

Therefore, I am waiting to see how this month closes before setting any large orders for NVAX. The CDC ACIP is set to meet on June 26th to discuss H5N1 alongside its routine votes on other vaccines. This meeting could provide us with some insight on how health agencies are viewing the bird flu, as well as their thoughts on other vaccines, including COVID and seasonal flu. Any mention about Novavax or comments about concerns over mRNA, or egg-based vaccines could be a powerful catalyst that could help the ticker end the month on a strong note.

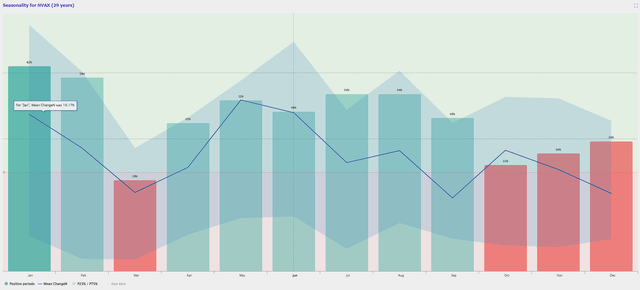

Thankfully, NVAX is heading into a nice stretch of bullish seasonality trends for June, July, August, and September.

NVAX Seasonality Trends (TrendSpider)

So, a positive update or headline could trigger a durable move for the share price as we grind through the summer.

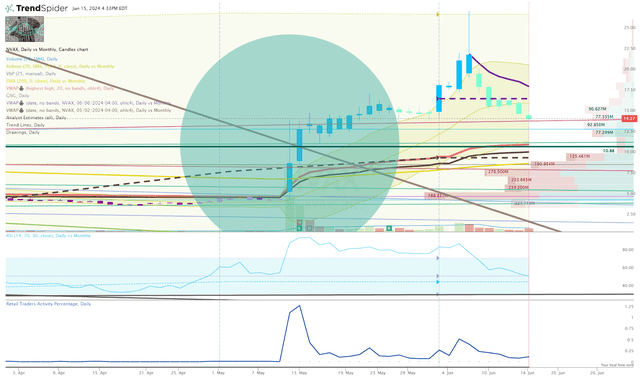

Looking at the Daily Chart, we can see that the share price broke that downtrend under heavy trading volume, with a large percentage coming from retail traders. That percentage has dropped in June; however, the retail investor is still making a greater percentage following the Sanofi deal. In my view, this makes for a great trading environment as people outnumber algos, allowing for plenty of opportunities to manage your position.

NVAX Daily Chart (TrendSpider)

In addition, the ticker is now trading above the 200-day EMA and is bullish on the Go-No-Go indicator. So, I think there is still some bullish energy remaining in the ticker.

I am looking to the proximal high and low-anchored VWAPs as the next key levels of conflict. I will use these as potential signals to determine my next buy. A break above the proximal high-anchored VWAP will command me to set some buy orders. If the share price drops below the proximal low-anchored VWAP it will signal a bearish condition and I will wait for a reversal before committing to a buy.

Once the ticker breaks and holds above that line, I will consider making an addition to my NVAX position. Next, I will set sell orders around $60 per share to book some profits and return my position to “House Money” status. I will continue to trade the ticker around these catalysts involving the company’s Sanofi deal, COVID-19 programs, and bird flu-related headlines to generate profit while building a core position.

Long term, I still expect NVAX to remain in the Compounding Healthcare “Bio Boom” speculative portfolio for at least five more years, or until it graduates to my growth portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVAX, MRNA, PFE, SNY, GSK, NVS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my research on Seeking Alpha. If you want to learn even more about my method and how I discover these investment opportunities, please check out my subscription marketplace service, Compounding Healthcare, and sign up for a free trial.