Summary:

- Nvidia’s shares managed to reach exuberant levels once again mostly thanks to the market’s obsession with everything that’s related to artificial intelligence.

- All of this is happening at a time when GPU sales are declining while geopolitical risks are increasing.

- It’s hard to see how Nvidia’s shares would be able to retain their momentum and continue to trade at over 50 times their sales thanks to the AI hype alone.

Justin Sullivan

The obsession with everything AI-related has reached the next level when Nvidia’s (NASDAQ:NVDA) shares appreciated by ~60% since the beginning of 2023 due to the company’s advantageous position in the GPU market as a lot of AI projects rely upon its products. However, such aggressive growth comes at a time when GPU sales are rapidly declining while geopolitical risks, along with Nvidia’s exposure to the Chinese consumer market that already negatively affected its performance in FY23, are making it nearly impossible to justify such an appreciation of the company’s stock in the current environment. While there’s certainly going to be a demand for AI-related projects in the future, it’s hard to see how Nvidia’s shares would be able to retain their momentum and continue to trade at over 50 times their sales thanks to the AI hype alone.

The AI Hype Train Is Here

A few weeks ago, Nvidia revealed its Q4 earnings report which showed that the company has managed to generate $6.06 billion in revenues during the three months, down 20.8% Y/Y but above the Street estimates by $30 million. Despite the Y/Y decline in revenues, the improvement of the gaming business coupled with the growth of the data center segment along with the market’s obsession with everything related to artificial intelligence made it possible for Nvidia’s shares to rally.

There’s no denying that Nvidia is likely to continue to greatly benefit from further investments and innovations in the AI field since its GPUs are likely to continue to power the current large language models like ChatGPT. It’s also safe to assume that the ongoing AI war between Microsoft (MSFT), Google (GOOG)(GOOGL), and others is likely to give a boost in sales to Nvidia’s flagship AI GPUs A100 and H100 as well. On top of all of that, the better-than-expected guidance for the following fiscal year in which the Street expects the company to increase its revenues by 10.2% Y/Y coupled with the expanding TAM have also given more reasons for optimism about Nvidia’s future.

However, there’s also a case to be made that by trading at over 50 times its sales, Nvidia’s shares are unlikely to retain their momentum for long solely on the market’s obsession with AI alone. That’s why it made perfect sense for the management to use the latest rally to file a $10 billion mixed shelf offering at the current levels. Once the AI hype train loses its steam, it’s hard to imagine how Nvidia’s shares would be able to continue to aggressively appreciate in the short to the near term, especially in the current turbulent macroeconomic environment full of geopolitical risks that have already negatively affected the business in recent months.

Is The AI Premium Justified?

Despite the potential to greatly benefit from the growth of the AI sector in the long run, Nvidia faces several problems that could make the company underperform in the following months and make it hard to justify its current valuation.

One of the biggest issues that Nvidia currently faces is the excess of inventory. The latest data shows that at the end of January, the company had a record $5.2 billion worth of inventory, significantly up from $2.6 billion a year ago, while GPU shipments have plummeted by 35% Y/Y in Q4 on weaker demand and were the main reasons behind Nvidia’s major decline in revenues during the recent quarter. To offset the risks associated with having record inventory levels at a time when sales are in decline, Nvidia would likely be required to offer discounts for its GPUs to prop up demand which in the end could lead to lower margins and weaker-than-expected performance.

At the same time, the company continues to face geopolitical risks that are likely to put additional pressure on its shares due to the deterioration of Sino-American relations along with the potential implementation of new chip export restrictions by the White House. A few months ago, I’ve already noted how Nvidia’s exposure to China, which accounts for over 20% of its total sales, is one of the company’s major downsides. The latest round of chip restrictions that were implemented by the Biden administration already led to up to $400 million loss in potential revenue in FY23 as it made it harder for companies like NIO (NIO) to obtain A100 chips from Nvidia. In addition, the release of reports which indicate that it’s likely that Nvidia wouldn’t be able to sell technology to Huawei is a sign that the company would continue to experience more economic pain due to its inability to fully decouple from China in this new geopolitical reality. As such, it makes it even harder to justify the recent rally of its stock.

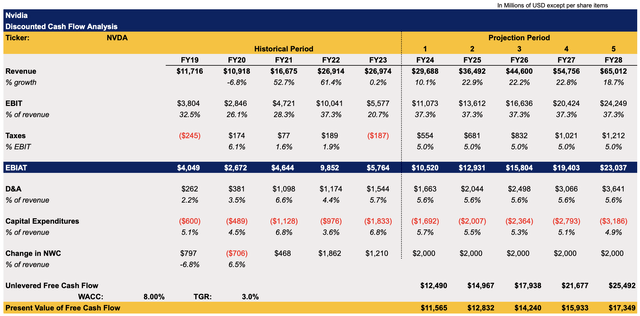

To figure out Nvidia’s intrinsic value in the current environment, I’ve decided to update my DCF model which showed the company’s value to be $138.69 per share back in September when the White House restrictions were about to be implemented while ChatGPT wasn’t released. The revenue assumptions in the updated model below are mostly in-line with the street expectations, while the EBIT assumptions are on the higher end and are in line with the previous model. The tax rate is capped at 5% on purpose as the company still pays less than that while potential subsidies and governmental assistance could prevent it from increasing significantly higher in the foreseeable future. The D&A and the capital expenditures as percentages of revenues are averages of their respective recent years, while the change in net working capital remains positive and is capped at $2000. The WACC and the terminal growth rate remain unchanged in comparison to the previous model.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

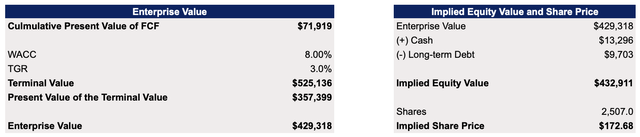

This updated model with more optimistic assumptions shows that Nvidia’s fair value is $172.68 per share, which is still significantly below the current market price of ~$230 per share.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, several things are needed to be considered. First of all, Nvidia has not been a value play for a couple of years as the aggressive growth of its business made its shares attractive for lots of investors even when they were trading at exuberant levels. At the same time, there’s still a case to be made that the ongoing AI war between Big Tech would ensure that Nvidia’s most advanced GPUs would continue to be in high demand in years to come as more investments are poured into the AI field.

The problem though is that it’s hard to see how Nvidia’s shares would be able to continue to aggressively appreciate in the following months on the market’s obsession with AI alone as the increase in geopolitical risks coupled with the rise in inventory at a time when overall sales are declining are making it hard to justify the current valuation.

The Bottom Line

There’s no denying that artificial intelligence is the next big thing and more investments will flood into the AI field in the foreseeable future. There’s also no denying that Nvidia is likely to greatly benefit from all of this thanks to its dominant position in the GPU market as its GPUs will play an important role in making it possible to scale various AI-related projects.

However, it’s also safe to assume that the recent appreciation of Nvidia’s stock was possible thanks to the market’s obsession with everything AI-related. Once the AI hype train loses traction and the market moves to another popular theme, then Nvidia’s shares have all the chances to depreciate since they already trade at exuberant levels while the decline in GPU sales is not going to help to retain the momentum. Add to this the fact that Nvidia is exposed to major geopolitical risks that have already negatively affected its performance in FY23 and it becomes obvious that now is not the time to purchase the company’s shares at the current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!