Summary:

- NVDA has chosen to sell its GPUs to hyperscalers and launch its cloud-native AI-training infrastructure at the same time.

- This shows that its aggressive R&D investments and SBC expenses were likely worth it, attributed to the company’s leading market share in the discrete GPU segment.

- However, with the stock trading at fair value, investors must proceed with caution in our view, since the AI hype may soon start to fade.

- The same moderation has been observed with GOOG and MSFT stocks, suggesting potential volatility in the short term.

- Do not chase this rally.

DKosig

We previously covered Nvidia (NASDAQ:NVDA) here, particularly its tailwind for recovery through China’s reopening cadence. By diversifying into the IoT and Automotive markets, the management also continued to expand its strategic exposure to many end markets, supporting its premium valuations.

For this article, we will focus on the AI hype attributed to ChatGPT’s success thus far, which may boost capex spending on GPUs in the intermediate term. On one hand, we reckon NVDA’s financial tailwinds may be minimal, attributed to the one-time capex implementation by interested tech companies. On the other hand, the management has strategically planned one step ahead by incorporating its AI training infrastructure into a cloud-native platform. We shall discuss this further.

The Cloud-Native AI-Training Investment Thesis

NVDA has chosen to participate in the ongoing ChatGPT and AI hype, by unveiling its NVIDIA DGX Cloud supported by Oracle Cloud Infrastructure (NYSE:ORCL), Alphabet’s Google Cloud (NASDAQ:GOOG) (NASDAQ:GOOGL), and Microsoft’s Azure (MSFT), amongst others. As highlighted by the company, the AI service will also be an extension of its cloud partners’ existing storage/ networking/security offerings.

We posit that the GPU designer may be offering the same support currently enjoyed by OpenAI, including “the AI supercomputer infrastructure, model algorithms, data processing, and training techniques.” On top of that, the company plans to provide pre-trained and customizable generative AI models.

Notably, MSFT also introduced a similar service in November 2021, with a public launch available from January 2023 onwards. Due to the immense associated costs of custom supercomputers used in AI training, the cloud-native pay-per-use model may be more appealing to smaller-medium tech companies with lower capital resources.

This also builds upon the nominal revenue contribution from one-time capital expenditures and the two-year replacement cycles for data center GPUs, with the macroeconomic outlook remaining uncertain through 2023.

While NVDA had previously supplied OpenAI with 10K units of A100 GPUs for the training of GPT-3 AI model, rumors suggested that its next-gen GPT-4 model might utilize up to 25K GPUs. These numbers implied a minimal top-line contribution of $250M, or the equivalent of 0.9% of NVDA’s FY2023 revenues, based on the product’s current price of $10K each.

Therefore, the company’s decision to offer the AI Software as a Service [SaaS] may prove to be another meaningful revenue stream in the long-term, in our opinion.

As long as NVDA maintains its cutting-edge technology, the tailwinds for long-term adoption and growth may be massive. This also builds upon its other SaaS offerings, such as the Omniverse, NVIDIA RTX, NVIDIA Drive Orin, and GeForce NOW cloud gaming service, amongst others.

Perhaps this was why the company continued to aggressively invest in its future while incurring elevated operating expenses, despite the impact of the PC headwinds. In FY2023, it reported $7.33B (+39.3% YoY) of R&D expenses and $2.7B (+35% YoY) Stock-Based Compensation, comprising 27.1% and 10% of its revenues at the same time.

These numbers are mostly higher in comparison to its peers over the last twelve months, such as Advanced Micro Devices (NASDAQ:AMD) at 21.1%/4.1%, Qualcomm (NASDAQ:QCOM) at 19.8%/5%, and Intel (NASDAQ:INTC) at 27.7%/4.9%, respectively.

However, with NVDA retaining its title as the leader in the discrete GPU market at a 86% market share as of FQ3’22, it appeared that its efforts and expenses have paid off handsomely. We think these endeavors prove that the company was more than capable in baking its own cake and eating it too, by selling both GPU hardware and AI-training SaaS at the same time.

Combined with the optimistic early recovery in gaming demand, attributed to its recently launched Ada Lovelace architecture, we concur that its inventory correction may be largely over, as highlighted by Colette Kress, CFO of NVDA:

Sequential growth was driven by desktop workstations with strengths in the automotive and manufacturing industrial verticals. Year-on-year decline reflects the impact of the channel inventory correction, which we expect to end in the first half of the year. (Seeking Alpha)

Things may also rapidly pick up over the next few quarters, due to China’s rapid reopening cadence and the country’s large gaming base. The country (including Taiwan) accounted for 47.3% of NVDA’s revenues in FY2022, attributed to its robust appetite for data center and gaming products.

Interested investors may be interested to refer to our previous article, to find out more about NVDA’s market opportunities in China, through cloud-gaming, Advanced Driver Assistance Systems [ADAS], and AI-chips, amongst others.

So, Is NVDA Stock A Buy, Sell, or Hold?

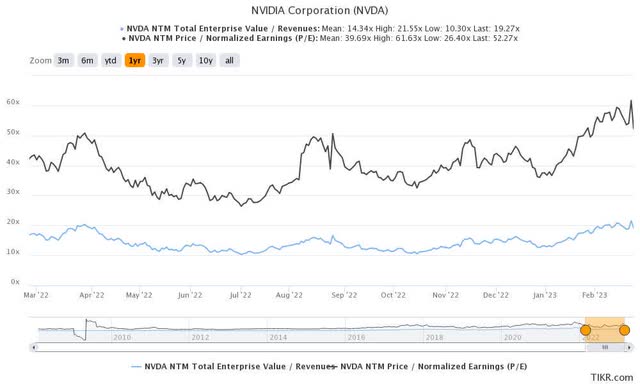

NVDA 1Y EV/Revenue and P/E Valuations

NVDA is currently trading at an EV/NTM Revenue of 19.27x and NTM P/E of 52.27x, higher than its 3Y pre-pandemic mean of 9.57x and 33.56x, respectively. We also believe it is still too optimistic against its 1Y mean of 14.34x and 39.69x, respectively.

Based on its projected FY2025 EPS of $5.87 and its 1Y mean P/E, we are looking at a moderate price target of $232.98, suggesting a minimal upside potential from current levels.

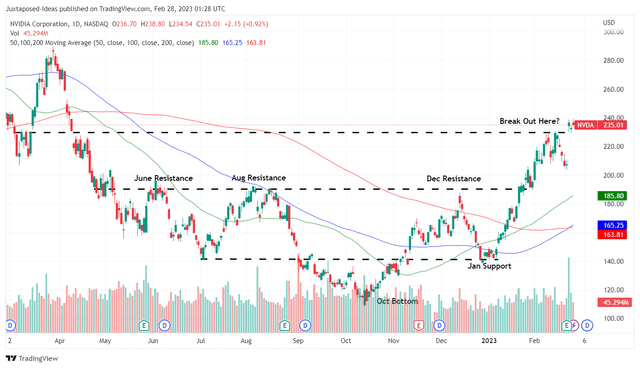

NVDA 1Y Stock Price

This is unsurprising since NVDA had recovered by +13.2% to $235.01 on the days after its FQ4’23 earnings call. Otherwise, the stock had rallied tremendously by +67.4% from the December 2022 levels of $140.36 and by +117.3% from October bottom of $108.13.

While the stock is now at around fair value, we reckon that it may be unwise to add at current levels, due to the minimal upside potential. The AI hype may soon start to fade as well, as witnessed with GOOG stock declining by -15.7% and the MSFT stock by -6.8% over the past few weeks.

Particularly, similar boom-and-bust cycles have been observed over the past few trends, including cryptocurrencies in 2020 and the Metaverse in 2021. Most had not ended well to the chagrin of investors.

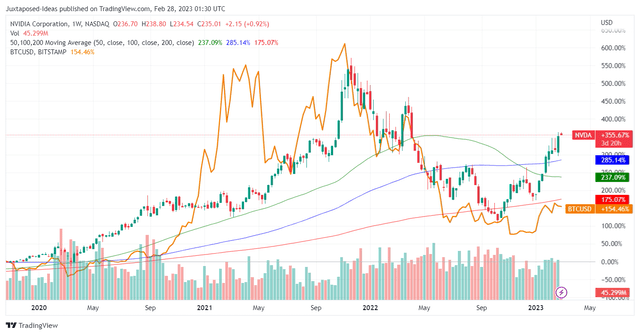

BTC & NVDA 3Y Price

Bitcoin’s price surged by 792.3% then, from $7.34K in January 2020 to $65.5K in November 2021, a peak price triggered by the hyper pandemic boom. Unfortunately, the optimism had waned due to the cryptocurrency winter, plunging its prices by -62.9% to $23.88K at the time of writing, bringing many other coins, NFTs, and blockchain along with it.

As its GPUs have often been used to mine cryptos, the cryptocurrency market may continue to influence NVDA’s performance in the intermediate term, as similarly described in its financial report:

Our Gaming GPUs began to be used for digital currency mining, including blockchain-based platforms such as Ethereum… Volatility in the cryptocurrency market… has impacted and can in the future impact cryptocurrency mining and demand for our products and can further impact our ability to estimate demand for our products. (Seeking Alpha)

The Metaverse hype had also been promoted by Facebook, with it strategically changing its company name to Meta (NASDAQ:META) in October 2021. At that time, NVDA was also a beneficiary, due to its timely release of digital twin/ Omniverse offerings. Market demand had remained robust thus far, growing by 13% QoQ to $226M in revenues for the Professional Visualization segment by FQ4’22.

However, it was apparent that the real money was still in NVDA’s hardware. In FY2023, the Professional Visualization segment only comprised $1.54B/ 5.7% of its revenues. This was a token sum, compared to the company’s main revenue drivers, the Data Center segment at $15.01B/ 55.6% and the Gaming segment at $9.07B/ 33.6% at the same time.

While we are uncertain how its AI endeavor through NVIDIA DGX Cloud may perform moving forward, we remain invested in its forward execution on AI, since the SaaS segment is also meant to “optimize the use of its GPUs.”

Nonetheless, we prefer to rate the NVDA stock as a Hold now, given the massive +37.38% recovery since our buy rating at $168.99 in our previous January 2023 article. Investors may want to wait for the optimism to fade a little before adding.

Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, INTC, GOOG, MSFT, META, QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.