Summary:

- Nvidia is a market leader in high performance graphics cards, data center chips and AI infrastructure.

- Its technical price chart shows its stock is close to a “breakout”, if it can pass through a tough resistance line.

- Nvidia is poised to benefit from the growth in the AI industry and data centers, as its new H100 chips are best in class.

Justin Sullivan

Nvidia (NASDAQ:NVDA) is a leader in Graphical Processing Units [GPUs] for gaming, data centers, and the automotive industry. Nvidia’s stock price was butchered by over 62% from its all-time highs in November 2021. This was driven by a variety of factors which included tough macroeconomic headwinds and a high inflation environment, which caused valuation multiples in “growth stocks” to compress. In the third quarter of 2022, things were still pretty bad as Nvidia missed earnings expectations due to a cyclical downturn in the gaming market and higher operating costs. However, Nvidia still reported strong revenue growth (over 30%) in its data center segment, as it benefit from the growth in the cloud industry. Automotive revenue also grew rapidly (86% year over year) and Nvidia is poised to benefit from the increasing connectivity of vehicles. Since October 2022 Nvidia’s share price has increased by over 58% on what has been a strong rally. In this post, I’m going to break down potential catalysts for this rally, the technical chart, and revisit Nvidia’s valuation, let’s dive in.

Strong Technical Chart

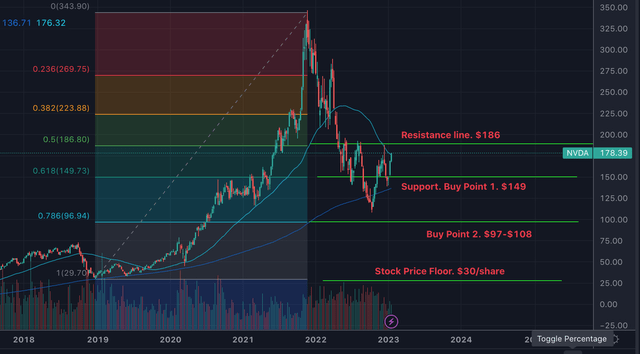

Generally, when reviewing a stock I analyze the fundamentals only, which is the revenue, earnings, etc. However, I believe it also makes sense to combine this with the technical charts in order to identify areas where investors have previously seen value. If the chart below looks overwhelming don’t worry I will walk you through it step by step, which should make it easy for those who haven’t read technical charts before. Looking at the left side of the below chart I have added a “Fibonacci retracement” indicator, this identifies both support and resistance lines. In this case, we can see Nvidia’s stock price bottomed out in October 2022 at just above Buy point 2 (~$108/share). Since then the stock price has blasted higher before hitting a strong “Resistance line” at $186/share, in mid-December 2022. The stock then dropped to Buy point 1 support zone at $149/share and bounced back up. Nvidia is now having another go at the “Resistance line” at $186/share. In the short term, this means the stock is likely a “short” for traders if it reaches that level and reverses. However, if the stock breaks through $186/share it will likely blast higher to at least $223/share, representing a ~19.8% increase which would result in solid gains.

Nvidia Technical chart 1 (created by author Deep Tech Insights)

For extra information, here is another technical chart that is interesting. The Chart below shows Nvidia has just reached the resistance line of a descending channel. As mentioned prior it is close to a breakout. If this occurs a “Reverse head and shoulders” pattern will be triggered which means the stock will likely blast higher.

Nvidia Technical chart 2 (TradingV-Nathan Black)

AI Tailwinds – Catalyst?

In order for Nvidia to “break out” or break through the resistance line, it will need a positive catalyst. Its fourth-quarter earnings report is set to be announced on February 15th, 2023 and if this is not as bad as expected that could be the catalyst we need, I will cover that report on my profile, for those following. In the short term, Bank of America chip analyst Vivek Arya, has forecast a “soft landing” for semiconductor stocks. He believes this will be driven by artificial intelligence tailwinds and automotive chips which are still in high demand. These are two areas Nvidia specializes in and thus the company is likely to benefit. In my previous post on Nvidia I discussed its business model and financials in great detail, in this post I’m just going to give a brief overview.

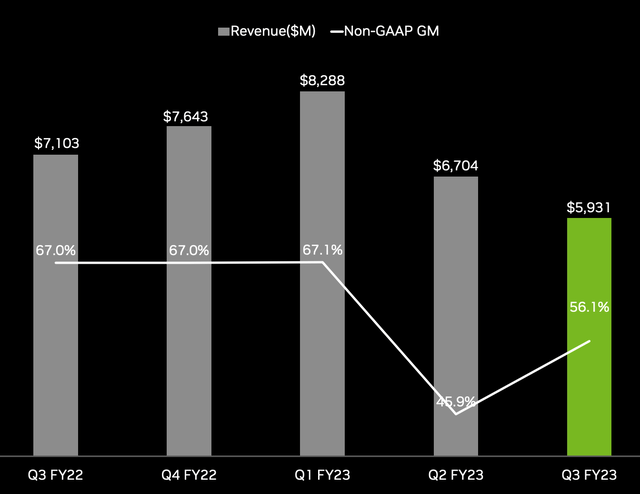

Nvidia reported mixed financial results for the third quarter of 2022. Its Revenue was $5.93 billion, this surpassed analyst expectations by $145 million, despite declining by 17% year over year. As mentioned in the introduction this was mainly driven by a decline in the gaming/PC market. Historically this has been a cyclical industry and thus I forecast it will (mostly) bounce back long term. The only exception will be “crypto mining” related GPU revenue, which likely remain muted as crypto prices have plummeted (crypto winter), the rise of ASIC mining and Ethereum is moving away from a proof of work to a proof of stake model.

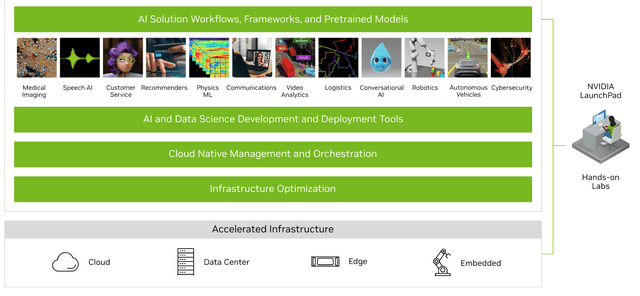

The positive for Nvidia is its Data Center segment reported strong revenue of $3.83 million which increased by 31% year over year, despite slowing down in the quarter. With respect to AI, Nvidia provides the backbone A100 Chip and in the third quarter, it began to ship its new H100 GPU. The H100 has approximately 7 times greater performance for high-performance applications and has 3 times lower cost of ownership, due to its lower energy usage. Therefore I expect this to be a “no-brainer” purchase for the major hyperscaler cloud providers such as Microsoft Azure, AWS, and Google Cloud.

Nvidia also enhanced its partnership with Oracle, in order to help scale the use of AI. Given Nvidia has effectively created the “gold standard” for AI infrastructure and an entire AI platform, the company is poised to benefit from industry tailwinds. The AI industry was valued at $387.45 billion in 2022 and is forecast to grow at a rapid 20.1% compounded annual growth rate [CAGR], reaching a value of $1.39 trillion by 2029. Recently conversational AI platform ChatGPT, by Open AI, has gone viral and racked up millions of users online. This has been dubbed as an “iPhone” moment and I believe this signals the real start of the “AI revolution”, let’s read this report again in 5 years. Interestingly enough, ChatGPT and Open AI, have its tools running on Microsoft Cloud infrastructure. Microsoft also was an early-stage investor in the company and has recently invested another $10 billion into the business. Given Open AI is unprofitable and not making significant revenue (according to CEO Sam Altman), this is a huge bet on the technology.

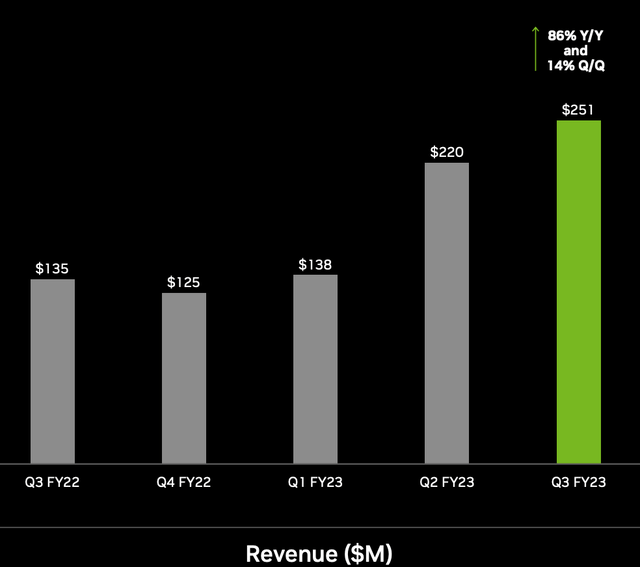

Nvidia also grew its automotive revenue by a rapid 86% year over year to $251 million. This is another area Bank of America chip analysts forecast will maintain robust demand. Nvidia has partnerships with the largest automakers in the world from Mercedes to Volkswagen, with its Drive Orin platform.

Nvidia automotive revenue (Q3,22 report)

Nvidia has a robust balance sheet with $13.1 billion in cash and marketable securities. The business does have $9.7 billion in long-term debt, but only $1.2 billion in short-term debt which is manageable.

Advanced Valuation

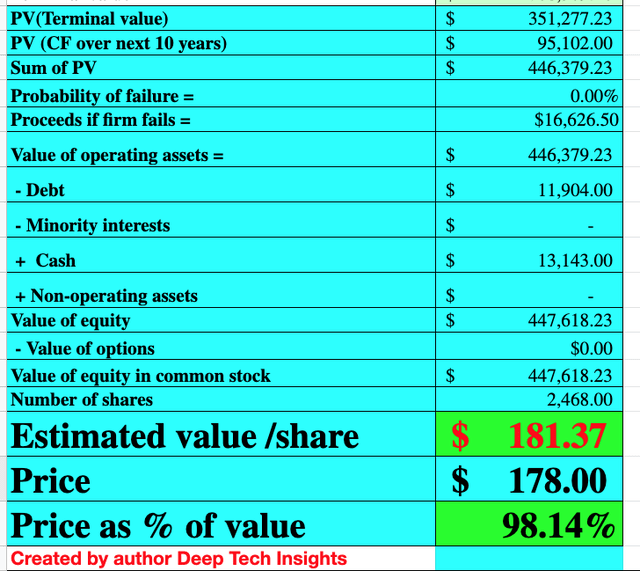

In order to value Nvidia I’ve plugged its latest financial data into my discounted cash flow model. I have adjusted my estimates to be slightly more optimistic following positive forecasts for the semiconductor industry, related to AI and the cloud specifically. I’ve forecast 12% revenue growth for “next year”, this refers to the calendar year of 2023 in my model, as Nvidia hasn’t released its Q4,22 results yet. I have based this forecast on a tough macroeconomic environment to be tough for gaming, but not as bad as expected in other areas. In years 2 to 5, I have forecast 26% growth rate per year, as the cyclical gaming market will likely rebound and we see continued growth in the cloud. Both the gaming and the cloud are growing industries but will have short-term downturns like most other markets.

Nvidia stock valuation 1 (created by author Deep Tech Insights)

To increase the accuracy of my valuation model, I have capitalized R&D expenses which has lifted the operating margin. I have forecast a further operating margin increase of 45% over the next 9 years. I expect this to be driven by a rebound in the gaming segment and continued growth in the cloud.

Nvidia stock valuation 2 (created by author Deep Tech Insights)

Given these factors I get a fair value of $181/share, the stock is trading at ~$178/share at the time of writing and thus it is “fairly valued”.

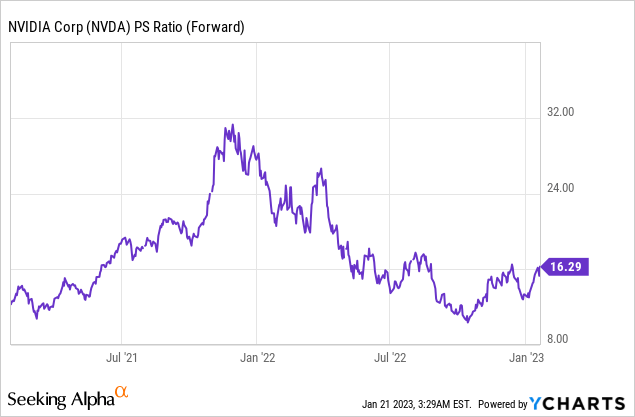

Nvidia also trades at a price-to-sales ratio = 14.66, which is 12.68% cheaper than its 5-year average.

Risks

Recession

Many analysts have forecast a recession in 2023 and thus this will likely cause delayed spending by both organizations and consumers alike. Nvidia will likely see its gaming segment continually impacted, as PC demand slows down.

Final Thoughts

Valuing Nvidia is fairly challenging and predicting its demand in individual markets is uncertain in the short term. However, I believe the long-term secular growth trends remain intact. Nvidia is poised to benefit from continued secular growth in the cloud, AI, connected vehicles, visualization (Metaverse), and of course gaming. Its technical chart is close to a breakout, so we are looking for it to pass the resistance line mentioned higher (by a margin of safety) and then the stock will likely move higher. This is not financial advice and I hope you found this post valuable.

Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.