Summary:

- Nvidia Corporation’s upcoming earnings report on August 28th is highly anticipated by investors; Wall Street analysts are largely optimistic.

- Personally, I am confident that Nvidia will meet or surpass analysts’ expectations, driven by ongoing strong CAPEX spending by the “Magnificent Seven.”.

- Despite strong momentum, Nvidia’s growth story may face strain from competition, supply chain issues, and market saturation risks.

- I continue to see Nvidia stock fairly valued at around $77 per share.

BING-JHEN HONG

Nvidia Corporation (NASDAQ:NVDA) will release its upcoming earnings report on August 28th during the after-hours session. It is anticipated with great investor interests, as the world’s leading AI-chip designer navigates both robust demand in AI-driven markets and potential hurdles in product development. With Wall Street analysts largely optimistic, the focus is on how Nvidia’s commercial momentum—largely driven by its dominance in the AI and data center markets—is sustainable amidst potential delays in product rollouts and market saturation.

Looking at the report, I am quite confident that Nvidia will manage to top analyst expectation, as Mag 7 CAPEX spending continues to boom. On a long-term perspective, however, the first cracks may be appearing in the Nvidia equity story. Competition is intensifying from Advanced Micro Devices (AMD) and other custom chip solutions like Google’s TPUs, and supply chain complexities, exemplified by the Blackwell chip delays, highlight potential vulnerabilities in Nvidia’s ability to maintain its rapid pace of innovation. These factors, coupled with the possibility of market saturation in AI and tighter economic conditions, could begin to temper the once-unquestioned bullish narrative surrounding Nvidia’s future growth prospects.

I will update my Nvidia valuation after Q2 reporting, but based on today’s projections, I continue to see NVDA stock as being fairly valued at around $77 per share.

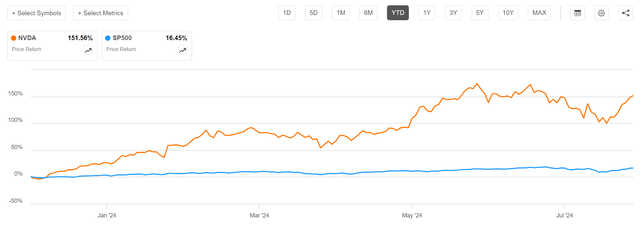

For context, Nvidia stock has been a strong relative outperformer in 2024 so far, with shares gaining approximately 152%. This is compared to a gain of about 16% for the S&P 500 (SP500).

The Positive: Data Center Boom Drives Supercharged Commercial Momentum

Nvidia’s growth trajectory has been nothing short of extraordinary, largely propelled by its leadership in the AI and high-performance computing sectors. In fact, the company’s results for the Q1 FY 2025 results were a testament to this, with revenue soaring by to $26 billion, up 260% YoY. The key driver behind this commercial momentum is the exponential growth in AI workloads. Companies like Meta Platforms (META) have dramatically increased their compute requirements for large language models (“LLMs”).

Indeed, Meta’s next-gen Llama 4 model, for instance, is projected to require ten times the computational power of its predecessor, Llama 3.1, according to estimates provided by Bank of America (Source: BofA research note on Nvidia, dated August 4th). This trend underpins a broader shift from general-purpose computing to accelerated computing, where Nvidia remains the undisputed leader.

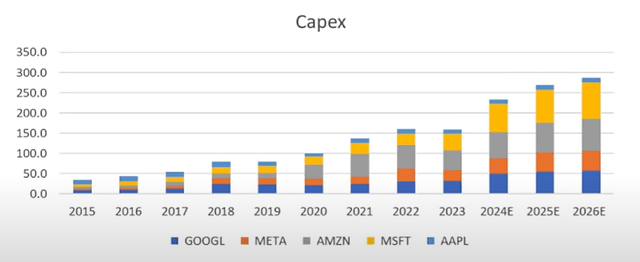

Looking ahead to Q2 FY 2025, analysts expect revenues to come in at approximately $28.6 billion, which would be $600 million above Nvidia’s guidance of $28 billion (up 297/10% YoY/QoQ). The bulk of this revenue—over $24 billion—is expected to come from the Data Center segment, highlighting the insatiable demand for Nvidia’s GPUs in AI workloads. This should be reasonable, in my opinion, as CAPEX spend by the large tech and cloud companies continues to boom. Indeed, adjusted to the guidance given in the Q2 reporting season, CAPEX spend by the big 5 data-center giants (Meta, Apple, Microsoft, Amazon, and Google) is projected to top $220 billion in FY 2024, up 45-50% YoY compared to 2023.

Here are a few selected key comments from Mag7 earnings calls:

Meta’s CFO Susan Li said:

Turning now to the CapEx outlook. We anticipate our full year 2024 capital expenditures will be in the range of $37 billion to $40 billion, updated from our prior range of $35 billion to $40 billion. While we continue to refine our plans for next year, we currently expect significant CapEx growth in 2025 as we invest to support our AI research and our product development efforts.

Google’s (GOOGL) CFO Ruth Porat said:

I think the one way I think about it is when we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over investing.

while Google’s CEO Sundar Pichai added:

With respect to CapEx, our reported CapEx in the second quarter was $13 billion, once again driven overwhelmingly by investment in our technical infrastructure with the largest component for servers followed by data centers. Looking ahead, we continue to expect quarterly CapEx throughout the year to be roughly at or above the Q1 CapEx of $12 billion

Amazon’s (AMZN) CFO Brian Olsavsky said:

For the first half of the year, CapEx was $30.5 billion. Looking ahead to the rest of 2024, we expect capital investments to be higher in the second half of the year. The majority of the spend will be to support the growing need for AWS infrastructure as we continue to see strong demand in both generative AI and our non-generative AI workloads.

Microsoft’s (MSFT) CFO Amy Hood said:

We expect capital expenditures to increase on a sequential basis given our cloud and AI demand, as well as existing AI capacity constraints.

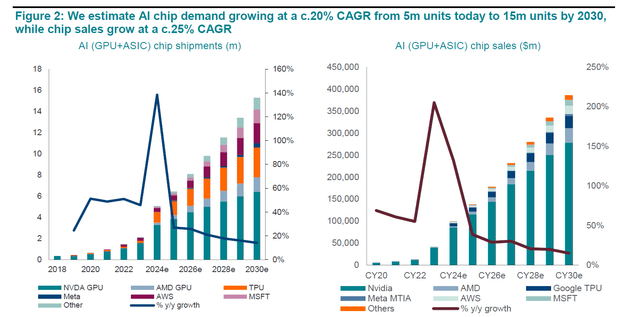

According to BNP estimates, AI chip demand may account for 40-45% of the CAPEX spend of large data center companies. This would suggest that in 2024 there may be a $100 billion revenue pool for AI chips — a figure that is expected to grow to $350-400 billion by 2030 (26% CAGR).

Interestingly, consensus estimates currently only see Nvidia’s revenue growing 2.5-3x by 2030 vs. 3.5-4x growth for AI-chip revenue at a macro level, according to data collected by Refinitiv. The takeaway from this analysis is that analyst expectations for Nvidia’s data center revenue growth may be lagging fundamentals.

The Negative: The Blackwell Delay and Market Saturation Risks

While Nvidia’s commercial momentum in the data center market is booming, I highlight that there are a few challenges that could temper the company’s growth trajectory — perspectives for the upcoming earnings report that may add pressure to investor sentiment.

Blackwell GPU Delay

One of the most discussed potential headwinds is the delay in Nvidia’s next-generation Blackwell GPUs. The Blackwell architecture, set to follow the highly successful Hopper series, has reportedly encountered engineering challenges, particularly with the interconnection of its dual GPU dies. These issues have forced Nvidia to revert to less complex packaging techniques, which could delay the mass production and deployment of Blackwell GPUs. This delay, while concerning, may have a limited near-term impact. Analysts from BofA and BNP Paribas suggest that Nvidia could extend the lifecycle of its Hopper GPUs or even release less complex versions of Blackwell as a stopgap measure. Still, any prolonged delay could pressure Nvidia’s competitive standing, especially if competitors manage to advance their technologies during this window.

As a side note, I point out that Super Micro (SMCI), a key Nvidia customer, recently guided for FY25 revenues to nearly double, indicating robust demand for AI servers that feature Nvidia GPUs. Specifically, I argue that the commentary from Super Micro suggests that while there are delays in the launch of Blackwell AI chips, Nvidia’s current-generation Hopper chips are in high demand.

Market Saturation in Generative AI

Another looming challenge is the potential saturation of the generative AI market. While current demand is robust, driven by the proliferation of AI models and applications, there are concerns about the long-term return on investment for customers. If enterprises begin to question the cost-effectiveness of their AI investments, this could lead to a slowdown in GPU orders, particularly from sectors that are more cost-sensitive. While commentary from Microsoft, Amazon and Meta was overall supportive for implications relating to booming CAPEX spending, additional color from Nvidia management will be key to understand the broader demand momentum.

Macroeconomic Uncertainty

Nvidia is not immune to broader economic challenges. Global macroeconomic concerns, particularly rising interest rates and geopolitical tensions, could dampen corporate capital expenditure on data centers and AI infrastructure. Additionally, potential trade restrictions on chip exports to China pose another significant downside risk to Nvidia’s earnings.

Increased Competition and Custom Chip Development

Lastly, I highlight that Nvidia also faces increasing competition from custom chips developed by large tech firms like Google and Amazon, which are optimizing their hardware for AI workloads. This trend, coupled with the broader adoption of alternative AI accelerators, could erode Nvidia’s market share in the future. The fact that Nvidia currently operates at a >50% net income margin suggests that customers will likely seek to pressure for flatter margins.

What Will Nvidia Do With Its Cash?

Building on the company’s underlying commercial strength, Nvidia’s cash pile is surging. As of Q1 FY 2025, Nvidia had approximately $20.2 billion of net cash on its balance sheet — and this figure is projected to grow rapidly, as analysts project $29 billion of annual free cash flow in CY 2024, and $35-40 billion expected in CY 2025. Personally, I am eager to understand what the company will do with all this cash. In my view, buybacks at >30x P/B do not really make sense. At the same time, and anchored on the same argument that shares look overvalued, doing M&A with cash may not be a wise choice. As an equity-based transaction may be cheaper. Thus, is there a special dividend in the cards? Hopefully, we learn more about this with Q2 FY 2025 reporting.

Investor Takeaway

Nvidia’s upcoming earnings report, set for August 28th after market close, will be an interesting event to watch: Wall Street analysts are generally optimistic, with a key focus on whether Nvidia’s impressive commercial momentum, largely fueled by its dominance in AI and data center markets, can be sustained despite possible delays in product launches and market saturation. Personally, I am confident that Nvidia will surpass analysts’ expectations, driven by ongoing strong CAPEX spending by the “Magnificent Seven.”

However, from a longer-term perspective, the Nvidia growth story may be encountering its first signs of strain. Growing competition from AMD and custom chip solutions, along with supply chain challenges, such as delays in the Blackwell chip, could expose vulnerabilities in Nvidia’s ability to maintain supercharged commercial momentum. In addition, the potential for market saturation in AI and a tightening economic environment, may start to cool the once-unquestioned bullish sentiment surrounding Nvidia’s future growth.

All that said, I will update my Nvidia valuation after Q2 reporting. However, based on today’s projections, I continue to see Nvidia Corporation stock fairly valued at around $77 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.