Summary:

- NVIDIA had to report declining revenue and steeply declining earnings per share in the third quarter of fiscal 2023.

- Despite short-term troubles, NVIDIA has great long-term growth potential due to gaming, data centers as well as AI, and the metaverse.

- However, NVIDIA is still overvalued and has to grow at an extremely high pace to justify the current stock price.

Justin Sullivan

My last article about NVIDIA (NASDAQ:NVDA) was published in June 2022 and back then, NVIDIA was trading for a similar price as right now. Back then, I argued that cutting the stock price in half was more than justified. In the meantime, the stock price declined as low as $108 and recovered again to about $170 right now.

And although it is half a year later, the fundamental picture has not really changed. I would still argue that NVIDIA is too expensive, and we will see lower stock prices again. We start our analysis by looking at the last quarterly results, which were anything but great.

Results: Not Great!

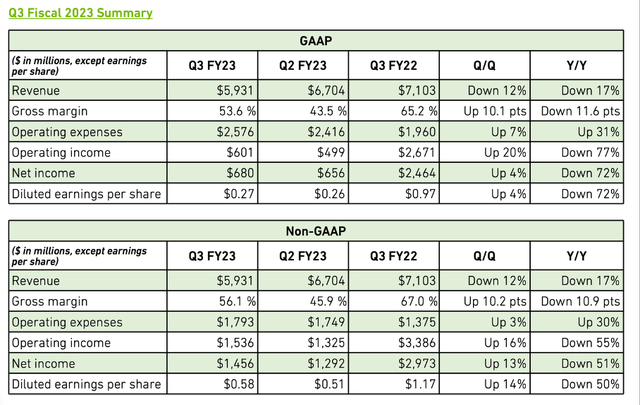

In mid-November 2022, NVIDIA reported third quarter results for the company’s fiscal 2023, and the results were not great. While the company could beat revenue expectations, it missed estimates for earnings per share.

Usually, NVIDIA could report high growth rates for the top and bottom line. But, in Q3/23, revenue declined from $7,103 million in the same quarter last year to $5,931 million this quarter – resulting in a 16.5% year-over-year decline. Consequently, operating income also declined steeply from $2,671 million in Q3/22 to only $601 million in Q3/23 – resulting in 77.5% YoY decline. And finally, diluted earnings per share were also 72% lower and declined from $0.97 in the same quarter last year to $0.27 this quarter.

When looking for reasons for the declining revenue, the CFO mentioned two different explanations. NVIDIA is reporting its revenue by different market platforms and the most important market platform is “Gaming” which generated $3,221 million in revenue in the same quarter last year but had to report a decline of 51% to only $1,574 million in revenue in Q3/23. Due to macroeconomic conditions and COVID lockdowns in China, the consumer demand was lower. Additionally, the U.S. government announced new restrictions on exports of A100 and H100-based products to China and any product destined for certain systems or entities in China, which had also an impact on third-quarter revenue.

Long-term Growth

The third quarter of fiscal 2023 was certainly a disappointment – similar to the previous Q2/23, in which NVIDIA also reported steeply declining operating income and earnings per share as well as revenue growth only in the low single digits.

But when looking at the bigger picture and look at the performance over several years (or even decades), NVIDIA is growing at a high pace and should have great growth potential in the years (and maybe decades) to come. NVIDIA is operating in several markets with the potential to grow in the coming years.

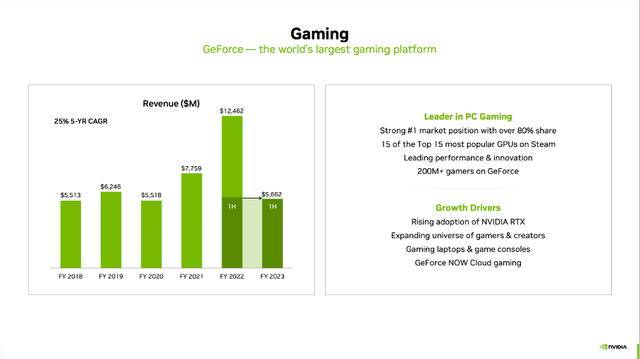

Gaming is one of the major market platforms of NVIDIA ($12.5 billion in revenue in FY 22, 46% of total revenue). And according to a study from Bain & Company, the global video gaming revenue is expected to grow from $199 billion in 2022 to $307 billion in 2027 – resulting in a CAGR of 9% in the next five years. Other studies see similar growth rates. And although “Gaming” is the problem child right now with revenue declining more than half in Q3/23, management is optimistic it will improve again in the coming quarters. During the last earnings call, CFO Colette Kress made the following statement:

There is tremendous energy in the gaming community that we believe will continue to fuel strong fundamentals over the long term. The number of simultaneous users on Steam just hit a record of 30 million, surpassing the prior peak of 28 million in January.

(…)

We continue to expand the GeForce NOW cloud gaming service. In Q3, we added over 85 games to the library, bringing the total to over 1,400. We also launched GeForce NOW on the new gaming devices, including Logitech, Cloud G, handheld, cloud gaming Chromebooks and Razr 5G Edge.”

And with China easing its COVID-19 restrictions, the demand for gaming might improve again. I don’t know if the gaming industry is recession-proof: on the one hand, it is a non-essential, leisure product and with lower disposable income people often cut these spending. On the other hand, when people are unemployed, they need to fill time and gaming is perfect. And gaming is also addictive for several people and addictive people won’t stop spending. However, it does not seem unlikely that major purchases (and a gaming PC might qualify) are postponed a few quarters when times are tough.

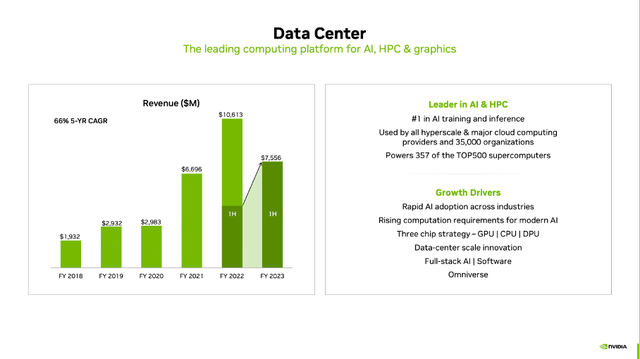

Aside from “Gaming”, the move towards cloud should be another growth driver for NVIDIA. And revenue from “Data Center” is still increasing at a high pace (while the other market platforms are struggling a bit). And we can expect data centers to be a tailwind in the coming years. All the big players in the cloud market – Baidu (BIDU) Cloud, Tencent (OTCPK:TCEHY) Cloud, Alibaba (BABA) Cloud, Amazon (AMZN) AWS, Microsoft (MSFT) Azure, and Google (GOOG) Cloud – are relying on technology from NVIDIA. And as growth expectations for the cloud business (see article about Alphabet as well as Baidu) are even higher as for gaming, NVIDIA will also profit when the cloud provider will report high growth rates for their businesses.

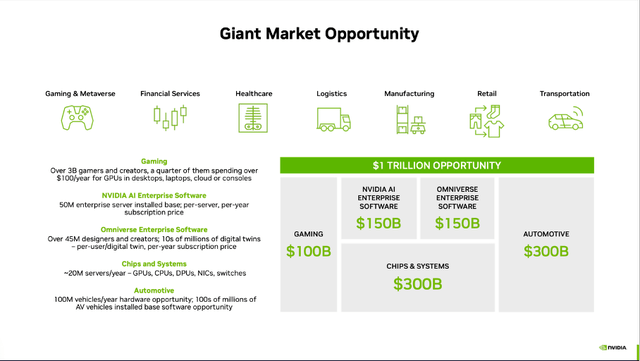

Aside from these two market platforms, AI and the potential vision of the metaverse will also be a major tailwind for NVIDIA. The company is confident that AI is the greatest technology force of our time, and management is also confident that data centers across industries will become AI factories – and NVIDIA will profit. Overall, NVIDIA sees a huge market opportunity. In total, the market is a $1 trillion opportunity – especially automotive is a huge market with $300 billion and chips & systems is another huge market with $300 billion. Of course, we should not get carried away by these numbers. Just because there is a market with $1 trillion in business opportunity does not mean NVIDIA will be able to take advantage of this market.

Despite all optimism, we should not ignore that NVIDIA’s growth is quite erratic over the years. Not only is the top line growth fluctuating (which is often ignored due to the extremely high growth rates NVIDIA could report in the last few years), but growth for the different business segments is also erratic – and, therefore, we should be rather cautious about growth expectations in the next few years.

Anchoring Bias

In case of NVIDIA, the risk is high for us being victims of some kind of anchoring bias. For starters, we should not make the mistake to use numbers for fiscal 2022 as basis for future growth assumptions as it seems likely that NVIDIA won’t be able to repeat similar growth rates. When looking at the different segments, especially Gaming and Professional Visualization reported growth rates that NVIDIA will not be able to repeat this year. And the high growth rates in the last 5 years (20% CAGR for Professional Visualization and 25% CAGR for Gaming) might be a bit misleading.

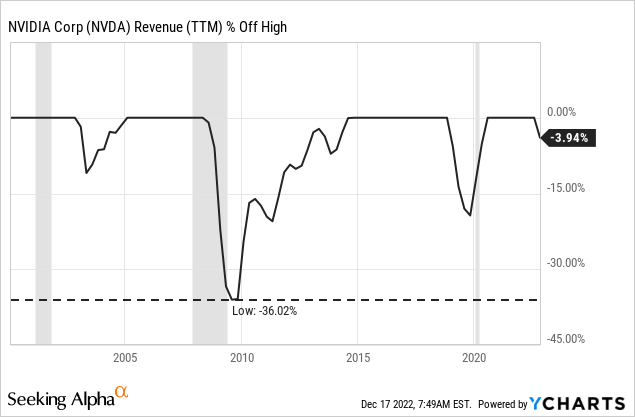

We should also not get anchored to the high growth rates of the last few years because when going back more than just a few years, we can not only see lower growth rates but revenue actually declined rather steeply following the Dotcom bust as well as the Great Financial Crisis. NVIDIA clearly had several years with impressive growth rates, but the company also had several mediocre years.

It seems a bit like investors are assuming extremely high growth rates as the norm and are anchored to these high growth rates completely ignoring that NVIDIA has been reporting lower growth rates as well and that there is no guarantee for these high growth rates to persist. And it seems almost understandable to be anchored to these high growth rates after a 13-year bull market. But such an extrapolation could be dangerous. There are shifts in economies and companies are usually not able to outperform forever. Management could also make strategic mistakes with huge negative consequences on the business.

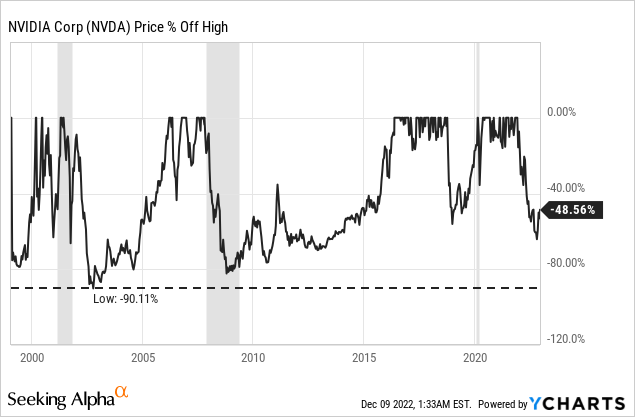

An anchoring effect is not only coming into play when making growth assumptions for the years to come. The stock price can also be an anchor for investors. When NVIDIA has been trading for $330 before and is now available for $165 it almost automatically seems cheap to us. And while past stock prices certainly are a piece of information we can look at, it should not determine what we are willing to pay for the stock. The calculated intrinsic value should determine what we are willing to pay – and past stock prices or the price movement in the last few years should be irrelevant. But when a stock has declined 50% or 60% or more it often seems cheap to us as the anchoring effect is setting a specific stock price in our head (in this case maybe above $300) and we compare the current stock price to this rather random price.

Intrinsic Value Calculation

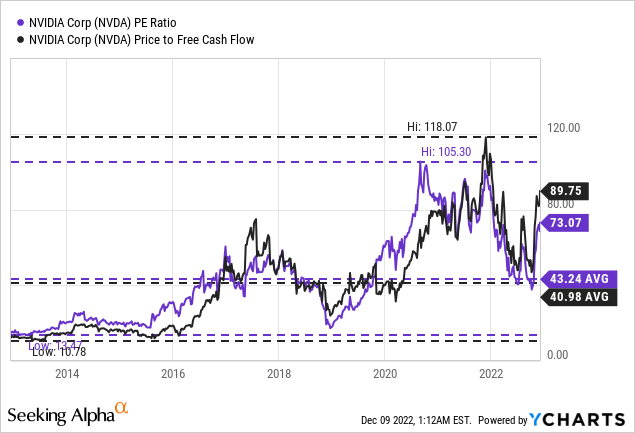

One way to fight this anchoring bias is by looking at numbers – and, in this case, simple valuation multiples might work quite well to demonstrate the dangers of the anchoring effect. Yes, the stock has been cut in half, but at the time of writing, NVIDIA is trading for 73 times earnings, which is not only above the 10-year average of 43.24, but a valuation multiple difficult to justify for any business. The stock is also trading for 90 times free cash flow – clearly above the 10-year average P/FCF ratio of 40.98 and close to the highest number in the last ten years.

Of course, we can point out that earnings per share and free cash flow have been declining pretty steeply and the trailing twelve-month numbers might not be an accurate description of the business. To counterbalance the fact that earnings per share and free cash flow are always a snapshot of current numbers (and can fluctuate quite heavily over time), we rather use a discount cash flow calculation as it enables us to make more specific assumptions.

But even when using the free cash flow of fiscal 2022 (which was $8,049 million) as basis instead of the free cash flow of the last four quarters (which was $4,829 million), NVIDIA must grow 17% annually for the next decade followed by 6% growth till perpetuity to be fairly valued right now (assuming 2,499 million outstanding shares and 10% discount rate). Of course, NVIDIA could grow revenue with a CAGR of 21.01% in the last ten years and earnings per share with a CAGR of 32.26% in the same timeframe. And one can argue that NVIDIA should be able to grow by 17% in the next ten years. However, we should not fall victim to the anchoring bias.

And to justify such high growth rates (and 17% annually for the next ten years is a high growth rate), we should be extremely confident about the business and management should not make any missteps. But when looking at past performance – and especially performance during down markets – I don’t know if such an optimism with such high growth rates is justified.

Conclusion

In my opinion, it is likely that NVIDIA will decline to its 52-week low of $108 again and I definitely expect lower stock prices in the coming quarters. I would also not rule out that NVIDIA will decline below $100. So far, NVIDIA has declined 66% during this bear market. And this is without doubt a steep decline. But when looking at the last two recessions and bear markets, we see much steeper declines. Following the Dotcom bubble, the stock declined 90% and during the Great Financial Crisis, the stock declined about 80%.

Over the long term, we can be pretty confident that NVIDIA will continue to grow and profit by secular tailwinds. But over the next few years, we should be cautious with such optimistic expectations.

Disclosure: I/we have a beneficial long position in the shares of BABA, BIDU, TCEHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.