Summary:

- Nvidia shares trade at a nosebleed valuation of 156 times annualized Q3 GAAP earnings (and 73 times annualized Q3 non-GAAP earnings).

- Enormous growth is necessary to justify such eye watering multiples.

- We examine the bull narrative of hypergrowth and see if expectation matches reality. The results might surprise you!

Justin Sullivan

Nvidia’s (NASDAQ:NVDA) earnings and revenues have fallen off a cliff, as it became evident that huge portions of their sales were due to Ethereum mining demand that has permanently gone away. Despite the negative growth, the stock is currently trading at around 156 times annualized Q3 GAAP earnings (and 73 times annualized Q3 non-GAAP earnings). Earnings multiples are even higher for the last 6 months earnings. These kind of lofty multiples are generally warranted only for firms with enormous growth.

The narrative of “hypergrowth” has been prevalent among NVDA bulls in recent years. But is that a theme that fits with the evidence? Now that we see what’s left after Ethereum (ETH-USD) demand vaporized, we can see how much organic growth the company has actually experienced.

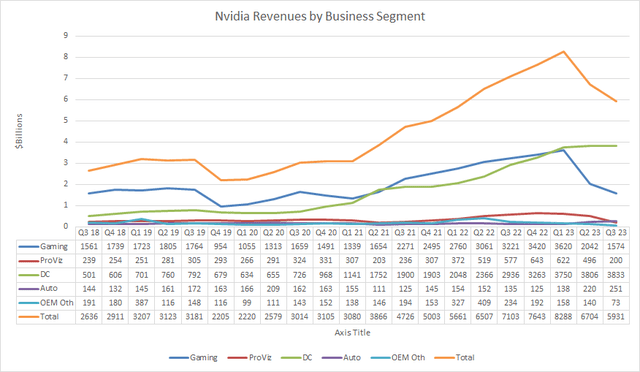

Let’s look at the last 5 years of earnings data, starting with Q3 FY2018, and going through the most recent announced quarter of Q3 FY2023.

Author

Gaming and Professional Visualization

Over the last 5 years there has been approximately no growth in the Gaming and Professional Visualization segments! Sales in Q3 were actually down slightly (from $1.800B to $1.774B) in the combined segments from 5 years ago! The big bubble in between appears to be from Ethereum mining demand, which appears to have inflated both segments dramatically. The fact of no growth in 5 years is remarkable given the heavy narrative for years from management about both gaming demand and professional visualization and omniverse being strong and growing quickly. And even more remarkable given how much the ASPs have grown for gaming GPUs. As EnerTuition recently pointed out, the top 3 Turing SKUs RTX2080Ti/2080/2070 launched at $999/$699/$499, respectively. The top 3 Ampere SKUs RTX3090Ti/3090/3080Ti launched at $1999/$1499/$1199, respectively. Normally rising ASPs in a growing business should lead to sustainably rising revenues.

It’s possible that the recent Q3 FY23 Gaming and Pro Visualization revenues are at a temporary low, suppressed by the enormous amount of inventory that NVDA previously stuffed into the channel (that the market thought were real sales to gamers). But it’s not clear if there is sustainable demand, even above the higher reported Q2 level of sales around $2B for Gaming. Even that figure is suspect given that the crypto demand bubble hadn’t yet ended during the start of Q2, so Q2 may contain a lot of crypto sales.

During the Q2 call, management told analysts that they expected around $5B in Gaming sell-through between Q2 and Q3 combined. Then a few weeks later management added the caveat that there would be “seasonality” in that estimate, indicating that it would be incorrect to assume $2.5B per quarter as a run rate. And then on the Q3 call, an analyst asked if the $2.5B per quarter estimate actually proved to be correct, and management did not answer the question. Instead they offered that Q3 sell-through (which included the launch of the highly anticipated 4090, which should have boosted sales considerably) was “relatively solid”.

Bulls may believe the $2.5B Gaming sell-through rate, even though management declined to actually confirm that the figure is correct. Let’s be generous and assume that it is correct, even though I am personally skeptical that it’s true. So once the inventory is cleaned out, and if sales rebound in H2 FY 2024 to the $2.5 billion level management estimated, then growth over 6 years for the Gaming segment would only be 8% CAGR.

The market saw a crypto mining bubble and confused it for organic growth.

Auto, OEM, and Other

Over the last 5 years there has been approximately no meaningful growth in the Auto, OEM, and Other segments. The combined segments are actually down (from $335M to $324M) in the last 5-year comparison. Management is endlessly hyping up their potential in these areas, but no actual meaningful results have been seen in the last 5 years.

Data Center

The lone source of growth for the firm the past 5 years has been the Data Center. But the true organic growth is obscured by the acquisition of Mellanox, which appears to contribute about $1.5B per quarter (per CEO remarks on Q3 call) at this point in time—or almost half of the entire growth in the segment.

After subtracting out the estimated Mellanox contribution, the organic datacenter growth appears to be around 34% CAGR over the last 5 years. In the last 12 months, the entire Data Center line, including the Mellanox contribution, grew 30%. This is very healthy growth.

But with such a high multiple on the stock, what are the prospects for the business looking forward?

The company faces significant headwinds here as AMD and Amazon and Google have introduced competing products (and Amazon and Google can push those alternatives heavily in their cloud services and for internal workloads). AMD’s next generation DC GPUs, set to launch in the coming quarters, may be a very formidable threat. With 80+% GPU market share in the cloud, Nvidia losing a lot of share is much more likely than gaining a lot of share. Nvidia will have to rely on expanded overall spending in the sector to help them tread water while losing market share.

But that hope is looking shaky at the current time. We are seeing signals from many sources that growth in datacenter spending in the economy is slowing. Additionally, startups that were flush with cash and spending lavishly may cut back their spending in the current fiscal environment.

We also have Nvidia management admitting that they had to take multi-hundred million dollar charges in each of the last two quarters for a reduced demand outlook in the Data Center segment. Management stated on the Q3 call that these lowered expectations of demand in the Data Center are looking several quarters out. We also can observe that the Data Center line has been roughly flat the last two quarters. Given the many headwinds, including management’s own outlook, the success of this line item may be tough to repeat going forward.

Total Picture

Over the last 5 years, excluding the Mellanox acquisition contribution, the organic business grew by an 11% CAGR. This is nice growth, but hardly in line with an eye-watering non-GAAP 73 multiple on declining earnings.

In comparison, peer company Advanced Micro Devices (AMD) grew at a 41% CAGR the last 2 years (27% CAGR after subtracting the Xilinx acquisition contribution), with strong growth in the datacenter, and is trading at only 21 times 2022 estimates.

The Nvidia hypergrowth narrative appears to have taken over the market. But it’s simply not consistent with the facts. I suspect that the earnings multiple will fall over time as the market comes to realize what the firm’s real prospects are.

Investors seeking datacenter growth may prefer AMD’s much cheaper earnings multiple, despite what I view as AMD’s much stronger growth prospects. A pair trade of long AMD, and short NVDA may also be a good trade to take advantage of AMD’s significant undervaluation and NVDA’s gigantic overvaluation, while hedging out macro effects, and giving time for the market to assign more appropriate multiples.

Considerations

Shorting NVDA is not without risk. The stock has a cult following and has traded at very high multiples for years, including in the triple digits several times in the past couple years. Just because the stock’s valuation is egregious and doesn’t make sense doesn’t mean that it can’t get even higher. There are many NVDA fans, analysts, and portfolio managers who have deeply bought into the hypergrowth hype. It will take time to have those beliefs give way in favor of reality.

Valuation shorts are often tricky. An investor must rely on the market eventually realizing that a company’s prospects are not so rosy as previously believed, and that investment dollars would be better deployed elsewhere. Without an impending catalyst (e.g. when shorting a firm on the verge of bankruptcy), valuation shorts often rely on the passage of time. And the market can remain irrational longer than you can remain solvent, as the old saw goes. NVDA is a good company and is not going to face an insolvency crisis anytime soon. An NVDA short may need to wait a long time for the market to come around.

In my case, I am betting that the undervaluation of AMD and the overvaluation of NVDA will both eventually correct, perhaps in the coming quarters/years. That lets me be patient, while the pair trade hedges out macro and sector fluctuations. And if the market sentiment shifts meaningfully to drive NVDA to even more egregiously high valuations, it’s likely that same sentiment will elevate AMD as well.

Pair trades often involve similar dollar amounts of the long and short positions. In my case, I have a pair trade with similar dollar amounts of AMD long and NVDA short. But I also have a much, much larger AMD long position outside of the pair trade.

Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long AMD/short NVDA as part of a pair trade, in addition to being long AMD outside of the pair trade.