Summary:

- The bulls and bears are divided over the future trajectory for Nvidia Corporation stock after the massive jump in 2023.

- The estimated total addressable market size in AI varies according to analysts, but we can say with a very high degree of certainty that Nvidia should be losing market share and margin.

- Advanced Micro Devices, Google, Meta Platforms, and other big competitors are looking to ramp up their AI chip efforts.

- Even though Nvidia could deliver strong revenue growth due to AI chip sales, a decline in market share and margins might lead to new questions about its long-term moat.

- Investors might not get good returns in a trillion-dollar company that is steadily losing market share.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) stock is running hot or too hot, according to some analysts. The estimates about the future growth potential within the artificial intelligence (“AI”) industry vary a lot. At this early stage, it is quite difficult to put a number on the future growth rate. There are many industries where the use cases for AI have not been discovered till now. However, we can forecast with a very high likelihood that Nvidia’s market share in the AI industry will fall in the next few years as competitors like Advanced Micro Devices, Inc. (AMD), Alphabet aka Google (GOOG), and others ramp up their AI chip production. Reuters had earlier reported that Nvidia’s market share in AI computing could be as high as 95%.

Nvidia offers CUDA, which is a software layer that interacts with the hardware to deliver better performance. This ability allows Nvidia to give a full stack option to clients. However, this full-stack option reduces the flexibility for bigger clients like Amazon’s (AMZN) AWS. Recently, AWS has rejected Nvidia’s DGX Cloud option because “it did not make much sense,” according to Dave Brown, Vice President of Elastic Compute Cloud at Amazon.

All the bigger cloud players would prefer to have more options for AI chips instead of relying on a single vendor. This should lead to a major decline in Nvidia’s market share over the next few years. A fall in market share and higher competition would reduce the pricing leverage for Nvidia, which would then have an impact on the company’s EPS growth trajectory. Long-term investors should gauge the future market share potential of Nvidia and also look at the current valuation multiple of Nvidia stock to find the returns potential for the stock.

Only one thing is certain

The AI industry is in its early days, and the full scope of its potential in different industries is being tested every day. The massive popularity of ChatGPT and the use of Nvidia’s chips to power the application has put a spotlight on the company. But we are quite far from the actual monetization of many AI applications. Nvidia is also making moves to show the application of its AI chips in different industries. It recently invested $50 million in Recursion Pharmaceuticals, Inc. (RXRX) to speed up the training of AI-based drug discovery models.

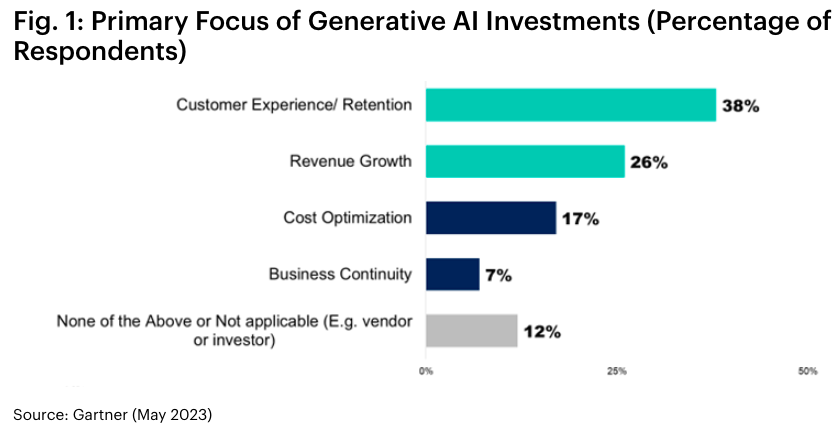

Gartner

Figure 1: Focus of generative AI investments according to Gartner poll. Source: Gartner.

A recent poll of 2,500 executives by Gartner shows that many of them are looking at AI tools to find the productivity and revenue growth it will provide to their business. There are a lot of estimates about the future trajectory of AI spending. However, it would be a few more quarters before we find the exact scope of AI in different industries.

As far as Nvidia is concerned, we can only say with very high certainty that it will be losing market share as other competitors improve their AI chip capabilities. AMD will be launching its new flagship AI chip in the near future. Amazon and a few other big players are testing AMD’s options to see if it works for them.

Future market share scenarios

Reuters has mentioned that Nvidia’s current market share for AI chips could be as high as 95%. This means that many early adopters of AI technologies will have to rely on Nvidia’s expensive chips. However, as the market matures, we should see more options come online. It should be noted that Nvidia’s CUDA software layer does improve customer loyalty, but companies looking for more flexible options might not rely on using CUDA. AWS has already rejected using this alternative from Nvidia, as it prefers to build its own servers and places very high importance on flexibility.

Nvidia is now part of the trillion-dollar club of companies which includes Apple (AAPL), Amazon, Alphabet, and Microsoft (MSFT). When we look at the other trillion-dollar companies, a common feature is that all of them have been able to retain their market share in their respective industries. Microsoft is still the dominant player in office products and operating systems. Alphabet has a stable 90% plus market share in the search industry. Amazon’s ecommerce retail market share is also quite stable. Apple has managed to retain its market share within smartphones and other devices in all major markets, which allowed the company to improve Services based revenue.

Even if Nvidia is able to deliver strong revenue growth over the next few years, it is almost certain that its market share for AI-based chips will decline. All the Big Tech companies are looking to build their own customized chips to optimize their services. Meta has recently scooped up the entire AI networking team at Graphcore. These Big Tech players have the resources to give better remuneration to employees and also rapidly monetize the AI chips through their own platforms. AMD’s management has also made AI chips the main focus. It is highly likely that AMD will be increasing its market share as the future iterations of its AI chips close the gap with Nvidia.

By 2030, we could see Nvidia’s market share within the AI chip industry fall to less than 50%. Falling market share within a rapidly expanding AI industry would still allow Nvidia to post good revenue growth in the next few years. However, higher competition will likely have a negative impact on margins. It would be impossible for Nvidia to sell or rent chips that have current eye-watering prices. Well-funded OpenAI’s CEO Sam Altman has also mentioned the exorbitant cost of running the new AI chips, which shows that we could see cost rationalizing in this industry in the near term.

Macro headwinds

All the major regulators are closely looking at the growth in the AI industry and the impact it will have on productivity and employment within different industries. European Commission has already proposed new copyright rules for generative AI tools like ChatGPT. We could see a massive increase in new regulations on AI tools as their usage in different industries increases.

There is also a big worry that AI might replace a significant chunk of the workforce in many industries. This would lead to a spike in unemployment and a reduction in tax revenue earned by all the governments. AI is a key topic when political leaders meet in G7 or G20 formats. Hence, we could see a strong regulatory framework that would control the growth of AI tools. Nvidia has made a big bet on AI, and any regulatory headwinds would have a severe impact on the bullish sentiment toward the stock.

Nvidia stock is priced for perfection

The question is whether Nvidia stock is hot or too hot. Nvidia’s market cap is close to Alphabet’s market cap, while the revenue base of Nvidia is 12% of Alphabet’s. In the last ten years, Nvidia’s revenue base has increased from $4 billion to $25 billion, equal to a 20% compound annual growth rate. If Nvidia delivers 40% CAGR growth by 2030, the revenue base of the company would be close to $200 billion. Even at that base, Nvidia’s revenue would be lower than the current revenue base of Alphabet. Also, Alphabet has delivered a higher operating margin than Nvidia.

Nvidia is not only competing against AMD and other chipmakers, but it will also have to compete against big tech companies like Alphabet, Meta, and Amazon, who are likely to develop their own custom-built AI chips. Alphabet has already announced that its chips can beat Nvidia’s products.

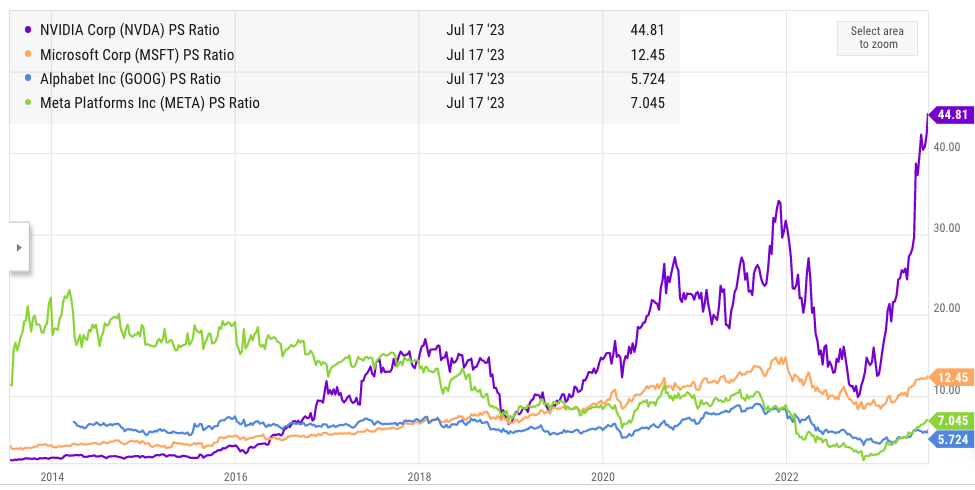

Ycharts

Figure 2: P/S ratio of Nvidia, Alphabet, Microsoft, and Meta. Source: YCharts

Most managements chase market cap instead of profits. If Wall Street is giving significantly higher valuation multiples to AI chipmakers, then we can be certain that many of the big tech players will enter this industry.

Even in the best-case scenario of a massive AI boom and decent market share retention by Nvidia, there is a very narrow path for Nvidia to go towards a $2 trillion market cap or $800 per share. There have been a number of upward price revisions for Nvidia stock by many analysts in recent weeks. Recently, Citi boosted the price to $600 which would take the market cap of Nvidia stock above Alphabet.

There is no denying that Nvidia will deliver good revenue growth in the short term as new AI tools are launched. However, the stock is now priced for perfection and faces challenges on a number of fronts. Any misstep by the management can lead to a correction. An increase in competition will also cause a decline in market share and lower margins in the future.

Investor takeaway

We can say that 2023 has been the year of AI boom and Nvidia stock has gained the most with a 225% year-to-date increase in stock price. Its market cap has increased by over $750 billion in 2023 which is almost equal to Meta’s market cap. At the same time, Nvidia’s P/S ratio is 8 times that of Alphabet. Even if Nvidia Corporation delivers very good numbers in the next few quarters, it is difficult to see how Wall Street can continue to reward the stock with a bullish momentum at the current price.

The AI market share of Nvidia Corporation is highly likely to fall in the next few years as AMD and other big tech competitors ramp up their own AI chip production. This should reduce the pricing leverage for Nvidia and also lower the long-term revenue projection for the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.