Summary:

- Nvidia Corporation faces a huge long-term headache with China AI chip curbs implemented by the U.S. government.

- The company obtains up to 25% of data center revenue from China.

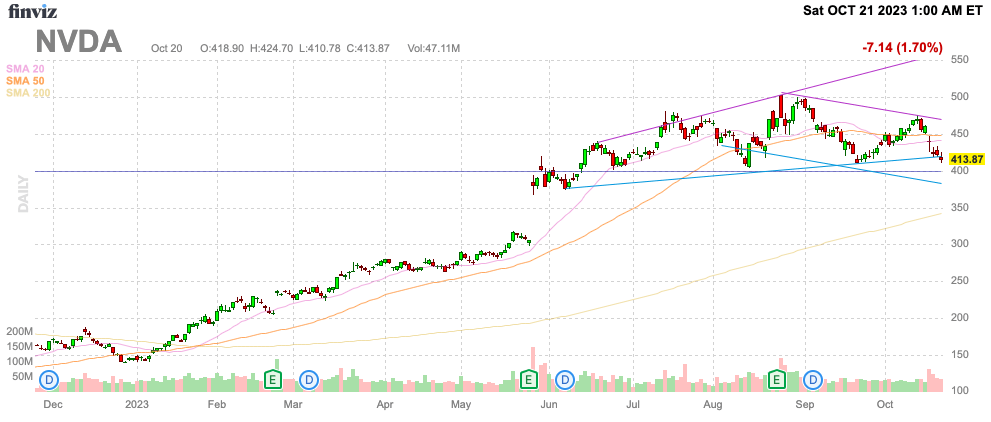

- The stock has fallen back to multi-month lows despite massive AI chip demand, setting up a gap close to $300.

- Nvidia is cheap at nearly 26x FY25 EPS estimates, but the China risk suggests the stock price could dip further.

William_Potter

NVIDIA Corporation (NASDAQ:NVDA) has wildly fallen out of favor as some of the artificial intelligence (“AI”) hype wanes. In addition, the U.S. government continues to press for chip companies to not sell advanced AI chips to China causing potential sales disruptions. My investment thesis remains Neutral on the stock, looking for an additional selloff on Nvidia to provide an opportune time to buy the AI chip company.

Source: Finviz

China Risk

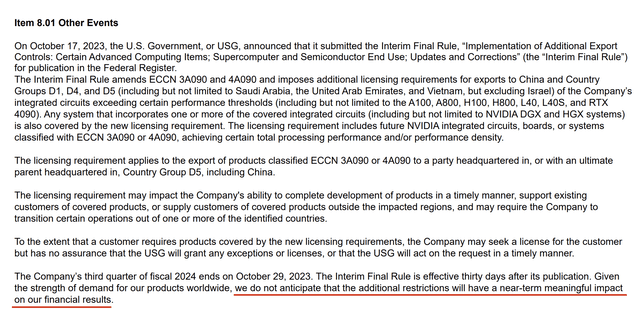

The U.S. government issued new rules curbing the sales of AI chips to China. The new restrictions from the U.S. Commerce Department directly target the A800 and H800 chips modified specifically for the Chinese market to comply with prior export controls.

The updated restrictions apparently allow for advanced commercial chips, but the U.S. government moves up restrictions to 40 countries where China could use the government as an intermediary. The news reports already highlighted how Saudi Arabia and UAE oddly were big buyers of the AI GPUs from Nvidia, and large tech companies, such as Alibaba (BABA) and Baidu (BIDU), in China apparently ordered $5 billion worth of A800 chips.

Nvidia claims the new China AI chip restrictions have a limited impact on near-term results. The major implication is that China demand was all pulled forward to front-run these feared additional restrictions.

KeyBanc Capital Markets analysts reinforced our view of the financial impact to Nvidia:

We believe this development likely will have minimal impact [near-term] to NVDA, as it should be able to backfill with demand from [the rest of the world]

The AI chip company is very clear in suggesting the updated AI chip export rules will not have a near-term impact. The suggestion is that the ban will have a long-term impact with Nvidia ultimately struggling to backfill China demand, which represents up to 25% of revenues.

The company recently guided to FQ3 revenues of $16+ billion after reporting $13.5 billion for FQ2’24. Nvidia only produced FQ1 revenues of $7.2 billion and the consensus target for FQ2 was just $11.1 billion.

The current quarter ends in 10 days, so Nvidia clearly wouldn’t face much financial impact on the October quarter now. Due to the chip company likely pulling forward China demand and possibly shipping through Saudi Arabia, the company could easily have pushed back extra demand from countries not facing restrictions.

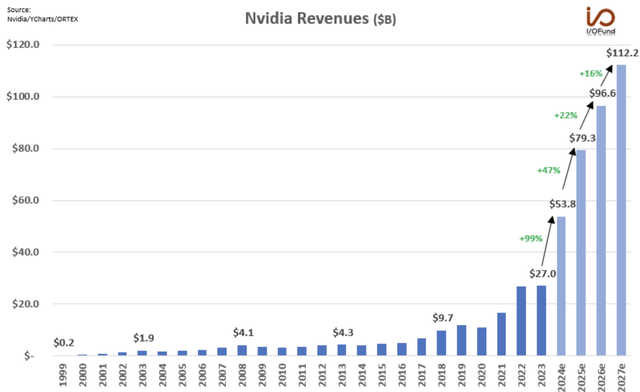

Analysts forecast revenues surging another 46% to reach $78.8 billion in FY25. Based on this chart, analysts are forecasting massive sales growth with FY27 reaching $112.2 billion, which is ~350% growth in those years.

Source: Beth Kindig – Twitter/X

Oddly Cheap

Nvidia has fallen down to $414 while financial projections have soared. The stock actually trades at a very reasonable 25.6x FY25 EPS targets.

The market definitely needs to question how Nvidia still hits the FY25 EPS target of $16.48. The AI chip company requires over 50% earnings growth next year to reach this amount. Technically, the number would appear near impossible based on the China AI chip ban, but the chip company likely has a plan on circumventing the export ban.

The stock actually trades below the forward P/E multiple back in early 2023 prior to the big revenue and EPS guide-up. Nvidia traded at nearly 40x forward EPS estimates when the stock was trading at $225 and analysts only forecast FY25 EPS estimates of ~$5.50.

Due to the fears over China AI chip bans and the precarious position of the stock chart, investors should look for Nvidia to close the gap to nearly $300 prior to the big guide-up in revenues that occurred at the end of May. Considering the stock faces a bearish H&S pattern, the market negativity, and the precarious position of the AI chip ban, Nvidia is likely to close the massive gap on the chart.

Ultimately, Nvidia is likely to resolve the China AI chip issue and eventually collect those massive data center revenue opportunities. Such a possible solution could be China working out a data center usage plan with an external ally able to import the AI chips with China allowed to access cloud computing services.

The stock definitely trades as if the financial targets highlighted above will be impossible to hit with China export curbs in place. Nvidia wouldn’t trade at half the current growth rates and prior P/E multiple if investors were confident in the consensus targets, though the numbers haven’t been adjusted down this last week

Several analysts cut price targets recently, such as Citi cutting the price target $55 to a still-high $575. Regardless, the consensus analyst targets are up at $643 providing over 55% upside to Nvidia now.

The stock could definitely hold at the current price and rally. Investors need to be prepared for either outcome, but the ideal time to buy shares for maximum return and reduced risk is to wait for a gap close to $300 on maximum fear.

Takeaway

The key investor takeaway is that Nvidia still appears full-speed ahead with insatiable AI chip demand. Nvidia Corporation stock has hit a wall due to China AI chip curbs, but investors should use weakness as an opportunity, with China and Nvidia likely finding a solution before sales are materially hurt. The stock is actually cheaper now and further weakness could turn Nvidia into a value stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BIDU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.