Summary:

- Nvidia recovered nearly 70% from its October lows toward its December highs, outperforming the S&P 500. NVDA bears wanted a collapse further, but market operators had not concurred.

- Is NVDA still priced at a premium? Yes, it is. Can it fall further? Why not. But with China’s rapid reopening, it could also lift its recovery in H2CY23.

- NVDA’s growth premium is still susceptible if the global economy falls into a deep freeze. So, if you are in that camp, you should abstain from adding positions.

- But, if you think Nvidia’s earnings estimates have been de-risked with the potential for upward revisions, don’t miss buying it here.

Justin Sullivan

Nvidia: Consumer Segment Still Expected To Be Weak. “Old” News Or New Information?

We highlighted in our previous article on NVIDIA Corporation (NASDAQ:NVDA), urging investors to await a pullback first and assess the buying support.

Notably, we gleaned that NVDA’s pullback has been highly constructive, even though its valuation remains priced at a steep premium against its peers. It should be clear by now that NVDA’s growth premium has likely contributed to a massive failure in Nvidia’s bullish thesis, as market operators didn’t concur with its overvaluation in a bear market.

Nvidia bulls accentuate the company’s leadership in consumer and data center GPUs, particularly in high-end AI GPUs. Notwithstanding, the company was also hit hard by the downturn in consumer electronics, which impacted its gaming GPUs significantly. Coupled with the tough comps from FY22 (CY21), the bears have gotten it right.

But, with NVDA down nearly 70% at its October lows, is the hammering finally over? NVDA has also recovered remarkably toward its recent December highs, notching a recovery exceeding 70%, as buyers returned strongly to outperform the S&P 500 (SPX).

Bears argue that Nvidia’s revenue growth could remain tepid as the downturn in the consumer PC segment remains in the doldrums. But, it’s also arguable that NVDA’s October lows could have anticipated these challenges, given the market’s forward-discounting mechanism.

China’s Reopening Could Propel Nvidia’s Recovery

Therefore, we believe the critical factor for Nvidia moving ahead is whether its gaming segment could recover robustly. We cautioned in our previous article highlighting that China’s stringent COVID curbs could stymie a sustained recovery in 2023.

However, with China’s move to reopen rapidly from its harsh lockdowns, we assessed that its growth algorithm has likely changed. China is keen on reinvigorating its economy, even as key semiconductor exports have faltered. As such, we believe China needs its consumption engine to recover remarkably, which suggests why it has been pushing for a fast and furious reopening cadence, accelerating the peak surge in infections.

Recent data suggests that some key cities could have reached peak caseloads, as economic activity has recovered. However, China is not expected to experience a broad-based peak until late January. Notwithstanding, with China lifting its restrictions in time for its celebration of the Chinese New Year, it’s clear the approach from China’s Politburo is to take the early hit in H1CY23, with an eye toward a faster and more broad-based recovery in H2CY23.

As such, can it potentially lift Nvidia’s growth in 2023?

Management highlighted in a November conference that it was still monitoring the “lockdown” in China, which clearly impacted its business in FY23. Moreover, with China accounting for nearly 26% of its Q4FY22 revenue, the company has taken a massive battering, as China’s share fell to just 19% in the recently reported fiscal quarter.

Analysts Could Lift Their H2’FY24 Estimates Subsequently

As such, we believe Street analysts have likely not reflected a reacceleration in Nvidia’s growth in H2FY24, suggesting that there could be potential upside surprises in store.

Accordingly, Nvidia is still expected to post negative YoY growth through H1FY24 before an inflection against lighter FY23 (CY22) comps. However, the recovery is not expected to be spectacular, with analysts penciling in a 4.8% revenue increase for Q2FY24.

Also, Newzoo’s gaming market estimates suggest a reacceleration in growth after its decline in CY22. Moreover, the estimates likely have not accounted for the change in Chinese President Xi Jinping’s gaming crackdown. However, Bloomberg also recently reported that Tencent (OTCPK:TCEHY) had scored another license approval from the authorities, “reinforcing hopes Beijing is easing a crackdown.”

Therefore, we assessed that Nvidia’s revenue and earnings projections could be due for upward revisions as China looks to rejuvenate its domestic economy to re-position for growth.

NVDA: No Doubt, Still Priced At A Premium

NVDA’s NTM EBITDA of 40.6x is still priced at a marked premium over its July lows of 25x. However, it’s also attributed to the substantial cuts in consensus earnings estimates that caused its valuation to surge.

Hence, investors are urged to consider whether its FY25 EBITDA multiple of 30.5x still makes sense to consider adding exposure at the current levels.

We think the bearish thesis is becoming a little stale after NVDA’s massive collapse. Sure, the bears have gotten it absolutely spot on over the past year. And with Nvidia’s FY23 revenue growth projection of just 0.1% to finish the fiscal year in January, it’s hard to argue otherwise.

However, does the market not know that Nvidia could continue to expect further headwinds in early 2023 as the PC market continues to come under pressure? In addition, with the global economy potentially moving into a recession, data center growth has also been curtailed. But is this new information or “old” news?

Takeaway

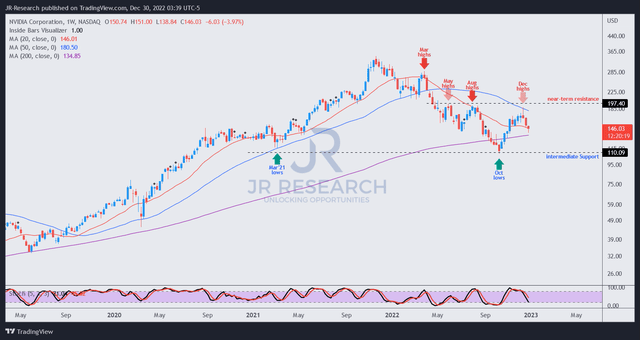

NVDA price chart (weekly) (TradingView)

We think what’s important here is whether the market is looking to re-rate NVDA from these levels. Our assessment is as long as NVDA buyers continue to support its October lows, the opportunity for a medium-term recovery looks constructive.

Accordingly, NVDA’s recent pullback also appears to be supported above its 200-week moving average, highlighting the potential of a higher-low retreat. Hence, we believe investors with high conviction in NVDA can consider adding progressively if NVDA continues to consolidate robustly here.

A successful re-test of October lows should also be considered another zone to add more exposure.

But, if you belong to the group of investors expecting a severe recession, then NVDA’s growth premium could likely be digested further. But, you could still partake in a potential recovery with a stop-loss measure at appropriate levels to mitigate your potential downside.

Rating: Buy (Revise from Hold).

Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!