Summary:

- Nvidia Corporation is scheduled to report its Q1 FY24 results after market close tomorrow 5/24 post-market.

- Analysts seem to be pricing the stock for perfection, and not factoring some of the recently-emerged risk-factors.

- Nvidia stock is likely to plummet post its earnings announcement.

PonyWang

All eyes will be on Nvidia Corporation (NASDAQ:NVDA) when it reports Q1 FY24 results after the market close this Wednesday, May 24. There’s good reason to believe that the chipmaker’s revenue growth momentum will falter in its upcoming earnings report. But with that said, investors may also want to monitor its inventory purchase obligations, inventory levels, bifurcated revenue, and its management’s outlook for the quarter ahead. These items will highlight the intensity of its growth slump and, so, they’re likely to dictate where its shares head next. Let’s take a closer look to gain a better understanding of it all.

Waning Consumer Demand

Let me cut to the chase — we’re in a recessionary environment and that’s bound to negatively affect the trajectory of rapidly-growing companies such as Nvidia. The chipmaker and its investors were banking on the successful commercial release of its RTX 40-series GPUs, for the company to be able to maintain its breakneck pace of growth. But latest reports reveal that it’s not all smooth sailing for the chipmaker.

See, Nvidia has priced its GPUs at what many would term as absurdly high levels. This has kept many PC/AI enthusiasts and mainstream gamers at bay. Sell-throughs are so bad that Nvidia’s partners have had to cut prices of RTX 4070 GPU within weeks of its launch, and the chipmaker is reportedly now halting its production due to dismal consumer interest. Preliminary reports suggest that market response is lukewarm for its just-announced RTX 4060/ti GPUs well.

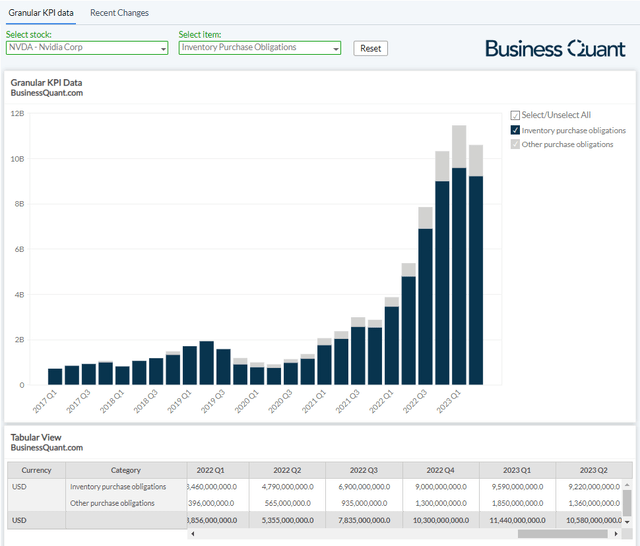

This weak consumer demand is bound to reflect on Nvidia’s financials in one way or another. For starters, if the chipmaker is halting production of its GPUs, then it won’t require as much silicon from Taiwan Semiconductor Manufacturing Company Limited (TSM) and assembly/distribution support from board partners such as Gigabyte and MSI. So, I’m expecting its inventory purchase obligations to sequentially decline in Q1. For the uninitiated, this metric is basically the aggregate dollar-value of cancellable and non-cancellable orders that Nvidia has placed with its vendors and channel partners.

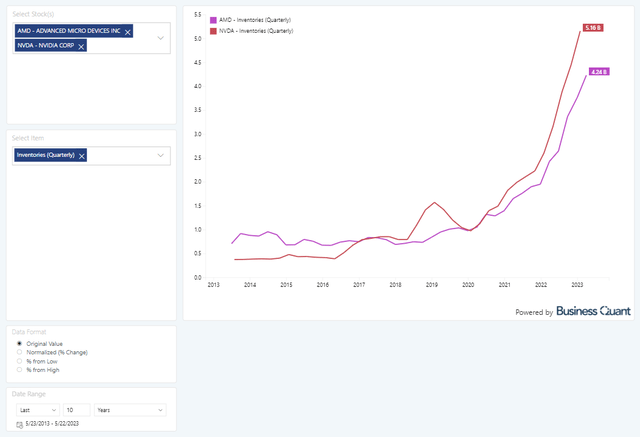

If sell-throughs are actually as bad, then Nvidia and its channel partners should have ended the quarter (approximately around April 30) with lots of unsold inventory. In this particular case, we’d also notice Nvidia’s inventory levels surge sequentially, rising to its all-time highs. However, if the chipmaker’s inventory levels are flat sequentially, then it would indicate that these reports are nothing more than baseless speculation. I personally believe the former case will be more prevalent but look for official numbers this Wednesday.

There’s another data point that investors need to know, to better assess Nvidia’s growth prospects. Per research firm Canalys, global shipments of PCs dropped by nearly 33% during Q1. This marks the fourth consecutive quarter of double-digit sales declines in PC shipments and it suggests the overall hit to the PC market is inevitably going to weigh down on Nvidia’s growth trajectory as well. But with that said, let’s shift attention to the chipmaker’s financials.

Bifurcated Financials

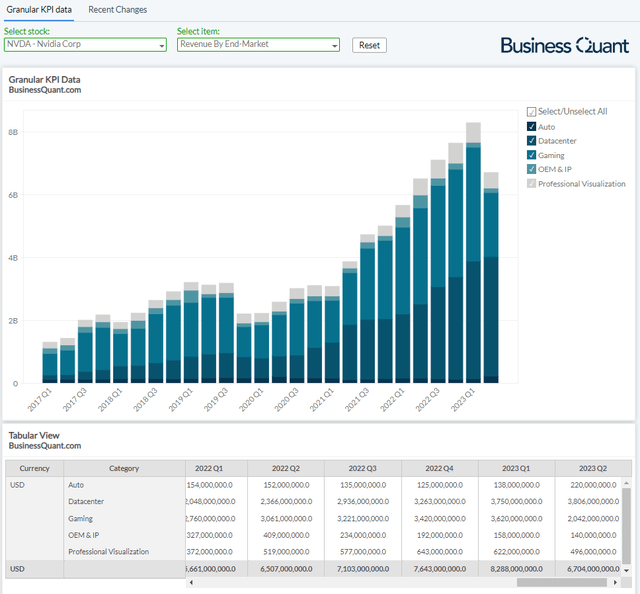

It’s worth noting that Nvidia breaks down its revenue in 5 verticals namely Datacenter, Gaming, Professional Visualization, Automotive and OEM/IP. The Datacenter division is the breadwinner for the company, contributing nearly 57% to its total sales last quarter. But things aren’t all smooth sailing here.

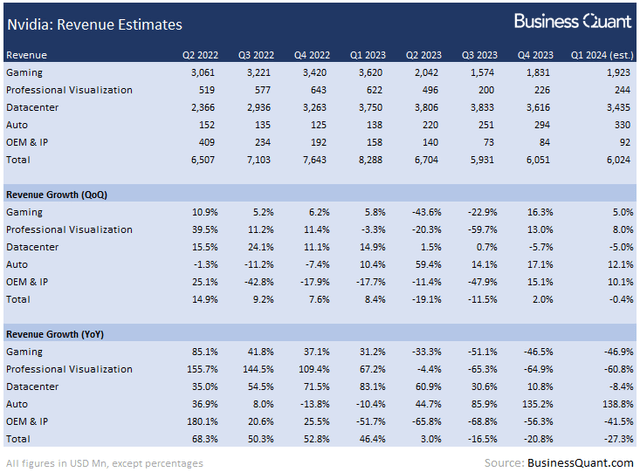

Several enterprises across the globe have begun cutting down on their datacenter-related capex (like here) in a bid to be financially frugal during these challenging macroeconomic conditions. The situation is such that cloud platforms from Amazon, Microsoft and Google, are seeing a growth slowdown due to spending cuts by their clients. So, I estimate the demand for Nvidia’s datacenter GPUs would be soft and the segment’s revenue would decline 5% sequentially to $3.4 billion in Q1.

Next, Nvidia’s Gaming division is its second-largest revenue driver, contributing a little over 30% to the chipmaker’s total sales last quarter. As I discussed earlier in the article, Nvidia’s RTX 40-series GPU launches are getting a lukewarm response in the market. So, I estimate this segment’s sequential revenue growth will decelerate to just 5% in Q1, with the revenue figure amounting to approximately $1.9 billion.

Moving on, its professional visualization, automotive and OEM/IP businesses collectively account for roughly 12% of the company’s total sales. None of these segments have any major catalysts at play that would cause a material change to Nvidia’s topline. I believe all 3 of these segments will register a growth deceleration, roughly to the tune of 500 basis points sequentially, largely due to the slowing down economy in general.

This brings us to a company-wide revenue estimate of $6.02 billion. But it’s important to note here that the Street’s consensus is spanning from $6.48 billion to $6.75 billion for the said quarter. This suggests that analysts are, perhaps, not pricing in recent developments (such as capex cuts by enterprises, RTX 40-series sell throughs being dismal) and that the chipmaker might very well miss the Street’s estimates this time around. So, investors may want to be cautious as we approach Nvidia’s Q1 earnings report.

Apart from these items, investors should also monitor Nvidia management’s outlook for the quarter ahead. Specifically speaking, are they planning to introduce more variants of their existing GPUs in a bid to reinvigorate sales. Also, are these production cuts actually happening and, if so, what’s the quantum of these cuts. Lastly, how do they forecast sales to trend in the coming months? These items will shed light on the longevity of Nvidia’s growth slump and I believe they’re likely to influence where its shares head next.

Final Thoughts

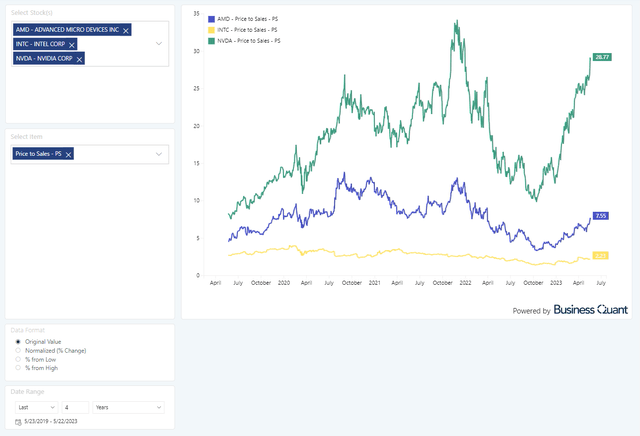

Nvidia’s shares are trading at over 28-times the company’s trailing twelve-month sales, which is extremely high on a standalone basis. The chart below reveals the multiple is nearing its multi-year high and it’s also much higher than the chipmaker’s closest rivals, Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC).

This high valuation doesn’t seem justified for a business that’s likely to experience a growth slowdown. So, I contend that Nvidia’s shares are priced for perfect and investors may be in for a rude shock when the chipmaker misses the Street’s revenue estimates in its Q1 earnings report this Wednesday. Stay vigilant and be careful. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.