Summary:

- Nvidia Corporation beat Q4 estimates on both lines.

- Results still were far from great.

- The valuation is pretty high, which could be a headwind for total returns going forward.

Justin Sullivan

Article Thesis

NVIDIA Corporation (NASDAQ:NVDA) (“Nvidia”) reported quarterly Q4 results that were far from strong, but still better than expected. This made investors bid up Nvidia’s shares, as NVDA stock jumped up by close to 10% in after-hours trading. Even though it looks like the current quarter could be somewhat better than the most recent quarter, Nvidia looks quite pricy at the current valuation, which is why I do not think NVDA stock is attractive right here.

What Happened?

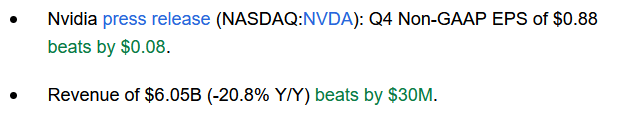

NVIDIA Corporation announced its fourth-quarter earnings results on Wednesday afternoon. The company reported a beat on both lines:

Seeking Alpha

Revenues were down by a hefty 21% year-over-year, but they still came in marginally above what analysts had forecasted. The earnings per share result, at $0.88 for the quarter, wasn’t strong relative to the profits that NVIDIA generated in previous quarters, but the company was at least able to beat estimates by a very solid 10%. As a result of the better-than-feared announcement, Nvidia’s shares shot up to the $220s in after-hours trading, up 9% at the time of writing.

Nvidia’s Q4: Better Than Feared, But Far From Strong

A double beat naturally is good news, all else equal, but that doesn’t mean that Nvidia’s results were strong. Instead, they were rather weak — but estimates had been even worse, so Nvidia was able to beat the consensus estimate.

A 21% revenue decline never is good news, and it especially isn’t good news when we are talking about a growth company that is trading at a pretty high valuation. Why did Nvidia’s sales slump this much? There are several factors at play.

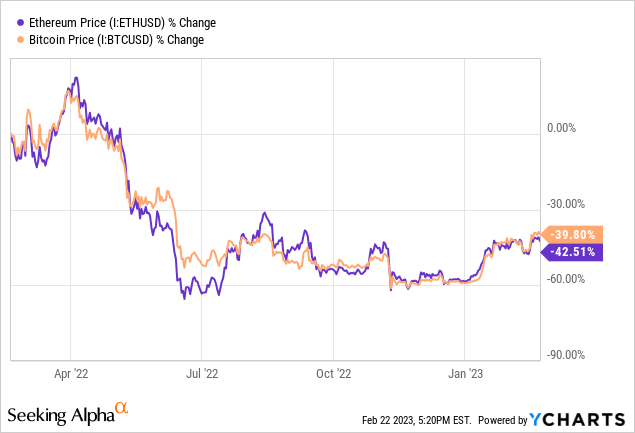

First, Nvidia was negatively impacted by the ongoing cryptocurrency winter. Prices for cryptocurrencies, including Bitcoin (BTC-USD) and Ethereum (ETH-USD), have pulled back quite a lot over the last year:

While Bitcoin usually isn’t mind with GPUs or CPUs, Ethereum is oftentimes mined with GPUs. The lower price for Ethereum has made mining less profitable, which is why GPU demand from crypto miners has waned. As one of the most important suppliers of these GPUs, Nvidia is negatively impacted by this macro issue — not only is it selling fewer GPUs to miners, but weakening demand has also hurt market prices for new and used GPUs, which also negatively impacts Nvidia’s sales potential.

At the same time, the company is also feeling an impact from less demand by gamers for GPUs. During the lockdown phase of the pandemic, when out-of-the-house activities were reduced, Nvidia and other gaming equipment companies benefitted from increased spending on these items by consumers. But as consumers are now free to pursue other activities again, such as traveling, dining out, and going to concerts, demand for gaming equipment has fallen — especially since many gamers still have modern or up-to-date equipment that they bought in the recent past.

On top of that, high inflation has resulted in increased spending on necessities such as food, gasoline, and energy. In turn, consumers have less spending power when it comes to discretionary items, including GPUs, which weakens the demand picture further. Due to the crypto winter, the end of the pandemic, and high inflation, the macro picture for Nvidia’s GPU business has thus weakened considerably — it looks like the pandemic years were absolute outliers, and things have now normalized again.

That being said, there are some positives for the gaming business, as revenue at least was up sequentially — this wasn’t a hard task due to weak results in Q3, but it indicates that the nadir might have been passed already and that things could improve going forward.

Nvidia’s most important business unit, however, is the data center business, which contributed around 60% of Nvidia’s company-wide revenue during the most recent quarter. Data center sales were up 11% year-over-year — depending on what one compares this performance to, one can be happy or unhappy about it. It is, of course, good that growth remained solidly positive, at a low-double-digit rate.

That being said, core peer Advanced Micro Devices, Inc. (AMD) has recorded a data center revenue growth rate of 42% during the fourth quarter — around 4x the growth Nvidia recorded (AMD also recorded revenue growth of 16% for Q4, versus a steep revenue decline for Nvidia). Compared to AMD, Nvidia has thus underperformed considerably. On the other hand, Nvidia performed much better than Intel Corporation (INTC) in the data center business, thus one might summarize Nvidia’s data center performance as “solid, but not great.” And that is perfectly fine, of course, as long as the valuation is appropriate for a solid business performance — which isn’t the case for Nvidia, however.

The Outlook For The Current Quarter

Nvidia has announced its guidance for the current quarter, Q1 2023. The company expects revenues of around $6.5 billion, which implies a sequential improvement in the high single digits range. On a year-over-year basis, however, Nvidia’s revenues will still be down quite a lot. In Q1 of 2022, Nvidia generated revenues of $8.3 billion, thus the guidance implies a 22% revenue decline. In other words, we will see a sequential improvement, but the year-over-year performance will be worse than during the fourth quarter when revenue was down 21%. Bulls might decide to focus on the expected improvement on a sequential basis, while bears might decide to focus on the worsening year-over-year performance. No matter what, it is pretty clear that things won’t be as good as they were during the pandemic for quite some time.

Based on Nvidia’s guidance for revenues, gross margins, etc. for the current quarter, Nvidia should earn around $2.25 billion during the current quarter on an adjusted basis. One can argue about some of these adjustments, such as stock-based compensation (“SBC”) expenses. But even when we take the $2.3 billion at face value, that gets us to around $9 billion in annualized profits — for a company that is valued at around $550 billion, that’s not a lot of profit. This gets us to what I believe is the key issue for Nvidia’s shares — the high valuation.

Priced For Perfection

Based on the Q1 profit estimate run rate, Nvidia is valued at around 60x forward net profits. That pencils out to an earnings yield of 1.7%, at a time when treasuries yield well above 4%. Of course, Nvidia’s earnings will grow over time if the company executes well, while interest on a specific treasury note or bond does not grow over time. But on the other hand, Nvidia and any other equity is a higher-risk investment relative to treasuries. Whether it makes sense to buy Nvidia at a sub-2% earnings yield thus seems questionable to me.

Nvidia also looks expensive when we take other approaches. When we look at forecasted earnings per share for the future, we see that it will take Nvidia until 2029 to breach $10:

And yet, shares trade for $225 today, which makes for an earnings multiple of 21 six years from now. The broad market is trading at around 17x forward earnings right now — if Nvidia hits the 2029 EPS estimate and trades at 17x net profits at that time, its shares would drop to $180 over the next six years. Even if Nvidia were to trade at 25x net profit in 2029, which would represent a premium valuation in absolute terms, shares would climb by just 18% over the next six years, to $265.

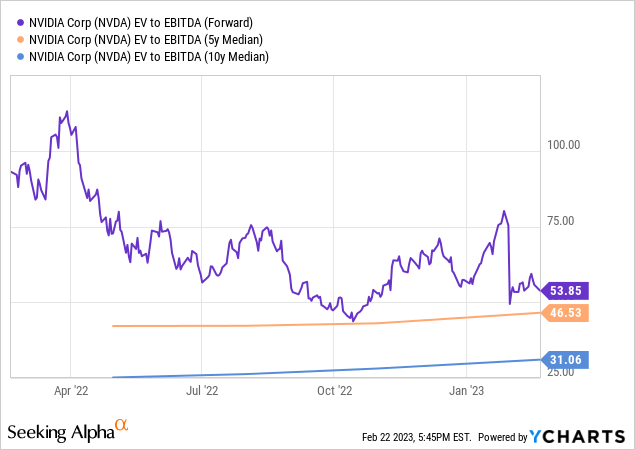

Another way to look at valuations is the enterprise value to EBITDA multiple, which accounts for changes in net debt (or net cash) over time:

Nvidia’s EV to EBITDA multiple stands at 54 today, which is quite high in absolute terms. This also represents a clear premium versus the 5-year and 10-year average. Is that justified? I’d argue that Nvidia’s growth outlook was better 10 years ago relative to today, thus it doesn’t make too much sense that Nvidia trades at an even higher valuation today.

Overall, this makes me believe that Nvidia is too pricey for an investment today. That doesn’t mean that the company is bad — but valuations have to be considered, even when investing in quality companies.

Takeaway

NVIDIA Corporation’s shares soared on Wednesday afternoon following the announcement of better-than-feared earnings results. But the performance wasn’t great during the quarter — revenues and profits dropped quite a lot, and the year-over-year decline will be substantial in the current quarter as well. At the same time, Nvidia is trading at a pretty steep valuation, which is why I do not want to buy into NVIDIA Corporation at current prices.

Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!