Transocean: Post Earnings Sell-Off Provides Buying Opportunity

Summary:

- Leading offshore driller reports fourth quarter and full-year 2022 results, largely in line with recently lowered expectations.

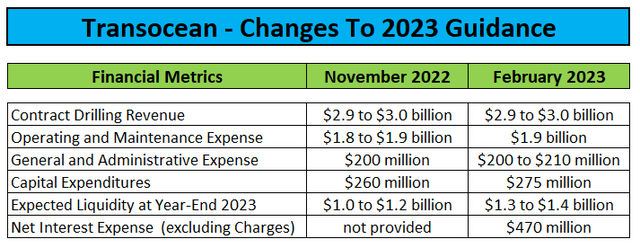

- On the conference call, management tweaked recently provided 2023 guidance but kept revenue expectations unchanged.

- In absence of earth-shattering news, investors decided to focus on an unexpected $157 million charge related to the company’s recent convertible debt issuance and ongoing lack of cold-stacked drillship reactivations.

- Company expects to successfully navigate the ongoing weakness in the harsh environment markets with contract announcements expected for all harsh environment rigs with near-term contract end dates including the warm-stacked Transocean Equinox.

- Investors would be well-served to focus on Transocean’s strong medium- and long-term prospects rather than expecting earth-shattering contract awards week after week. While speculative investors and traders exiting RIG stock might result in more short-term volatility, I consider Wednesday’s sell-off as an opportunity for investors to scale into the shares.

Ion-Creations

Note: I have covered Transocean (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

After the close of Tuesday’s regular session, leading offshore driller Transocean reported fourth quarter and full-year 2022 results largely in line with the recently lowered guidance provided by management on the company’s third quarter conference call.

That said, the less-than-stellar terms of last year’s ill-advised convertible debt issuance continue to haunt Transocean as the recent rally in the company’s shares resulted in the requirement to record a whopping $157 million non-cash charge in interest expense.

With shares up another 34% since the beginning of the year, Transocean would be required to record an additional, triple-digit million increase to interest expense this quarter.

Undoubtedly, the unnecessary and substantially dilutive convertible debt issuance in September has been a major mistake but investors need to remember that the resulting charges are mostly accounting noise.

In fact, Transocean has become the victim of its own success as the very strong performance of the company’s shares in recent months is the sole reason behind the charges.

On Wednesday’s conference call, management tweaked recently provided full-year 2023 expectations and guided for Q1 contract drilling revenues of $635 million, slightly below the current analyst consensus.

Conference Call Transcripts

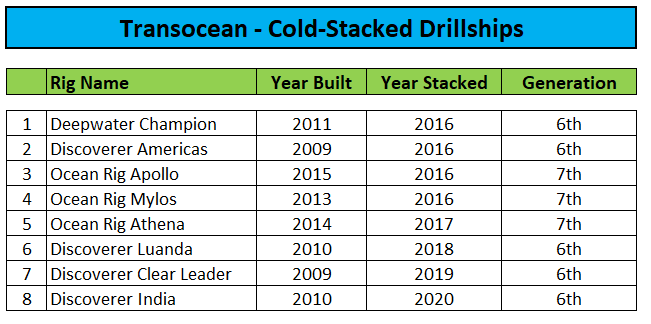

With the previously warm-stacked drillships Deepwater Orion and Dhirubhai Deepwater KG2 scheduled to re-enter the active fleet this year, Transocean seems to have picked all the low-hanging fruits.

Given this issue, I wasn’t exactly surprised to see analysts focusing on the company’s cold-stacked fleet during the question-and-answer session of the call.

Fleet Status Report

That said, I was perplexed by management’s disclosure that the company has pulled a cold-stacked rig from a recent Petrobras (PBR) tender due to allegedly insufficient contract economics:

(…) It’s often difficult for us to talk about individual tenders and awards and negotiations. However, there’s a couple great example, one in Brazil, which is, as you know on certain tenders are fully public there where all the results are published. So for example in the pool tender in the lot two basket, that’s one where we won a job with the Orion, we were also the next rig to be awarded in that line, and the day rate on the rig was $474,000 a day.

However, when we went through the details of this and we went through the timeline that Petrobras was going to execute upon, we decided that the cash flows just didn’t meet our return requirements, so we kind of stepped aside from that one and took the disciplined approach of not putting forward the [indiscernible] into that that tender any further. And since then the Petrobras moved to the next operator or the next rig contractor, and that’s going to be the according to the results of the public tender, the DS-8, which should see their award at $460,000 a day.

Keep in mind that Petrobras had been offering three years of firm employment plus an option for another three years. Just the firm part of the contract would have resulted in approximately $520 million of additional backlog for Transocean. Assuming an EBITDA margin of 30%, the company would have generated more than $150 million in EBITDA over the initial contract term, which apparently remains insufficient for management to consider reactivation.

As a result, competitor Valaris (VAL) has inherited the contract award and expects to reactivate the cold-stacked drillship VALARIS DS-8 at a total expense of approximately $75 million.

At least in my opinion, a number of factors has contributed to management’s decision on this particular opportunity:

- Transocean’s high-specification drillships have been cold-stacked for many years already thus substantially increasing execution risk and reactivation expense.

- Most of the company’s cold-stacked, high-specification drillships were part of the acquisition of Ocean Rig back in 2018. Transocean never operated any of these rigs.

- In contrast to Valaris, Transocean has no experience in reactivating cold-stacked drillships.

- Petrobras has set a tight schedule with work expected to start in mid-November at the latest date.

- Even after the recent issuance of additional debt, Transocean’s liquidity remains tight, particularly when considering the $500 million minimum liquidity covenant governing the company’s revolving credit facility.

Instead (and in stark contrast to Valaris two days ago), management pointed to stranded newbuild rigs as primary candidates for new contract awards this year:

But I think what we’ve seen right now is the first in line are not the cold stacked rigs, it’s the rigs that are being completed that are sitting at the yards in South Korea. And several of these are projected to be contracted in Brazil, West Africa and elsewhere throughout this year.

Please note that Transocean recently joined forces with largest shareholder Perestroika A.S. and private equity firm Lime Rock Management to acquire the newbuild drillship Deepwater Aquila from Korean shipyard DSME.

On the conference call, management also hinted to a potential acquisition of the sister rig “Libra” going forward.

Given the issues discussed above, I would expect Transocean to abstain from reactivating cold-stacked drillships for the time being.

While certainly a disappointment for investors, the company might be well-served to avoid investing in potentially bottomless pits without any sort of experience in reactivating cold-stacked drillships.

In fact, focusing on stranded newbuilds might indeed make more sense for Transocean, particularly with ongoing support of third party capital providers as it has been the case with the Transocean Norge and Deepwater Aquila.

On the flip side, a capital-light approach does apparently result in the requirement to share the profits of these assets with co-owners.

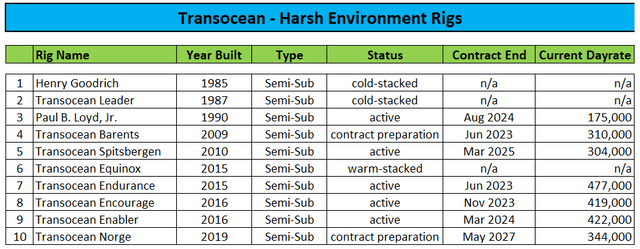

But management also offered some decisively good news to investors on the call as the company expects to successfully navigate extended weakness in the harsh environment markets (emphasis added by author):

(…) With that said, we have line of sight jobs on pretty much all of our harsh environment including the stacked CAT-D and I can’t really disclose the details about that, but essentially it’s safe to say that for all of our harsh environment fleet, including the stacked CAT-D we’re in active negotiations for placing in all of those.

I think and over the period of this year, you’re going to see pretty much all those rigs get fixtures on them. And you’ll see that the day rates associated with those and the locations should raise a few eyebrows in terms of the trajectory of rates for harsh environment rigs.

Quite a statement, I guess.

Fleet Status Report

Please note that management is likely referring to the so-called CAT-D rigs Transocean Equinox, Transocean Endurance, Transocean Encourage and Transocean Enabler as well the Transocean Barents while the Henry Goodrich and the Transocean Leader are likely to remain cold-stacked for the time being.

Transocean Norge, Transocean Spitsbergen and Paul B. Loyd, Jr. are already committed to or working on long-term contracts.

The CAT-D rigs have been a major concern for some time now as these semi-submersibles have been purpose-built to the specifications of Equinor (EQNR) and are still working at rates substantially above current market levels (except for the recently idled Transocean Equinox).

Last year, Equinor surprisingly decided against awarding a second contract term to both the Transocean Equinox and Transocean Endurance thus stoking fears of the remaining two units also being returned to the company at the end of their respective contract terms.

Successfully navigating the current weakness in the harsh environment markets would be quite an achievement but even assuming a number of contract awards this year, work is unlikely to commence before some time in 2024.

Bottom Line

Nothing really wrong with Transocean’s fourth quarter and full-year 2022 report as well as the company’s outlook for this year but after the recent 200%+ rally from September lows and in absence of additional long-term contract awards, investors apparently decided to focus on the massive charge related to the recent convertible debt issuance and management’s hesitant approach to the reactivation of cold-stacked assets.

But as CEO Jeremy Thigpen stated on the call: “While the growth will be slow, it’ll be steep and should last longer” when asked about the impact of ongoing capital constraints and supply chain issues on the industry, investors would be well-served to focus on Transocean’s strong medium- and long-term prospects rather than expecting earth-shattering contract awards week after week.

While speculative investors and traders exiting the shares might cause some additional short-term volatility, I consider Wednesday’s sell-off as an opportunity for investors to scale into the shares.

Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.