Summary:

- After a stunning rally in recent months, Nvidia is once again the most valuable semiconductor company on the face of the earth, with a market capitalization of ~$560B.

- While AI is all set to reinvigorate growth and profits at Nvidia, the stock is baking in unrealistic assumptions for revenue growth. I love the company, not the stock.

- In this note, we’ll perform a reverse DCF analysis to determine an implied revenue growth rate for Nvidia and check its feasibility in relation to its business.

- Furthermore, we’ll determine Nvidia’s fair value estimate and projected five-year CAGR returns using TQI’s valuation model.

- At ~21x P/S, Nvidia stock is ridiculously expensive, and I wouldn’t touch with a 10-foot pole at current levels. I rate Nvidia neutral or avoid at $225 per share.

Drew Angerer/Getty Images News

Introduction

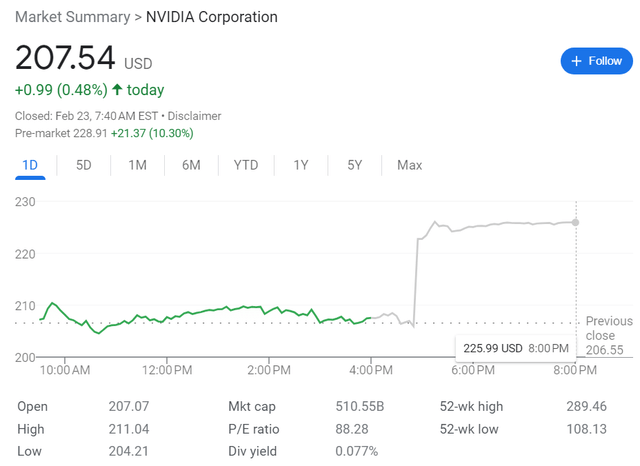

After doubling off of its October lows in a matter of weeks, Nvidia (NASDAQ:NVDA) has regained its title as the “world’s most valuable semiconductor company” (as measured by market capitalization at 8:00 PM EST on 02/22/2023 – Nvidia: $555B, data from Google Finance). While the GPU supply glut is still creating an adverse impact on Nvidia’s financial performance, yesterday’s quarterly earnings report showed early signs of a recovery. With generative AI touted to reinvigorate growth and profits at Nvidia, the stock rallied higher in the after-hours session.

GoogleFinance

Despite Nvidia undergoing revenue and earnings contraction in recent quarters amid a supply glut, investors have piled into Nvidia’s stock in recent weeks, sending the stock to unfathomable heights. Quite astoundingly, Nvidia’s stock price has more than doubled from its October lows of $108. Now, I love Nvidia as a company – its products are miles ahead of competitors, its leadership team is as good as they come, its brand loyalty is top notch, its total addressable market is massive, and its long-term growth story is far from over. However, I’m not a fan of Nvidia’s stock because of the unrealistic assumptions baked into its valuations. In this note, we will perform a reverse DCF exercise to see what Mr. Market is pricing into Nvidia’s stock right now.

Generally, I tend to receive a lot of negative feedback for providing financial reality checks through my research articles on momentum stocks like Nvidia. However, as a financial analyst and equity researcher, I feel compelled to adhere to my responsibility toward retail investors, and so I will continue to point out bubbly valuations when I come across them.

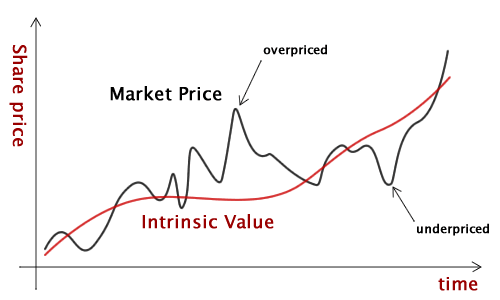

As I have said in the past, Mr. Market is a drunken psycho who tends to trade stocks way up and way below their intrinsic values for short (and sometimes long) periods of time. And I think the market is once again getting way ahead of itself in the case of Nvidia.

mediaaccess.hu

Riding high on the back of the AI hype train, semiconductor stocks, and Nvidia in particular have experienced sort of a renaissance in the last four months or so. Despite revenue growth falling off a cliff and earnings being in contraction mode, Nvidia’s stock has regained bubbly valuations of >20x Price-to-Sales, and that too in a rising interest rate environment.

In this article, we will briefly discuss Nvidia’s Q4 results, find the implied growth rate for Nvidia using reverse DCF analysis, and then determine a realistic valuation for Nvidia. With so much to cover, let’s get started!

Brief Review of Nvidia’s Q4 Earnings Report

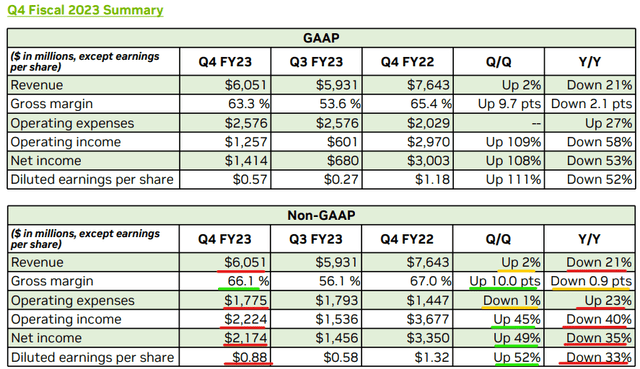

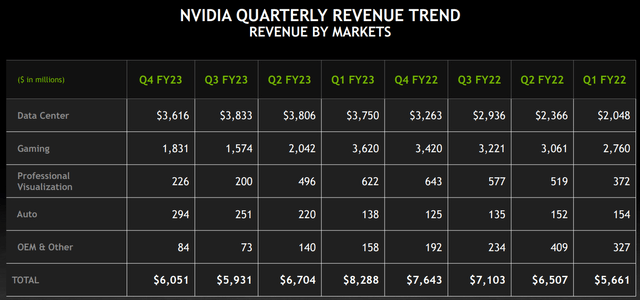

For Q4, Nvidia surpassed expectations on both top and bottom lines, with revenues and non-GAAP EPS coming in at $6.05B (vs. est. $6.02B) and $0.88 (vs. est. $0.80), respectively. Nvidia’s report was slightly better than expected, with a recovery in gross margins indicative of an end in sight for the GPU supply glut. However, Nvidia’s Q4 revenue was down -21% y/y, and earnings contracted even more due to ballooning operating expenses!

Nvidia Q4FY23 CFO Commentary

Here’s what Jensen Huang, Nvidia’s CEO, had to say about Nvidia’s Q4 report in the earnings press release –

AI is at an inflection point, setting up for broad adoption reaching into every industry. From startups to major enterprises, we are seeing accelerated interest in the versatility and capabilities of generative AI.

We are set to help customers take advantage of breakthroughs in generative AI and large language models. Our new AI supercomputer, with H100 and its Transformer Engine and Quantum-2 networking fabric, is in full production.

Gaming is recovering from the post-pandemic downturn, with gamers enthusiastically embracing the new Ada architecture GPUs with AI neural rendering

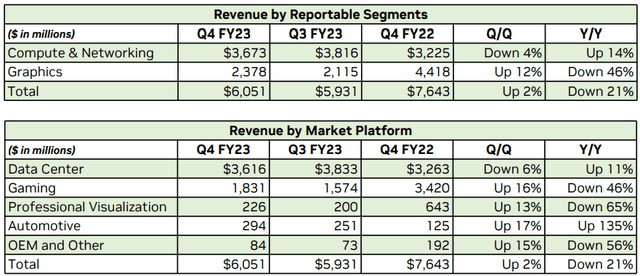

In Q4, Nvidia’s Data Center revenue came in at $3.62B, up +11% y/y but down -6% q/q, missing street estimates of $3.85B. The sequential decline was driven by reduced sales in China and some pullback from cloud services providers in the US. In a big announcement, Nvidia revealed that it is partnering with leading cloud service providers to offer “AI-as-a-service” that provides enterprises access to NVIDIA’s world-leading AI platform. According to the press release:

Customers will be able to engage each layer of Nvidia AI – the AI supercomputer, acceleration libraries software or pretrained generative AI models – as a cloud service.

Using their browser, they will be able to engage an Nvidia DGX™ AI supercomputer through the Nvidia DGX Cloud, which is already offered on Oracle Cloud Infrastructure, with Microsoft Azure, Google Cloud Platform and others expected soon. At the AI platform software layer, they will be able to access Nvidia AI Enterprise for training and deploying large language models or other AI workloads. And at the AI-model-as-a-service layer, Nvidia will offer its NeMo™ and BioNeMo™ customizable AI models to enterprise customers who want to build proprietary generative AI models and services for their businesses.

Further details will be shared at the company’s GTC developer conference, taking place virtually March 20-23.

Source: Nvidia Q4 FY2023 Press Release

While this news is an exciting development, Nvidia’s Q4 CFO commentary suggests that 2022 results included purchases made by several cloud services providers to support multi-year cloud service agreements for their new Nvidia AI cloud service offerings. Hence, I don’t foresee a significant revenue boost from Nvidia’s “AI-as-a-service” offering in the near term.

Nvidia Q4FY23 CFO Commentary

Now, Gaming segment revenue jumped up +16% q/q in Q4 due to a successful ramp of Nvidia’s new GeForce RTX 40 series GPUs (based on Ada Lovelace architecture), and yet, this segment was down -46% y/y. The sharp decline in Gaming revenues is a result of faltering demand (in a challenging macro environment) and under-shipping to channel partners to help reduce inventory levels.

For Q4, Nvidia’s Automotive segment was a bright spot, with revenues here growing 135% y/y and 17% q/q. The strength in the automotive segment was reflective of robust growth in sales of self-driving solutions, computing solutions for electric vehicle makers, and AI cockpit solutions. Professional Visualization revenue was down -65% y/y but up 13% q/q.

Nvidia Quarterly Revenue Trend

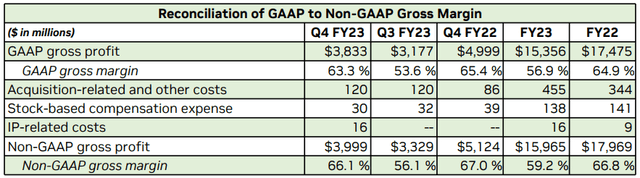

Overall, Nvidia’s business shrunk by 21% y/y in Q4 2022, however, sequential growth turned positive after two straight quarters of sequential declines. As the GPU supply glut eases off, Nvidia’s gross margins are recovering from the sharp dip seen in Q3.

Nvidia Q4FY23 CFO Commentary

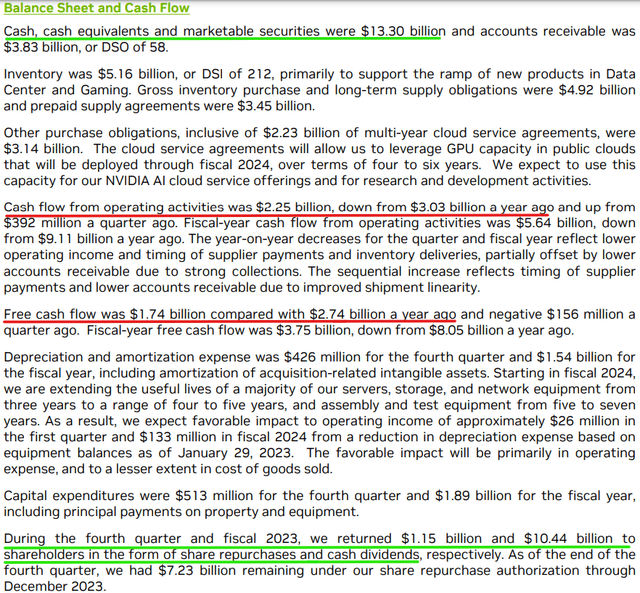

With a recovery in margins, Nvidia’s quarterly free cash flow rebounded from -156M in Q3 to +$1.74B in Q4. The semiconductor giant has a sound balance sheet with $13.3B of cash and short-term investments, and now that the company is back to positive FCF generation, I see no liquidity risks for Nvidia in the foreseeable future.

Nvidia Q4FY23 CFO Commentary

Nvidia is making billions of dollars in free cash flow and looks set to make more in the coming years. With the company adopting shareholder-friendly capital allocation policies, I think we will continue to see bigger share repurchases and dividends from Nvidia in years to come.

In my mind, Nvidia is a great company. The problem I have with investing in Nvidia is that its stock is priced for perfection and more. Let’s perform a reverse DCF analysis to understand my rationale.

Nvidia’s Implied Growth Is Unrealistic

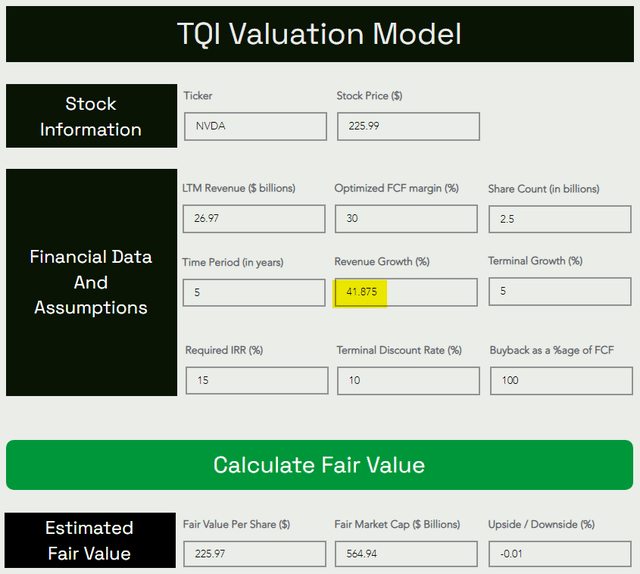

For the purpose of this exercise, we shall first set up some common assumptions that would be re-used in the next section, where we will determine Nvidia’s actual fair value and expected returns. Here are the assumptions we will take into consideration for inputs to TQI Valuation Model:

|

Assumptions: |

|

|

Nvidia’s LTM Revenue (in $ B) |

26.97 |

|

Optimized Free Cash Flow Margin (%) |

30 |

|

Share Count (in B) |

2.5 |

|

Modeling Time Period (in years) |

5 |

|

CAGR Revenue Growth In Modeling Period (%) |

??? |

|

Terminal growth rate (%) |

5 |

|

Required IRR (%) |

15 |

|

Terminal Discount Rate (%) |

10 |

Here’s the result for implied growth:

TQI Valuation Model (TQIG.org)

|

Final Result: |

|

|

Implied 5-yr revenue CAGR for Nvidia |

41.875% |

As you can see in the table above, Nvidia’s implied revenue growth rate for the next five years is ~42% CAGR. Such a growth rate would support Nvidia’s current share price. However, this rate seems excessive because Nvidia just reported a revenue decline of -21% y/y for Q4 2022.

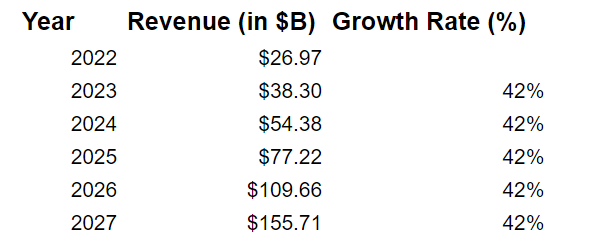

If Nvidia were to grow at 42% CAGR for the next five years, its annual revenues would grow from ~$27B to $155.7B (~6x 2022 revenue). Here’s how the numbers work:

Author

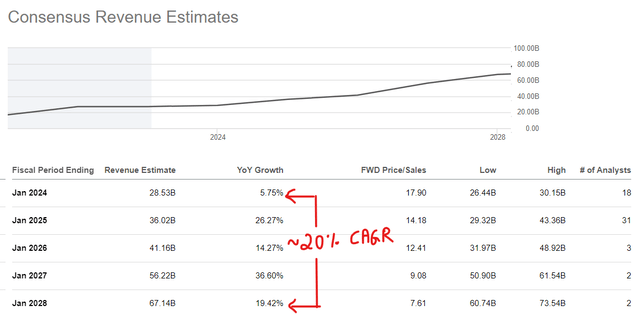

According to Nvidia’s CEO, Jensen Huang, AI is at an inflection point and Nvidia is set to be a large beneficiary as the leading accelerated computing platform on this planet. Now, I agree with him. However, these implied growth rates are simply unrealistic. As per consensus analyst estimates, Nvidia is set to grow revenues at a 20% CAGR over the next five years.

SeekingAlpha

Despite Nvidia touting a $600B TAM opportunity ($300 hardware + $300B software) on yesterday’s earnings call, I wouldn’t model for ~42% CAGR growth in the best of economic times, let alone the current uncertain macroeconomic environment. With the Fed putting brakes on the economy with one of the most aggressive tightening cycles ever seen, a recession could be hanging just around the corner. And as you know, semiconductors are exposed to macroeconomic cycles.

For 2022, Nvidia’s revenue growth flatlined, and the Q1 2023 guide of $6.5B calls for yet another quarter of negative growth (-22% y/y to be precise). While Nvidia’s management is optimistic about a growth re-acceleration in 2023 based on higher interest in AI due to the chatGPT breakthrough, I see this positive management commentary as nothing more than a big dose of AI hopium until I see significant improvement in financial performance. Now, consensus analyst estimates could be wrong, and Nvidia could continue to grow rapidly. With that being said, the law of large numbers is real, and the actual TAM for Nvidia is limited by the breadth of its product portfolio.

According to my projections based on several growth drivers (e.g., gaming, AI, 3D design, self-driving cars, etc.) for the company, Nvidia could realistically pull off ~15-20% CAGR revenue growth over the next five years. When the AI hype wears off and the market wakes up to Nvidia’s financial realities once again, I expect the stock to get battered big time. As the revenue base increases, I think Nvidia’s growth rates will taper over the next decade (even with continued technological leadership, product innovation, and AI software expansion).

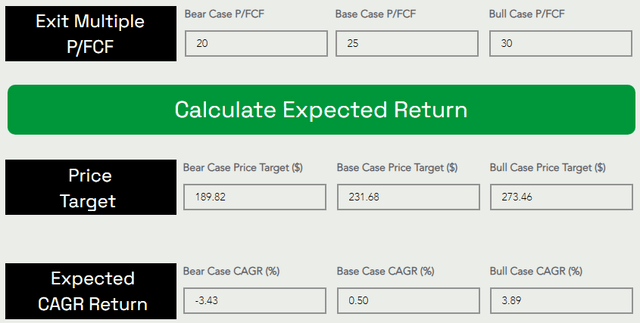

Nvidia’s Actual Fair Value And Expected Return

I expect Nvidia to maintain its technological leadership position and expand successfully into other markets. However, as investors, we must remain levelheaded when buying into any business. The price we pay for a business will determine our future returns on the investment. Believe it or not, starting valuations do matter.

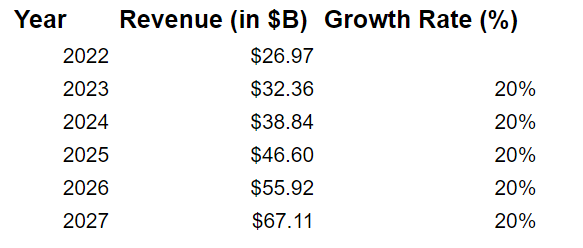

Let us now look at a more realistic growth trajectory for Nvidia:

Author

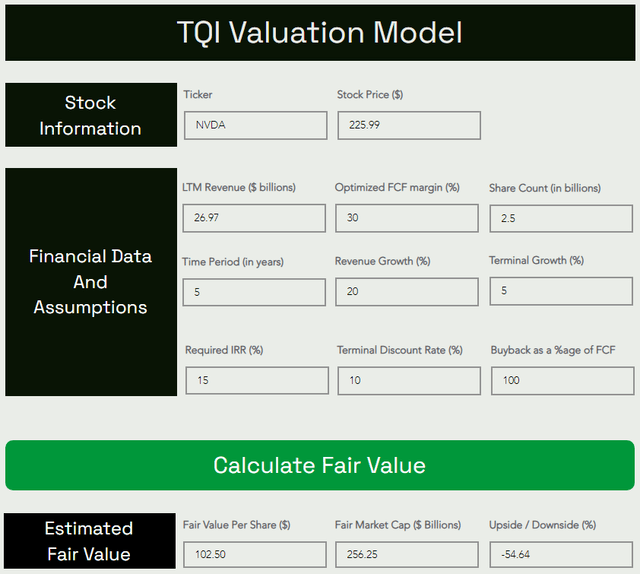

By the end of 2027, I think Nvidia’s revenue could reasonably grow to consensus analyst estimates of $67B (~2.5x from 2022 revenue). Consequently, I can see Nvidia holding onto its margins over the long term due to the negative impact of competition being nullified by the positive impact of product advantage and partial transition to an AI software business. Using the 5-year CAGR of 20% from the above projections, we get an intrinsic value of $102.50 per share for Nvidia, as can be seen below:

TQI Valuation Model (TQIG.org)

TQI Valuation Model (TQIG.org)

In my mind, Nvidia’s quality has never been under question. However, despite assigning a generous exit multiple of ~25x P/FCF, the stock looks unlikely to generate any returns over the next five years. The risk/reward for a long-term investor is absolutely terrible, and this is why I wouldn’t touch Nvidia with a ten-foot pole at current levels.

Concluding Thoughts

Nvidia is a great company with market-leading products and arguably the best CEO in the semiconductor industry. However, the price we’re being asked to pay for Nvidia ($225 per share or ~21x P/S) is way more than its intrinsic value. With a terrible risk/reward on offer, long-term investors should avoid buying Nvidia until the valuation normalizes through a steep decline in shares or a multi-year consolidation.

Key Takeaway: I rate Nvidia “Avoid/Neutral/Hold” at $225.

Thanks for reading, and happy investing! Please share your thoughts, questions, or concerns in the comments section below.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month). New users can also avail of special introductory pricing!