Summary:

- Despite this being one of the “smaller” beats in recent quarters, it’s a testament to the strength of Nvidia Corporation’s demand to guide for $2.5 billion sequential growth.

- Direct liquid cooling doesn’t lie, as it’s intricately linked to the Blackwell launch, implying that Blackwell would indeed ship by Q4.

- Margins remained strong in Q2, with Nvidia reporting gross and operating margins at the high end and above guided ranges. However, management guided for Q3 margins to contract slightly QoQ.

Sundry Photography

Our firm extrapolated supply chain data to conclude that Blackwell is in production at Taiwan Semiconductor (TSM) and Super Micro Computer (SMCI) last week in the analysis: Nvidia Stock: Blackwell Suppliers Shrug Off Delay. The media was making much ado about nothing (and astonishingly, still is) despite crystal clear confirmation from Nvidia’s (NASDAQ:NVDA) management team that all is well.

Given these delay rumors, it was widely expected that Nvidia’s management would provide some transparency in Q2 as to the status of Blackwell. I joined ‘Making Money’ on Fox Business Network shortly before Nvidia’s report, telling host Charles Payne that “we are getting bullish signals from the supply chain,” such as TSM’s HPC growth and Super Micro’s liquid cooling growth, and that I “fully expect Nvidia’s management team to calm any concerns about the outlook for Blackwell.”

Direct liquid cooling doesn’t lie as it’s intricately linked to the Blackwell launch, implying that Blackwell would indeed ship by Q4 – and Nvidia just confirmed that (multiple times) in Q2’s release (emphasis added):

Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026. In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue.”

Later in the call, Jensen Huang stated:

There were no functional changes necessary. And so we’re sampling functional samples of Blackwell — Grace Blackwell in a variety of system configurations as we speak. There are something like 100 different types of Blackwell-based systems that are built that were shown at Computex. And we’re enabling our ecosystem to start sampling those. The functionality of Blackwell is as it is, and we expect to start production in Q4.”

We had published for our free readers going into the print that the valuation was stretched, and it would require fiscal year revisions to create room in the valuation. As you’ll see below, we got a few revisions today, which is paramount for the stock price. Will these upward revisions be enough to sustain the price? We look at this and more below.

Q2 Revenue Beats Estimates

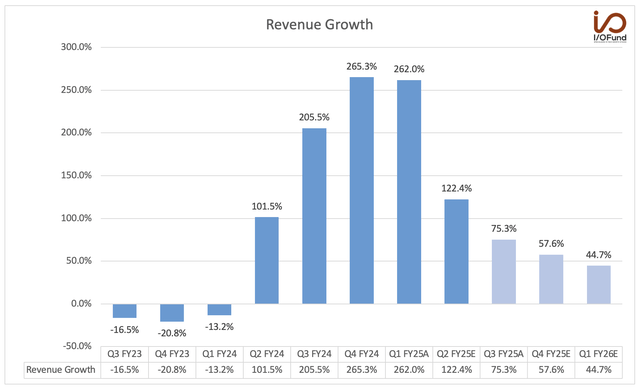

Q2’s revenue of $30.04 billion increased 122% YoY and 15% QoQ, with management pointing out that “customers continue to accelerate their Hopper architecture purchases while gearing up to adopt Blackwell.” This marked a $1.3 billion beat to the consensus estimate for $28.75 billion. It also was a deceleration from 262% YoY growth in Q1, as Nvidia is now facing tougher comps against the vertical ramp of Hopper last year. GAAP EPS of $0.67 beat estimates by $0.03, and represented YoY growth of 168% and QoQ growth of 12%.

Nvidia guided for Q3 revenue of $32.5 billion, once again above consensus estimates, though it was only $700 million higher than the $31.77 billion estimate at the midpoint. This represents growth of 79.4% YoY at midpoint, compared to the estimate for 75.3% growth next quarter. Despite this being one of the “smaller beats” in recent quarters, it’s a testament to the strength of Nvidia’s demand to guide for $2.5 billion sequential growth primarily based on Hopper demand with no contribution from Blackwell.

Data Center Strength Visible with Blackwell on Tap

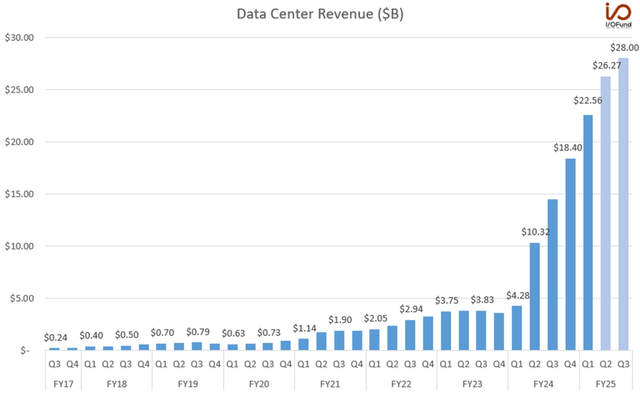

Data center revenue surpassed a $105 billion annualized run rate this quarter, up from $90 billion annualized last quarter, as Nvidia reported $26.27 billion in data center revenue, up 152% YoY and 16% QoQ. Nvidia said that “Hopper demand is strong, and shipments are expected to increase in the second half of fiscal 2025,” while Blackwell is on track to ramp in Q4 with “several” billions in revenue expected that quarter.

Notably, purchase commitments and obligations for inventory and capacity rose nearly 48% QoQ to $27.8 billion, including “new commitments for Blackwell capacity and components,” another signal that Nvidia is prepared to ramp in full-force come Q4.

In the segment, compute revenue was $22.6 billion, up 162% YoY, while networking revenue was $3.67 billion, up 114% YoY. In networking, Nvidia noted that InfiniBand and Ethernet drove growth in the quarter, and the 16% QoQ growth included “a doubling of Ethernet for AI revenue.”

Nvidia’s Q3 revenue guide implies data center revenue above $28 billion to $28.5 billion, which we had modeled in our pre-earnings analysis earlier this week.

Delay Concerns Cleared, But Valuation Looks Stretched

Nvidia cleared the delay concerns for Blackwell, saying that they “shipped customer samples of our Blackwell architecture in the second quarter. We executed a change to the Blackwell GPU mask to improve production yield. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026,” with several billion in Blackwell revenue expected in Q4. Purchase commitments reiterated that Nvidia is serious about launching on schedule, and lining up the capacity and components to launch in full-force by the end of the year.

I spoke with Yahoo Finance on Thursday morning following the report, reemphasizing that the delay concerns were

“completely thrown off the table last night. … Wall Street obviously is very closely tied to estimates, and we never saw revisions downward based on the so-called delay. … Nvidia beat, and they’re saying Blackwell is basically on time,” which is “not a concern — if anything, it’s extremely bullish.”

However, I cautioned on the valuation:

“When you have a high-flyer like Nvidia, you get stretched at times. Going into the print, we warned our members that this valuation is looking a little toppy. What we need is for the fiscal year estimates next year to go up, so we’re in a waiting game for analysts to revise their estimates upward, which eventually they will, but until then the valuation is stretched.”

This morning, while I was being interviewed by Yahoo, we’ve already seen analyst estimates for Nvidia’s revenue revised higher following the report:

-

Fiscal 2025 revenue is now estimated at $124.8 billion, up 3.9% from the $120.1 billion estimate before Q2’s report.

-

Fiscal 2026 revenue is now estimated at $172.1 billion, up 5.2% from the $163.6 billion estimate before the report.

However, the true impact of Blackwell is yet to be seen in these estimates, with the only clues right now being Q3’s $32.5 billion guide and expectations for several billion in Blackwell revenue in Q4. From a long-term perspective, I explained on Yahoo Finance that the first “pathway for growth is to pay very close attention to Nvidia around the fiscal year guide,” while the “second-biggest moment of the year will be when Blackwell is shipping in volume. This will be the Q2 report, but we’ll get some signs in Q1 with that forward guide.” I believe that “early next year will be fireworks” for Nvidia, similar to Hopper’s moment in the fiscal Q1 report in May 2023.

Eyes on Margins as Blackwell Ramps

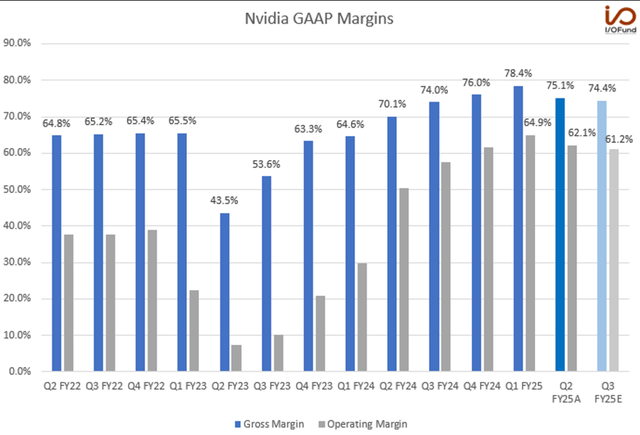

Margins remained strong in Q2, with Nvidia reporting gross and operating margins at the high end and above its guided ranges. However, management guided for Q3 margins to contract slightly QoQ, suggesting that Q1 was the peak for both gross and operating margins with some pressure ahead as Blackwell gears up to launch in Q4.

-

GAAP gross margin was 75.1% in Q2, ahead of management’s guide for 74.8%. Adjusted gross margin was 75.7%, ahead of guidance for 75.5%. Per the CFO: “As our Data Center mix continues to shift to new products, we expect this trend to continue into the fourth quarter of fiscal 2025.” It’s likely she is referring to the higher cost of memory components, which we outlined in our pre-earnings analysis.

-

GAAP operating margin was 62.1%, ahead of the implied guide for 60.5%, indicative of the operating leverage power that Nvidia still commands in mid-launch cycle for Hopper with the H200s shipping now. Adjusted operating margin was 66.4%, ahead of the implied guide of 65.5%.

-

GAAP net margin was 55.3% down from 57.1% last quarter. This represents profits of $16.6 billion, up over $2 billion. This was a considerable beat compared to the $14.3 billion guided.

The chart above shows Nvidia’s margins, with the slight sequential contraction this quarter and next quarter visible. It’s no small feat to maintain GAAP operating margin >60% for four consecutive quarters while simultaneously undergoing the semiconductor industry’s most advanced and most rapid product release cycle. However, with management guiding for full-year gross margins to be in the mid-70% range, we’ll be keeping a close eye on how margins trend in Q3 heading into Q4 as Blackwell ramps — where the market is a tad concerned is gross margins, which peaked at 78.4% and will exit the year in the mid-70% range.

Conclusion

Our pre-earnings write-up expressed concerns about the valuation going into the print, and I think the selling on Thursday reflects the valuation. Our firm stuck our neck out over the past few weeks to bring quality information to our readers on how the supply chain for Blackwell is ramping. We were the first and only firm that I’m aware of to present actionable data that countered what other media outlets were reporting. To refresh your memory, media outlets stated Blackwell was delayed into Q1:

If the upcoming AI chips, known as the B100, B200 and GB200, are delayed three months or more, it may prevent some customers from operating large clusters of the chips in their data centers in the first quarter of 2025, as they had planned.”

In contrast, my analysis stated:

From the horse’s mouth, Nvidia’s own management team, it was stated during the GTC Financial Analyst Day in March that the very first systems will ship in Q4, but to expect constraints.”

Well, we have our answer – Blackwell is, in fact, shipping in Q4 and ramping in Q1. Purchase commitments up 48% QoQ help to reflect how serious the company is when it comes to the speed of ramping shipments.

Earnings reports are truly 50/50 – nobody can tell you what the market will do following a report. For example, we had high confidence Nvidia would beat, but there’s much more to consider than a beat. What’s important is to have a strategy. Our firm champions actively managing tech positions rather than buy-and-hold.

Our plan is to trim Nvidia Corporation stock at key levels and attempt to buy lower. This is due to valuation concerns, but also importantly, many AI stocks are trading at stretched valuations. We’ve stated publicly a few times that Nvidia is a buy on dips, implying investors who are patient will find entries at lower prices.

Recommended Reading:

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our cumulative returns are 131% and a lead over institutional technology portfolios by as much as 157% since inception.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services include an automated hedge, portfolio of 10+ positions, broad market analysis, deep-dives, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.