Summary:

- We continue to be bullish on Nvidia Corporation post earnings results.

- Nvidia Corporation stock is up nearly 61% since we first upgraded to a buy last October; we expect the stock rally to continue as Nvidia experiences demand tailwinds toward 2H23.

- We expect Nvidia to see demand recovery this year, driven by new product cycles and the AI boom.

- We believe the downside of crypto-mining GPU demand has been priced into the stock; we now expect Nvidia’s core businesses of gaming and data centers to experience sequential growth.

- We believe Nvidia is rebounding amid the global hype on AI, and recommend investors buy the stock at current levels.

Sundry Photography

We remain buy-rated on NVIDIA Corporation (NASDAQ:NVDA) post 4Q23 earnings results. We believe NVDA is rebounding toward 2H23 and expect the company to experience significant demand tailwinds driven by its new product cycle and hype around Artificial Intelligence (A) chips.

We believe NVDA is doing well to return its gaming supply to a more normal total addressable market (TAM) after the severe downside from crypto-mining-related GPU sales has been priced into the stock and outlook. We’re more constructive on NVDA now than we were a year ago, as we expect the company’s serviceable available market (SAM) expands as it joins the AI bandwagon. We believe the stock provides a favorable risk-reward profile at current levels.

NVDA stock surged more than 8% in extended trading this Wednesday after beating top and bottom line estimates. The company reported $6.05B in revenue versus the expectation of $6B, and EPS came in as $0.88 compared to an expectation of $0.81. We believe NVDA has hit its inflection point and is now eyeing a broadening addressable market within the semi-space: AI chips. We expect to see sequential growth recovery in the company’s two core segments: Gaming and Data Center.

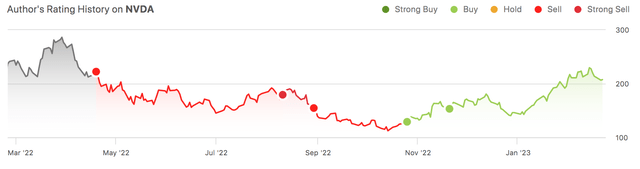

We had been sell-rated on the semiconductor company for the greater part of 2022 due to softer cloud demand and the company’s exposure to weaker crypto-related GPU sales due to Ethereum’s (ETH) switch from Proof of Work to Proof of Stake. We upgraded NVDA stock in October based on our belief that the weakness from crypto-related sales had been priced in, and the company was better positioned to outperform. Consistent with our expectations, NVDA has been bouncing back and is expanding its AI services in the process. The following graph outlines our rating history on NVDA over the past year:

Demand tailwinds expand through 2023

Our bullish sentiment on NVDA stock is driven by our belief that the company is better positioned to rebound this year, driven by demand tailwinds. The past year was rough on NVDA, with the stock dropping to a 52-week-low of $108.13 per share. We believe the downside from the weaker gaming demand and softer cloud demand have been priced into the stock, and expect NVDA to outperform expectations and the peer group going forward. We expect NVDA to recover on the following fronts:

1. Wake-up moment for its AI capabilities

We believe part of the stock’s surge post-earnings results is NVDA’s push into the AI space. The company’s investments in AI computing chips are paying off, big time. We believe NVDA is taking steps to consolidate its position in the growing AI market. How does NVDA fit into the AI battlefield? NVDA’s AI chips enable computers to make sense of massive quantities of data and train software decision-making. NVDA provides NVIDIA DGX solutions, the first portfolio of purpose-built AI supercomputers, and several AI enterprise offerings. The company also announced it’ll have its own AI cloud service, teaming up with Oracle Corporation (ORCL), Microsoft Corporation (MSFT), and Alphabet Inc. (GOOG) to provide the use of NVDA’s GTX machines for AI processing.

OpenAI’s ChatGPT has opened the market’s eye to the larger growth opportunities in the AI space, and we expect NVDA to be an essential player in the AI arms race going forward. NVDA’s CEO Jensen Huang highlighted this in the 4Q23 earnings call, saying:

“AI adoption is at an inflection point. OpenAI’s ChatGPT has captured interest worldwide, allowing people to experience AI firsthand, showing what’s possible with generative AI.”

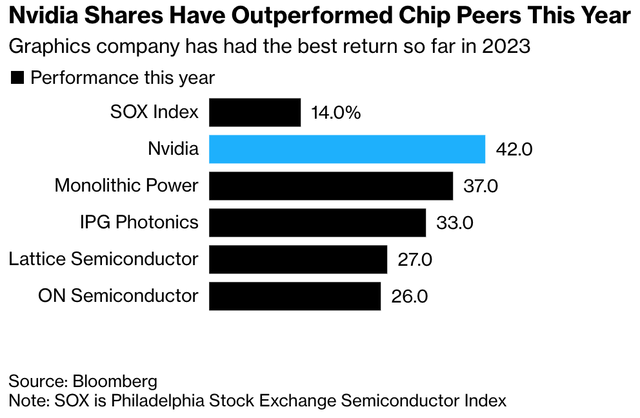

NVDA shares have already outperformed the Philadelphia Stock Exchange Semiconductor Index (SOX) this year. The following graph outlines NVDA’s shares in comparison to its peers.

We expect NVDA to continue outperforming expectations and the peer group driven by the global adoption of generative AI applications that require NVDA’s expertise across AI supercomputers, algorithms, data processing, and training methods. We believe NVDA already has a head start against its biggest competition in the GPU space, Advanced Micro Devices (AMD). Tom’s Hardware recently tested NVDA, AMD, and Intel Corporation (INTC) products in terms of AI inference and found NVDA graphic units outperform. We expect NVDA’s AI services to significantly boost revenues as AI becomes the global spotlight. We expect the company to play a more vital role as the largest supplier of GPUs to train AI models, with the generative AI market expected to grow at 34.6% CAGR between 2022-2030. We believe NVDA is not only recovering from the downturn of its gaming segment and a slowdown in data centers but is also penetrating new growth markets.

2. New product cycles to boost demand

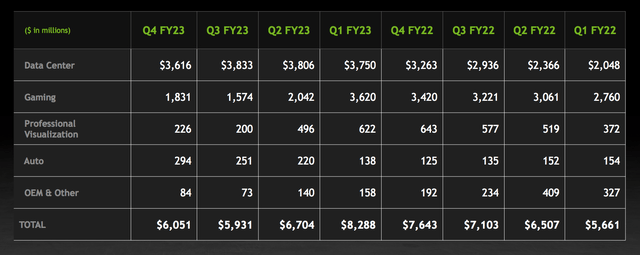

We believe NVDA’s Gaming and Data Center weaknesses have been priced into the stock. NVDA’s 4Q23 earnings results reported gaming revenue down 46% Y/Y but up 16% sequentially. We’re not too concerned about the Y/Y drop in revenue; we believe the company is adjusting gaming supply to the normalizing demand after last year’s crypto-bust. We believe it’s more important to highlight the gaming revenue’s sequential growth, which is positive. We expect to see gaming demand pick up more meaningfully toward 1H24.

On the other hand, data center revenue was up 11% Y/Y but down 6% sequentially. We believe the drop in data center demand sequentially is largely due to softer cloud demand due to macroeconomic headwinds pressuring IT spending. We’re seeing weaker cloud spending from other semiconductor companies, including INTC and AMD. We expect NVDA’s data center segment to see revenue growth recover toward 2H23, driven by its new data center GPU.

The following outlines NVDA’s quarterly revenue trend by markets as of 4Q23.

NVDA earnings presentation 4Q23

Contextualized within the larger semi-peer group, NVDA is among the biggest semiconductor companies worldwide, with a market cap exceeding $500B- $581.43B, to be precise. As the AI boom unfolds, we expect NVDA to emerge as the biggest chipmaker competing for market share. We recommend investors buy the stock at current levels.

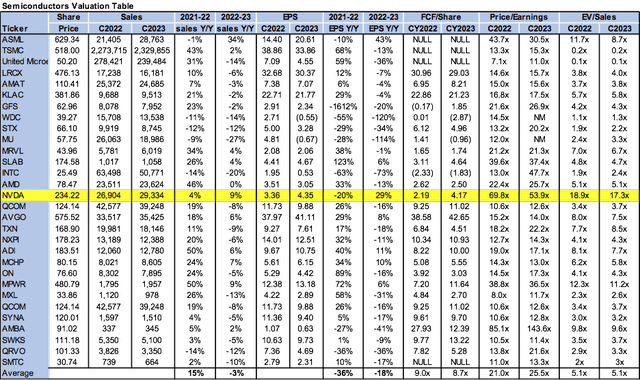

Valuation

NVDA stock is not cheap, but despite its relatively high valuation, we believe the stock provides a favorable risk-reward profile. On a P/E basis, the stock is trading at 53.9x C2023 EPS $4.35 compared to the peer group average of 25.5x. The stock is trading at 17.3x EV/C2023 sales versus the peer group average of 5.1x. We recommend investors buy the stock, although it is trading well above the peer group average. We believe NVDA is well-positioned to benefit from demand tailwinds in the AI space and through its new product cycle.

The following table outlines NVDA’s valuation compared to the peer group.

Word on Wall Street

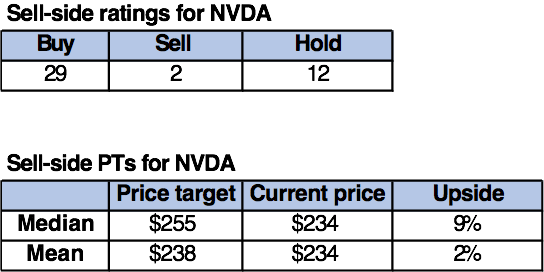

Wall Street shares our bullish sentiment on the stock. Of the 43 analysts covering the stock, 29 are buy-rated, 12 are hold-rated, and the remaining are sell-rated. We believe the downside of the weaker gaming demand and softer cloud spending have been factored into the stock and recommend investors begin looking for entry points into the stock as NVDA expands its AI services.

The following table outlines NVDA’s sell-side ratings.

TechStockPros

What to do with NVDA stock

We’re bullish on NVIDIA Corporation, despite its high valuation. The company’s 4Q23 earnings report beat estimates but highlighted a 46% Y/Y decline in the gaming segment. While NVDA may not have regained its pandemic-led highs, we expect the company to be meaningfully rebounding from its 2022 lows and actively expanding its growth opportunities in generative AI and data center markets.

We believe NVIDIA Corporation provides a favorable risk-reward profile at current levels. We expect NVDA stock to continue to rally toward 2H23, and we recommend investors buy into the re-emerging NVDA story.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.