Summary:

- Nvidia Corporation is the powerhouse name associated with the graphics and GPU industry.

- Strong FY21 and FY22 has been overshadowed by a flatline FY23.

- A fundamentally robust set of business segments combined with strong growth potential means Nvidia’s long-term outlook remains positive.

- High valuations mean little rooms exists for value oriented investors to get involved.

- Therefore, Nvidia Corporation warrants a Hold rating due to an excessively high price tag on their shares.

Justin Sullivan

Investment Thesis

Nvidia Corporation (NASDAQ:NVDA) is the powerhouse name when it comes to GPUs and data center computational. equipment.

Their unrivalled portfolio of consumer and enterprise grade products creates a wide economic moat which provides the company with a robust set of diversified revenue streams.

A fundamentally strong FY22 has been followed-up by a less than impressive flatline FY23. However, strong future value generation potential remains unmarred by short-term headwinds.

Therefore, a fundamental analysis and valuation must be conducted to better understand the opportunity – or lack thereof – which may lie in the company’s shares for value-oriented investors.

Company Background

Nvidia is an American MNC headquartered in Santa Clara, California. It is one of the most influential software and fabless tech companies, primarily designing graphics processing units (GPUs) and application programming interfaces (APIs).

The company has rapidly diversified the customer-base for their GPUs with a critical pivot away from the more cyclical consumer electronics market towards more stable data center corporate customers.

While the collapse of the crypto-farming industry led to a sharp decline in GPU demand and, thus, GPU prices, Nvidia has managed to already make up for a large portion of this lost revenue with their new data center GPUs.

Furthermore, the huge growth being experienced in artificial intelligence (AI) technologies should undoubtedly produce tangible demand-pull inflationary effects for GPU prices once more.

One of the firm’s key strengths is the continued leadership provided by Nvidia founder, current president, and CEO Jen-Hsun Huang. It is incredibly rare that the founder of a tech-hardware company like Nvidia is still at the helm two decades down the line, and he is an undoubtable asset for the company.

Though the firm has had a troubled fiscal history, recent years have seen the firm earn significant revenues and boast health margins. Nonetheless, fierce competition from the likes of Advanced Micro Devices, Inc. (AMD) and Intel Corporation (to INTC) mean Nvidia must continue to innovate should they wish to stay ahead of their main rivals.

Economic Moat – In Depth Analysis

Nvidia boasts a wide economic moat thanks to their broad range of varying GPU products targeting vastly different market segments. The primary drivers for their current economic moat stem from their consumer gaming GPUs, datacenter GPUs and the new push towards providing computational power for a wide set of artificial intelligence (AI) models.

I also believe the engineering knowledge Nvidia has with regards to GPU design is also an overarching driver for their moatiness.

The company can be credited for the creation and commercialization of GPUs back in the late 1990s and has ever since been a cornerstone of the GPU market. According to research conducted by Jon Peddie Research, Nvidia currently holds about 82-86% of total discrete GPU market share.

This absolute market dominance in the standalone GPU market with their “GeForce” lineup of cards is unsurprising given it is one of the company’s core businesses and illustrates Nvidia’s continued excellence in the field.

Nvidia – GeForce Homepage

Nvidia has also devoted themselves to ensuring the software accompanying their GeForce GPUs equips consumers with further performance-enhancing features aimed at improving the overall experience of using their cards. Nvidia also has many partnerships with game developers to ensure new releases are optimized for use with their GPUs, rather than competing ones from AMD or Intel.

Overall, Nvidia’s gaming GPU segment is a key driver for their public image and economic moat. Furthermore, the significant innovation Nvidia engages in within the space (both with software and hardware) allows the company to experiment with new technologies with consumers whose tasks are not mission critical.

However, the largest segment by revenue for Nvidia is actually their data center business, by almost three-fold. Many cloud computing workloads favor the computational power GPUs are able to provide, which has made them a favorite pick for many Infrastructure as a Service (IaaS) and cloud computing companies.

Nvidia’s understanding of future growth and pivot towards this business segment has allowed the company to become a key provider of cloud-based GPU acceleration solutions with a primary focus on providing customers with powerful virtual workstations and GPU-accelerate AI and data analytics solutions.

The company has a wide range of GPU architectures to cater for differing corporate consumer requirements as well as an AI as a Service (AIaaS) solution which can deliver enterprise clients Nvidia powered infrastructure and software to streamline the entire AI lifecycle.

Nvidia Data Center

Nvidia’s big bet on AI seems to finally be paying-off, with the company being critical to the support of Microsoft and OpenAI’s ChatGPT large language model as well as a host of other AI powered products. The significant growth being seen and expected from this market segment could provide Nvidia with huge expansion potential moving forward.

I believe this data center business segment is a key driver for Nvidia’s huge moatiness thanks to the more stable demand and expected growth of the enterprise GPU and AIaaS markets.

Nvidia also engages in the professional virtualization business which focuses on providing professional enterprise clients with powerful 3D workflow solutions, workstation grade GPUs and critical software applications to streamline design and creative workflows.

While this market segment is significantly smaller than their gaming and data center divisions, the moatiness extracted from this segment is large. The business provides enterprise clients with unrivalled levels of customer support and a superior product compared to competitors.

any high-profile clients such as Mercedes-Benz, Lockheed Martin and the U.S. National Oceanic and Atmospheric Administration provide Nvidia with lucrative contract agreements which act as revenue guarantees for the firm.

Furthermore, the segment acts as a funnel to get enterprise clients into the Nvidia ecosystem of software, hardware and infrastructure which can significantly increase the potential for these companies to adopt further Nvidia powered products in the future.

Nvidia Automotive Products

Finally, Nvidia also engages in the Automotive and Embedded business providing automated and autonomous driving computing solutions to consumers. The company is one of the market leaders for providing comprehensive end-to-end autonomous and AI learning driving workflows which can handle data ingestion, curation, labeling, and training, plus validation through simulation for automotive clients.

Overall, it is clear that Nvidia boasts a varied and robust product portfolio which targets multiple different sets of consumers, enterprise clients and market demographics. The huge profile of their gaming business supports the fundamental profitability of their data center and professional virtualization businesses with their push to supporting AI being the cherry on top.

Therefore, I believe Nvidia holds a wide economic moat which provides the company with multiple tangible competitive advantages when analyzed on a 10 year timeframe.

Financial Situation

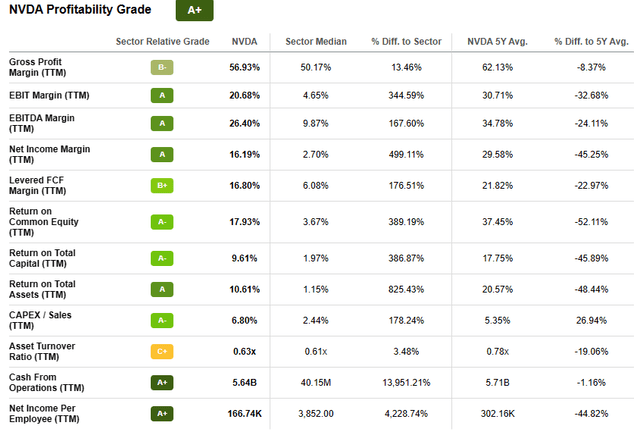

Nvidia has been a largely profitable firm for a greater part of their existence. Consistent 5Y EBITDA margins of 34.78% combined with a 5Y average ROIC of 26.97% illustrates the strong profit generating characteristics currently present at the company.

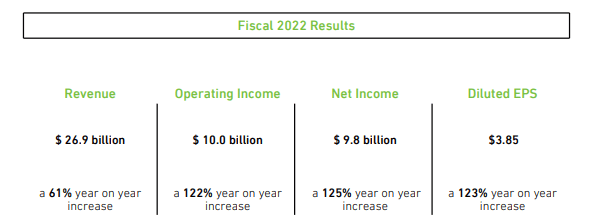

Nvidia FY22 Results 10k

FY22 proved to be a hugely profitable one for Nvidia. Revenues increased 61% up to $26.9B compared to just $16.68B in FY21 with gross margins increasing a whopping 260 basis points and EPS growing 123% to $3.85 a share.

The primary drivers of this FY22 growth were strong revenue growth seen in their gaming division thanks to higher sales of GeForce GPUs as well as strong demand for their Nvidia Ampere architecture products.

Huge growth of 58% in their data center revenue also contributed to the strong FY22 figures thanks to increased demand for GPUs across both training and inference for cloud computing and AI workloads such as natural language processing and deep recommender models.

Their professional visualization segment revenue increase 100% YoY thanks to the ramp of NVIDIA Ampere architecture products and strong demand for workstations as enterprises supported hybrid work environments, as well as growth in workloads such as 3D design, AI and rendering.

These strong annual revenue statistics illustrate the current groove Nvidia has found through the expansion into more enterprise-oriented products which provide the firm with increased stability and sustainability when it comes to revenues and sales.

The pivot towards providing compute & networking services rather than simply core graphics products has proven very lucrative for the company, with the segment accounting for 41% of total revenues.

Net income for FY22 increased a whopping 128% to $9.75B. This was partially due to Nvidia managing to decrease the proportional size of their COGS from 37% of total revenue in FY21 to just 35% in FY22. Such a decrease in the current inflationary market environment suggests Nvidia has a streamlined and efficient production process which differentiates the company from many operationally inefficient tech-firms.

Unfortunately, FY23 has not been as kind to the company, with the most recent FY23 Q4 press release indicating ToT quarterly revenues are down 21%, with fiscal year revenue plateauing at an almost identical $27B.

GAAP earnings per diluted share for the quarter were $0.57, down 52% from a year ago but positively up 111% from the previous quarter. The company blames this muted FY23 performance on a post-pandemic downturn in gaming GPU demand and a slower than expected ramp-up in AI development.

Nonetheless, CEO Huang is confident that the company is set to take advantage of a huge wealth of profits beginning to be generated from new AI supercomputer technologies as well as a once more strengthening gaming GPU environment.

The company is continuing to innovate despite the flatline FY23 results which is positive to see and suggests internal attitudes are optimistic about the future.

Operating expenses were up 27% due to inflationary pressures which while not ideal, illustrates the company has still managed to control the price increase relatively well.

The primary drivers for profitability was their resilient data center business providing a 11% YoY growth and total FY23 revenue growth of 41%. This supports the earlier hypothesis that a focus on the enterprise solutions will provide the company with greater stability and growth opportunity moving forwards, especially when compared to the largely matured gaming market.

FY23 also saw strong growth by the automotive and embedded business which saw 135% YoY revenue growth. This was primarily thanks to new partnerships with Foxconn and increased production capabilities.

Seeking Alpha | NVDA | Profitability

The revenue and profit generating prowess that Nvidia holds has earned the company an A+ Profitability rating according to Seeking Alpha’s Quant. I believe this is an absolutely representative snapshot depiction despite the relatively unimpressive FY23.

Nvidia’s balance sheets looks to be in relatively healthy shape, too. Their total current assets for FY23 are $23.1B while current liabilities for the same period amount to just $6.6B. This leaves the company with a debt/equity ratio of only 0.54.

Their quick ratio (current assets minus inventory divided by current liabilities) is 2.61.

These fiscal stability metrics suggest Nvidia is well protected against any liquidity issues. S&P rate Nvidia with an A- (upper medium grade) credit rating while Moody’s reiterates an A2 (upper medium grade) rating. The outlook is stable.

Nvidia has $10.9B in long-term debt as of January 30. 2022. Only around $7.5B is due to mature before 2030 with a majority maturing thereafter.

To manage their interest rate risk Nvidia has secured fixed rates on a majority of their debentures. This protects the company more effectively against the continuous interest rate hikes pursued by the Fed.

Overall, it is safe to say that the firm does not face any risk from their balance sheets, particularly when considered against their profit generating abilities and strong annual growth.

Valuation

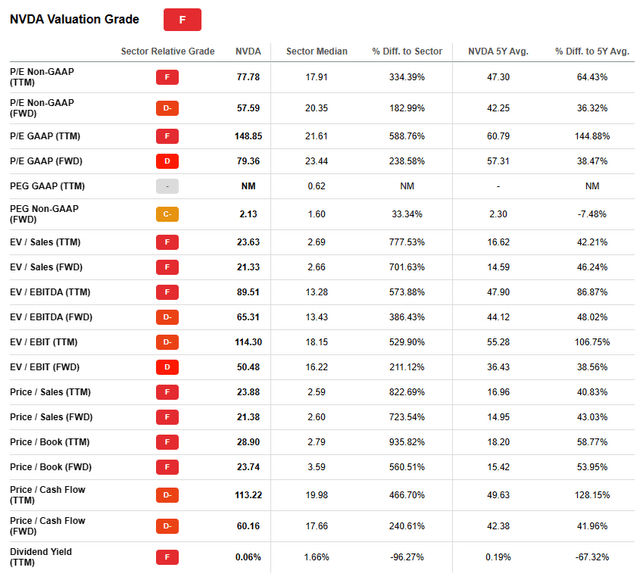

Seeking Alpha | NVDA | Valuation

Seeking Alpha’s Quant has assigned Nvidia with an F Valuation rating. Unfortunately, I am largely inclined to agree with this assessment as it represents a fair evaluation of Nvidia’s current share price when considered against traditional valuation metrics.

The firm is currently trading at a P/E GAAP FWD ratio of 79.36 and a P/CF FWD ratio of 60.16., Furthermore, when considered against a FWD Price/Book ratio of 23.74 and an EV/Sales FWD of 21.33, it is clear that the current share price represents an intrinsic overvaluation of the firm.

Seeking Alpha | NVDA | Summary

From an absolute perspective, Nvidia shares have decreased on a one-year basis by only around 3%, a significant overperformance of the general U.S. market’s performance.

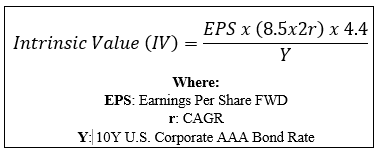

By accomplishing a simple financial valuation based on the calculation below and using the forecast average EPS for 2023/2024 of $5.32, a conservative (contextually) r value of 0.12 (12%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive an IV for Nvidia of $170.2.

When using this conservative CAGR value for r, Nvidia appears to be over-valued by a chunky 82.2%. A slightly more realistic CAGR value of 0.15 (15%) leaves Nvidia being valued at around the $200 mark.

The Value Corner

Therefore, I believe Nvidia is currently sitting somewhere between overvalued and hugely fairly valued.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. Much depends on the prevailing macroeconomic conditions and the ability of the U.S. and Global economies to achieve a soft landing on inflation to ensure the technology sector avoids a significant gulley.

The instability being experienced in the global banking systems also places increased uncertainty on the short-term outlook as significant recessionary effects could be seen should further global bank institutions collapse.

In the long term (2-4 years) I fully expect their position as a leader in the industry to become even stronger. Their unique product offerings combined with the undoubtable growth in AI computing demand means the company should be able to offer significant returns to shareholders.

However, at current time the high price-tag of Nvidia shares means building a position from a value-perspective is not only difficult, by essentially unfeasible.

Risks Facing Nvidia

Nvidia faces risk from a few different perspectives with the most notable threats arising from botched product executions, market shifts and the potential for increased competition.

Nvidia relies on a significant research and development drive to ensure their products outpace those provided by competitors such as AMD and now, Intel.

The potential for a new product launch to be relatively unimpressive (particularly with regards to the consumer gaming category) could result in poor sales figures and negative consumer sentiments.

The significant positive press associated with AMD over their current gen of gaming GPUs means Nvidia must continue to cater to the important business segments to ensure a significant set of revenues are not lost over the coming years.

Another threat for Nvidia arises form the potential for markets to shift away from the discrete GPU and data center computing units towards more mobile or localized processing solutions. While this seems a remote possibility from a data center perspective, the increasing rate at which desktop gaming is being superseded by mobile alternatives means Nvidia must begin to consider entering this more handheld market segment.

Finally, Nvidia is beginning to face more competition in their businesses than ever before. Once again their professional visualization and data center business is more well protected thanks to its robust economic moat, but the consumer discrete GPU segment is left exposed. Particularly, the entrance of Intel into the marketplace with their Arc series of desktop and laptop GPUs could mean Nvidia will face increased competition in the future.

Intel’s ARC has already begun degrading AMDs market share in the GPU market with promised future improvements to their products taking direct aim at reducing Nvidia’s current market dominance.

From an ESG perspective, Nvidia faces no real material risk from these metrics. According to The Upright Project, which measures holistic value creation and impact of companies, NVIDIA has a net impact ratio of 28.1%, which suggests an overall positive sustainability impact arising from their business operations.

The only potential risk for Nvidia is the relatively impactful nature of their operations and the running of their GPUs form a Green House Gas (GHG) emissions perspective. The company is focused on reducing their GHG emissions moving forwards and is exploring the manner in which they may achieve net carbon neutrality in the coming decades.

Summary

Nvidia has had a turbulent but impressive history from an investor standpoint. Their robust and moaty business model, good operational efficiency and significant devotion to R&D has allowed the company to become the dominant player in the GPU and graphics industry.

Unfortunately for value investors, current share prices have left the company trading somewhere between a fair to overvaluation compared to the company’s intrinsic value. Nonetheless, the promise of strong cashflow generation combined with a diversified revenue generation portfolio suggests significant returns are on the horizon.

As a short-term investment, I believe there is some volatility in-store for the stock as tricky macroeconomic conditions continue to dominate the marketplace. However, in the long-term I believe their undeniable position as a market leader places Nvidia firmly in position to generate great shareholder value.

While the company is great, the current price simply isn’t. Nvidia Corporation’s current valuation is a great example of, “the right company at the wrong price.”

For the time being, I will not be building a position in Nvidia Corporation. However, I will continue to analyze the company to see if a new IV proposition could be made.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.