Summary:

- NVIDIA Corporation’s channel partners have reported a steep decline in sales during October and November.

- This is a clear indication that Nvidia’s sales resumption isn’t happening in Q3 FY23 and its management is likely to issue a soft revenue guidance for Q1 FY24.

- Investors may want to avoid the chipmaker for the time being.

PonyWang/iStock via Getty Images

NVIDIA Corporation (NASDAQ:NVDA) shares are down over 40% in the last year, but the shareholder’s pain may not be over yet. Latest channel data reveals that several key computing parts and peripherals manufacturers registered a steep sales drop in October and November. Many of these firms happen to be manufacturing and distribution partners for Nvidia. This suggests that the chipmaker will be revenue-challenged in its ongoing Q4 FY23 quarter and its shares will consequently remain subdued in the near future. Let’s take a closer look to gain a better understanding of it all.

The Channel Sales Data

Let me start by saying that Nvidia is a fab-less chip designer at best. Its silicon engineers design the chip architectures which are then fabricated by companies such as Samsung (OTCPK:SSNLF), Taiwan Semiconductor Corporation (TSM), and GlobalFoundries. This silicon is then sent to board partners such as Gigabyte, Micro Star International, ASUS and ASRock, to package them in the form of usable GPUs and distribute them globally. Some of these firms also manufacture computing peripherals around Nvidia’s ecosystem of products, such as motherboards, networking systems and other products.

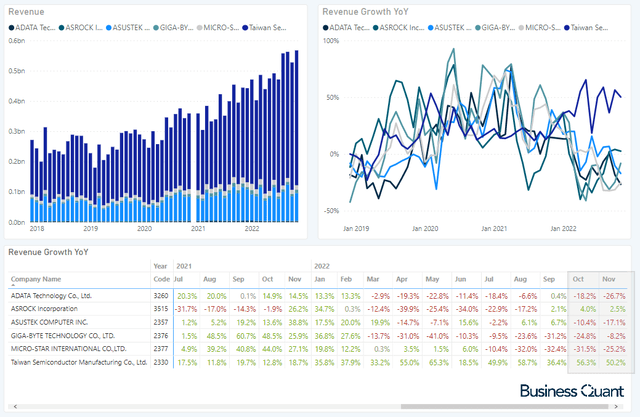

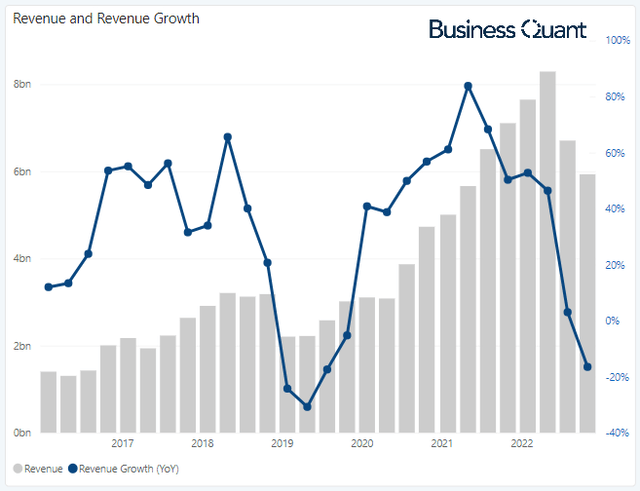

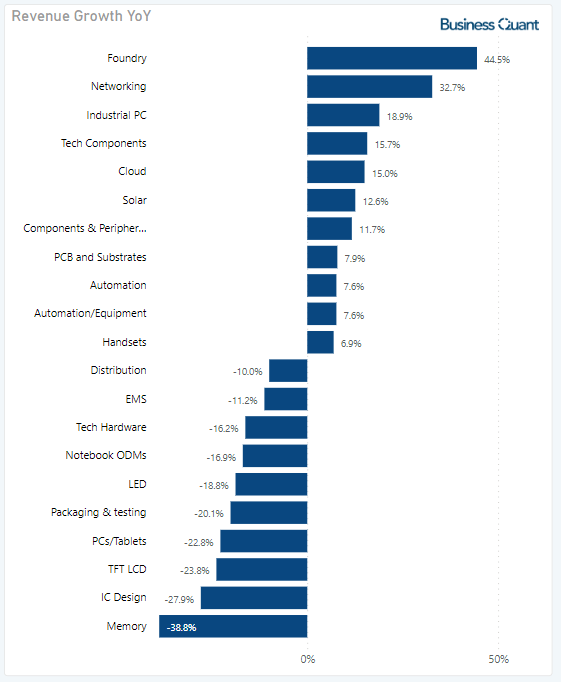

The point that I’ve tried to make here is that Nvidia isn’t a vertically integrated company and it relies on channel partners for its business continuity. We can track their monthly sales to understand how Nvidia’s ongoing quarter is shaping out to be. For instance, if Nvidia’s partners register a steep drop in monthly sales, then it’s likely because Nvidia’s products aren’t selling well in a particular month. Conversely, if these partners register breakneck sales growth, then it indicates heightened consumer demand for Nvidia’s SKUs and suggests the chipmaker’s sales will grow rapidly as well. We, at Business Quant, have developed a tool for exactly this purpose, to monitor monthly sales data for over 1300 Taiwan-listed firms.

It’s evident in the table below that many of Nvidia’s key channel partners registered a sharp sales decline in October and November by a varied magnitude. This suggests that Nvidia’s ecosystem of products hasn’t been selling like hotcakes of late and a sales resumption hasn’t happened yet. Bulls have been arguing that Nvidia is en route to posting blockbuster Q4 results as its latest RTX 4090 and RTX 4080 GPUs sold out at launch, during October and November, respectively. But after seeing the plight of its channel partners in November, we now know the ground reality is a lot grimmer than what the bulls believe it to be.

I believe there are broadly 3 reasons why this sales slump may have occurred:

- Average Selling Prices (or ASPs) for older cards have been plummeting for GPUs due to the withdrawal of cryptocurrency miners. So, the sales decline could be driven by the dropping value of shipments sold.

- Although Nvidia has released its RTX 4090 and RTX 4080 GPUs, these are high-end cards and the mainstream market might be withholding their purchases until more affordable cards are released, like 4070 and 4060.

- There’s also the possibility that its RTX 4080 and 4090 cards were exorbitantly priced, which limited consumer demand. The chipmaker slashed the prices last week so this seems like a valid thesis too.

Note that in the table above, Taiwan Semiconductor Corporation sales have continued to grow rapidly. I contend that it’s an exception to the prevailing sales slump being experienced by Nvidia’s other channel partners. I say this because Taiwan Semiconductors fabricates semiconductors to a wide range of companies, spanning across different industries. So, whilst the demand for computing parts and peripherals slumped last month, other industries grew.

BusinessQuant.com

But this leads us to an important question – what does all this mean for Nvidia’s shareholders?

Implications for Shareholders

I’d like to point to readers that the channel partners mentioned in the table above aren’t pure plays. For instance, companies such as Gigabyte, MSI and ASRock, manufacture GPUs along with a host of other computing parts and peripherals. Also, their contracts with Nvidia aren’t exclusive, and many of them also manufacture SKUs for the chipmaker’s key competitors, that is, Advanced Micro Devices (AMD) and Intel (INTC). So, the aforementioned data isn’t indicative of just Nvidia’s sales momentum, but the sell-throughs of computing parts and peripherals industry in general.

Having said that, if the industry demand was recovering and Nvidia’s SKUs were truly selling like hotcakes, these channel partners would have seen their sales grow or at least stabilize in recent months. But what we see here instead is that their sales continue to plummet with each passing month. This is a tell-tale sign of weak consumer demand and/or poor pricing mix for Nvidia and its channel partners. So, I believe that Nvidia will remain revenue challenged during Q4 FY23 and its management will issue a rather soft revenue guidance for Q1 FY24.

However, this forecast is not set in stone. Nvidia might be able to stave off yet another sales slump in Q1 FY24. The chipmaker has slashed prices of its recently-released RTX40-series flagship GPUs to reinvigorate consumer demand amidst inflationary pressures. It can further move the odds in its favor by releasing a slew of mid-range GPUs (4070ti, 4070, 4060 and 4050) in quick succession, prompting technology enthusiasts to upgrade their gear. Pricing them attractively might limit the ASP increases but it’s also bound to bring more volumes.

Final Thoughts

The takeaway here is that Nvidia’s sales should continue to decline in the next couple of quarters at the very least. It’s not necessarily the company’s fault, though, as macroeconomic pressures seem to be weighing down on the entire computing parts and peripherals industry.

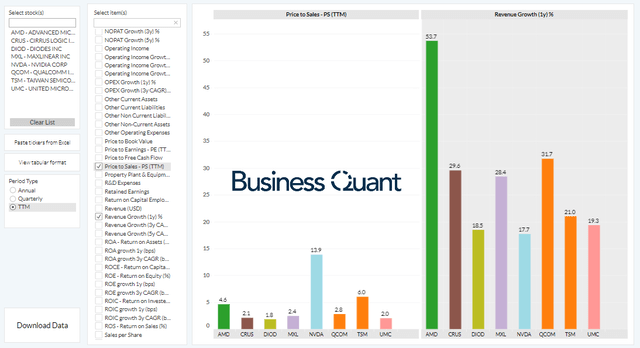

NVIDIA Corporation stock is trading at almost 14-times its trailing twelve month sales. This is an exorbitant premium compared to many of the other semiconductor stocks that are growing sales at a relatively faster rate, but still trading at much lower Price-to-Sales multiples. So, in light of mounting challenges and a stretched valuation, I rate Nvidia as a “Hold” for the time being. This, however, should not be construed as a call to short the stock. Good Luck!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.