Summary:

- Nvidia Corporation’s Q2 earnings release showed doubled revenue and a 50% operating margin, driving a 13% rally in the stock.

- Despite strong recent performance, the stock is almost 20% lower than this year’s high, indicating that investor optimism fueled by the AI buzz may have peaked.

- The competition in the advanced AI chipsets field is poised to intensify from a large number of strong players with vast resources.

- My valuation analysis suggests Nvidia Corporation stock is about 36% overvalued.

Daniel Chetroni

Investment thesis

My latest bearish call about Nvidia Corporation (NASDAQ:NVDA) did not age well, as the stock outperformed the broader U.S. market over the last quarter by rallying 13%. The company’s Q2 of FY 2024 earnings release was a positive catalyst for the stock price as it doubled its revenue and delivered a staggering 50% operating margin.

Nvidia performs extremely well in absorbing massive secular tailwinds related to the expanding penetration of artificial intelligence (AI) and machine learning (ML) technologies. The company is well-positioned to continue investing heavily in innovation and widen the technological gap with competitors.

Undoubtedly, Nvidia is a wonderful company, and we all remember that Warren Buffett said, “it is better to buy a wonderful company at a fair price than a fair company at a wonderful price.” However, my valuation analysis suggests that the valuation is far from fair, and the stock is almost 40% overvalued. This year’s buzz around AI might continue fueling investor’s optimism around Nvidia, but when the stock is that overvalued, any slightly negative information might cause a massive selloff. Therefore, I reiterate my “Sell” rating for NVDA.

Recent developments

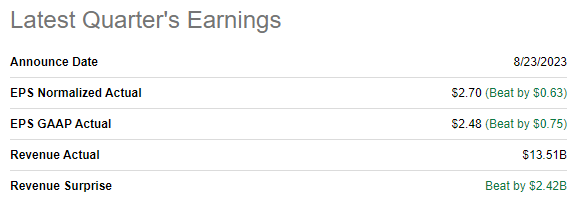

The latest quarterly earnings were released on August 23, when the company smashed consensus estimates. Revenue doubled on a YoY basis, and the adjusted EPS demonstrated an even stronger move by expanding five-fold, from $0.51 to $2.70. The next earnings release is scheduled for post-market on Thursday, November 21st.

Seeking Alpha

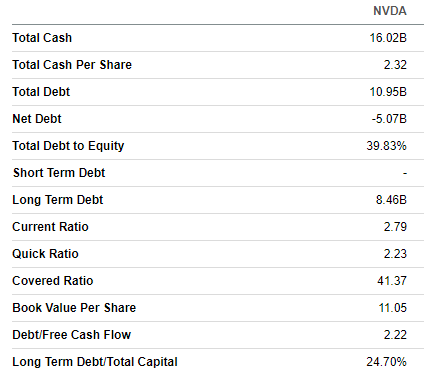

The bottom line expansion was due to the stellar operating leverage unlocked with the massive revenue growth. Thanks to the economies of scale, the operating margin expanded to a staggering 50%. As a result, the levered free cash flow (FCF) ex-stock-based compensation (ex-SBC) was above $4 billion in Q2. To add context, the FCF ex-SBC level for the full FY 2022, the company’s most successful year, was at about $4.4 billion. This enabled NVDA to make its fortress financial position even stronger. As of the latest reporting date, the outstanding cash balance was $16 billion, which was substantially above the total debt level. Low leverage and stellar liquidity give Nvidia’s management many options for allocating capital to ensure further innovation and massive revenue growth.

Seeking Alpha

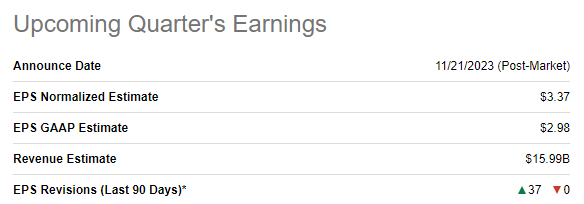

The upcoming quarter’s earnings release is fast approaching, as mentioned scheduled for November 21. Consensus estimates forecast quarterly revenue at $15.99, which indicates a staggering 170% YoY growth. The bottom line is poised to continue skyrocketing, with the adjusted EPS expanding YoY from $0.58 to $3.37. There were a staggering 37 upward EPS revisions over the last 90 days, which is a vital bullish sign.

Seeking Alpha

I think that there is a high probability that Nvidia will beat consensus estimates as the world’s largest semiconductor foundry, Taiwan Semiconductor (TSM) recently reported a robust rebound in chip demand, driven by increased sales of the most complex offerings capable of powering AI. It is also crucial to understand that almost all of the largest software companies invest heavily in integrating AI-powered solutions into their offerings, spurring further the demand for advanced chipsets.

Another notable and technologically advanced player in the AI field, Super Micro Computer (SMCI), also delivered a strong quarter recently and upgraded its outlook significantly. This also adds optimism before Nvidia’s earnings release in the upcoming quarter. On the other hand, it is crucial to mention that despite delivering strong performance and guidance upgrades, the stock now trades almost 20% lower than this year’s high, which might indicate that investor optimism fueled by the AI buzz already has peaked.

Another sign that the market’s optimism around AI semiconductors might have peaked in the summer is the fact that despite a staggering Q2 earnings release, Nvidia’s stock did not skyrocket like after the Q1 earnings release. There was an almost 20% pullback in September after the stock peaked slightly below the $500 resistance level. The fact that in early September, Jensen Huang, the CEO, sold nearly 60 thousand NVDA shares might also indicate that the AI frenzy’s peak is already in the rearview mirror.

From the secular point of view, it is also important to understand that generating a 30% FCF margin thanks to the AI chipsets is too tempting, and technology hyper-scalers will invest substantial resources and all their expertise in order not to miss such a highly profitable business. We already see news that Microsoft is willing to reduce reliance on Nvidia, and this does not look unrealistic given Microsoft’s vast financial and intellectual resources. Advanced Micro Devices (AMD) also explicitly indicates the company’s determination to battle against Nvidia in the AI race. AMD is also a strong competitor that can potentially gain the advanced GPU market share at Nvidia’s cost.

While Intel’s (INTC) turnaround plans look risky to me, but if they are completed successfully, and on time, this might also change the AI hardware landscape. It is also important to understand that Asian giants are also not sleeping, as companies like Samsung (OTCPK:SSNLF) and Huawei are also notable players in the AI race. That said, the competition is poised to intensify, and long-term competition risks are increasing for NVDA.

Valuation update

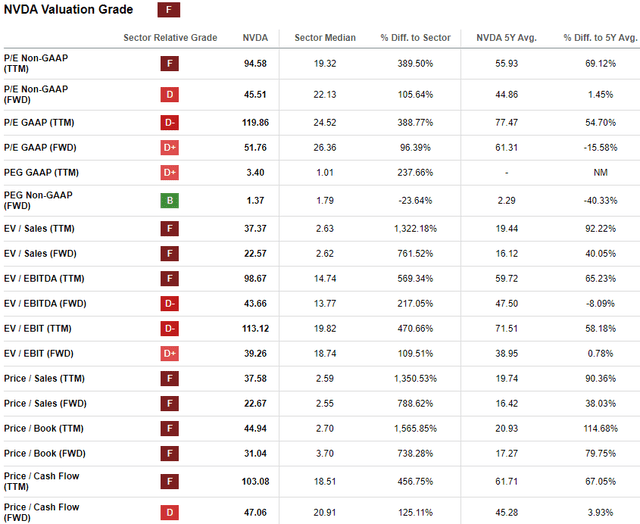

The stock soared by almost 250% year-to-date, significantly outperforming the broader U.S. market. Nvidia has been historically substantially overvalued from the perspective of valuation ratios compared to the sector median. On the other hand, Nvidia’s strong competitive edge and historical revenue growth pace are unmatched, and the premium to the sector median looks fair to me. However, I believe the comparison between the current valuation ratios and historical averages signals overvaluation.

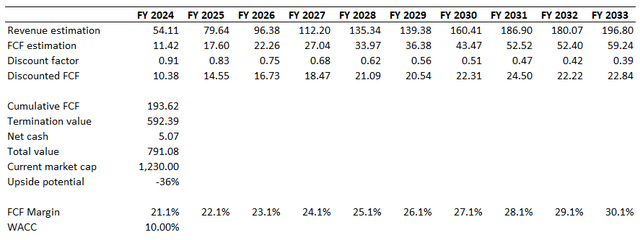

I need to expand my analysis by simulating the discounted cash flow (DCF) model to get more evidence. I use the same 10% WACC for discounting as I did before. I incorporate revenue consensus estimates, which project a 15% top-line CAGR for the next decade. I use a 21.1% TTM FCF ex-SBC margin for my base year and expect a one percentage point yearly expansion for the years beyond. Assumptions look fairly optimistic to me.

According to my DCF simulation, the business’ fair value is below $800 billion, which is substantially lower than the current $1.23 trillion market cap. That said, the stock is about 36% overvalued, and such a premium looks too generous, even considering the company’s massive dominance in the AI chips field. That said, my target price for NVDA is $315 per share.

Risks to my bearish thesis

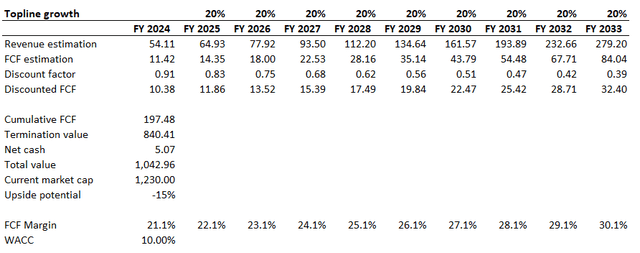

Even a substantial overvaluation, like in Nvidia’s case, does not guarantee that the stock will stop rallying. All valuation models are based on assumptions with high uncertainty levels, especially for growth companies when we project revenue CAGR for the next decade. A new solid upgrade in the management’s guidance will lead to an upgrade in long-term consensus estimates for revenue growth, which will mean a massive boost for the company’s fair value. For example, if revenue CAGR projections for the next decade switch to 20%, this will add more than $200 billion to the business’s fair value. If this is the case, the premium to the stock price will narrow to 15%, which looks somewhat reasonable for a superstar like Nvidia.

Nvidia’s stock might look unstoppable this year with an “A+” momentum grade from Seeking Alpha Quant. Potential investors should not underestimate the power of stock price growth momentum as the “Fear Of Missing Out” effect also continues fueling the stock price.

Bottom line

To conclude, NVDA is still a “Sell.” Although I consider Nvidia a superstar that can absorb massive AI tailwinds, there are signs that the AI mania is cooling down. The intensifying competition in the AI field is also likely to put pressure on the company’s financial performance over the long term, and as AI chips become more commoditized, profitability metrics are likely to see compression in the future. Last but not least, my valuation analysis suggests that the stock is about 40% overvalued, which does not look like a reasonable premium, even for a company like Nvidia.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.