Summary:

- Meta Platforms talked about reducing expenses for most of 2022 but never got around to it.

- However, the company is now taking a reduction in expenses and CapEx seriously, and I’ve been waiting for this to come for three quarters.

- With a drastic reduction in expense growth, negative CapEx growth, and a 20% increase in advertiser conversions, the worst is now behind the company.

- With the story shifting, the stock may work toward $250, with an opportunistic pullback possibly occurring before it gets there.

Leon Neal

Last May, I outlined how Meta Platforms (NASDAQ:META) decided to finally shift its resources away from metaverse investments and toward dealing with its declining revenue growth. I applauded how it was the right decision and would turn the stock around. But, it didn’t follow through on the changes, and the stock was walloped after its Q3 earnings report, where spending remained largely unchanged, and revenue growth continued to deteriorate. However, the message finally got to Mark Zuckerberg and his team in Q4 as the company has shown material interest in reducing 2023 expenses and has slowed the bleeding of its revenue decline. These actions are the follow-through to my initial assessment in Q2, and I’ve taken notice of the – albeit delayed – initiative. Overall, the company’s headwinds are set to abate in 2023 and the cloud should finally lift.

Expenses And Not So Good Times

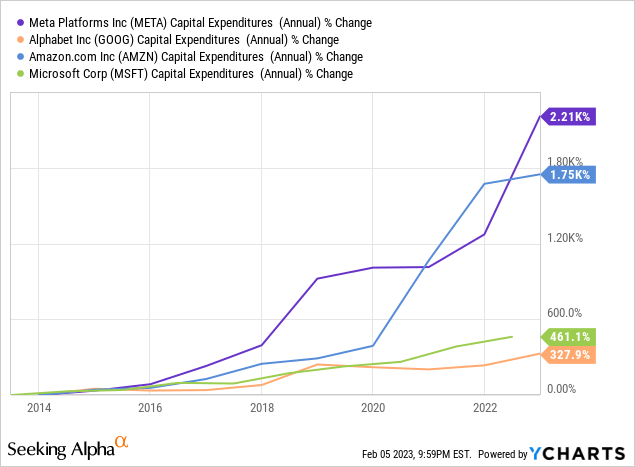

It’s no secret Meta has spent like a drunken sailor over the last several years. It has grown capital expenditures over the last ten years more than any other big tech rival, even ones two and three times its size.

But spending like money grows on trees only works while money is growing on trees. The fact Meta has one of the largest cash hoards in the tech industry isn’t hyperbole, but it still means the outlay must match the intake. And lately, the intake hasn’t been so hot. Therefore, investors were none too happy to see the company spend like it did in 2022 while its industry was under fire in more ways than one.

Q4’s earnings report was needed sooner to save the stock from visiting double digits. But sometimes it’s better to be late than never.

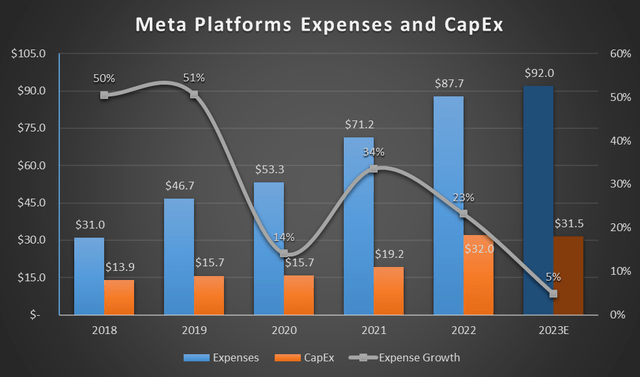

In its Q4 earnings report, it guided for 2023’s expenses and CapEx much lower than initially assessed during the Q3 report. After a small guide down in mid-November (after Q3’s earnings through an SEC filing) for $94-$100B in expenses, the company revised it to $89B-$95B. Similarly, CapEx guidance went from $34B-$37B to $30B-$33B. To put it further into perspective, the company’s original 2023 guidance on the Q3 call was $96B-$101B for expenses and $34B-$39B for CapEx. From Q3’s call to Q4’s call, 2023 expenses and CapEx were reduced $6.5B (6.6%) and $5B (13.7%) at the midpoints, respectively.

Compared to 2022’s expenses, the company is projecting a year-over-year increase of 4.9% at the midpoint, down from 2022’s 23% year-over-year growth. CapEx is guided to be down 1.7% at the midpoint after growing 66.5% in 2022.

The trend is clear if management follows through on it.

Chart mine, data from Meta’s 10-Ks

Some may say this reduction in expense guidance is due to the 11,000-employee layoff, but the absolute reduction of $1.5B in CapEx year-over-year has nothing to do with employee salaries. The $1.5B less in CapEx is $1.5B more moving to the free cash flow line, a net positive for 2023 over 2022. While it may be small, if revenue can tip back into positive territory for the year, margins can do their thing, and free cash flow will see momentum move back toward growth.

Shifting Expense Gears

It has only now become apparent management is taking its expense growth seriously and plans to make the chart at the beginning of this article less vertical.

This is important because of the difficult year-year-and-a-half of revenue growth. Continuing to grow expenses at rates welcomed in “good” times during “not-so-good” times pressures every margin and turns the cash cow into a cash drought.

In a word: unsustainable.

But this isn’t any business genius, it’s merely on par with the concept of supply and demand. If there isn’t demand, well, you might want to think about reducing your supply. Similarly, if there is a decline in the cash coming into the business, it’s best to conserve what’s going out of the balance sheet. This has not been the time to invest tens of billions of dollars in a new project when the industry is hurting from all angles (iOS privacy changes, economic headwinds, etc.). This is a two-front war, and management needs to consider both in tandem.

Thankfully, it appears to be doing just that as it also works toward slowing its revenue growth deterioration.

Revenue Growth Stabilizing

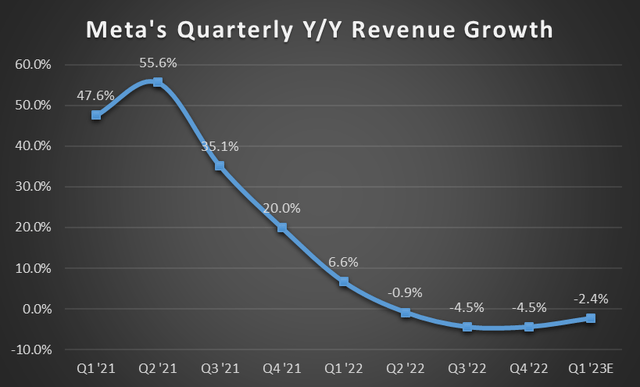

One of my main points in my pre-earnings article was the need to stabilize revenue growth. Cutting expenses is great and all, but if revenue continues to fall, expenses are going to be chasing. The report offered a glimmer of light after a troubling year where the company posted its first-ever quarter of negative revenue growth (which would continue for more than just a quarter). But now it appears there’s pressure on the wound.

Chart mine, data from Seeking Alpha

The company plans to invest much of its CapEx toward AI, not just for the metaverse but for internal product enhancements and improvements. This is key to improving revenue growth.

Let me explain why.

When iOS tracking signals were drastically changed with iOS 14.5 in 2021, it no longer allowed Meta to track an individual user through its ad journey. Knowing the demographic and data points of a user to target an ad is the first step. Tracking which of those users who saw the ad clicked the ad is the second step. And knowing which of those who clicked an ad bought the product is the full loop. This process continued to refine itself, leading to better ad targeting, which translated to less money spent by advertisers for an action.

It’s not the spray and pray method, it’s the shoot well, hit your target method.

This all changed when individual tracking (personalized ad targeting) became an opt-in experience with 14.5. iOS 14.5 changes prompted users to opt in versus opting out. The vast majority – 78% – have supposedly opted out (at least for the App store, but the statistic likely holds across most apps), which makes ad targeting a difficult game. Without being able to identify individual ad responses, the signal gets very muddy as it’s now around a cohort, or group of users, rather than a one-to-one match of user-to-action to protect privacy.

This requires Meta to rely on other methods to identify users best suited for a particular ad, as well as tracking the action or follow-up action. AI has become an increasingly efficient way of doing this. In the interim, after these privacy changes were implemented but AI was struggling to get off the ground, it was a manually intensive process to help advertisers meet their campaign goals.

This is the opposite of what Meta set out to do with Facebook ads in the beginning. The idea of automated auctions, ad placement, and ad targeting was to alleviate the human process; let the system do the work. And that was fine with direct one-to-one ad signals.

But now, a new paradigm must emerge to counteract this signal loss and regain the targeting ability Meta became known for.

Enter AI.

AI is the reason for a major part of CapEx dollar investments and the reason for the layoffs. AI has come a long way in both content moderation, content algorithms, and ad targeting, and now Meta’s management is moving fully toward this. And it’s not without tangible results:

In our broader ads business, we’re continuing to invest in AI and we’re seeing our efforts pay off here. In the last quarter, advertisers saw over 20% more conversions than in the year before. And combined with a declining cost per acquisition, this has resulted in higher returns on ad spend.

– Mark Zuckerberg, CEO, Q4 Earnings Call

…we’re investing heavily in AI to develop and deploy privacy-enhancing technologies and continue building new tools that will make it easier for advertisers to create and deliver more relevant and engaging ads.

– Susan Li, CFO, Q4 Earnings Call

If the company can continue to provide better ads and ad targeting more efficiently, then it’s going to bring back the advertisers who’ve reduced spend due to the cautious economy. In this sense, Meta will gain market share from other ad outlets and formats as it returns to the former glory of the best place to advertise.

The 20% year-over-year gain in conversions is telling, showing Meta is making progress against the iOS privacy headwinds, which is good because Android may not be far behind in its own privacy changes. Getting to a near fully AI system is paramount for the business on all fronts, from a better end-user product to a better way to mine advertising dollars.

Meta Is Now On The Right Track

It took the company longer than needed to get to where it should be in terms of priorities and expenses. However, now that it’s arrived at priority station, the progress looks to be coming along quickly. A reduction in expenses and CapEx will allow the cash flow to remain open. Currently, estimates are for 5% year-over-year revenue growth, which should end margin contraction if expenses come in at the midpoint.

The progress the company is seeing with AI is encouraging, notably around increased conversions. Abating headwinds with Reels monetization is another major headwind the company expects to be neutral on by year-end.

All of this means the worst is behind the company in terms of battles, though the fight to overcome signal loss isn’t over. The continued investments in AI should prove themselves as the year progresses and revenue growth turns positive outside of the easy comp lap coming up.

The stock has some more room to run, though it may begin to consolidate after being up almost 120% off its October lows. A pullback would be healthy and would be the opportunity to add with an eye toward $250 as the year progresses.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Decrypt The Cash In Tech With Tech Cache

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, become one of my subscribers risk-free with a free trial, where you’ll be able to hear my thoughts as events unfold instead of reading my public articles weeks later only containing a subset of information. In fact, I provide four times more content (earnings, best ideas, etc.) each month than what you read for free here. Plus, you’ll get ongoing discussions among intelligent investors and traders in my chat room.