Summary:

- Opendoor Technologies is a disruptive technology company which aims to automate the house buying process.

- In the third quarter of 2022, the company beat revenue growth estimates but missed on earnings.

- Its stock is undervalued intrinsically and relative to historic multiples.

Jaskaran Kooner

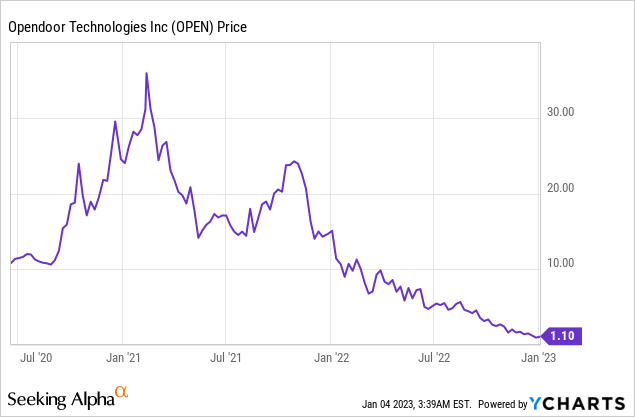

Opendoor (NASDAQ:OPEN) is on a mission to automate the home buying process and take market share in the fragmented real estate market, worth an estimated $2.3 trillion per year. Since its IPO in 2020, the company has increased its revenue by over 167%. Despite this progress, its stock price has been butchered by nearly 97% from its all-time high in February 2021. Given these factors, Opendoor is now deeply undervalued according to my valuation model and a potential opportunity for a contrarian investor. However, the company still has many challenges ahead, given the declining housing market and recessionary environment. Thus, in this post, I’m going to break down its business model, financials, and valuation, let’s dive in.

Business Model

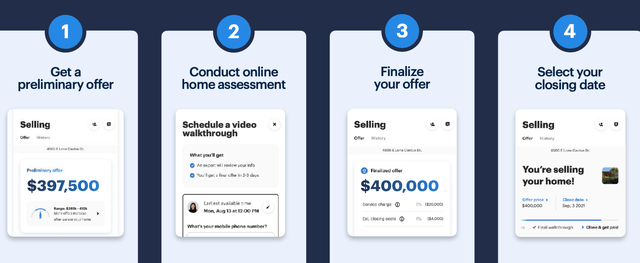

Opendoor technologies focuses purely on automating the house-buying process, with its “iBuying” methodology. The home buying/selling market is heavily fragmented with over 6 million homes sold annually and over 3 million realtors across the U.S.A. The current process for selling a home is time-consuming, expensive, and clunky, with multiple stakeholders. Opendoor has streamlined this entire process with a four-step “buy it now” solution. This involves getting a “preliminary offer”, doing a video walkthrough, before finalizing the offer and selecting a close date.

Opendoor process (Investor Presentation)

The Real Estate industry is one of the last to be “digitally transformed”, and I often think to myself, why hasn’t someone already done this? Opendoor is arguably the furthest ahead in the world and long term, the company aims to make the process as easy as “buying a car” or “booking a flight”. Its plan is to create a managed marketplace, where buyers can transact directly with each other. In the fourth quarter of 2022, the company launched this marketplace in Dallas-Fort Worth and Austin, under the name Opendoor Exclusives. This is a major deal as effectively it means the real estate market can become more “liquid”, which could change the face of real estate as we know it. Of course, with Opendoor being the enabler, it will take a cut of every transaction where it is not buying/selling homes itself.

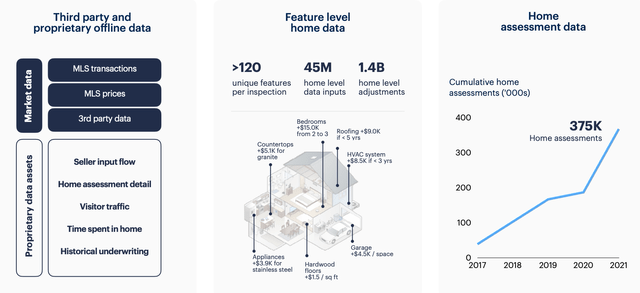

The company still has a major challenge ahead though, previously I did posts on Zillow (Z) and discussed its disaster with its “iBuying” process. Zillow has now “wound down” its ibuying business completely. A positive for Opendoor is it means it has less competition in the market and Zillow has even partnered with them for a referral type ibuying scheme. However, there are still questions as to whether automated home buying is even a sustainable business model. Zillow failed because its models “failed to predict” home prices. Opendoor believes its models are more accurate and given this is the core of its business, one would expect better. Opendoor’s data set includes a variety of sources from market data, to feature-level home detail and past underwriting.

Opendoor data (Investor presentation)

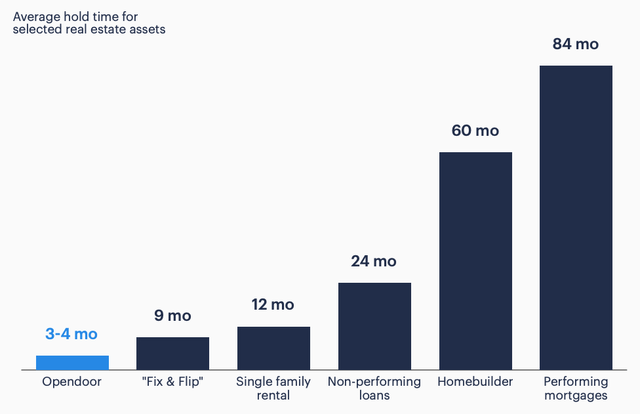

Opendoor has also learned from the past mistakes Zillow made by only holding its properties for 3 to 4 months. In addition, ~35% of its inventory is under a resale contract at any given time, which further reduces its risk profile.

Opendoor 2 (Investor Presentation)

Financial Review

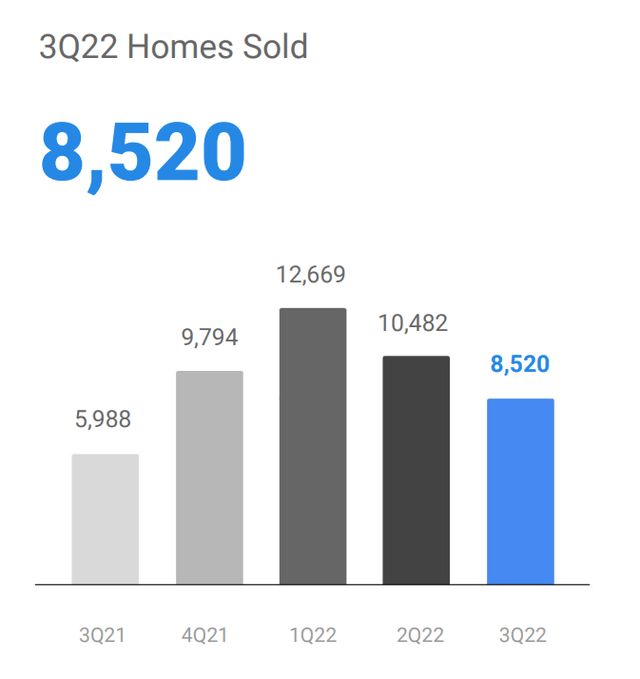

Opendoor reported solid financial results for the third quarter of 2022. Revenue was $3.36 billion, which beat analyst estimates by $639.68 million and increased by a solid 48% year over year. The company sold 8,520 homes in the quarter which was down from the prior three quarters but still increased by 42% year over year.

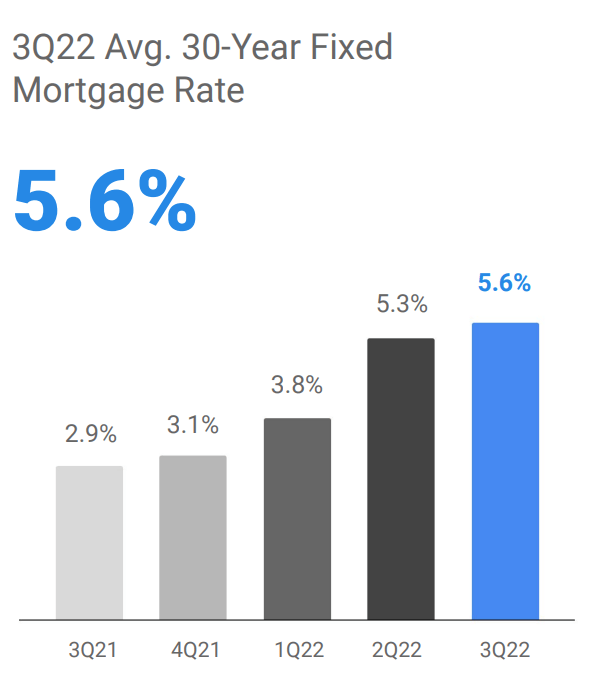

The main decline in home sales looks to have been mostly driven by a tepid macroeconomic environment. The high inflation numbers have caused the Fed to raise its federal funds rate, which acts as a leading indicator for the broader interest rate environment. In this case, we can see the average 30-year fixed mortgage rate is 5.6%, up from just 2.9% in the same quarter last year.

Mortgage Rate Opendoor (Q3,22 report)

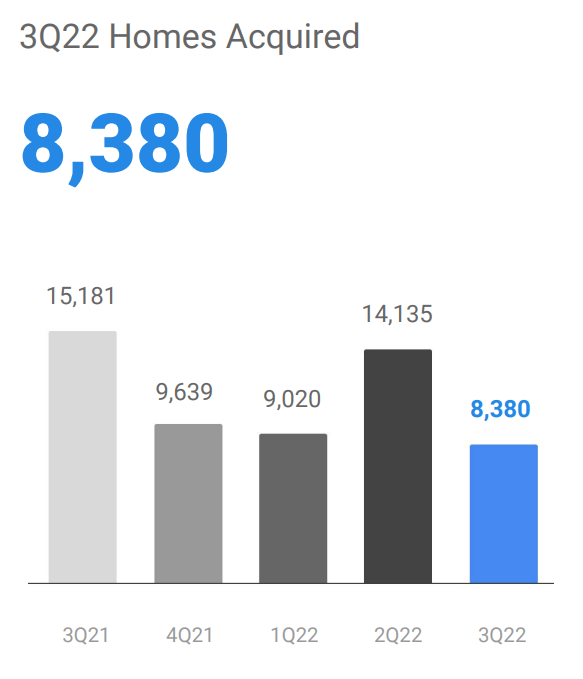

Opendoor has continued to buy homes, albeit at a lower rate than the past few quarters, which is prudent. For example, Opendoor acquired 8,380 homes in the third quarter of 2022, which was down substantially from the 14,135 in the second quarter of 2022. As Opendoor runs a house buying/selling business it must carefully manage its inventory so it’s not left with a “Zillow scenario”, where house prices spiral down and it’s left holding the “keys” to many houses.

Homes acquired (Q3,22 report)

Given the tepid macroeconomic environment, Opendoor has also introduced new tacts such as driving “expedient” inventory sell through and increasing its acquisition spreads, to ensure a greater margin of safety. In the third quarter of 2022, Opendoor had 40% of its second-quarter properties under resale contract, which is above its average of ~35%. Management aimed for 65% of its properties under contract by the end of the fourth quarter of 2022, so we will find out whether they achieved this on the next earnings call, which I will cover here.

Opendoor has also expanded its customer base through the inclusion of institutional buyers. I think this is a strong strategy, as these buyers are often more consistent no matter what the market conditions are. In addition, they have the “dry powder” to buy at scale, which adds to the predictability of Opendoor’s revenue. In 2022, institutional buyers made up 10% of its homes purchased directly, overtime I would like to see this metric increasing. The beauty of this system is over 1,800 were already on a resale contract, before they were closed with sellers. This is great for price security and liquidity. In Opendoor’s exclusive marketplace platform, it has 20% of its homes listed under contract within just two weeks, which is a positive for its direct buyer base.

Profitability and Balance Sheet

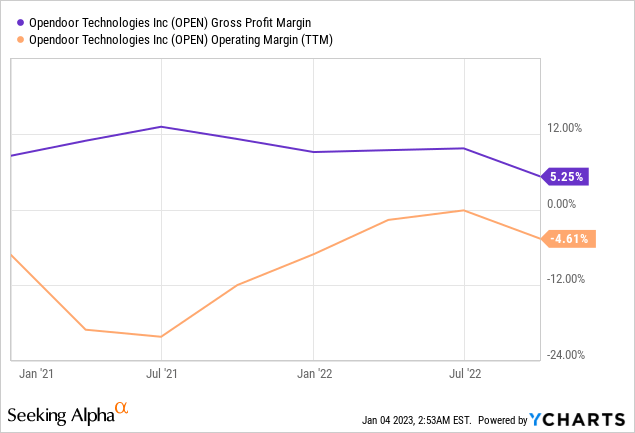

Onto profitability or the “lack of”, its Operating income ballooned from negative $68 million in Q3,21 to negative $809 million by Q2,22. The company reported earnings per share [EPS] of negative $1.47, which missed analyst expectations by negative $0.94. On a non-GAAP basis, the result was slightly better with negative $0.52 EPS reported, below analyst estimates by negative $0.11.

These poor results were driven by lower unit margins, which were caused by the “accelerated” sell-through of its properties. Selling its properties faster as the housing market turns makes sense but it still doesn’t help ease the pain in the short term. The company reported adjusted operating expenses of $190 million, which was aligned with guidance. A positive is the company reduced its marketing spend during the third quarter, to adjust to the lower demand.

As of the end of the third quarter of 2022, Opendoor had $1.5 billion in unrestricted cash and short-term investments. In addition to $1.5 billion of equity invested in its homes. Management decided to expand its “borrowing capacity” to $11.8 billion, which was much higher than the $8.6 billion committed. The idea is for Opendoor to use this extra capacity for home financing, while also giving the business flexibility for when it has to buy and sell. Any good house trader will know the goal is to “buy low and sell high”, not the other way around.

Moving forward management, guided for Q4 revenue between $2.3 billion and $2.5 billion. This is lower than the third quarter result of $3.36 billion, which is expected due to the tough macroeconomic environment for housing. The fourth quarter is usually a seasonally “soft” quarter for the housing market in general, as sellers often prefer to stay where they are for the holiday period.

A positive is management has forecast adjusted operating expenses of ~$145 million in Q4, which is less than the $190 million reported in Q3,22. This has been driven by aggressive cost-cutting including a substantial 18% reduction in employees, which resulted in 550 people being laid off.

For the full year of 2022, the company is expected to generated $530 million in “contribution profit”, at approximately a 3.5% margin. This is just below management’s target range of between 4% and 6%, which given the macroeconomic environment isn’t bad.

Advanced Valuation

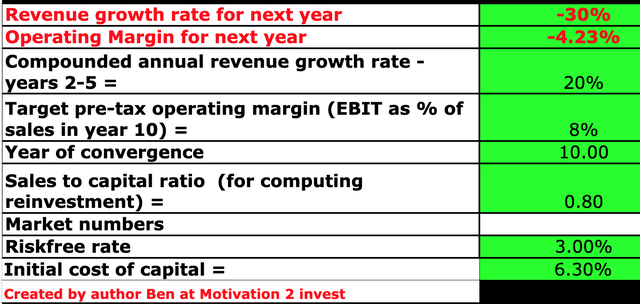

I have plugged the latest financials into my discounted cash flow valuation model. I have forecast negative 30% revenue growth for next year, given the tepid housing market. However, in years 2 to 5, I have forecast 20% revenue growth per year on the back of a rebound in the housing market, as it has historically been cyclical.

Opendoor stock valuation 1 (created by author Ben at Motivation 2 invest)

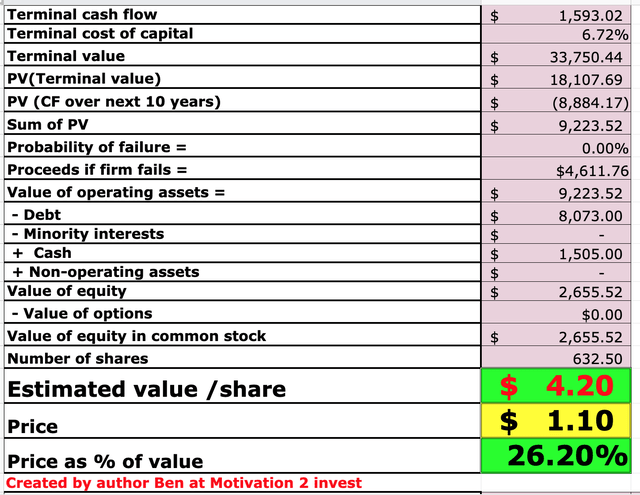

I have capitalized the company’s R&D expenses to increase the accuracy of the valuation model. In addition, I have forecast an 8% operating margin in the next 10 years. This is fairly optimistic and I expect it to be driven by increased adoption of its “Exclusives” marketplace and more digitization of the process. I would like to see Opendoor pivot to more of a marketplace enabler, which should result in improved margins. Its customer base of institutional investors is also likely to act as a tailwind toward growth.

Opendoor stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $4.20 per share, the stock is trading at ~$1.10 per share and thus is ~75% undervalued.

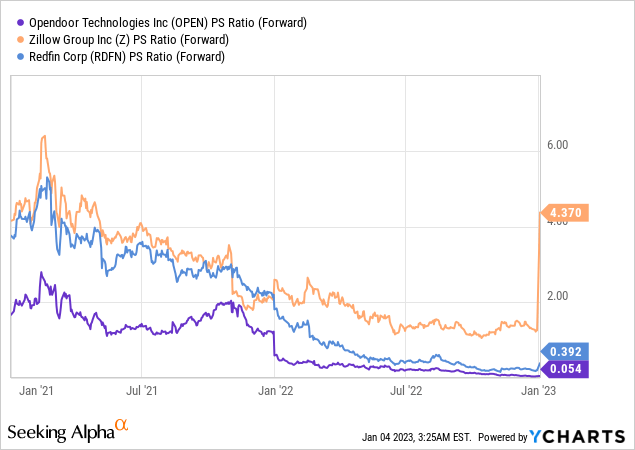

Opendoor trades at a Price to Sales ratio = 0.054, which is 99% cheaper than its 5-year average. Relative to other real estate stocks such as Zillow and Redfin, Opendoor looks to be trading the cheapest.

Risks

Business Model Risks/Housing market

Zillow failed at the home buying/selling game and thus this is a major red flag over Opendoor and its ability to execute long-term. This risk is heightened given we are currently going through a cyclical downturn in the housing market and many analysts have forecast a recession.

Final Thoughts

Opendoor has a bold vision to automate the entire home-buying process. This is a major challenge, but if the company can sustain its business model through a tough economic environment, its potential is huge. I believe the company’s pivot towards a marketplace model, with institutional investors, is a strong positive. This will likely result in greater revenue predictability and stability. In addition, its stock is undervalued intrinsically and relative to historic multiples, thus it could be a great long-term investment for a contrarian investor.

Disclosure: I/we have a beneficial long position in the shares of Z either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.