Summary:

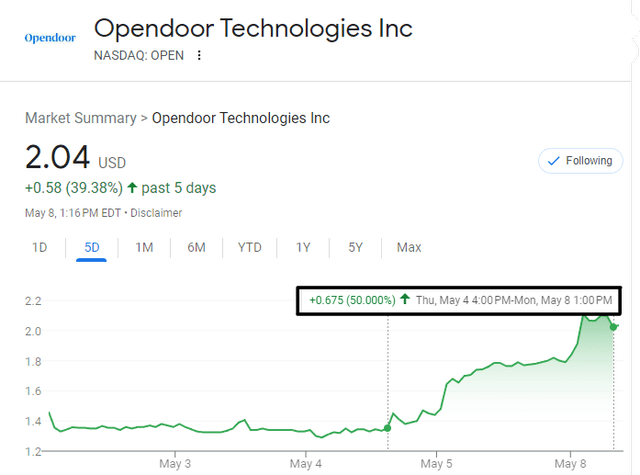

- In the aftermath of its Q1 2023 earnings release, Opendoor’s stock is up ~50% in a couple of trading sessions.

- For Q1, Opendoor delivered a double beat on the back of stronger-than-expected market clearance rates.

- With worsening supply constraints allowing home prices to hold up well amid a demand crunch caused by higher mortgage rates, the housing market remains in limbo.

- However, Opendoor has worked through most of its inventory problems, and unit economics are likely to turn back to positive in the second half of this year.

- Given the asymmetric risk/reward opportunity on offer, I rate Opendoor a generational buy at ~$2 per share.

Wasan Tita/iStock via Getty Images

Introduction

On 4th May 2023, Opendoor (NASDAQ:OPEN) published a promising quarterly earnings report, wherein the iBuying leader’s net losses narrowed to ~$101M, and management guided for a return to positive contribution margins by Q3-2023. Consequently, Opendoor’s stock has jumped up by ~50% over the last couple of trading sessions as investors cheer the Q1 report.

Now, despite this significant bounce, Opendoor is still trading close to its book value. And in my view, the opportunity to buy a (potentially) monopolistic real estate e-commerce platform at such depressed levels is unlikely to last for much longer, especially when the unit economics are set to turn positive again in a matter of months, and most competitors have conceded defeat to partner up with Opendoor.

As a long-term investor, I like to look beyond near-term business volatility, and in Opendoor, I see a generational company in the making. Here’s what I wrote about Opendoor in my last update on the iBuyer:

Opendoor is building the way future generations will transact real estate 10, 20, and 50 years from now. And the official launch of Opendoor Exclusives is a key milestone for the iBuying pioneer. In the long run, this shift from a 1P to the 1P-3P hybrid model will reduce the capital risk for Opendoor whilst increasing scalability and improving the margin profile. Opendoor’s iBuying rivals are folding up in a hurry, and it could emerge as a monopolistic platform by the end of this ongoing downturn in housing markets.

Due to the rapid reversal in housing markets since May 2022, Opendoor’s top and bottom line performance weakened significantly in Q3 (2022). With home prices still in decline, Opendoor’s financial performance is likely to deteriorate further in Q4; however, most of the bad news has already been reported in Q3 (in the form of a massive inventory writedown). While Opendoor’s cash flows are set to bottom out next quarter, I think Opendoor will not return to positive operational cash flows until H2 2023. Given the uncertain macro environment, Opendoor’s stock may continue to remain under pressure in the near to medium term. That said, at less than a $1:$1 valuation (less than book value), Opendoor is a once-in-a-lifetime investment opportunity!

As we saw in this note today, Opendoor has ample liquidity (~$3B) to survive through this downturn. Now, I understand that a rapid 20-30% crash in house prices can wipe out Opendoor’s book value; however, going forward, I expect the reset (or correction) in housing to be a slow burn lower. As a market maker, Opendoor has widened its offer spreads significantly in Q3, and it is still getting sellers (real seller conversion rate of 10-15% in this quarter). Opendoor is currently undergoing an inventory reset, and once that is completed by Q2 2023, I see Opendoor returning to positive contribution margins (and cash flow breakeven). Investors may need to remain patient in this counter over coming months and endure volatility. Opendoor is not a stock for the faint-hearted! Therefore, I suggest accumulation via DCA plans and proactive risk management through option-based hedging strategies.

Source: Opendoor Q3 Review: Don’t Miss The Forest For The Trees

Over the last six months or so, Opendoor’s business and stock performances have trended in line with my expectations. At our investing group, The Quantamental Investor, we have been buying up OPEN stock via DCA plans as it traded in the $1 to $2 range in recent months. With this post-earnings bounce, our Opendoor position is nearing breakeven, and I think there’s a lot more upside room ahead.

My original investment thesis and subsequent research updates for Opendoor are available on SA:

- Opendoor: All Aboard The Roller Coaster [21st March 2022]

- Opendoor Is The Ultimate Stock For A High Inflation Environment [5th May 2022]

- Opendoor Is At An Inflection Point [23rd May 2022]

- Opendoor Q2 Review: Decent Earnings, Weak Guidance, Killer News (Zillow Partnership) [11th August 2022]

- Opendoor: A Generational Buy For Bold, Contrarian, Long-Term Investors [26th September 2022]

- Opendoor Q3 Review: Don’t Miss The Forest For The Trees [22nd November 2022]

In this note, we will review Opendoor’s Q1 2023 results and assess the company’s outlook for the next quarter. Furthermore, we will analyze Opendoor’s liquidity situation and revisit its valuation in light of its latest earnings report.

Demystifying Opendoor’s Q1 2023 Numbers

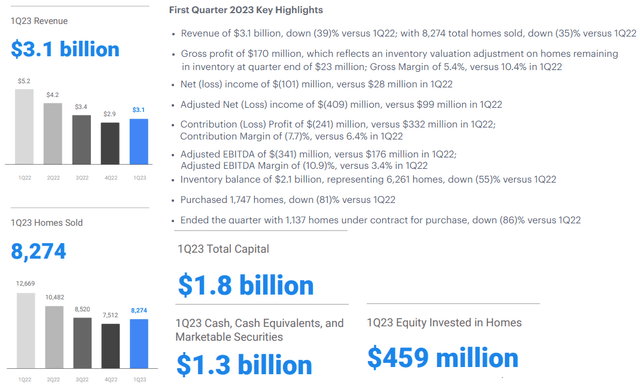

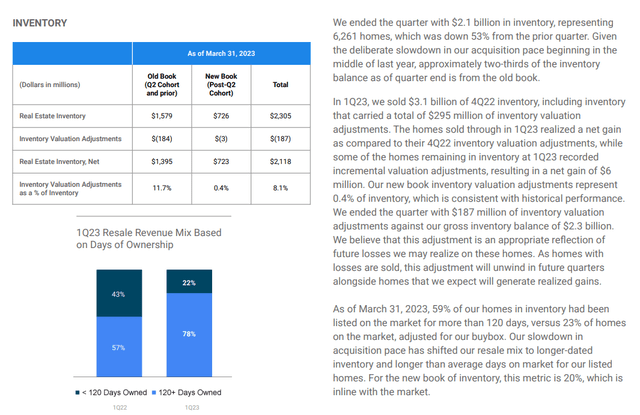

For Q1 2023, Opendoor’s revenue came in well ahead of projections at $3.1B (est. $2.55B) as market clearance rates of ~3% outperformed expectations of 1-2% (typical Q1 market clearance rate from 2014-2020). While housing demand has collapsed under the weight of higher mortgage rates, prices have held up in recent months as the housing supply has gotten even more constrained as sellers have moved to the sidelines (hanging onto their low (2-3%) interest rate mortgages).

And this dynamic is helping Opendoor get rid of its toxic “Q2-offer cohort” inventory faster than expected. Here’s some commentary from the Q1 2023 shareholder letter:

Notably, 92% of the homes we made offers on between March and June of 2022 (the “Q2 Cohort”) were sold or in contract as of the end of the quarter, versus our prior expectation of 85%.

During Q1 2023, Opendoor was once again a “net seller” of homes, as it sold 8,274 homes (down -35% y/y) whilst acquiring only 1,747 homes (down -81% y/y). According to Opendoor’s management, the sharp reduction in acquisitions has been driven by two primary factors:

1. Sellers being in a holding pattern (low housing supply, new listings down -27% y/y in March 2023), and

2. Lower offer-to-contract true seller conversion due to higher spreads baked into Opendoor’s offers.

Highlights from Opendoor’s Q1 2023 report:

Opendoor Q1 2023 Shareholder Letter

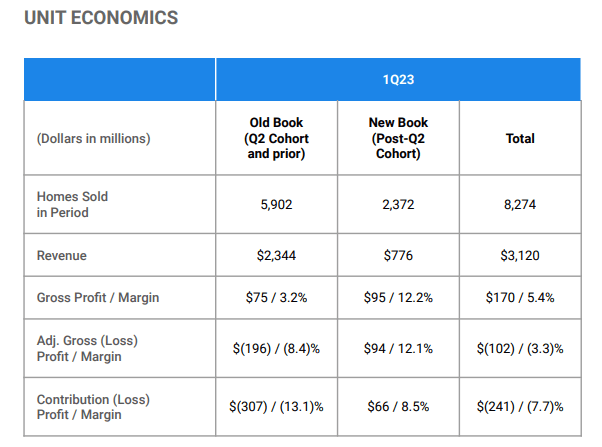

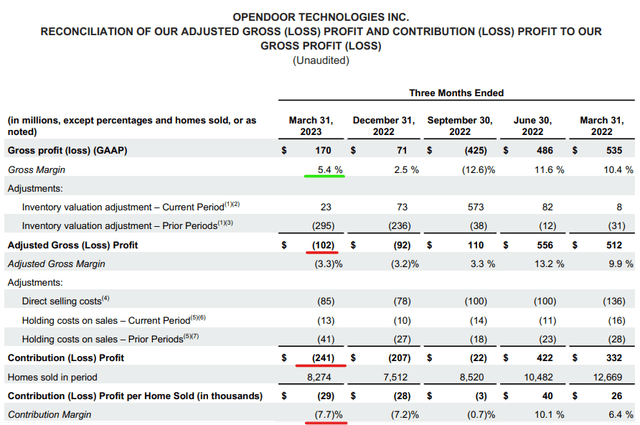

Despite robust margin performance from its new book of inventory, Opendoor’s contribution margins fell to -7.7% in Q1 2023 as the resale mix remained highly tilted towards the old book of inventory.

Opendoor Q1 2023 Shareholder Letter Opendoor Q1 2023 Shareholder Letter

Due to heavy resale losses, Opendoor’s contribution margins (unit economics) turned negative in Q3 2022, and have now remained in the negative territory for the last three quarters. And despite working through nearly 92% of its “Q2-offer” cohort, Opendoor is set to report negative contribution margins for at least one more quarter, given the current state of its inventory.

Opendoor Q1 2023 Shareholder Letter

What’s In Store For Q2 And The Rest Of 2023?

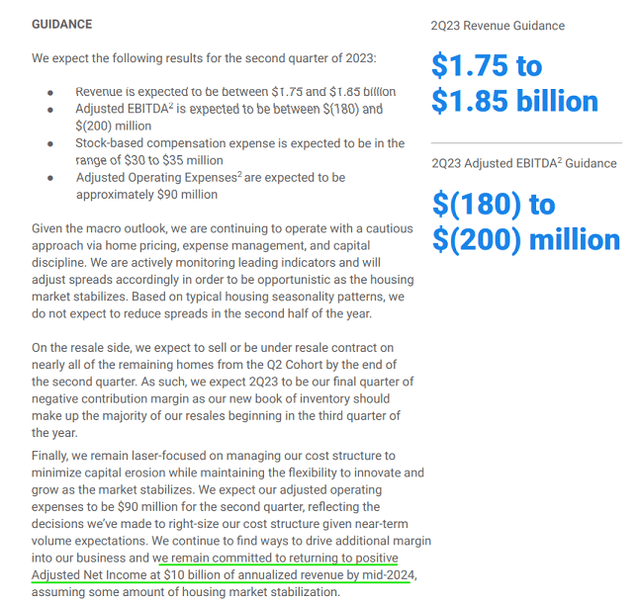

For Q2 2023, Opendoor guided for revenue and adj. EBITDA to be in the range of $1.75B to $1.85B and -$180M to -$200M, respectively. While Opendoor’s contribution margins are set to remain under pressure in Q2 2023 as the iBuyer works through the last batch of its “Q2-offer” cohort, I think the company getting back to positive contribution margins in the second half of 2023 would be an incredible feat considering the macroeconomic environment.

Opendoor Q1 2023 Shareholder Letter

According to Opendoor’s management, the inventory reset will be completed in Q2 2023, and the business could return to positive adj. net income by mid-2024 at ~$10B annualized revenue. Despite persistent uncertainty around the housing market and the economy in general, the outlook for Opendoor’s business performance is looking much better than it did a few months ago.

Assessing Opendoor’s Liquidity Situation

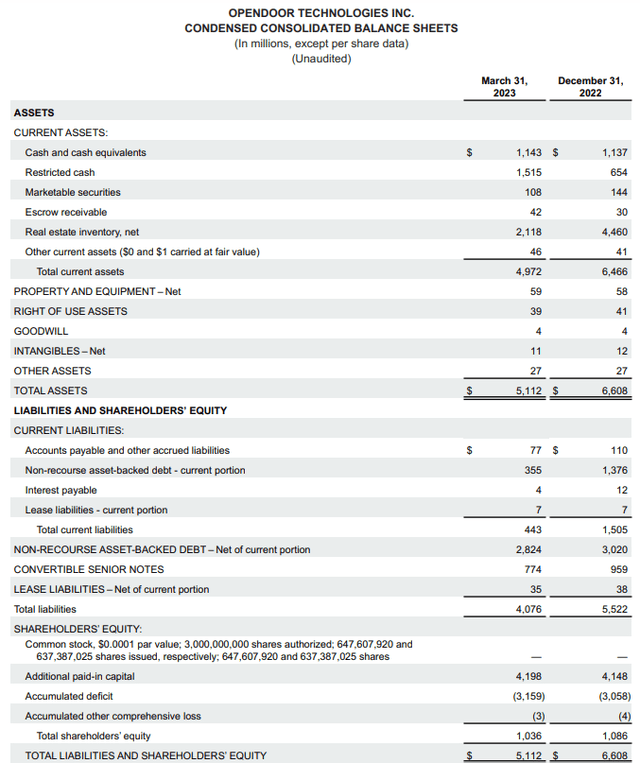

After resale losses wiped out nearly $1.2B of Opendoor’s book value in the second half of 2023, the company’s liquidity situation has come under immense scrutiny, with Mr. Market pricing Opendoor for an imminent bankruptcy in recent months. However, I have a very different view here.

With a total cash (unrestricted + restricted) position of ~$2.6B, I continue to believe that Opendoor has ample liquidity to ride through this housing downturn. The macroeconomic outlook remains uncertain; however, the worst of the cash burn for Opendoor is behind us. With reduced inventory levels, Opendoor is unlikely to suffer big losses as it did in H2 2022 (due to the most aggressive interest rate hike cycle in history) for the foreseeable future.

Opendoor Q1 2023 Shareholder Letter

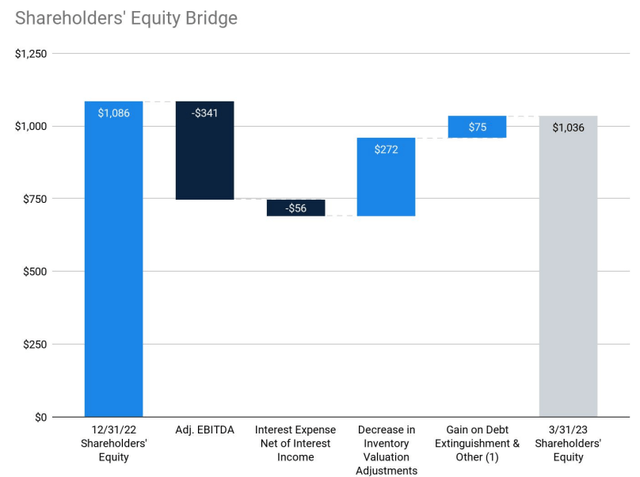

While investors have been panic-selling OPEN stock, the company remains well-capitalized, and management has made concrete progress on stemming losses. In Q1 2023, Opendoor’s shareholder equity dropped by just $50M. Now, I understand that a reduction in book value is not ideal, but I am happy with management’s focus on preserving shareholders’ equity value.

Opendoor Q1 2023 Shareholder Letter

With Opendoor’s contribution margins expected to return to positive territory in the back half of 2023, I think the liquidity/bankruptcy fears are overblown. In addition to its balance sheet, Opendoor had ~$10.7B in borrowing capacity as of the end of Q1.

Opendoor Q1 2023 Shareholder Letter

While I have a cautious near to medium-term outlook for the economy, I think any housing market downturn will be a slow burn lower on prices going forward. When the housing market rebounds, Opendoor will be there to pounce on its humongous TAM opportunity [most of its rivals won’t survive this downturn]. Considering everything, I like Opendoor’s balance sheet power and borrowing capacity.

Business Highlights From Q1 2023

So far, we have studied Opendoor’s financial performance; however, as with all early-stage growth businesses, we need to look beyond the financials to understand where the puck is headed and not where it is right now. As I said in my last update, I am thrilled with how Opendoor is navigating through the current macroeconomic environment, and I remain convinced of Opendoor’s ability to digitally transform the archaic real estate transaction process.

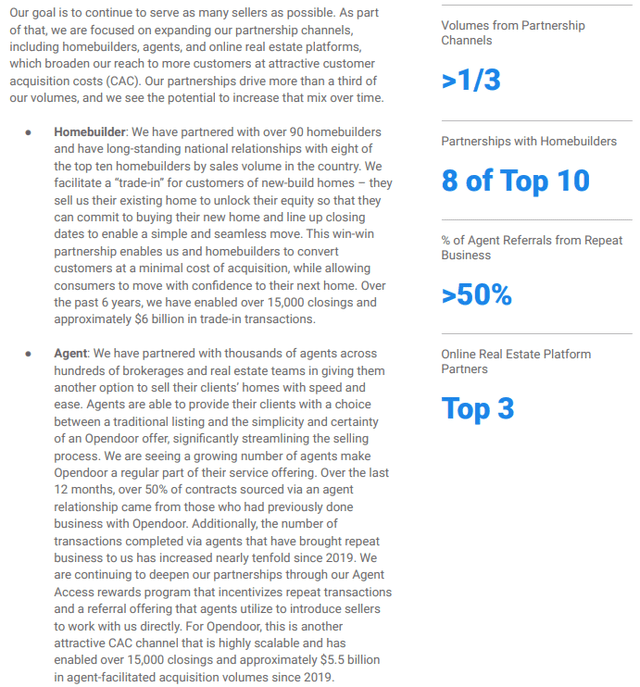

While investor confidence in the “iBuying” business model is next to non-existent, I think Opendoor has all the ingredients required to ride out the ongoing downturn in housing and emerge as a dominant, monopolistic platform business on the other side. Before Q3 2022, Opendoor had reported 20+ quarters of positive contribution margin. However, my confidence in Opendoor stems from its growing list of partnerships:

Opendoor Q1 2023 Shareholder Letter Opendoor Q1 2023 Shareholder Letter

Now, I understand that Opendoor’s core 1P business is currently losing money; however, with all of its credible rivals deserting the space and partnering up with Opendoor, I see a bright future ahead for the iBuying pioneer.

For those following my work on Opendoor, you already know that my investment thesis has always been based upon Opendoor shifting from a low-margin, 1P marketplace model to a high-margin, 3P marketplace model. And management’s positive commentary on Opendoor Exclusives is precisely what I wanted to hear as a long-term shareholder. Since the early results of Opendoor Exclusives are limited to one market (Plano, TX), I am not getting overly excited here. However, I do think that Opendoor’s 3P marketplace could be an absolute game changer in the real estate market. In my view, Opendoor Exclusives will be additive on volumes and accretive to margins [5% seller fee, no selling or financing costs], whilst it would also reduce capital risk.

With ~$2.6B in total cash (restricted [$1.5B] + unrestricted cash & short-term investments [$1.1B]) and ~$10.7B in borrowing capacity ($4.9B committed financing), I think Opendoor has adequate liquidity to get through this tumultuous period and emerge as a dominant 1P-3P real estate e-commerce platform on the other side of this housing market downturn.

Let us now evaluate Opendoor’s intrinsic value and projected returns.

Opendoor’s Fair Value And Expected Return

For 2023, I am still projecting Opendoor to achieve ~$10B in revenue, with housing demand and supply likely to remain constrained in the near term as consumers (buyers and sellers) adjust to elevated mortgage rates (~6%). With housing supply still being constrained, I expect home price declines from here to be a slow burn lower (similar to what we saw during the Great Financial Crisis). In a bear market, Opendoor’s value proposition improves significantly for sellers, and Opendoor could realistically charge a higher spread in a buyer’s market (bear market). We have seen evidence of this business model feature in Opendoor’s recent quarterly reports, where real-seller conversion rates have come in at 10-15% (down from 30%+) despite Opendoor raising spreads very significantly.

Over the long run, I see Opendoor’s transaction spread (difference between buy and sell price) stabilizing in the ~3-5% range. As we know, Opendoor charges a service fee of 5% to sellers. Furthermore, I believe that Opendoor could generate another ~3-5% margins from the sale of ancillary services (financing, moving, insurance, warranty, renovations, etc.) to buyers. Overall, Opendoor can end up generating ~10-15% in gross margins at the unit level in its 1P business. At scale, Opendoor aims to get its Operating Expenses down to ~3% and Interest, D&A, and Tax expenses down to ~2%. I believe these targets are achievable. Hence, a 5% long-term margin assumption for Opendoor’s 1P business is not out of whack with reality.

The unit economics and volume outlook for Opendoor’s 3P marketplace (Exclusives) are not yet clear, but we do know that the service fee for sellers will still be ~5%. In my opinion, Opendoor can also generate additional fees of ~3-5% from buyers for various services in the long run. And if Opendoor can build an advertising & discovery business on top of its platform (like Zillow), then margins could go even higher. If Opendoor Exclusives succeeds, the sky is the limit for Opendoor in terms of scalability; after all, residential real estate in the US alone is a $1.9T addressable market opportunity.

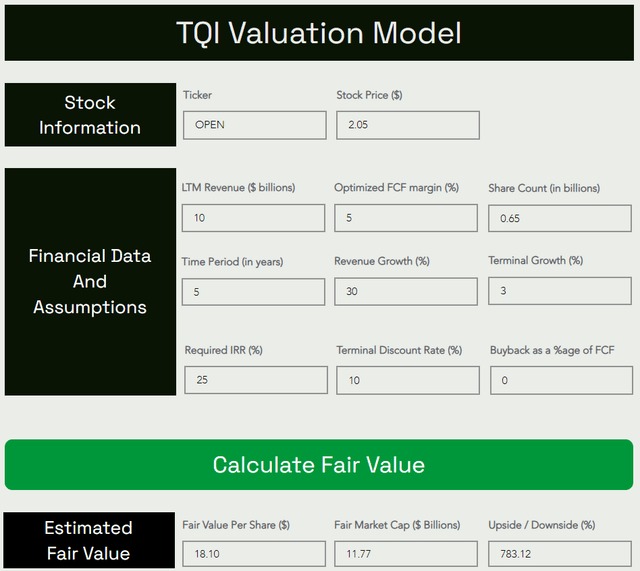

In a nutshell, I continue to believe that Opendoor’s free cash flow margins could reach ~6-10% at maturity. To implement a margin of safety, I chose an optimized FCF margin of ~5% in my valuation model for the company. Despite a downturn in housing driving negative growth at Opendoor right now, I think Opendoor (and iBuying) is still at a nascent stage, and this means Opendoor could grow through and beyond this downturn after its inventory reset is complete. Therefore, I am maintaining my 5-yr CAGR revenue growth forecast at 30%. Please note that Opendoor Exclusives (3P marketplace) will likely create a significant impact on the bottom line, but little impact on the top line.

Under TQI’s required IRR [discount rate] of 25% (for moonshot growth investments), Opendoor’s fair value came out to be ~$11.77B (i.e., $18.1 per share). With the stock trading at $2.05, it is currently trading at a significant discount to its fair value. Mr. Market has no faith in the iBuying business model, and Opendoor’s depressed valuation is a reflection of widespread FUD.

TQI Valuation Model (TQIG.org)

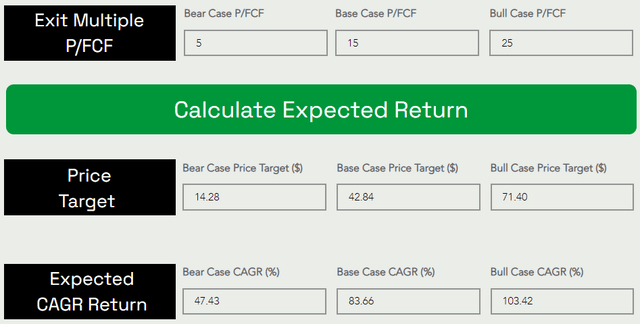

In a base case scenario, I expect Opendoor to trade at ~15x P/FCF (optimized FCF) at the end of 2027, which would be equivalent to ~0.75x 2027 P/S ratio based on my forward revenue projections shared above [most e-commerce platforms trade anywhere between ~1-3x P/S].

TQI Valuation Model (TQIG.org)

With these assumptions, I see Opendoor trading at ~$28B in market cap ($43 per share) by the end of 2027 [~20x current levels], which would translate to an expected CAGR return of ~84%+ over the next five years. Hence, I think Opendoor stock offers a truly asymmetric upside potential for investors.

OPEN’s Technicals And Quant Factor Grades

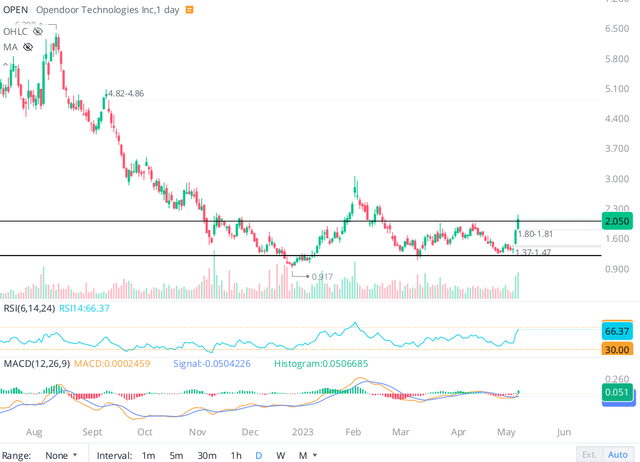

After an incredible fall from grace in 2021-22, Opendoor’s stock seems to be forming a Stage-I base in the $1-2 range over the past six months or so.

We have seen a ~50% bounce in OPEN stock over the last couple of trading sessions, and the stock is now trading at the upper end of this base formation. With the iBuyer likely to return to positive unit economics in H2 2023, Opendoor’s stock looks primed to break out to the upside from this Stage-I base formation within the next quarter or two.

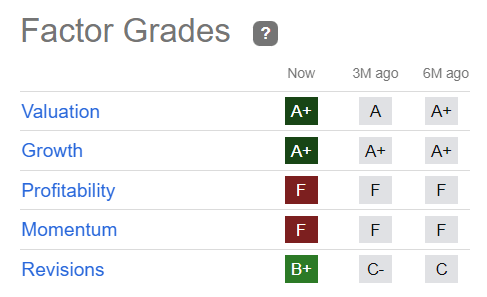

According to SA’s Quant Rating system, Opendoor gets an “A+” on “Valuation” and “Growth”, an “F” on “Profitability” and “Momentum”, and a “B+” on earnings “Revisions”.

SeekingAlpha

From a quantitative data-based perspective, Opendoor stock is a “Hold” [with a total score of 3.15/5 on SA’s Quant Rating system]. And technically, Opendoor is trading in a Stage-I base, which is an accumulation pattern. Hence, Opendoor’s isn’t necessarily a great near-term bet. However, I like it as a long-term investment, and I am satisfied with its “neutral” technical and quantitative data.

Final Thoughts

In my view, Opendoor has the right product, capabilities, capital, and team to not only weather the current market cycle but to emerge stronger on the other side of it. As real estate continues to move online, Opendoor’s 1P-3P platform is likely to be a big winner. While the near-term business outlook remains uncertain, Opendoor’s long-term risk/reward is truly asymmetric in favor of bullish investors. The company made material progress on its path to profitability during Q1, and I expect to see better financial performance in upcoming quarters.

Key Takeaway: I rate Opendoor a generational buy at $2 per share.

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At The Quantamental Investor, we make investing simple, fun, and profitable. To learn more about our community –> Click Here