Summary:

- Palantir’s Q1 FY2024 financials show sales growth, improved gross margin, and excellent cost management. But you should stay cautious.

- Expanded partnerships with tech giants such as Oracle should enable Palantir to maintain its growth rates in commercial segments.

- Despite potential growth drivers, even on bullish assumptions, PLTR appears to be a highly overvalued stock, although there are tailwinds from all sides.

- Based on my valuation calculations, the fair price by the end of FY2027 should be $17.62 – that’s around 17.35% below PLTR’s current stock price.

- I believe any earnings miss in the foreseeable future or slightly negative news can lead to potential losses for current buyers. Be vigilant.

Michael Vi

Intro & My Coverage History

I have been covering Palantir Technologies Inc. (NYSE:PLTR) here on Seeking Alpha since October 2021: I initially rated the stock as a “Sell” due to its overvaluation and seemingly limited growth at the time. My bearish calls were successful for about a year – until market expectations shifted towards rapid growth through AI, which allowed PLTR stock to recover quickly.

Due to persistent overvaluation, I couldn’t upgrade PLTR to “Buy”, even though the positive effects from their new-at-the-time AIP bootcamp program seemed quite obvious. Anyway, I upgraded the stock to “Hold” in February 2023 and have written about the company once a quarter since then, coming to either neutral or pessimistic conclusions (mostly neutral). In my last article on PLTR, I concluded that the AIP bootcamps had become the company’s “pearl” when it comes to revenue expansion, and I anticipated even more growth drivers once the company completed work on the Mission Manager project and began mass marketing it. But again, I couldn’t upgrade PLTR stock because at the time it traded at 46 times FY2027 earnings, which made the stock too overvalued even assuming stronger EPS growth than Wall Street expects today.

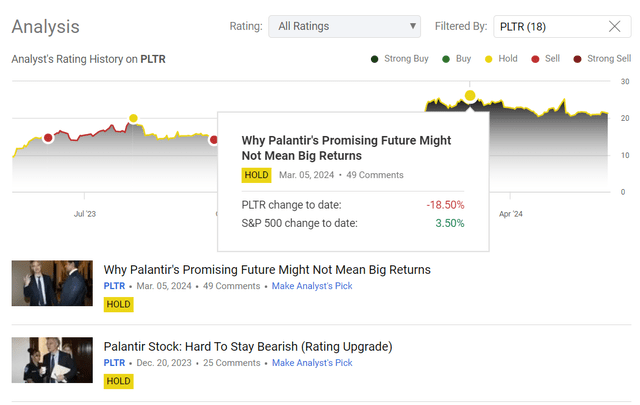

Since my last neutral call, the stock is down 18.5% while the broader market – the S&P 500 index (SP500) (SPX) is up 3.5%:

Seeking Alpha, my coverage of PLTR stock

It’s been a full quarter since I last looked at Palantir, so I thought it was a good time to revisit my thesis. I wanted to see how much progress Palantir has made in growing its business and maintaining profitability; more importantly, I wanted to determine if it makes sense to take risks on PLTR stock now, especially with its stock price currently consolidating.

Q1 FY2024 Review: Financials And Corporate Developments

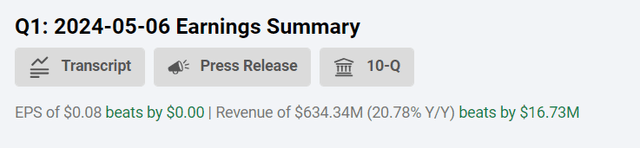

In Q1 FY2024, Palantir’s sales went up by approximately 21% YoY, with gross margin expanding to 81.7% from 79.5% last year thanks to better COGS management. The income statement shows that Palantir also has excellent operating cost management: Despite active sales growth in the first quarter, total operating costs rose by only 4.7% year-on-year, enabling the company to achieve 18-fold growth in EBIT. Strange as it may sound, I also like the fact that interest expense more than doubled – this indirectly indicates that the company is gradually moving away from SBC as a source of financing for its operations as it matures and relying more on debt (which is cheaper than equity according to financial theory). Thanks to good operating leverage, PLTR’s first-quarter EPS amounted to $0.08 (normalized), beating the consensus estimate by ~4% (actual revenue of $634 million beat expectations by 2.71%).

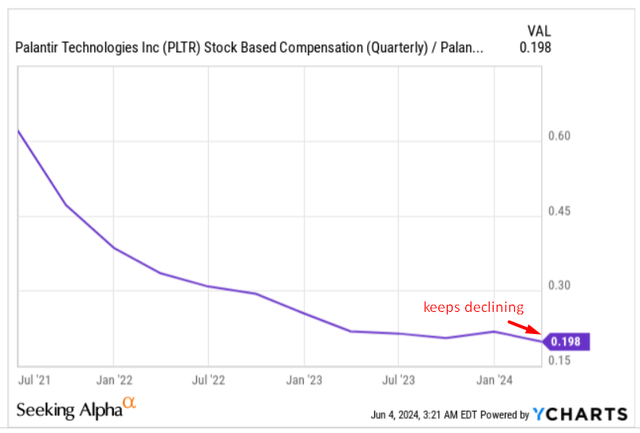

My indirect conclusions about the declining importance of SBC for the company’s growth are confirmed by the ratio of SBC to sales, which continues to fall from quarter to quarter. The absolute value of SBC increased by 9.5% YoY in Q1, based on the company’s cash flow statement, but with sales growth exceeding SBC growth by more than 2 times, I have to note this as an important positive trend.

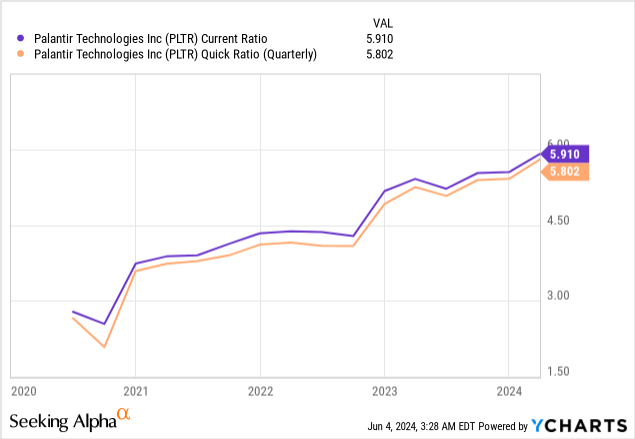

When we talk about the most important financial report – the balance sheet – we see relative stability here, with no clearly expressed worrying signs. Current assets grew by 7.2% quarter-on-quarter, while current liabilities only increased by 0.6% over the same period – this inevitably led to an improvement in liquidity in the first quarter. Looking at the current and quick ratios, PLTR’s liquidity actually looks more than adequate:

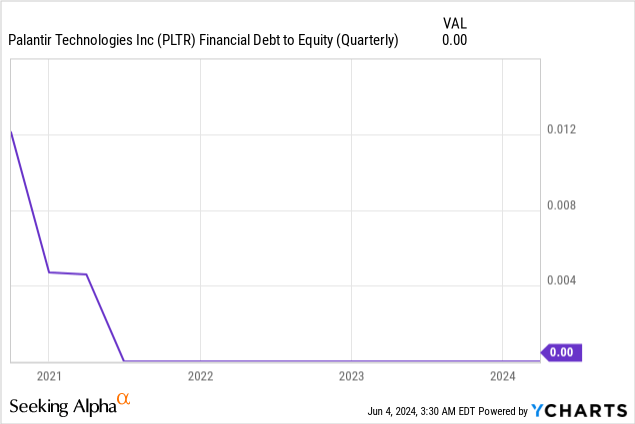

At the same time, the debt-to-equity ratio remains at 0 (even though interest expenses are growing).

There was quite a lot of very important news over the quarter.

Firstly, the U.S. Army confirmed that Palantir won a two-year contract to begin phase 3 on its next-generation targeting system (a $178.4 million agreement for the development of 10 TITAN prototypes). Relationships built over the years with government agencies allow Palantir to win almost all tenders in which it participates within the scope of its competencies (especially in the field of AI) relatively easily and without much competition. I have noticed that the market always reacts very positively to news about the next army contract, even though such contracts are usually spread over several years in advance and do not provide a marginal contribution to the company’s overall revenue pot in the short term. Recent contracts include the $480 million fixed-price contract from the U.S. Department of Defense for a prototype of the Maven AI system, which will develop an AI tool for processing images and full-motion videos from drones and automatically detecting potential targets.

According to Markets.us research, the global AI in military market size is expected to be worth ~$24.7 Billion by 2032, from $8.9 Billion in 2023 – the CAGR, therefore, should amount to around 12.4% during the forecast period, which is a lot.

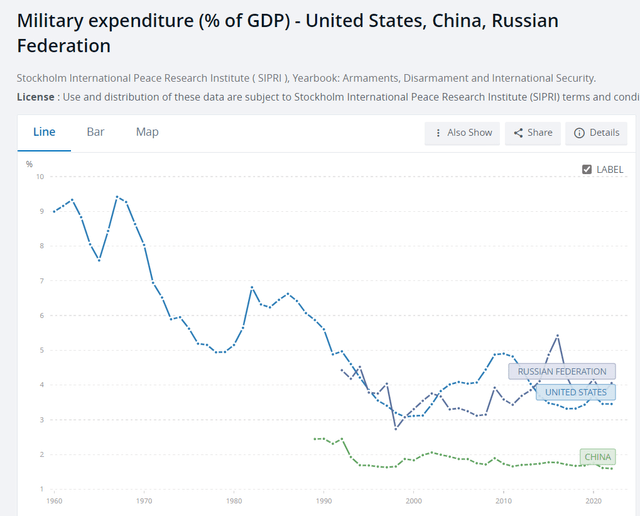

Palantir appears to be a worthy market leader in this industry, with a product range that is hard to beat. So the external backdrop for the company to grow and develop further adds up in the best possible way. The same applies directly to the opportunity to increase the overall US budget for the defense complex: Military spending as a percentage of GDP has been declining in the US for the past few decades, while geopolitical opponents such as Russia have militarized their economies for logical reasons (the below data is a bit outdated). China also spends quite a bit on its defense complex now.

I suspect the US will spend more on defense. Maybe not as a percentage of GDP, but certainly in absolute terms. And a significant portion of those costs will go directly to AI – that’s been debated in the Senate recently.

A bipartisan group of four U.S. senators, led by majority leader Chuck Schumer, have called for at least $32B in Congress spending on artificial intelligence over the next three years to “harness the opportunities and address the risks” associated with the technology.

The group of two Democrats and two Republican senators said the U.S. needs to build a consensus and address the matter, especially with countries like China investing heavily in its development. They published a joint report outlining broad policy recommendations.

Source: SA News

The second positive for Palantir is the success of the commercial side of the business and its recent collaboration with Oracle (ORCL). As Seeking Alpha reported, “the partnership will combine Palantir’s AI and decision acceleration platforms with Oracle’s distributed cloud and AI infrastructure to help organizations “maximize the value of their data.” I see a lot of synergistic benefits for both companies in this partnership.

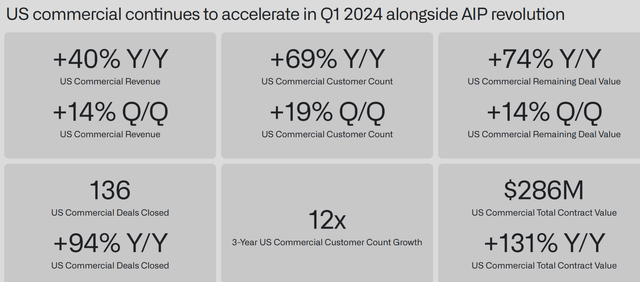

Expanded partnerships with tech giants such as Oracle should enable Palantir to maintain its growth rates in commercial segments. However, the main growth driver remains, as I mentioned in the last article, the AIP program, which only seems to be gaining momentum recently – at least the number of US commercial customers increased by 19% QoQ in Q1 FY2024, resulting in a 12x growth over the last 3 years.

The company predicts revenue in Q2 2024 to be between $649-$653 million (+22% YoY based on the mid-range), with adjusted EBIT between $209-$213 million. For the full year, they aim for $2.683 billion in the mid-range (+20.5% YoY), with a growth rate of at least 45% in US commercial revenue (which confirms my conclusions about the main growth drivers).

From a financial and corporate development strategy perspective, I have no questions for Palantir – let’s look at what growth potential can be derived from the company’s current valuation and market expectations.

Palantir’s Valuation Analysis Update

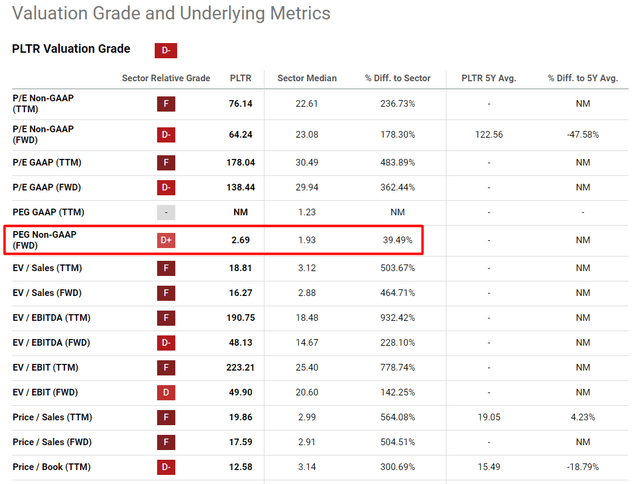

Unfortunately for the bulls, Palantir is still not inexpensive: Seeking Alpha’s Quant gives it a “D-” Valuation Grade – that’s the level we saw 3 months ago when the stock was trading 18.5% higher. So PLTR’s key multiples are still much higher than the sector’s averages – more than that, last time I mentioned PLTR had a great PEG ratio of 1.62x (21% lower than the sector’s norm at the time), but today, this metric has grown to 2.69x, which is 39.5% higher than the median:

Seeking Alpha, PLTR, the author’s notes

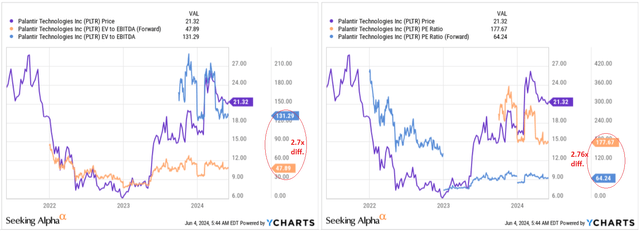

The bulls may argue that Palantir is a fast-growing company that can be forgiven if net profit or EBITDA is in double digits. I accept that, but everything has a limit. If you look at how much the EV/EBITDA and P/E ratios are expected to shrink next year compared to the TTM numbers, you’ll see a 2.7x contraction for these 2 ratios. However, if this forecast comes true, PLTR would still be too hot to handle in my opinion:

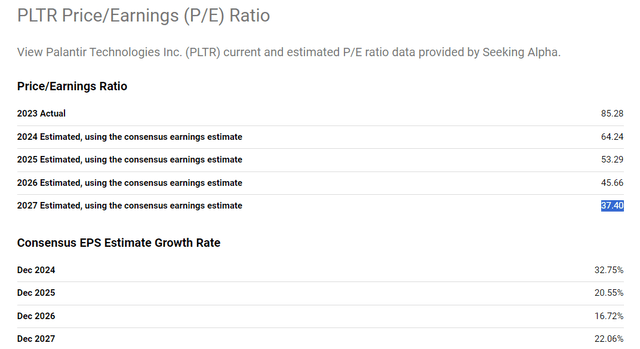

Unfortunately for Palantir shareholders, the market seems to be pricing the stock very expensively for the next few years to come: according to Seeking Alpha, PLTR’s price-to-earnings ratio will be ~37.4x in FY2027. However, according to consensus estimates, once Palantir becomes consistently profitable (this year), its EPS will grow at a CAGR of only 14.64% up to and including FY2027 – in my opinion, this is too little growth to justify such a high implied P/E ratio in 4 years.

Seeking Alpha, the author’s notes

Okay, what value then should be considered fair?

Nobody knows exactly what the PLTR price will be in a few years’ time. We can only assume that the strength of the end markets – especially the commercial segment ones – should help the company continue to beat Wall Street’s EPS and revenue estimates. Let’s assume that the FY2024 EPS consensus is understated by 10% and earnings grow at a 5% premium to current consensus estimates through FY2027. In this case, adjusted earnings per share in FY2027 would have to be ~$0.7 instead of the current expectation of ~$0.57 (that is, I assume a premium of almost 24%). This means that the long-term EPS CAGR should be 18x. Assuming that the valuation premium sustains, I assume the P/E ratio for FY2027 is 25x. In this case, the fair share price by the end of FY2027 would be $17.62 – around 17.35% below PLTR’s current stock price.

So even on bullish assumptions, PLTR appears to be a highly overvalued stock, although there are tailwinds from all sides.

The Verdict

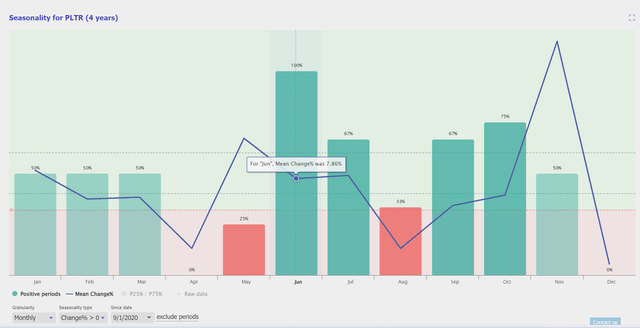

Of course, PLTR has a lot of chances to rise in the short term. First, AI euphoria seems undiminished, and if news of another contract win with the US Army suddenly emerges, enthusiastic Palantir fans could drive the stock price back above $25. Secondly, seasonality is on the side of the buyers today. Since 2020, PLTR stock is up an average of 7.86% at the end of June. So far in June, PLTR is only down about 2% – perhaps statistical power will prevail and PLTR will close higher at the end of the month.

TrendSpider Software, the author’s notes

Furthermore, I could be wrong in my conclusions about a significant overvaluation of the company – perhaps the EPS growth potential is much greater than the premium to Wall Street projections that I have included in my valuation calculations. In any case, the business continues to develop relatively quickly, with rising margins and good tailwinds from the end markets.

Despite all these positives, PLTR still seems too expensive for me to touch, even in a bullish scenario. I would encourage investors to remain vigilant, especially now that the share price continues to consolidate and the company’s valuation is not falling. I believe any earnings miss in the foreseeable future or slightly negative news can lead to meaningful losses for current buyers. Stay cautious.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!