Summary:

- Palantir’s Q2 revenue grew 27% YoY, with a 70% surge in US commercial revenue driven by AI adoption; GAAP net income hit a record $134M, and cash reserves reached $4B.

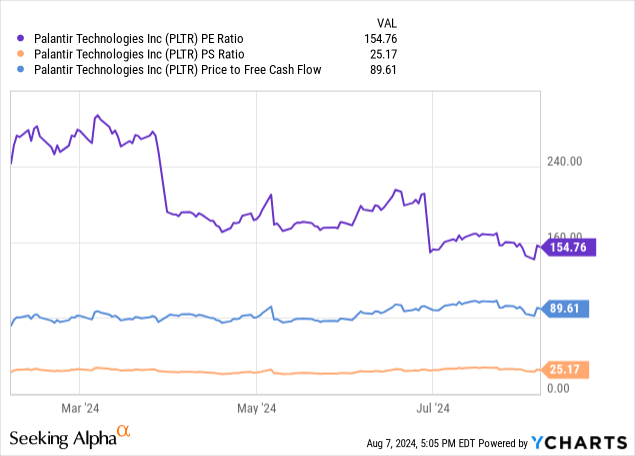

- Despite these strengths, Palantir’s valuation remains problematic, with a PE ratio of 155 and a PS ratio over 25, making it overvalued even as future growth is anticipated.

- Strategic expansion in AI and defense sectors, including partnerships like Microsoft and Voyager Space, positions Palantir for potential outperformance, but sentiment may drive a price contraction by FY 2025.

Martin Ruegner/DigitalVision via Getty Images

Palantir (NYSE:PLTR) is one of my favorite companies due to its unique, nuanced, and specialized approach to Western empowerment, both commercially and governmentally. I’ve covered Palantir before and put out Hold ratings based on valuation concerns. Q2 results were historic, and the team on the earnings call was dynamic and very open about the forward-looking strengths of the company. I think PLTR is positioned for long-term outperformance of current Wall Street fundamental estimates, potentially making its valuation slightly more tolerable. However, despite my bullish outlook on the company, the valuation is still uninvestable, for now.

Q2 Earnings Call Analysis

Palantir delivered exceptional growth in Q2, with 27% YoY revenue growth, exceeding guidance by 5%. It also delivered a 70% YoY increase in its US commercial revenue, driven by AI adoption in production. Furthermore, government spending grew 23% YoY, with strong contributions from US government contracts.

PLTR also delivered the seventh consecutive quarter of GAAP profitability, with a record GAAP net income of $134M. It also generated $149M in adjusted free cash flow—a 22% margin. PLTR ended the quarter with $4B in cash and ST equivalents.

Management raised its full-year revenue guidance midpoint to $2.746B, a 23% YoY growth. Furthermore, US commercial revenue guidance increased to exceed $672M, indicating a 47% growth rate. Free cash flow has also been guided to reach up to $1B for the full year.

Management emphasized its strength as a leader in transitioning AI from prototypes to production scale, differentiating from competitors who are stuck in the prototype phase. Heavy emphasis is being placed on its Artificial Intelligence Platform, which is resulting in significant customer expansions. Management mentioned that the AI infrastructure build-out is expected to reach $600B per year, and PLTR is uniquely positioned to capitalize on this. However, as I will outline later, this has also opened up valuation risks, and I believe the market has overpriced PLTR despite its fundamental growth deserving strong sentiment.

PLTR also stressed its $153M initial order from the DoD for an AI-enabled operating system, showcasing the critical role of PLTR’s software in national defense. This is one of the reasons that I am particularly bullish on PLTR because I consider it to be on the path to developing defense AGI.

To further support Western leadership, PLTR also launched “Warp Speed”, which is an operating system which is designed to modernize American manufacturing, leveraging AI and ontology to optimize the production process.

PLTR closed 27 deals worth $10B or more and signed nearly $1B in total contract value in Q2. It also grew its US commercial customer count by 83% YoY, with existing customers expanding engagements. PLTR is benefiting from Apollo, ontology, and SDK, which continue to drive competitive differentiation. Also, as Palantir has been developing its AI from prototype to production capabilities for a decade, it is well-positioned to meet the current bottleneck demand. I believe that moving forward PLTR will be able to build its growth opportunities in manufacturing significantly, not only commercially but also in defense use cases.

Valuation Analysis, Sentiment Analysis, And Management Direction

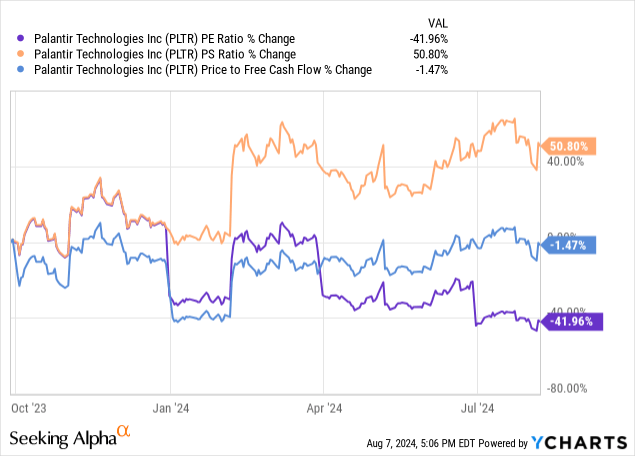

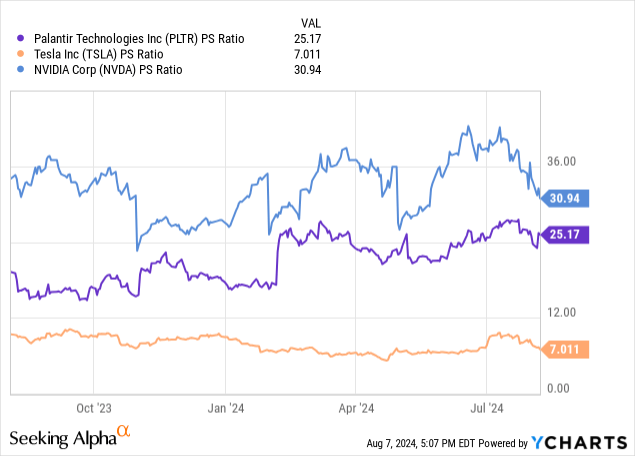

Palantir is undoubtedly overvalued at the moment, with a PE ratio of 155 and a PS ratio of over 25. Its PE ratio is improving due to profitability expansion, but what is concerning to me is that the PS ratio continues to expand. PLTR is one of the most richly valued tech stocks I know at the moment. It is much more richly valued than Tesla (TSLA) and almost as richly valued as Nvidia (NVDA) on a PS-ratio basis.

Arguably, PLTR does deserve a rich valuation because it is such a unique company with such a rich value-add in the West, both commercially and governmentally. However, whether investors like it or not, there is no escaping that valuation is paramount when selecting the right companies to invest in. I believe in the long-term fundamental growth trajectory of PLTR; however, I believe the stock is currently not a wise investment. Wall Street also agrees, as the consensus is a potential 12-month contraction of around 8% in price.

In my opinion, price contraction over the next 12 months is likely, and any further expansion in valuation multiples would make the stock further significantly overvalued despite EPS estimates for 2025 indicating 19% growth. What I am concerned about is that for FY 2024, which ends in December, the full-year growth estimated on the Street is 43%, much higher than the coming FY 2025 growth estimated. Therefore, I think sentiment is going to lower despite these strong Q2 results, which are likely to strengthen the short-term momentum until FY 2025 is closer. In other words, Q2 reaffirmed how important, revolutionary, and significant a company PLTR is, but now is not the time to invest in the stock based on the valuation.

Alex Karp, from listening to the earnings call, continues to be bullish on Western dominance, and PLTR was set up by the founders to be a “ray of light to America and our Western allies,” in Karp’s own words from the earnings call transcript. So, on an operational front, I think most Seeking Alpha readers can agree Palantir is a vital company to support our continued success in Western economic leadership to maintain stability in the global order, support Israel, Ukraine, and American leadership to drive what could be a multipolar world order led by the Western technological moat. I believe it is the West’s moat in AGI, which may be tapped by Palantir, which will help keep the West at the helm of the new multipolar world order. In other words, Palantir significantly supports the West in retaining global leadership, but the moat it has will inevitably narrow as China and India rise. Multipolarity should bring more global equality, which is positive, and PLTR is one of the companies that can create a dynamic of security among international relations through deterrents to war.

China And India Specialized AI Competition And Risks

Despite the bullishness I and many others feel towards Palantir in its ability to strengthen Western leadership, China has developed Mininglamp, which focuses on providing big data and AI solutions, particularly in areas like public security and enterprise services. Furthermore, Yonghong Tech specializes in data analysis, with some similarities to PLTR’s offerings. While nothing in China matches the expertise and technological lead, nuance, and sophistication of PLTR, China does have the infrastructure to develop more sophisticated AI defense tools. That is why I think PLTR could benefit from closer relationships with big tech companies like AWS, OpenAI and others to collaborate on defense AGI. I think this could reduce the competitive threat from China.

India also has a burgeoning AI sector, including Logic Fruit Technologies, which specializes in product engineering and design services; Asteria Aerospace, which is a robotics and AI startup providing drone-based solutions; and Tata Advanced Systems Limited, which focuses on aerospace and defense electronics. PLTR benefits from a specialized focus on unified defense and empowerment of commercial and national security for the West, and both India and China lack the West’s caliber of sophisticated, unified technological focus on empowerment, in my opinion. This is where the US is potentially undervalued as it has a technology moat that is still relatively latent to be tapped for security leadership.

Catalysts For Future Operations

US commercial growth is arguably the strongest segment for PLTR moving forward, more so than defense, as this has grown by 83% YoY, reaching 295 clients, which has been driven by its AIP and data analytics solutions. This places PLTR more akin to Salesforce (CRM) at the moment, meaning that it is potentially entering a highly competitive commercial SaaS field and could find itself competing in less specialized use cases, making its moat narrower as a result of its seeking broader growth. Notable PLTR clients now include Morgan Stanley (MS), Airbus (OTCPK:EADSY), and Fiat Chrysler, among many other large commercial companies.

Palantir has also now collaborated with Microsoft (MSFT) to deliver secure cloud, AI, and analytics capabilities to the US defense and intelligence community. This alliance is another reason to be very bullish on PLTR for the long term, as I believe this is likely to lead to increased adoption in high-stakes environments and even open up the possibility for higher technological capability. This is an example of a growing synthesis between tech and government security, which I mentioned earlier, of which I believe more emphasis will be placed on by the US defense community moving forward, with PLTR strategically positioned to capitalize on this.

Furthermore, PLTR is venturing into space operations with its partnership with Voyager Space—this intergates AI into space and defense technology sectors. This is another big future market opportunity, and it is new ventures and partnerships like this which is why I am becoming convinced that PLTR may be able to outperform the Wall Street fundamental estimates over the next few years.

PLTR has also developed a Bootcamp approach to sell its AI solutions, and this hands-on sales strategy has led to rapid customer acquisition and conversion. The substantial deals and customer conversion coming from this are likely to help the company secure bigger deals, as I believe much of the long-term growth in business is related to sales, as well as product/service quality. Innovative sales strategies such as its Bootcamp model bode well for its commercial sector clients, as this is who the AIP Bootcamp is directed toward. That being said, it does not explicitly exclude government clients, but I believe recently, management has noticed the high growth opportunity in commercial use cases, and I think doubling down on the recent 83% increase in commercial customers is strong strategically to trade off momentum and demand.

Conclusion

Palantir is a company that I am waiting for the right time to own. I believe that sentiment in the market could shift around the stock in FY 2025 when fundamental growth rates are estimated on the Street to be lower than in FY 2024. If the PS ratio contracts by ~30%, I believe it could present a strong buying opportunity. However, at the current valuation, I am expecting a contraction over the next 12 months of potentially up to 15% in price due to sentiment shifts that I expect based on lower growth estimated for FY 2025. As a result of my analysis of the firm’s valuation, and in spite of my bullish outlook on the company and management itself, my rating for PLTR is reiterated as a Hold for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.