Summary:

- My initial valuation of Palantir was too pessimistic, overlooking the higher likelihood of growth the AIP bootcamps have made clear.

- I am more convinced they possess a moat, being a technological disruptor and enjoying hard-to-replace trust with governments.

- The biggest issue is what happens with share dilution and buybacks, and too much stock-based compensation could undermine FCF per share.

VioletaStoimenova/E+ via Getty Images

In my initial thesis on Palantir Technologies Inc. (NYSE:PLTR), I expressed concern about the potential for a long-term correction in the stock price or poor returns, such that it might be better to put one’s money elsewhere. I concluded:

My case is that when we allow for perfectly plausible downsides to be reflected in the valuation, we see that PLTR is at best fairly valued and at worst very overvalued. Investors make money by allowing a margin of safety and the possibility for less optimal outcomes in their entry price. That is not what Mr. Market offers today.

The price is a bit lower since I wrote that, but the real difference here is my appraisal of the facts, which I reconsidered after Q1 results were announced and while listening to the discussion in its conference call. Crucially, I think PLTR is much closer to a fair valuation than I previously discussed.

Initial Valuations

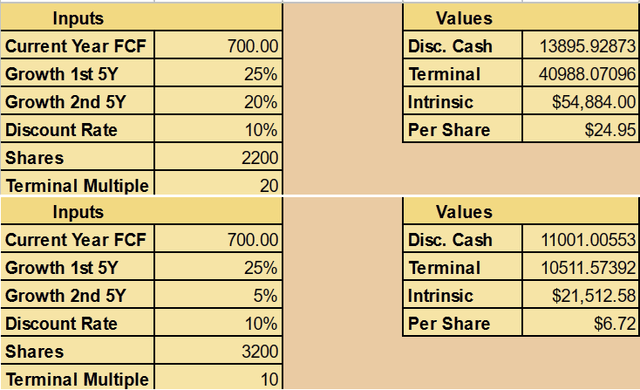

In my first analysis, I gave an upper and lower end of PLTR’s intrinsic value, both based on 2023 free cash flow but with different assumptions on how growth and share-based compensation would play out over a decade.

Author’s previous calculations

I think my lower end was too pessimistic, too dismissive of the revenue potential of the company and too worried that they could fall behind or get flanked by something disruptive. Let me go into the things that changed that view.

Cash Flow Situation

The first thing I want to review is how the cash flow situation looks as of Q1. With free cash flow being important, some might notice that operating cash flows are down from the prior-year quarter.

Cash Flow Statement (Q1 2024 Form 10Q)

It’s about $58M less, but I also indicated how much of this difference is due to Accounts Receivable. Q1 2024 needed to adjust for a much larger gain there. While this isn’t cash yet, it does show future cash to be realized in the near future. Palantir’s sales are known to be seasonal anyway.

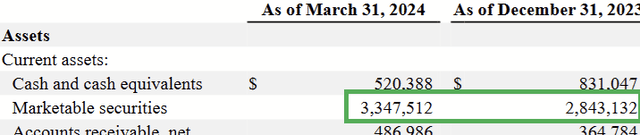

Balance Sheet (Q1 2024 Form 10Q)

If you notice the change in AR, you might also notice the change in marketable securities on the balance sheet. Palantir’s portfolio is over $3 billion at this point, and is growing.

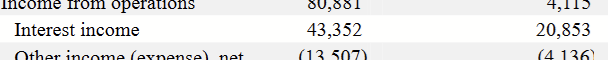

Income Statement (Q1 2024 Form 10Q)

With higher rates and a larger portfolio, interest income more than doubled, and rising interest income as Palantir grows its portfolio is something I failed to consider. Though small, it is something that adds up over time.

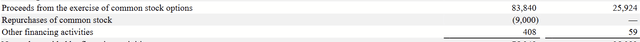

Cash Flow Statement (Q1 2024 Form 10Q)

A quick note, $9M in shares were repurchased in Q1, a new move but not one indicative of obvious trends yet.

The overall takeaway here is that I believe their free cash flow is growing favorably. Let’s talk more about why.

AIP Bootcamps Boosting Sales

In my first article, I discussed the AIP bootcamps, these training programs they’ve added to their sales process to give customers a feel for Palantir’s product and open their eyes to its potential. Their very long-dated sales process has gotten much shorter as a result. Chief Revenue Officer Ryan Taylor described the progress as such:

So, we announced bootcamps two quarters ago as a go-to-market motion. And we’re seeing that play out. As — you see that in the results. So, in one to five days with a bootcamp, we’re able to do what used to take three months. And we’re seeing — as I talked about, we’re seeing customers shortly after bootcamp sign seven-figure deals.

Chief Technology Officer Shyam Sankar added:

And I can think of the most recent, say, two quarters, our ability to come in there, help them solve one problem, but ignite hundreds of use cases that they’re able to do on their own. So, really, even without needing additional partners, leveraging repeatable reference implementations, reference architectures, quick starts, tutorials that get them going, again, and across different — we have these for all the industries that we’re working in, for all the functions within these customers, and including in government itself.

Taylor’s half of it was something I could appreciate in Q4 2023. Sankar’s remarks, however, made me take the growth story much more seriously, that a small sale on the seven-figure scale could evolve into an eight figure as the customer realizes the potential for their operations if applied more broadly. If it translates to more revenue or less cost, they are going to do it.

Taylor spoke to the bootcamps making the case of the value-add, but Sankar connected the other dot, where a paradigm shift occurs in the minds of the customer, and there are not many products where you get that kind of reaction. That has the makings of a very loyal customer, and it’s something I felt should be considered more carefully.

Clear and Present Moat

Building on that, I am more convinced that Palantir possesses a strategic moat and that it is less vulnerable to disruption than I was before. Consider what CEO Alex Karp observed in the call:

And I would say, I don’t believe we have competitors. So, I don’t believe in the US commercial market we have competition. I don’t believe in the US government market we have competition. I don’t — I think that’s the reason Ukraine and Israel bought our product. We are differentiated because in order to actually make AI work, you need an ontology. No one has an ontology.

I had previously noted my concern, something the company even discusses in its disclosed Risk Factors, that many customers may try to generate their own systems for data analytics internally, bypassing Palantir. Karp reflected on the history of this issue:

The bootcamps also have, quite frankly, another massive advantage because de facto it sets a standard that will be very hard for any other company to meet. So, even if you don’t buy our product, you de facto have locked in an idea of what’s possible…And most people we actually offered our platform to did not buy the product in year one, but by year five, they’d all bought it… And even if you say, oh, I’m going to go try to do this myself. In fact, you can’t.

This was something that wasn’t clear to me before either. Where this risk really materialized itself was in the long-term uncertainty of when a sale might be realized. The bootcamp process is stripping so much of that away. Palantir can proceed into the less costly part of the relationship where they sign bigger contracts for larger implementation much sooner.

Another important observation he made:

I believe, we are the only Company in America, the only really relevant market, that will allow you to do useful things with large language models…with 10 years of IP that presupposed LLMs before LLMs existed.

This was another advantage I had overlooked, which could be abstracted as Palantir’s ability to remain in the lead on technology, to be the disruptor, to have all the right people, skills, and vision for it, and I think their edge in technology is part of their moat story.

I’ll also add: With government contracts in particular, as those apply to defense and security, trust is far more important than profit, and once Palantir has that trust, it’s hard for another company to come in and replace that.

Revised Valuations

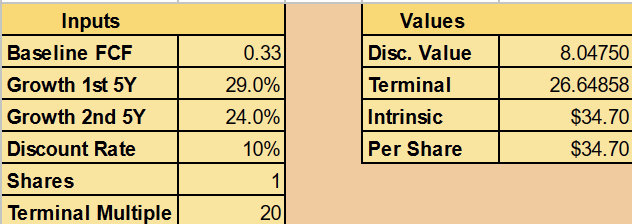

With that said, let me revise the valuation. I will do another Discounted Cash Flow model, with the following assumptions:

- $0.33 of FCF per share.

- 29% growth in the next five years.

- 24% growth five years after that.

- Terminal multiple of 20.

$0.33 per share is based on an increased estimate I have for FCF going forward, given Q1’s growth. I decided to do it on a per share basis in order to quantify the effects of dilution better than before.

Based on revenue growth of 20% per year (which I believe can continue as more accounts are closed and as those accounts convert into bigger contracts), paired with single-digit increases in operating expenses and capex, annual growth of FCF of 29% is very possible. I’ve reduced it by 5% for the second half of the decade, as they may have fewer new accounts. A terminal multiple of 20 reflects additional growth opportunities, as this only puts revenue around $12 billion after a decade.

Author’s calculation

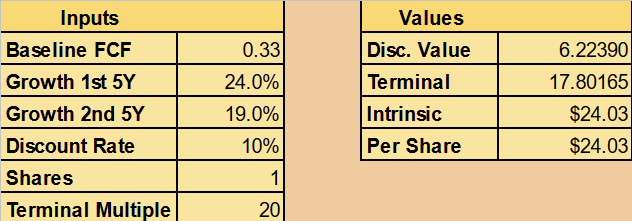

This would assume that a fair value per share is about $35. Yet, where I would show more caution is the potential for share dilution through their share-based compensation.

Author’s calculation

Share-based compensation, at its current levels, could shrink a shareholder’s stake by about 5% each year, and if we adjust for that, we get a fair value much closer to today’s price. If SBC declines and if favorable trends in buybacks emerge, that could improve the story, and we will want to see what kind of appetite Palantir has for its own shares in the quarters to come.

Conclusion

I was cautious in my first thesis on Palantir. While too much caution is my favorite mistake to make, the light provided by Q1 results and management’s treasure of detail made me realize it was unwarranted this time. Palantir is an amazing company with red carpets rolling themselves out for it, as LLMs have unlocked the vast potential of their product, well ahead of almost anybody else.

While I’ve increased my lower-end and upper-end valuations, the main risk I see is that share-based compensation will likely weigh the value down to just a fair value, with the upside insufficient to call this a “low-risk, high-reward” type of bet. Yet, that could change depending on PLTR’s capital allocation going forward (or if the price goes below $20 again).

As we monitor that situation, I think it’s fair to treat the shares as a reasonable Hold for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.