Summary:

- Palantir Technologies Inc.’s commercial segment has outperformed expectations well, capitalizing on the AI-driven momentum.

- The recent Titan deal has likely assured investors that Palantir’s government segment could see a reacceleration.

- The market is likely increasingly confident of Palantir’s near-term monetization.

- As a result, it should lend credence to its 2024 outlook significantly.

- With Palantir Technologies Inc.’s valuation reaching potentially unjustifiable levels, I explain why investors should consider getting out.

Kevin Dietsch

I upgraded my Palantir Technologies Inc. (NYSE:PLTR) thesis in my previous update in January 2024, as I assessed worsening geopolitical strife would keep demand dynamics robust. However, as it consolidated, I also assessed that PLTR’s valuation has surged to highly expensive levels. As I monitored its pullback, PLTR saw solid buying support as it avoided a steeper plunge toward the $13.5 level. Consequently, PLTR bottomed out at the mid-$15 level before Palantir released its fourth-quarter earnings release in February, which led to an incredible post-earnings surge.

Observant Palantir investors should be well aware of PLTR’s solid performance in its commercial segment, suggesting highly robust near-term monetization. Accordingly, Palantir experienced a revenue growth deceleration to 17% for FY23, down from FY22’s 24% growth. Despite that, investors are looking forward to a reacceleration in 2024, driven by the optimism attributed to its commercial business. Palantir saw its U.S. commercial business rise by 70% in Q4. Companies leveraged Palantir’s AIP to “serve as the connective tissue, enabling effective interactions and an organization’s scattered proprietary data.” Consequently, Palantir telegraphed its confidence in maintaining a significant growth cadence in 2024, anticipating commercial revenue of at least $640M, up 40% YoY.

Notwithstanding the optimism in its commercial business, investors must consider the sharp growth deceleration in its government business. Palantir delivered government segment revenue growth of just 11% YoY in Q4. Buying sentiments on PLTR were lifted with the recent Project Titan win. The $178M two-year deal has bolstered Palantir’s capabilities to win large government deals in the future. It also offers a pivotal opportunity for Palantir to demonstrate its leadership in AI, helping to develop the U.S. Army’s “next-gen deep-sensing capability platform.”

Consequently, I assessed that the recent bullish sentiments suggest the market is increasingly confident of Palantir meeting its 2024 revenue outlook. Recall that Palantir guided for full-year revenue of between $2.652B and $2.66B. Analysts project Palantir to deliver revenue of $2.68B, up 20.4% YoY. Therefore, I believe the market has likely attempted to price in a better-than-anticipated revenue growth trajectory, leading to improved profitability dynamics.

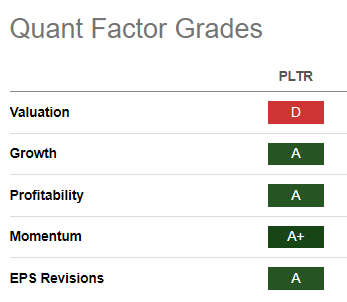

PLTR Quant Grades (Seeking Alpha)

Palantir already operates with a profitable (adjusted) business model and is expected to maintain its GAAP profitability in 2024. As a result, the market may have priced in the potential of an S&P 500 (SPX, SPY) inclusion, given its solid execution and near-term monetization gains. PLTR has also been assigned a best-in-class “A” profitability grade, corroborating my confidence. Furthermore, PLTR has garnered the “A” range grades for four of the five quant grades, underscoring the market’s confidence in further potential upside.

I’m not trying to argue that Palantir is pure AI hype with no fundamentals to underpin my conviction. I’ve already discussed in my previous article why PLTR is a pivotal AI platform (“AIP”) company. CEO Alex Karp also clarified his thoughts about Palantir’s competitive advantages at Palantir’s recent AIPCon. Palantir has developed and pushed through its proprietary platform in double-quick time, leveraging the market’s enthusiasm about its offerings. As a result, it has built on its boot camp approach to drive a faster go-to-market motion, converting into revenue accretion. Hence, it’s possible that the market may not have fully appreciated the potential revenue upside not captured in its 2024 guidance.

However, if I consider PLTR’s forward valuation metrics, the market doesn’t seem dumb. In other words, it looks like the market has baked in significant optimism as investors reflect confidence in its opportunities over the next few years.

Accordingly, PLTR is valued at a forward adjusted EBITDA multiple of almost 60x, well above its SaaS peers’ median of 22.7x (according to S&P Cap IQ data). PLTR’s FY26 adjusted EBITDA multiple of 41.5x corroborates my thesis that PLTR seems priced for perfection at the current levels.

As a result, I find it increasingly challenging to justify my rating at the current level, as PLTR looks primed for a significant potential downside at the next steep market pullback.

Rating: Downgrade to Sell.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!