Summary:

- PLTR stock recently reported Q1 results.

- The stock sold off in the wake of the earnings report despite the company reporting robust growth in its US commercial segment.

- We evaluate the highlights of PLTR’s Q1, the negatives that still plague the company, and share our take on whether or not the stock finally warrants a buy rating.

ismagilov

Palantir Technologies (NYSE:PLTR) recently reported its Q1 results. You can see my analysis after they reported their Q4 2023 results here where I considered the stock to be overvalued and overhyped, assigning it a Sell rating in the process. The stock continues to be range-bound despite the company generating strong growth due to valuation concerns, which I’ve highlighted in the past. As a result, it continues to grow into its valuation, which is being propped up largely by bullish sentiment on the AI sector in general. In this article, we will provide an updated outlook on the stock by reviewing its Q1 results and valuation.

PLTR Stock Q1 Highlights

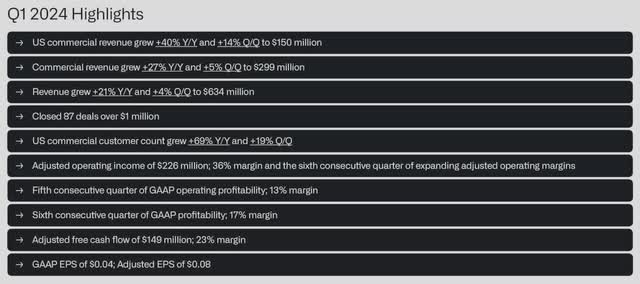

The best news from the quarter was that the US commercial business is growing at a rapid pace, with revenue up by 40% year-over-year. Moreover, customer acquisition remains strong, with the company rolling out initiatives like its boot camps to raise awareness of how it can meet the needs of potential clients. As a result, US commercial customer count grew by 69% year-over-year in Q1. In addition to bringing on new clients, the company also pointed out that its existing clients, including its largest clients, continue to increase their spending on Palantir’s software products and services.

Other highlights in the quarter included a major win with the Titan project, which further supports Palantir’s claim to being the first defensive software prime for the US military. Additionally, the company saw some improvement in its US government business growth and continues to deliver 20% and above revenue growth overall with a 21% year-over-year growth rate during the quarter. The company also remains quite profitable and reported its fifth consecutive quarter of GAAP operating profitability and even bought back a few shares during the quarter from its massive and growing cash pile. Overall, the business seems to be firing on all cylinders with strong profitability, strong growth, and an even stronger balance sheet.

PLTR Q1 Highlights (Investor Presentation)

PLTR Stock Lingering Challenges

That being said, it was not all sunshine and roses for the company, as its international business, especially in Europe, continues to struggle. This was especially notable with reported declines on a quarter-over-quarter basis. PLTR management – which normally spins the numbers as positively as possible for the company – even admitted on the earnings call that the challenging economic environment in Europe is serving as a headwind for the business:

First quarter international government revenue … declined 9% sequentially to $79 million as a result of the revenue catch-up in Q4 that we noted last quarter and continued headwinds in Europe … We do have headwinds in Europe, 16% of our business is in Europe. Europe is gliding towards zero percent GDP growth over the next couple of years. That is a problem for us.

Additionally, issues with Palantir’s ability to generate growth in the international business have been lingering for quite some time and appear unlikely to abate anytime soon. While strong growth in the US, especially in its commercial business, is enough to still drive robust overall numbers, our concern is that, over the long term, unless they can break through into international markets more meaningfully and generate significant growth there, their total addressable market is likely not as big as they may have cast in the past. If this proves to be the case, ultimately, their growth runway and valuation will be quite capped.

The other big concern we have is simply the valuation itself. We certainly think that the company’s products are high quality and the range of industries and businesses they are applicable to is only increasing as the artificial intelligence revolution continues to accelerate, they’ve proven that they can be consistently profitable on a GAAP basis, and their balance sheet is stellar. As a result, our issue is not with the quality of the business itself, its long-term outlook, or the safety and stability of the business model and balance sheet. The only issue we have is that the company is only growing revenue at around 20% and its economies of scale are not particularly strong given that its EBITDA margins have remained range-bound over the past several years, so profits are not growing at a much faster clip than its top line is. In fact, from 2021-2023, its revenue grew at a 20.1% CAGR while its EBITDA grew at a 16.8% CAGR.

Meanwhile, their EV/EBITDA ratio remains quite high at 47.85x and the price to earnings ratio is 64.23x. Moreover, due to the law of large numbers, the more they grow their revenue, the harder it will be for them to accelerate that growth rate, especially if they are unable to crack the international market. With interest rates as high as they are and the risk of a recession looming large over places like Europe, Japan, and potentially even the United States, it is hard for us to buy a stock with such a high valuation. As a result, we continue to rate it as a Sell and would only be interested in buying it if the stock price fell considerably from here or if it were able to meaningfully and sustainably accelerate its growth overseas.

Investor Takeaway

While we think that Palantir has a bright future ahead of it and eventually will grow into its current valuation-and for all we know, the AI bubble in the stock market will keep the stock from falling meaningfully below the $20 per share level for some time-it simply does not offer significant enough upside potential from here until it can change its growth fundamentals internationally. As a result, the risk-reward profile is very unfavorable, prompting us to rate the stock as a sell. Moreover, we would not likely view it as a hold until it drops into the mid-teens and would not view it as a buy until it falls below $12.00 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio which has beaten the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing high yield-seeking investment service on Seeking Alpha with ~1,200 members on board and a perfect 5/5 rating from 166 reviews.

Our members are profiting from our high-yielding strategies and you can join them today at a compelling value.

With the 2-week free trial, you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!