Summary:

- Palantir reported better-than-expected Q1 results with revenue of $634.33M, representing a 20.8% year-over-year growth.

- Despite positive results, PLTR stock declined by more than 10% after the earnings report.

- The price can fall more in the near term due to factors such as the company’s profitability outlook, operating expenses, and selling pressure both in the open market and from insiders.

OlekStock

Palantir stock: Q1 highlights

Palantir Technologies (NYSE:PLTR) just released its 2024 Q1 earnings report. Overall, the company reported results that were better than market expectations. To wit, its non-GAAP EPS dialed in at $0.08, in line with market expectations. But its revenue totaled $634.33M (representing a 20.8% YOY growth) and beat consensus slightly (by ~$16.7M).

Despite such results, PLTR stock plunged by more than 10% (about 10.5% as of this writing) after the earnings report. And it’s the goal of this article to argue that there will be more downside pressure in the near future based on my reading of the Q1 report. In the remainder of this article, I will detail a few leading factors for such pressure (profitability outlook, operation expenses, insider activities, etc.).

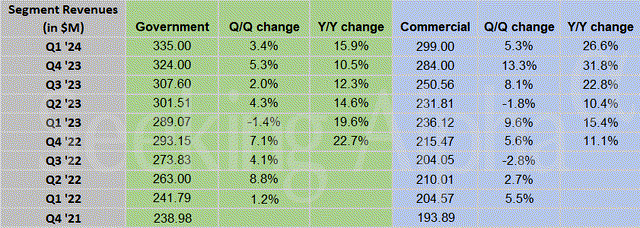

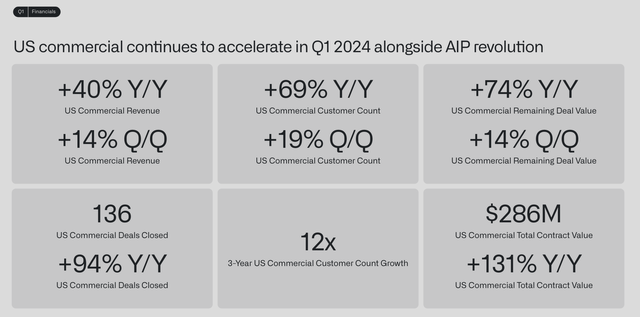

But let me first start with the positives. I used to be very concerned about PLTR’s heavy reliance on government contracts which are sensitive to policy changes and government budgeting. This concern of mine is relieved to a large degree given the Q1 results. As seen in the two charts below, PLTR’s commercial revenues grew 26.6% YOY this quarter, outpacing its revenues from government contracts by a large gap again. All told, revenues from commercial contracts now reached almost $300 this quarter, now representing a good balance compared to government contracts (with total revenue of around $335M).

Next, I will move on to discuss some of the negatives that can keep pressuring its stock prices.

Seeking Alpha

PLTR ER

PLTR stock: Profitability outlook

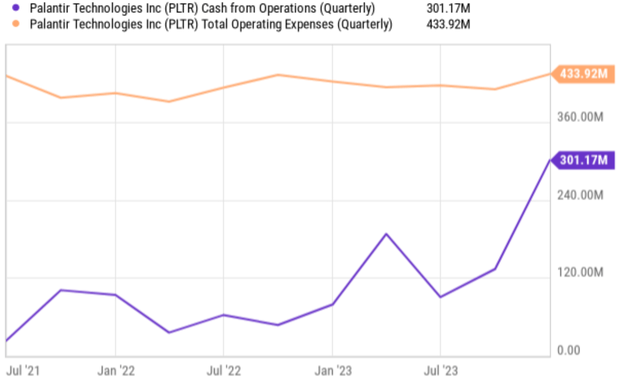

In the earnings report, PLTR also issued its guidance for Q2, which pointed to an adjusted income from operations between $209M and $213M. To better contextualize this guidance, the next chart shows PLTR’s cash from operations (“CFO”) and total operating expenses in recent quarters. As seen, the CFO is yet to catch up with the expenses even with the new guidance.

As the company expands its product lineup, I expect the expenses to keep rising quickly. A notable example involves its A.I.P. (Artificial Intelligence Platform), launched in May of 2023. The technology is of course very promising and can enable defense and commercial organizations to train private data on third-party Large Language Models (“LLMs”). It offers several key differentiating features such as keeping data secure and also reducing transfer and storage costs.

Seeking Alpha

However, I also expect such initiatives to involve considerable amortization of software and stock-based compensation. These items are typically excluded from the accounting business expenses. But my view is that they’re “real” and also substantial expenses for a business like PLTR. I expect them to weigh heavily on the overall profitability of the company in the years to come.

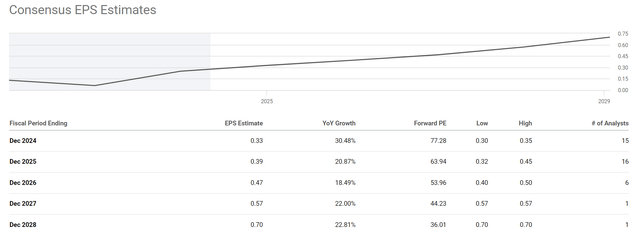

As a reflection of such pressure, consensus estimates expect a negligible amount of profit from the company in the foreseeable future. For example, the chart below describes consensus EPS estimates for PLTR stock in the next five years from FY 2024 through FY 2028. The consensus EPS estimate for fiscal year 2024 is only $0.33. Despite the rapid growth rates projected, the expected EPS is $0.39 in FY 2025 and only $0.7 in FY 2028 (which still translates into an implied FWD P/E of 36x) if such high growth rates are indeed sustained.

Seeking Alpha

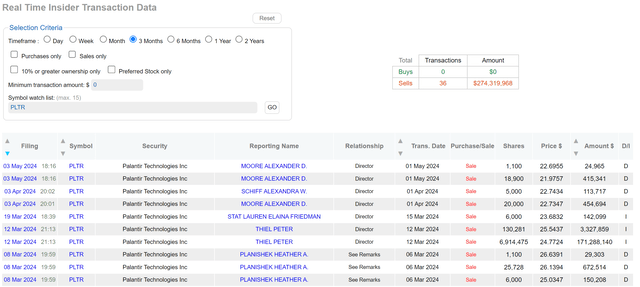

PLTR stock: Insider activities

Another negative sign in my view involves the insider activities surrounding the stock in recent months. In particular, the chart next shows insider selling activities on PLTR stock in the past three months, from March to May 2024. There has been a total of 36 insider transactions during this period and all of them were selling transactions. As seen, many of these transactions were made in a price range between $25 and $26 per share. For example, Peter Thiel himself sold two batches of shares (6,914,475 shares and 130,281 shares, respectively, in March) with an average price of around $25. Heather A. Planishek sold several smaller batches in March with an average price of around $26.

DataRoma

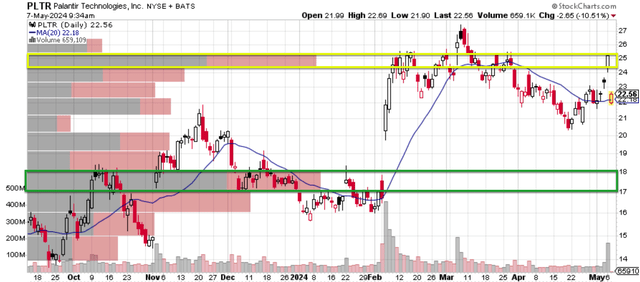

The above insider activities coincide with the trading pattern on the open market in my view. As such, I consider the price range of $25 and $26 to be a key resistance level for the stock in the near term. More specifically, the next chart below shows the price-volume information on PLTR in recent months.

Here, I want to focus particularly on the two price ranges highlighted below by the yellow and green trading windows. The green trading window represents the price range that attracted the heaviest trading volumes, thus representing the first resistance level, before February 2024. And the good news is the stock has decisively overtaken this price range. The investors in this range now have been replaced by more bullish investors in the new $25~$26 range (or have become more bullish themselves) as indicated by the heavy volume in this new range after February 2024. The stock has challenged this new resistance level a few times since February and failed every time as seen.

And the selloff after the Q1 earnings report is just another example of a failed attempt in my mind. Given the profitability pressure and the insider activities, I’m not optimistic that the stock can overcome this resistance level in the near term.

StockCharts

PLTR stock: Other risks and final thoughts

Before closing, I want to reiterate that my analyses in this article are more oriented toward the near term. In the longer term, I expect the company’s defense products to perform well given the differentiating features discussed above. The company is well positioned to capitalize on its AI-related technologies (such as its AIP as aforementioned) in the long term. Another highlight involves its TITAN platform, which is also a system powered by artificial intelligence. The company recently closed a large contract (around $178M) with the U.S. Army. According to the contract, PLTR plans to deliver 10 prototypes in the next two years that use machine learning to enhance the speed and accuracy of combatant targeting. If these prototypes are successful, I won’t be surprised for more and larger contracts to follow in the years or even decades to come.

However, in the near term, I see more downside pressure than upside potential and I rate the stock as HOLD. To reiterate, the first concern on my mind is its small profit due to cost pressure. Despite solid analyst EPS projections for the coming years, the profit will likely be quite small. This leads to very high P/E ratios, even on an FWD basis several years out, which suggests the market has already priced in much of this future growth in my view. Finally, I’m not optimistic that the stock can overcome the ~$26 resistance level anytime soon judging by the recent insider activities and technical trading patterns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.