Summary:

- Palantir Technologies Inc. has outperformed the S&P 500 by 50% since late-November 2023.

- The company’s strong recent earnings are attributed to its expertise in commercializing artificial intelligence.

- Palantir is considered a valuable investment due to its success in utilizing AI for customer needs.

Michael Vi/iStock Editorial via Getty Images

Palantir Technologies Inc. (NYSE:PLTR) is a company that we’ve discussed for years. In early-2021, we discussed the company as our top technology pick for the 2020s. The company stagnated initially after that article, however, the growth of artificial intelligence helped it pick up. In late-November 2023, we discussed the company’s momentum, describing it as a “log rolling down a hill.”

As we’ll see throughout this article, the company’s strong and commercialized artificial intelligence centered business will support strong returns. The company remains our top technology pick of the 2020s.

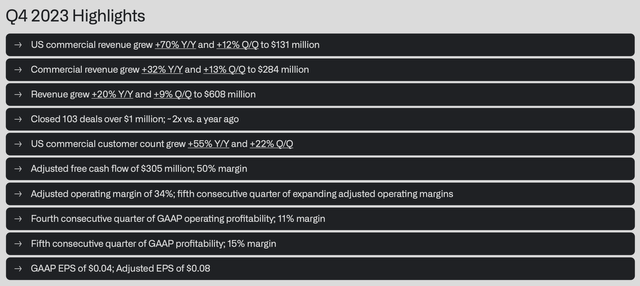

Palantir Quarterly Highlights

Palantir had arguably the strongest fourth quarter of its history as it benefits from companies looking to expand in artificial intelligence with its direct to corporate solutions.

Palantir Investor Presentation

The company saw U.S. commercial revenue grow a massive 70% YoY supporting overall commercial revenue growth of 32%. U.S. companies are at the forefront of attempting to integrate the power of artificial intelligence into their portfolios, and Palantir is at the forefront of that effort for the majority of companies that can’t run their own artificial intelligence.

All of this together drove more than 20% YoY revenue growth. The company closed more than 100 deals >$1 million, double a year-ago. Given the company’s success in driving larger and larger contracts with its existing customers, this is a massive accomplishment.

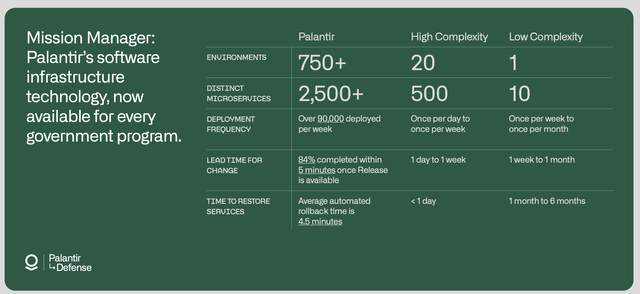

Palantir Mission-Critical Applications

The company’s core strength is its ability to take the benefits of artificial intelligence and scaled technology and deploy it in a way useful to companies.

Palantir Investor Presentation

The above shows the company’s mission manager software infrastructure technology, which is now available for every government program. Even in lead times for change and the time taken to restore services, the infrastructure is unparalleled in its strength. However, it can also do all of this at an unparalleled scale.

That’s why the company has won consistent military contracts for the strength of its technology.

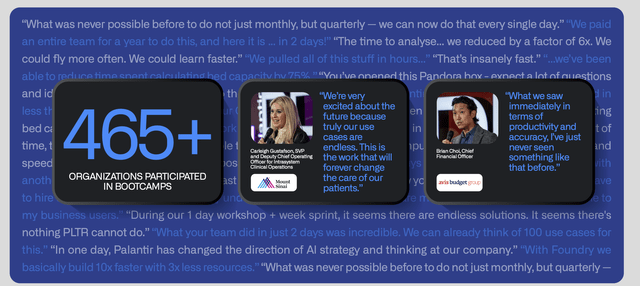

Palantir Investor Presentation

The company also has AIP boot camps to show the strength of its artificial intelligence platforms. The company has seen more than 460 organizations participate in these boot camps, and the company’s technology is bringing a new level of productivity to these companies. These are companies that often don’t have massive software infrastructure outside of their core offerings.

The same way that AWS saved them from needing to maintain and pay for server farms, Palantir is giving them all of the benefits of artificial intelligence while saving them from needing to pay for the almost impossible levels of development it would require for those companies. The company’s mission-critical assets here lend themselves to larger and larger contracts.

This strength of assets and how young the company is very exciting to see.

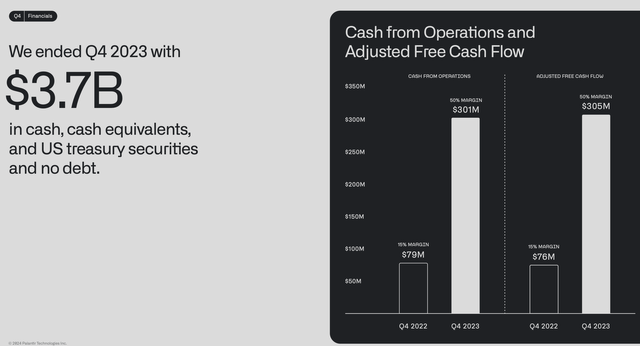

Palantir Financials

The company’s financials remain incredibly strong, backed by its strong margins and continued growth.

Palantir Investor Presentation

The company, with a $58 billion market capitalization, has ~6% of its value in cash, cash equivalents, and U.S. treasury securities. The company has no debt. It’s taking advantage of its strong free cash flow (“FCF”) generation the same as other technology companies, building up a massive portfolio of cash that it can deploy for a variety of shareholder returns.

The company’s adjusted FCF has improved dramatically. The company had more than $300 million in FCF in the last quarter, up from just over $75 million the prior year. This shows the benefits of both growing billing and continued margins for that billing. With annualized FCF at more than $1 billion, growing at the double-digits, we expect the cash pile to rapidly grow.

Palantir Growth

Palantir is rapidly achieving growth, improving its margins, as it fires all its cylinders to chase growth.

Palantir Investor Presentation

The company managed to grow total revenue by 20% YoY and 9% QoQ, supported by the acceleration of its U.S. commercial business. The company’s total revenue for the quarter hit a massive $608 million, from $509 million a year ago. At the same time, the company’s margins increased from 82% to 84% YoY.

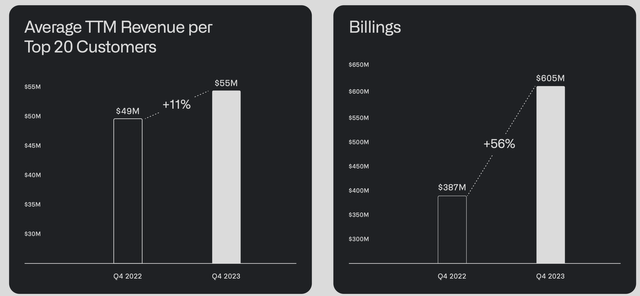

That combination resulted in even faster growth in the company’s bottom line profits. Not only did U.S. customer count increase by more than 50%, but even among the company’s largest customers, it continues to improve with average TTM revenue up 11%. The company’s AIP “artificial intelligence platform” continues to perform incredibly well.

In the most recent quarter, the company closed more than 100 deals of more than $1 million, and more than 20 deals worth at least $10 million. These are all large new deals that the company will be able to leverage into future growth.

Thesis Risk

The largest risk to our thesis is competition. As massive technology companies build their own artificial intelligence departments, government contracts could become increasingly appealing. These companies could deploy their artificial intelligence to compete with Palantir, hurting returns. However, in this case, Palantir is protected by the slowness at which the government moves forward.

Conclusion

Palantir Technologies Inc. has been building up its software applications for decades now. In our view, the company is doing for corporate data management and artificial intelligence what Amazon AWS did for computing. No longer did companies need to maintain their own massive server data centers along with the associated costs.

The same is happening now. Customers cannot build their own massive artificial intelligence platforms, which massive cost, but they can use Palantir. Palantir is winning larger and larger contracts as it grows, increasing cash flow and enabling strong shareholder returns. All of that makes Palantir Technologies Inc. our top technology pick of the 2020s.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.