Summary:

- Palantir’s stock is up 13% since our bullish call in November, in line with the S&P 500, but we think there’s still potential for the stock to double by 2027.

- The company’s strong financial performance, growth potential, and potentially durable premium valuation support this outlook.

- Recent developments, such as strong Q4 earnings and accelerating sales growth, further reinforce the positive story for Palantir.

- As Operating Margins continue to improve and AI demand drives results, we think organic financial growth could send shares to $50, assuming a stable sales multiple.

- We re-iterate our ‘Strong Buy’ rating on the stock.

hapabapa

Last November, we penned an article titled: “Palantir: $50 Per Share Is Not Unreasonable” (NYSE:PLTR).

In it, we covered the company and talked about how we think that the stock could increase to $50 per share in the coming years, assuming stable revenue trends, reduced dilution, and a stable multiple, all of which seemed like reasonable expectations at the time.

Fast forward to now, and the stock is up 13% from our ‘Buy’ rating, in line with the S&P 500 growth over that period.

However, while the overall market appears to be richly valued at present, we still think that there is a clear path for PLTR shares to double by 2027.

Today, we wanted to re-visit PLTR, discuss recent developments with the stock, and explain why we believe that the company has a lot of remaining upside in the tank.

Sound good?

Let’s dive in.

Our Palantir Thesis

In case you didn’t read our initial article, here’s a few quick points to catch you up with our general thinking when it comes to Palantir:

- Strong Financial Performance: Palantir boasts a strong financial profile. The company recently turned their first ever profit, and top and bottom-line results continue to grow year-over-year. Management also appears to be doing a good job at controlling expenses. This financial health positions PLTR well for future growth, especially when you consider the general lack of debt & liabilities on the balance sheet.

- Growth Potential: If you look at the Total Addressable Market, Palantir is still in the early stages of saturating end markets, particularly in its commercial business. Their new Artificial Intelligence Platform (AIP) is a valuable addition to their product suite, and their high Net Revenue Retention (above 100%) shows that customer continue to trust and spend more with the company.

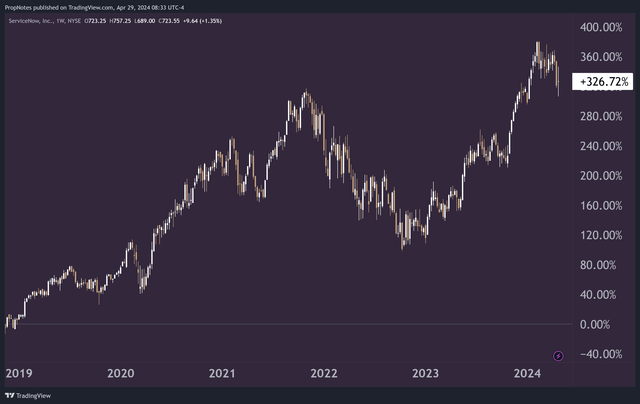

- A Potentially Enduring Premium Valuation: Finally, while nominally ‘expensive’ when compared vs. the market as a whole, the company trades in-line with other high-growth peers. Looking back, other companies like ServiceNow (NOW) had a similar valuation and growth profile to Palantir. Shares in those companies increased substantially after becoming materially profitable, keeping the expensive-looking top line premium. We expect the same thing could happen here.

So, to summarize; PLTR enjoys stable financial footing, a strong growth profile, and a premium valuation that we think could endure over time as the company continues to execute.

Recent Developments With Palantir

In February, the company released its Q4 earnings report, which solidified a lot of our aforementioned beliefs about the company.

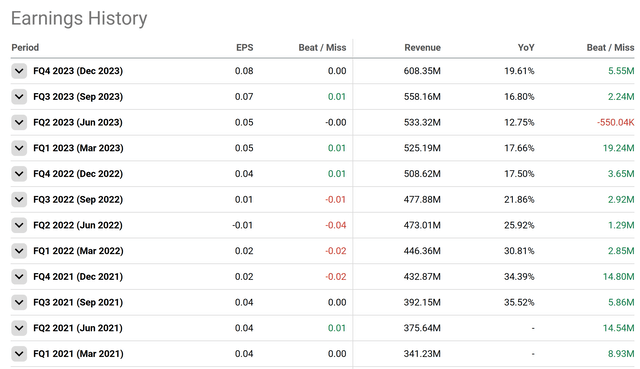

The company came in line on EPS, but beat on top line sales, growing revenue nearly 20% YoY:

This top line growth near 20% actually represents a re-acceleration of new sales, as previous quarters had come in closer to the mid-teens YoY growth mark.

Why the re-acceleration? A bump in commercial revenue growth, which came in at 32% YoY, as discussed by management on the recent conference call:

Our commercial business surpassed $1 billion in revenue over the last 12 months, a noteworthy milestone. And our fourth quarter commercial revenue grew 32% year-over-year.

AIP and bootcamps are accelerating our business, particularly in US commercial, where fourth quarter revenue grew 70% year-over-year, evidencing a significantly expanding addressable market. In October, we set a goal of executing 500 AIP bootcamps within one year. We have already blown that goal out of the water, having completed more than 560 bootcamps across 465 organizations to-date.

…

I’ve never before seen the level of customer enthusiasm and demand that we are currently seeing from AIP in US commercial.

This is incredibly bullish, and it shows how the recent trends surrounding AI are powering further product adoption for PLTR.

Thus, the growth story in PLTR, in our minds, remains strong as U.S. corporates and foreign commercials continue to pour resources into improving their organizational decision making & data frameworks.

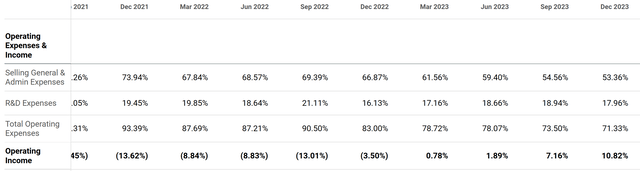

On the bottom line, operating results continue to improve rapidly, and in Q4 PLTR was able to notch an operating margin of nearly 11%, a record for the company:

This shows that PLTR has strong operating leverage within the business, as a relatively fixed cost base recedes against the backdrop of increasing top line sales. This should lead to an even stronger financial position, from which the company can invest in other high IRR projects.

This also shows that the company may be able to slow down its share dilution and use cash to comp high-performing employees, as opposed to printing shares as has been required in the past. This should lead to improved share supply and demand dynamics.

Overall, we’re happy with the performance and profile of the business, which appears healthy and growing.

Palantir’s Upcoming Q1 Earnings

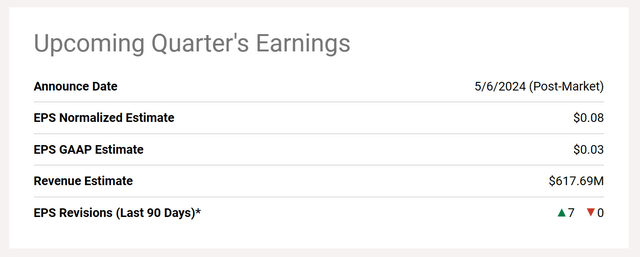

Looking ahead, PLTR is set to report earnings in about a week, on May 6th.

Right now, the company is expected to produce $0.08 in EPS, along with $617 million in top line sales:

Looking more closely, we think these estimates are conservative, especially when you consider how quickly the company’s QoQ margins are improving. From Q3 to Q4, PLTR saw a 700-basis point jump in operating margins, which caused operating income to grow from $40 million to $65 million in one quarter. Given the largely recurring nature of PLTR’s business, it would appear as though more gains are likely in store here, which should lead to a beat, in our book, on the EPS front.

We’re also encouraged by the 7 positive EPS revisions put out by analysts over the last 3 months, which shows continued optimism on the institutional end. As time has passed and analysts have conducted channel checks, it’s clear that there’s positive momentum for PLTR’s products.

We’re expecting a continuation of PLTR’s recent, strong results when Q2 comes out in a week.

Value

This is all great, but ultimately, it matters little if it doesn’t affect the stock.

So – in our view, what is the stock worth?

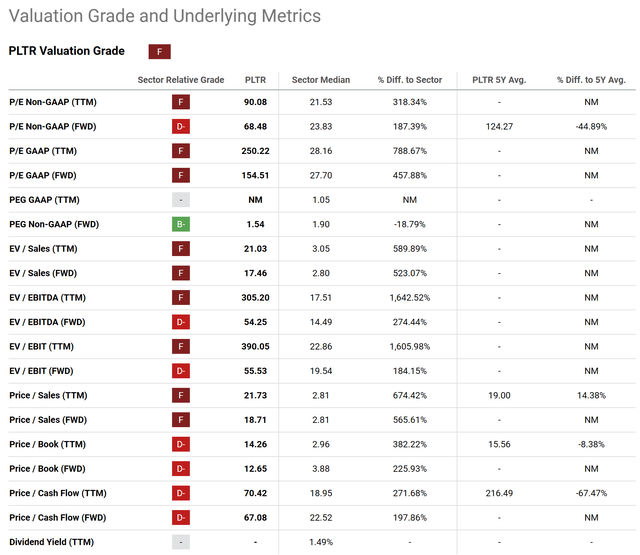

Well, it depends on how you slice it, but as we mentioned before, we see shares on a path to $50 by 2027. Why 2027? In short, because, right now, the stock is trading at an expensive-looking TTM sales multiple of 21x:

In fact, on almost all metrics, the valuation would seem to suggest that there’s very limited multiple upside for shares at current prices.

And, in our mind, that is true.

However, if the multiples simply stay stable, then the interim growth could lead to massive gains on an organic basis, without requiring further multiple expansion in the stock.

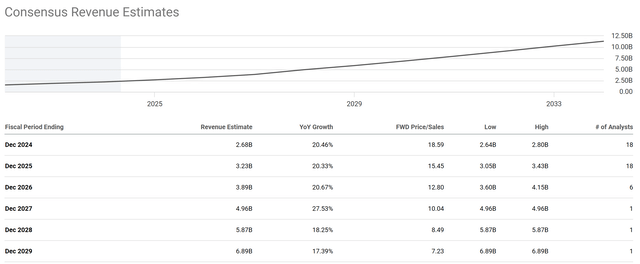

If PLTR’s sales keep growing at 20%+ over the next few years, then we end up with Revenue, FY27 at around $5 billion:

Sure, right now, that represents a 10x revenue multiple, but if the multiple stays where it is, then it indicates that the company could be worth >$100 billion by that point. This works out to a share price of $50 or above.

This, again, is our base case scenario – it incorporates average analyst estimates.

The real key here is whether or not the valuation can remain above 20x.

We believe it can. Looking at other high-growth, secure-revenue businesses like NOW, ANET, PANW, and others, it would appear as though companies with premium earnings profiles can sustain high sales multiples as they scale, which has led to some excellent returns over time:

Plus, with margin momentum and room to expand operating profits even further, there’s room for investor sentiment to actually improve as well, which should buoy the multiple in the face of any potential macro-driven headwinds.

Overall, we think the stock could see significant growth in coming years on the back of strong organic growth and stable multiple tailwinds.

Risks

That said, there are some risks to our thesis. The stock, right now, is expensive, there’s no denying that. The market is giving the company a lot of credit for the AI business driver, as well as the strong growth profile combined with an apparent inflection point on unit profitability.

However, if results falter, or slow down in any way, then it’s easy to see the stock getting hit substantially.

We think this appears unlikely, given how the company has been able to execute its way to where it is now, but bumps could send the stock reeling, simply due to its super-premium multiple.

The earnings report in a week is an event that could create these types of bumps, so be sure to keep your eyes peeled for risks as they crop up.

That said, zooming out, any bumps are likely to be short term, due to the strength and market position of PLTR’s product suite, so any significant dips could be seen as an opportunity to purchase the stock with a better margin of safety.

Summary

All in all, while there are some risks associated with purchasing PLTR stock ‘up here’ (in terms of the multiple), we think that PLTR’s significant, B2B AI tailwinds, strong financial footing, and continued opportunities for growth should propel the stock towards $50 per share over time.

Thus, we re-iterate our ‘Strong Buy’ rating on PLTR.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.