Summary:

- Palantir, founded in 2003, initially developed software for U.S. government counter-terrorism efforts, addressing urgent needs during the Iraq and Afghanistan wars.

- The Gotham platform revolutionized intelligence operations, and is now used by Ukraine and Israel for real-time battlefield data analysis and AI-driven warfare.

- Palantir’s Foundry platform extends their expertise to commercial sectors, enabling data integration, security, and analysis across many industries.

- PLTR’s strategic partnerships and advanced AI technology highlight its critical role in modern conflict and commercial data solutions, positioning it as a pivotal player in both sectors.

- We initiate a BUY rating with a target price of $41.13, reflecting a 10% upside.

Digital Vision./DigitalVision via Getty Images

Introduction

Palantir Technologies (NYSE:PLTR) has been a prominent name in the tech landscape since its IPO in 2020. However, if you’ve never made your due diligence on this name or if you have been a bit late for whatever the reason, you are not alone.

Our Initiation serves as an invitation to dive into a detailed examination of PLTR, whether you’re a newcomer or looking to refresh your memory.

For those familiar with the company’s history and operations, we still recommend reviewing the entire article, as it may provide new insights.

In this Initiation, we will present a detailed overview of PLTR, presenting its business model and industry. We will try to understand how robust the firm is financially, all that combined with our thesis and valuation.

Company Presentation

Founded in 2003 by Peter Thiel, Alex Karp, and Stephen Cohen, PLTR was named after the magical seeing stones from The Lord of the Rings. A blink of an eye, many of you will appreciate.

It was initially developed to provide top-tier software for the U.S. government, particularly for counter-terrorism efforts, addressing the lack of effective tools for defense and intelligence analysts.

This need became critical during the Iraq and Afghanistan wars, where outdated technology forced soldiers to manually map insurgent networks.

Gotham – The Right Arm of Government Agencies

Recognizing these inadequacies in a world set to become more and more data dependent, PLTR developed Gotham, a revolutionary platform designed to support analysts and troops both in the field and at headquarters.

As of today, PLTR Gotham solution is being used notably by all these U.S. institutions:

Company data

PLTR reach goes beyond U.S. governmental institutions. It also works with many U.S. allies.

Drawing a parallel with current events, PLTR solutions are being used by two countries currently engaged in conflicts, namely: Ukraine and Israel.

An interesting report written by Time Magazine, which we highly recommend you to read, highlighted that early in the Ukraine conflict, PLTR’s CEO Alex Karp personally visited President Zelensky to offer the company’s capabilities.

Since then, PLTR has become a vital tool for the Ukrainian Army, particularly in target identification and decision-making.

The report also notes that PLTR’s involvement has turned Ukraine into a “testing ground” with profound implications for the future of AI in military operations.

Note that we will delve further into PLTR’s AI features with its Artificial Intelligence Platform (AIP) later.

In early 2024, PLTR also partnered with another major military power: Israel.

According to Bloomberg:

PLTR has agreed to a strategic partnership with the Israeli Defense Ministry to supply technology in support of the country’s war efforts.

This agreement comes in a context where Israel initially sought to develop its own software solutions, highlighting just how advanced PLTR’s Gotham platform is even for a nation with some of the world’s top engineers and coders.

The deal is recent, and there might be some additional needs for Israel as tensions with Lebanon and Iran are escalating.

Foundry – The Right Arm of Commercial Entities

After decades of working with the U.S. government which imply meeting some of the highest standards in the world, PLTR believed in its capacity to address the needs of commercial companies with their data-related challenges.

With its Foundry platform developed in the mid-2010s, Palantir helps companies to create real-world models using vast dataset. Foundry enables clients from various industries to integrate, monitor, secure, and analyze their data.

Here are some of the notable commercial clients:

Company Website

We highly recommend to our readers to have a look at PLTR website, where the firm provide several concrete use cases. As car fans, we particularly appreciated Ferrari (RACE) story.

The data management software tends to be complex. Foundry differentiate through its approach, aiming to enable people to work with data even if they have never written a line of code in their entire life.

On top of the Gotham and Foundry platforms, PLTR developed two major additional upgrades called Apollo and AIP.

Apollo – To Keep the “Crystal Ball” Up to Date

Developed in 2021, Apollo is an additional service that allow organizations using Foundry or Gotham to have their software updated securely.

Before Apollo release, clients would have had to manually update their software through their own internal IT teams, which could lead to delays, downtime, or security risks.

Apollo streamlines this process, making it efficient, especially when dealing with complex infrastructures.

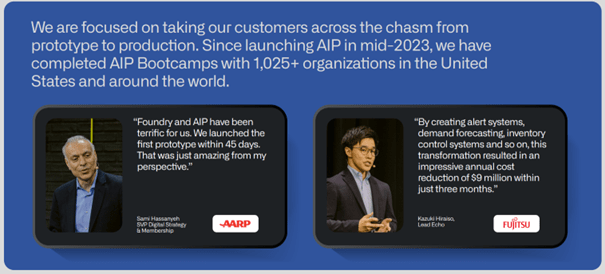

Artificial Intelligence Platform – To Make Smarter Choices

Launched in mid-2023, Palantir’s AIP enhances Gotham and Foundry by integrating AI directly into decision-making processes.

Clients can train their models on existing data and apply them in real time for faster, smarter decisions.

Unlike Gotham and Foundry on their own, AIP insists on AI and leverages it for tasks like predictive analytics and automation, providing a new level of insight and efficiency.

Revenue Segmentation

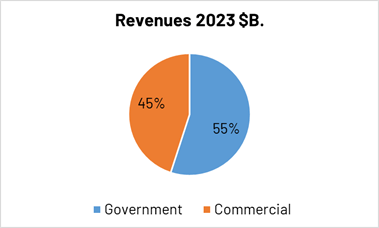

In terms of revenue segmentation, the Government segment represents 55% of the firm revenues, while the Commercial one represents 45%. This segmentation has remained stable since 2019.

Company Data

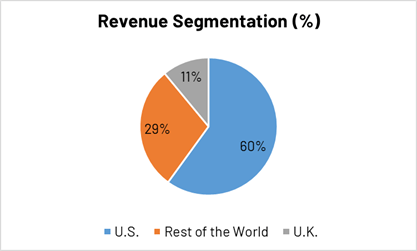

Geographically, the U.S. represents 60% of the firm revenue, the rest of the world 29% and the U.K. 11%.

Company Presentation

A Complex Industry With Few Pure Players

The world of data management is facing big challenges, especially when it comes to security and data privacy.

Many companies try to build their own software. However, older systems struggle to keep up and can be expensive to maintain with technology changing so fast.

Security is another issue, as it’s usually added late in the development process, leaving systems vulnerable. On top of that, many companies deal with fragmented data systems, known as data silos.

In a 2023 McKinsey study of 83 multi-billion-dollar companies, 80% answered:

Some parts of our business operate in silos, each with its own approach to managing and using data

In our view, this is confirming the need for an adapted solution.

An Appealing Total Addressable Market

Initially, PLTR management valued their Total Addressable Market (TAM) at $119 B.

When making this assumption, management first excluded countries that do not align with U.S. values. For obvious reasons, the group doesn’t want its products to fall in the wrong hands.

Commercial Sector TAM

On the commercial sector, the firm estimated that their products could be useful to 6000 potential companies around the world with more than $500 million in annual revenues. Assuming the value of the contract on the organization size, the group estimated a $56 B. TAM for its commercial platform.

Government Sector TAM

For the defense and government sectors, PLTR based its forecasts on IMF data covering spending in areas such as defense, education, healthcare, and public safety, applying a 5% allocation for software spending.

This resulted in an estimated TAM of $63 B. for the government segment, with $26 billion expected from the U.S. market and $37 B. from international markets.

In our view, this target seems reasonable. These expectations were provided during PLTR’s Initial Public Offering, a time when companies often overestimate such figures.

However, in our view, these projections now appear more realistic, especially when considering the release of the AIP platform, which should help PLTR attract new industries, increase contract sizes with existing clients, and expand further into international markets.

Competitive Strengths

PLTR is not operating alone in this market, but it has few competitors like Snowflake (SNOW), C3.ai (AI) and IBM (IBM).

However, in our view, PLTR is way ahead of them and seems particularly well positioned to address this huge market.

As we said earlier, unlike its competitors, the firm has been working with many institutions requiring the highest standards of security while having some of the most complex data infrastructures, which we consider as a valuable strength both in terms of execution and reputation.

These government’s standard allow the firm to now collaborate with companies belonging to more than 36 industries. Having a close relationship with its customers, the group is constantly improving its offering, as shown by the capacity for its software to work even for disconnected clients or for customers with specific network needs.

We also have the conviction that once PLTR solutions are adopted, it is almost impossible for their customers to use something else.

First, regarding the government, PLTR is operating with very sensible actors on classified data and documents, making it very hard for the administration to choose another partner once one is chosen.

For commercial customers, once PLTR is adopted, clients tend to stop to develop their own Data management software to reduce their costs. Once this choice has been done, it would take years if not a decade to develop a brand-new infrastructure.

On the other hand, we consider that once customers are engaged, it is easier for PLTR to do cross-selling or to increase prices.

Financial Analysis

Seeking Alpha Data, Author

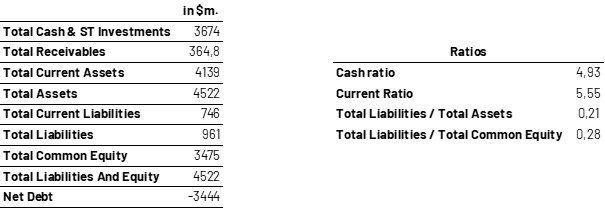

When looking at the firm’s consolidated balance sheet, we clearly see that it is a fortress with plenty of cash and very little debt.

The company has a very robust short-term liquidity position, with its cash position being almost 5 times higher than its short-term debt. The firm also has plenty of assets with Total current Asset being 5.5 times higher than current liabilities.

On the long-term horizon, the firm has also well managed its debt level, with Total liabilities representing only 20% of Total Assets.

Finally, when looking at the financing structure, the group is mainly financed through Equity as debt only represents 28% of the Total Common Equity. We view this positively, the firm managed to raise a lot of money during the Covid-19 crisis where valuations were off the roof. This idea to raise capital at that timing was brilliant and explains why the company has now very little debt and a lot of flexibility.

Profitability Analysis

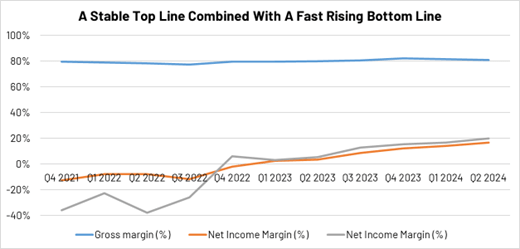

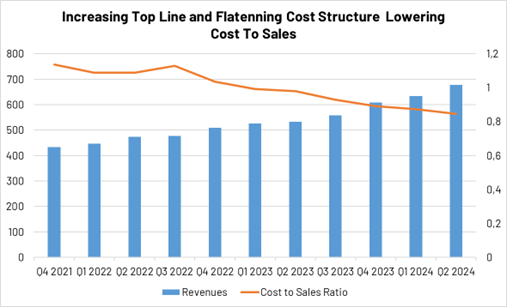

PLTR profitability breakeven was in Q4 2022 and since then, the firm never stopped to become more profitable. As shown on the chart below, the firm had a stable gross top-line margin standing close to 80%, but it has struggled for years to improve its bottom line.

Seeking Alpha Data

What explain such a change and will it last?

After digging into the company’s financial statement, it turned out that the PLTR case was relatively easy to understand.

In our view, it can be explained by one single chart:

Seeking Alpha Data

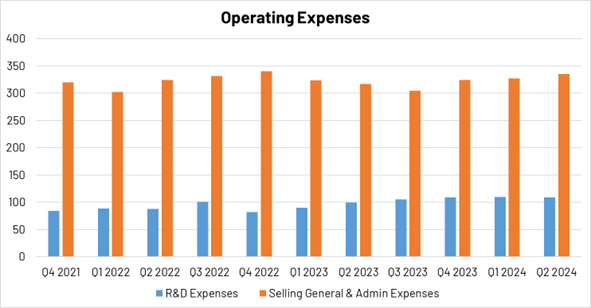

PLTR has been investing massively on both R&D, a justified decision due to its focus on innovation characterized by the development of its sophisticated platforms integrating more and more new features.

On the other hand, the company has invested heavily in sales and marketing with a strategy we found both interesting and effective. Palantir has focused on securing long-term contracts, especially with governments and large enterprises, which has led to higher sales and marketing expenses. The company has historically relied on a direct sales approach, targeting large and complex deals, driving up SG&A costs. While this strategy seemed expensive in the short term, it is now proving to be successful.

Another interesting aspect is PLTR’s approach to helping its commercial clients understand AI, its challenges, and providing them with training. Since the launch of AIP, PLTR has held several AIP bootcamps to attract new clients and build momentum for its products. We believe this is one of the most effective ways to engage clients, build networks, and encourage word-of-mouth promotion.

Palantir Company Presentation

An important element to notice is that quarter over Quarter, and for almost 11 quarters these spending have remained flat.

Seeking Alpha Data

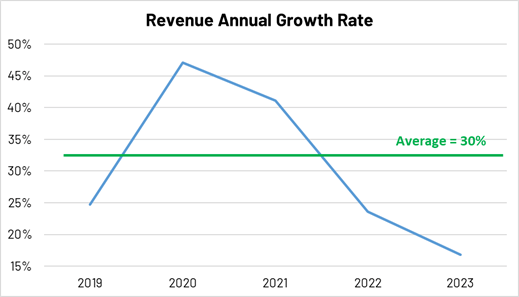

On the other hand, revenues have been growing by an average of 30% for the last 5 years.

Seeking Alpha

Although growth seems to be slowing on an annual basis, Palantir is still achieving mid-double-digit revenue growth without taking on more debt or increasing investments compared to previous years.

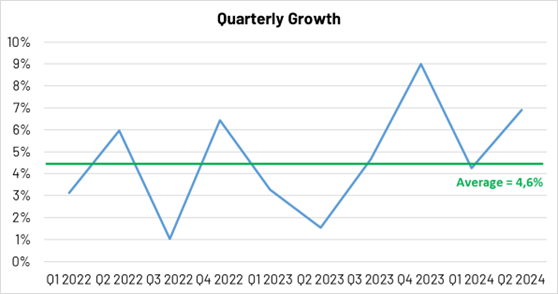

This is particularly impressive given the recent quarterly growth rebound, which has exceeded the two-year quarterly average of 4.6%.

Seeking Alpha Data

After seeing those charts, it now seems clear that PLTR strategy has been achieved by maintaining and stabilizing variable costs why being sure that they could fuel a top-line growth strong enough to improve substantially the firm profitability. PLTR strategy to play the long game is paying off, showing us how patience and precision can lead to profits.

Valuation

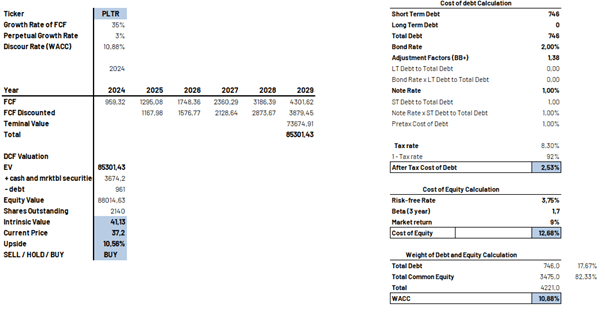

For our valuation we made several assumptions. We expect the AIP platform and the strong marketing push associated to help the firm to deliver high double-digit growth from 2024 to 2028.

These expectations are consistent with research made by Precedence Research where it is mentioned:

The global artificial intelligence is expected to expand at a CAGR of 19.1% from 2024 to 2034.

Also, we expect SG&A to increase by 5% per year, which has been consistent with the firm strategy over the last few years. Aggressively we implemented a low double-digit growth spending on Capex anticipating that the group will have to spend more in order to maintain innovation to support strong growth levels. On the other hand, we expect the firm’s cost of revenue to adjust progressively so that Palantir reaches 85% gross margin by 2028.

All these assumptions lead us to an average FCF growth of 35% for the upcoming 5 years. Applying a 3% Perpetual Growth rate and discounting it at a 10.88 WACC, we reach a target Price of 41.13 representing a 10% Upside potential.

Author forecasts

Risks

The competitive landscape in the data management and AI space is intense, but there are very few pure players. On the other hand, many companies are investing heavily in their own internal platforms, and while PLTR has an edge in security and government contracts, the commercial market could pose more challenges. Foundry’s success hinges on continued customer adoption, and there’s always the risk that companies may revert to in-house solutions or competitors’ offerings.

We actually see PLTR’s reliance on government contracts as an opportunity rather than a risk. These contracts provide steady visibility and benefit from historically higher spending in defense and national security, especially in an increasingly complex geopolitical environment. However, it’s the commercial side of the business that could face more cyclical risks. In times of economic downturn, businesses may cut back on tech investments, which could slow PLTR’s growth in that segment.

Conclusion

We believe in PLTR’s potential to drive a major transformation in a context of surging data management demand from both commercial and governmental institutions. With its cutting-edge platforms combined and the recent launch of its AIP, PLTR continues to prove its ability to stay ahead in a fast-evolving industry. The company’s strong financial position, growing profitability, top-tier products, and forward-thinking approach position it well for sustained growth in the coming years. We initiate a BUY rating with a target price of $41.13, reflecting a 10% upside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.