Summary:

- Given its future potential, PLTR could be one of the best AI-related stocks on the market right now.

- PLTR’s business shows acceleration in revenue growth due to AIP boot camps, widening margins after first profit six quarters ago, and apparent stability in operational processes.

- Unfortunately for Palantir bulls, even against the backdrop of out-of-consensus bullish expectations, PLTR seems to be too expensive to ignore and just “buy” it at today’s prices.

- I decide to downgrade Palantir to “Hold”, even though I believe the company is doing its job right and has a lot of room to grow.

Michael Vi

My Thesis Update

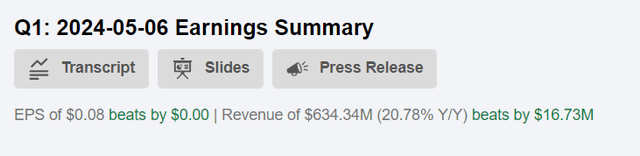

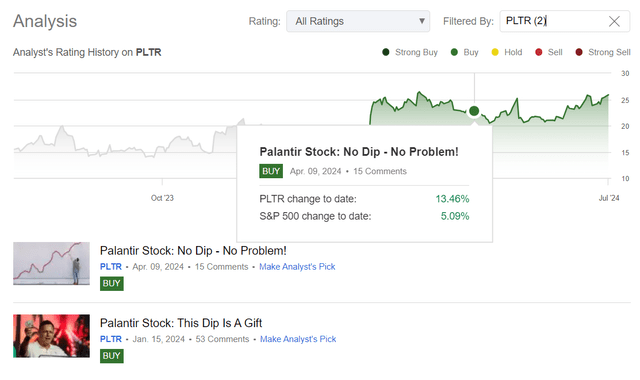

I initiated coverage of Palantir Technologies, Inc. (NYSE:PLTR) stock back in January 2024 with a “Buy” rating, reiterating it 3 months ago on April 9, 2024. Since the publication of my most recent article, the PLTR stock has managed to grow significantly on the back of its strong report, the details of which I’m looking forward to going through today.

Seeking Alpha, Oakoff’s coverage of PLTR stock

We see that PLTR is up over 50% YTD and 66% YoY. Despite some bearish articles on Seeking Alpha suggesting that it might be a good time to close out long positions. After my analysis today, I have to partially agree with this argument.

I still stand by my earlier thesis: Palantir remains a solid AI investment, even at seemingly high prices. I believe it’s important to look beyond the short term: Given its future potential, PLTR could be one of the best AI-related stocks on the market right now. But even against the backdrop of out-of-consensus bullish expectations, PLTR seems to be too expensive to ignore and just “buy” it at today’s prices.

My Reasoning

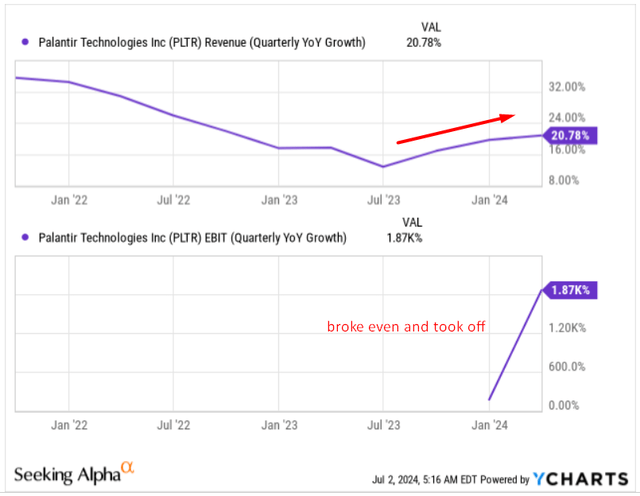

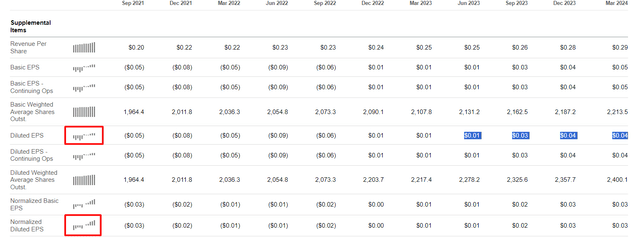

Palantir reported a GAAP net income of $106 million thereby marking a margin of 17% and for the 6th consecutive quarter it achieved GAAP profitability, according to the press release. The GAAP income from operations (aka EBIT) stood at $81 million or ~12.7% of sales, while the GAAP EPS was $0.04 and the adjusted EPS was $0.08 (marginally beating the consensus). Revenue significantly improved by growing at 21% YoY and by 4% QoQ to attain $634 million – this figure was ~$17 million more than expected.

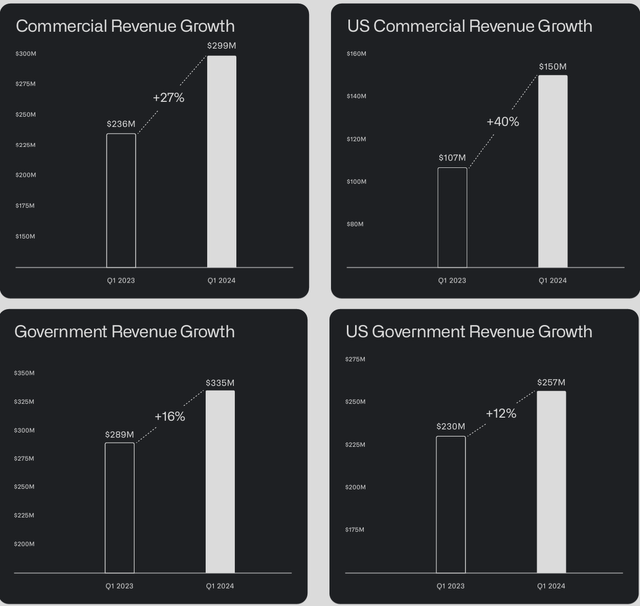

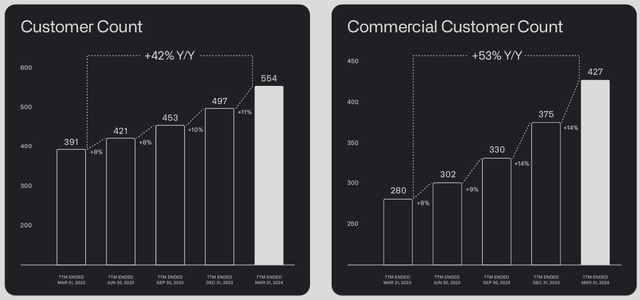

In terms of specific segments, in US Commercial space, Palantir grew strongly with revenues increasing by +40% YoY (+14% QoQ) to reach $150 million amid the total number of US commercial customers increasing by +69% YoY (+19% QoQ) to sum up to 262. On a YoY basis, the remaining deal value (RDV) for US Commercial surged by +74%. Overall, Commercial revenue amounted to $299 million over a year compared to last year’s period, having increased by +27% YoY, whereas the Government revenue increased by +16% YoY or +3% QoQ to totalize ~$335 million; particularly US government revenue rose by +12% YoY (+8% QoQ) amounting to nearly $257 million.

PLTR’s IR materials, Oakoff’s compilation

So, what I see today from PLTR financials literally makes me happy: a) acceleration of revenue growth due to AIP boot camps, b) widening of margins after the company made its first profit 6 quarters ago, and c) apparent stability of these processes.

Why do I think these processes are stable? The number of commercial customers continues to grow rapidly, and their current number (262) tells me that this is still a very low base for Palantir’s business. I think this base will at least double in a year or two, which should provide an additional incentive for revenue growth, given the relatively high margins of the Commercial segment.

PLTR’s IR materials, Oakoff’s compilation

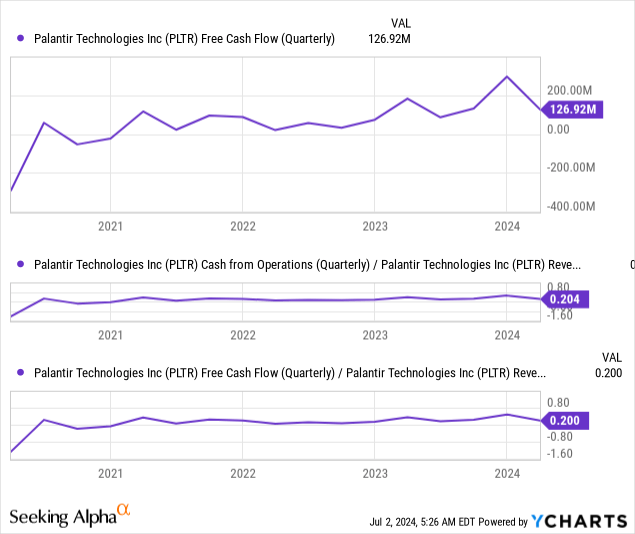

Also important to note here is that Palantir is a CFO-positive firm (CFO stands for cash flow from operations in this case): in Q1 this metric amounted to almost $130 million amid the CFO-to-sales staying above 20%, which is a great sign, in my opinion. The adjusted free cash flow amounted to about $149 million excluding some costs with an FCF margin of ~23% (or 20% on a non-adjusted basis, as shown below). The company also reported cash and short-term US Treasury securities totaling $3.9 billion, well covering its obligations and potential basic needs for growth.

Palantir’s management anticipates Q2 2024 revenue to be between $649 million to $653 million, with adjusted EBIT ranging from $209 million to $213 million. The full-year 2024 guidance has been raised across all key metrics:

For full year 2024, we are raising our revenue guidance to between $2.677 billion and $2.689 billion. We are raising our US commercial revenue guidance to in excess of $661 million, representing a growth rate of at least 45%. We are raising our adjusted income from operations guidance to between $868 million and $880 million. We continue to expect adjusted free-cash flow of between $800 million and $1 billion, and we continue to expect GAAP operating income and net income in each quarter of this year.

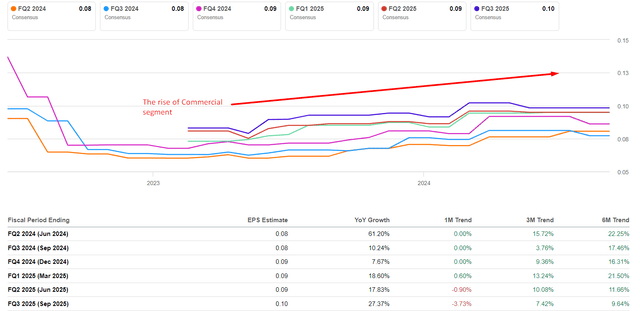

So, in my opinion, Palantir’s business is indeed booming. The company has long been known for serving the needs of the US defense and intelligence community, but the company’s expansion into the commercial sector with data management and analytics platforms that can provide solutions to complex business problems has been a game changer in terms of higher margin revenue growth. Actual growth is higher from quarter to quarter than analysts and management itself initially assume – which is why EPS expectations are steadily rising in light of management’s positive guidance revisions.

Seeking Alpha, PLTR, Oakoff’s notes

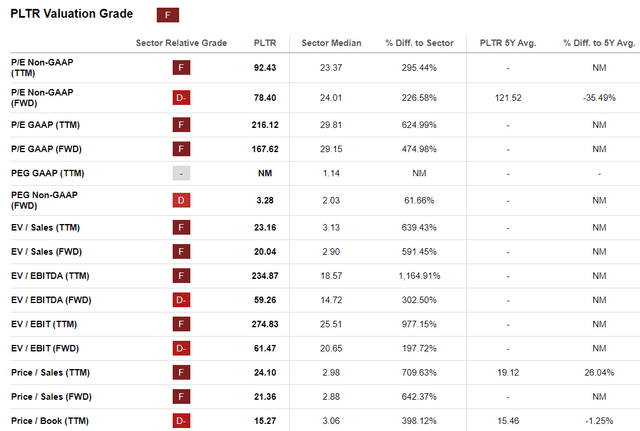

Seeking Alpha’s Quant System rates PLTR stock as an “F” on its Valuation metrics, but if you look closely, you’ll see that most of those metrics are “backward-looking” rather than “forward-looking.”

Seeking Alpha, PLTR’s Valuation

I mean, the 92x P/E (non-GAAP, TTM) is just a reflection of the last 4 quarters at a time when the company was just coming out of the unprofitable phase.

Seeking Alpha, PLTR’s IS, Oakoff’s notes

The market expects PLTR’s earnings per share to grow at 18.47% annually over the next 5 years, with the implied P/E ratio declining to 37x by the end of 2028, according to Seeking Alpha Premium data.

I think the market underestimates the true growth potential of the company. Like many enterprise software companies, Palantir relies on new AI-powered applications to grow its business. PLTR’s big advantage is that its go-to-market approach is centered on its direct sales force to grow both its customer base and the wallet within that customer base. In theory, Palantir offers its customers pretty good customization, a kind of consultancy, but as far as I know, with a ready-made, unique platform that the company has been developing for years (unlike many start-ups that have only recently emerged). As noted during earnings calls, they aim to secure 5-year contracts with clients, which is a relatively long period, in my view, reflecting the complexity of its solutions (and as the customer base grows rapidly, this speaks to the uniqueness of Palantir’s products, which are highly valued when customers are willing to sign such long contracts).

Another key growth driver quite actively utilized by Palantir is the “boot camps” or multi-day product seminars during which PLTR showcases the capabilities of its software and educates clients on the benefits and use of its generative AI tools. As the demand for generative AI solutions in the commercial sector grows, the demand for training is also likely to continue to increase, and this is one of the highest margin segments for Palantir – hence I think we should expect the overall margins to increase in the long term.

So if we assume that Palantir’s actual earnings per share grow by 25% over the next 5 years instead of 18.47% (here I include both more active revenue growth and higher margins), then instead of the current $0.7/share, we will see earnings of ~$0.916/share by 2028. If we assume that PLTR trades at 30-40x P/E by the end of 2028, its fair value should be in the middle of the $27.5 – 36.6 price range. That means, according to my calculations, PLTR is undervalued by ~24% over the next 5 years. That is, the stock will grow by about 4.4% annually over the next 5 years if my calculations are true and Palantir is indeed able to grow faster than the industry (and current forecasts) while maintaining a premium to its valuation in 5 years.

With the 10-year treasury notes providing a risk-free yield of 4.46%, I have decided to lower my rating on Palantir from “Buy” to “Hold” as it now seems to be heavily overvalued even against a backdrop of my optimistic expectations.

Final Thoughts

From what I see today, Palantir’s positive cash flow, robust financials, and optimistic outlook for 2024 indicate continued strength: I believe the market may underestimate its real growth potential. However, everything has its price. The premium that PLTR is trading at today seems justified, but also gives the company little chance of quickly “growing out of its valuation”, in my view, Even if I assume much higher EPS growth rates, my valuation calculations suggest that the stock should earn as much as the risk-free rate – this makes PLTR an unfavorable investment in terms of the risk/reward.

So I decide to downgrade Palantir to “Hold”, even though I believe the company is doing its job right and has a lot of room to grow.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.